🪄ABRACADABRA Vol. 1: Case Study/Tutorial of how Spy Magic worked this week, including Friday deep dive

Have a look under the hood..it's all good.

🔮 ABRACADABRA 1: SPY MAGIC FILTER TRADE REVIEW AND TUTORIAL

“What goes up… gets hit again on the ask.”

Welcome back to YEET, where we don’t follow the money — we front-run it. Let’s talk about a 90% ITM Alert filter we call SPY Magic, and why what happened Friday into the weekend was a near-perfect storm of predictive flow, price logic, and CUMULATION 🧃.

🦄VIDEO EXPLAINER: SPY MAGIC USE CASES THAT BROUGHT 5/5 on Twitter last week, and have us like 10/11 or something ridiculous in The Garden

CONCEPTS EXPLAINED LONGFORM BELOW!'

🎯 SPY Magic: The Core Idea

SPY Magic is a filter built around one obsession:

Which flow hits go in the money — and why?

The goal isn’t just volume. It’s high-confidence patterns where buyer behavior, timing, and laddering converge to tell us: “This ain’t noise — this is the move.”

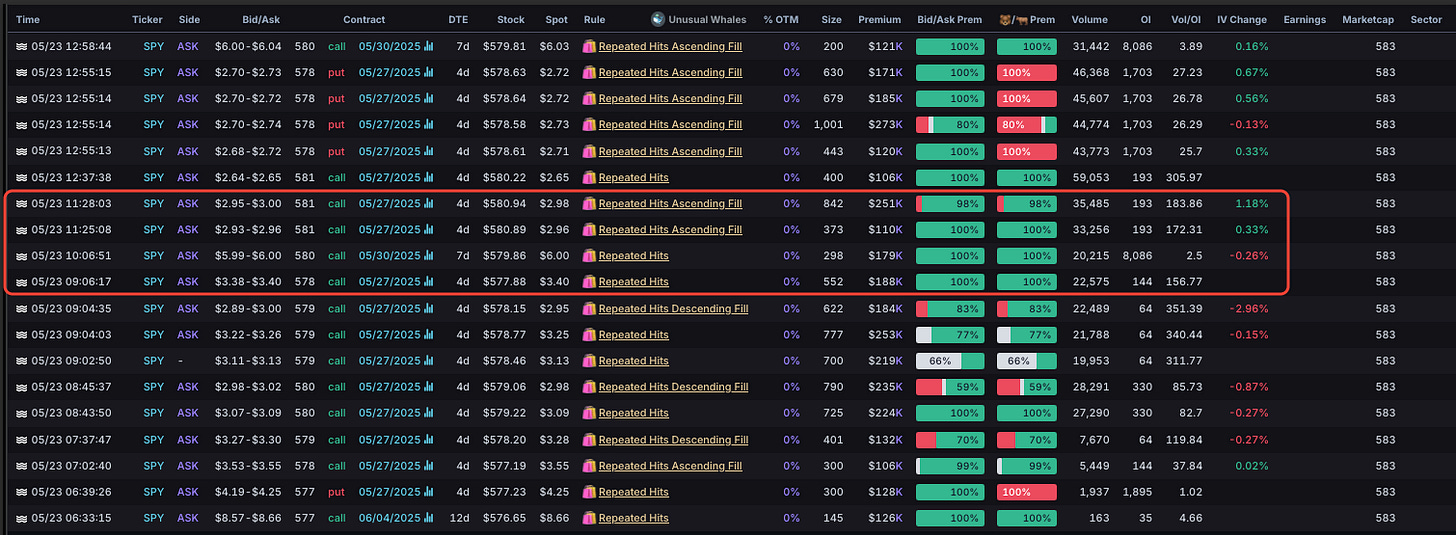

🪜 Laddering 101: The Trend Day Giveaway

Laddering is when one order goes in the money on magic, then triggers a next-level order — then another. Think of it like climbing:

🔹 580c hits

🔹 Price moves up

🔹 581c hits

🔹 Then 582c

🔹 All with ASK pressure and zero puts to fight it

This shows logical price progression, not YOLO randomness. On 5/23, the flow ladder climbed in real time, and the chart confirmed — no bounce, just ascend. The 578c–581c chain formed a tight structure with whales following the move, not front-running against price.

