🎄🚨 12 Days of YEETMAS 4: YEET HOLIDAY SHOPPING SPECIAL

Take a look at some countertrend index/ETF thesis and of course picks!

🎄 YEET HOLIDAY SHOPPING SPECIAL: WHAT ARE WE LIKING INTO NEXT WEEK

🚨 PS HOLIDAY SALE: GETS YOU YEET PLUS ACCESS:

📊 YEET Terminal Access

Live site access with PARI and VISE updating automatically, always current.

⚡ Automatic Alerts in Discord

All alerts across filters delivered automatically. No scanning. No guesswork.

🧠 All TEN YEET Filters + SPY Data Filters

Full access to every YEET filter, plus SPY-specific data tools like Orange Swan, SPY Magic, and related models.

🟠 Daily Orange Swan Reads

Systematic divergence analysis highlighting countertrend and squeeze setups.

🔍 Contract-Level Whale Tracking

Identify repeat contracts and sustained positioning across sessions.

🧭 Market Regime Awareness

Know when flow is signal and when it’s noise.

📰 At Least 8 Issues Per Week

Consistent coverage across sessions, events, and market regimes.

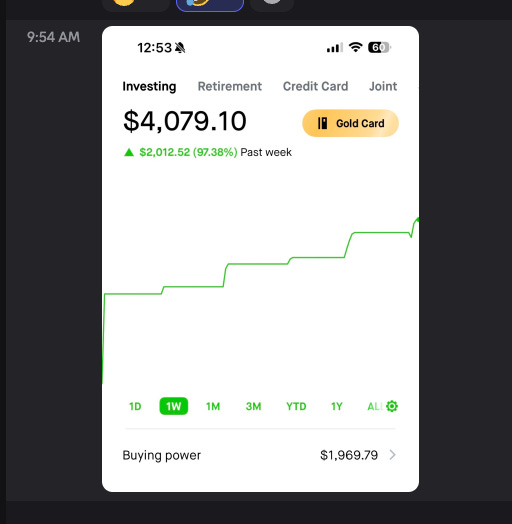

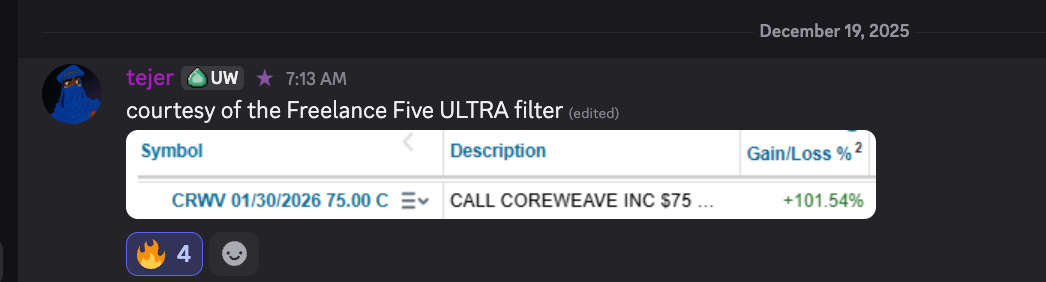

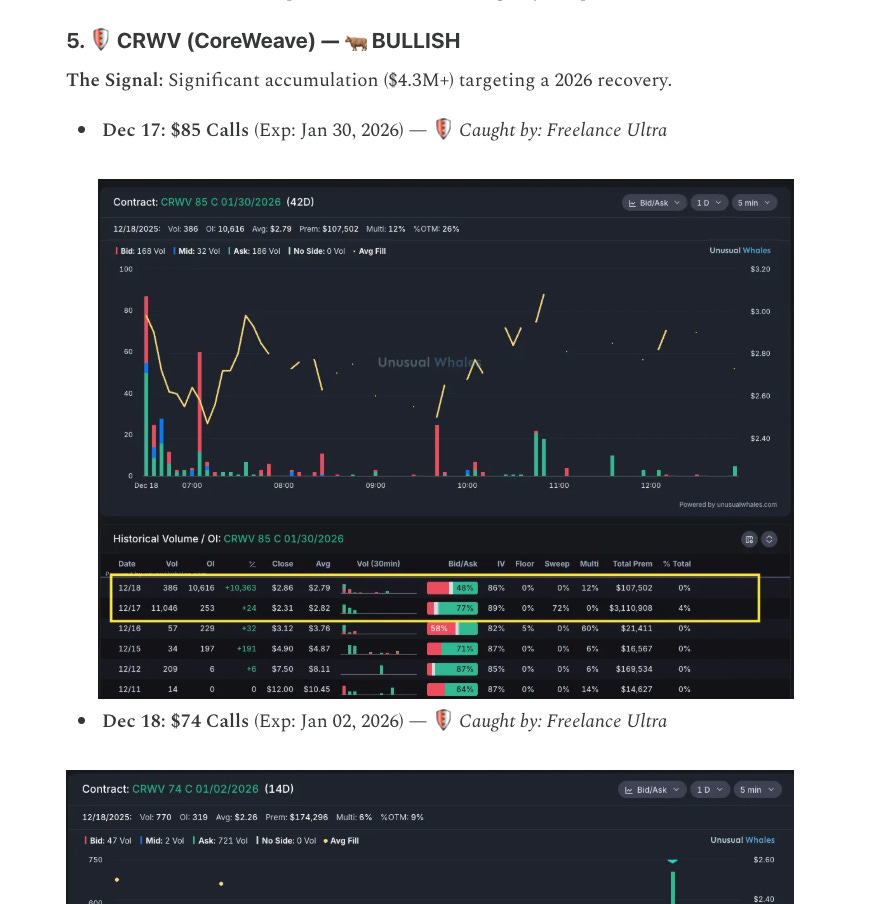

Divergence picks proved themselves again yesterday with CRWV jumping 17% day one! it’s starting to feel like Christmas again in the YEETcord.

After talking about how counter-trend flow provided by applying SWANDEX and Cerebro found CRWV yesterday (which exploded for +17% immediately), we are doubling down on that exact strategy today.

While the broad market hedges, the “Smart Money” is shopping.

📉 THE MACRO DIVERGENCE: HEDGING VS. HUNTING

We are seeing two huge sector divergences within the SWANDEX today that tell the whole story.

1. THE INDEX (SPY) = HEDGING 🛡️

The Flow: The tape is lit up with “Repeated Hits” on SPY Weekly Puts (Dec 23-29 Expirations).

The Strikes: Traders are paying up for $660 - $665 Puts.

The Read: The crowd is scared. They are buying short-term protection into the holiday liquidity gap.

2. THE SECTORS WHAT COUNTERTREND FLOW = HUNTING 🦅

YEET PLUS: ETF Divergence from SwanDex, four high confidence picks using the Cerebro Method for Bangers Only