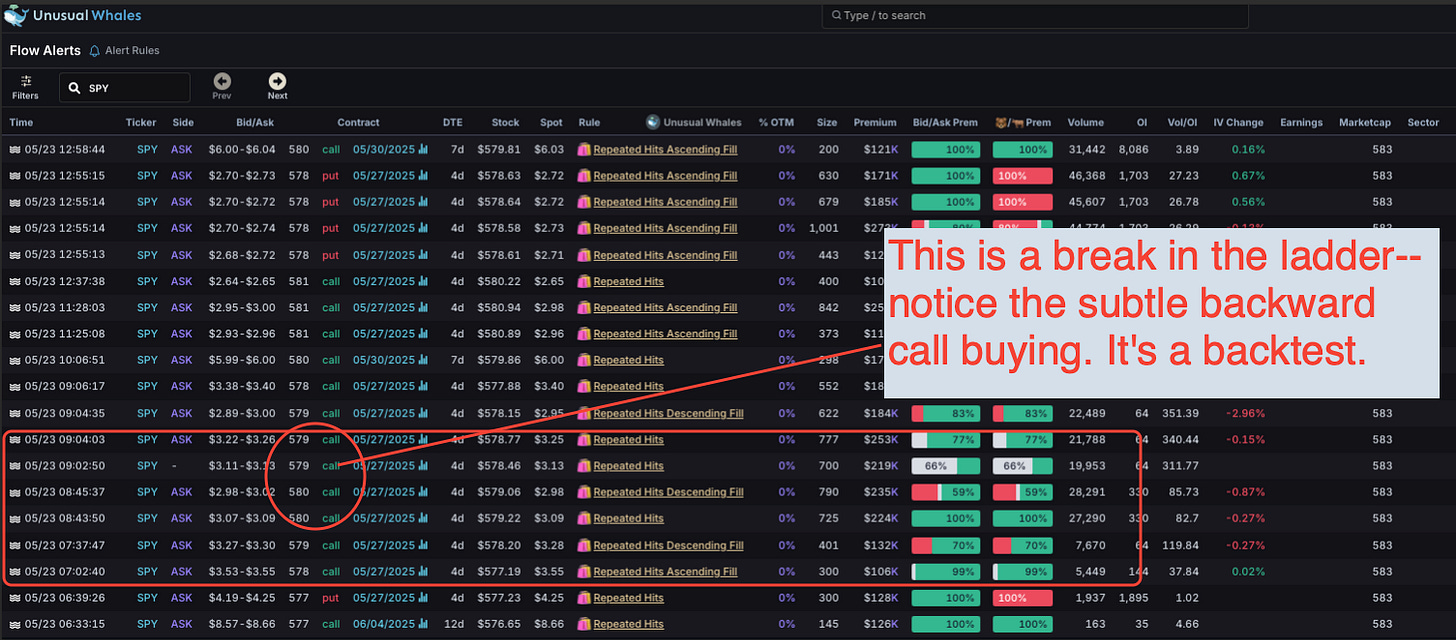

🚨 When Ladders Break

SPY Magic turns cautious when:

🟥 A put hits at a lower strike

🟥 A call ladder skips and reverts (e.g., 580c to 579c = ⚠️)

🟥 You get two ladder levels DOWN

🟥 Or the chart trend diverges (chop or reversal)

In that case? It’s often just a liquidity grab or backtest. And you wait.

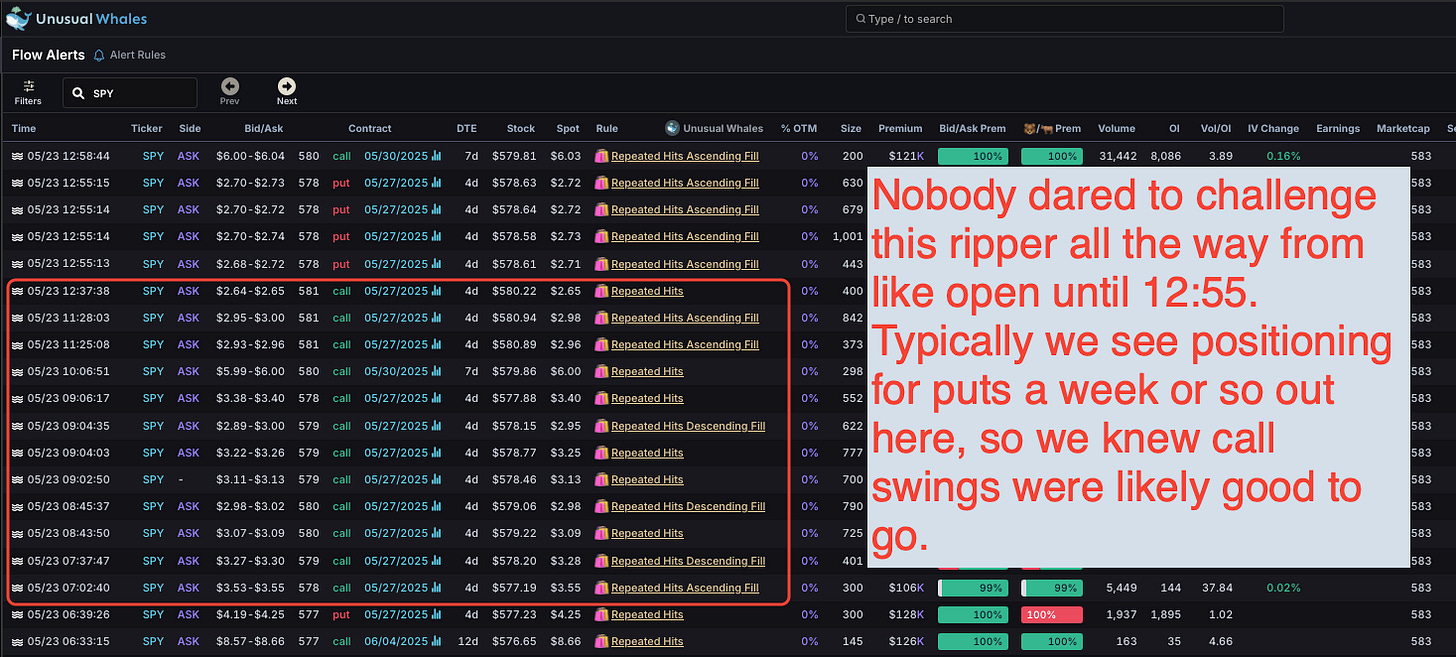

🔥 CUMULATION: Why We Held Calls

Late Friday we saw multiple repeated strikes across DTEs — not just 0DTE.

Look at the 578c, 579c, 580c, and even 05/30 contracts. That spread means whales were building, not flipping. They were risking theta over a weekend. That’s conviction.

And if futures running during the Monday holiday were any clue — we’re being paid. ☀️💰

🧊 Why we IGNORE the Puts at the End

Yeah, the 578p slapped late day. But:

They came during a dump — emotional flow

Were nearly at the money already

Had no ladder logic

And occurred after peak call cumulation

SPY did end up touching those levels — but the real edge came from avoiding chop and trusting the signal before the reversal risk.

🧬 YEET Plus: Signature YOLO Pick

We’re never just about SPY. Here’s a non-SPY candidate with YEET Flow Certification™: