🧨Absolute YEET: Joker's Sunday Service

Volatility flow and instruments for your week ahead!

🧨Absolute YEET: Sunday Service No. 2

This week’s Service runs in Absolute Mode, meaning we read every tool through volatility, not trend. The tools themselves don’t change, but the lens changes.

🃏 PLUS: NEW Volatility Filter — Joker’s Deck

Joker’s Deck is the newest YEET Plus filter, and it’s built for volatility itself.

it hunts whale orders across volatility instruments and anything else whales use to hedge, attack, or pre-load chaos.

This filter exposes:

where volatility whales are positioning

when defensive instruments suddenly get volume

when safe-havens flash signals (GLD / SLV tightening)

where bond volatility (TLT) starts preparing for macro shifts

where the true pressure valves in the market are forming

Joker’s Deck is now the volatility early-warning system for the entire YEET ecosystem.

It tells you where volatility wants to ignite, before it shows up in the index or single names.

YEET Tools

Here’s what each tool does in its normal form:

📈 PARI: measures trend strength vs trend fragility.

⚡ VISE: measures volatility expansion pressure (the volatility version of PARI).

🔮 SPY Magic: intraday directional footprints from real flow.

🧿 Black Magic: far-OTM whale bets that hint at hidden positioning.

🟣 Orange Swan (Plus): shock-move probability from weighted flow.

🃏 Joker’s Deck (Plus – NEW): hunts IV ramps before price moves — early signals of pops/drops.

TODAY’S READ (Volatility Mode)

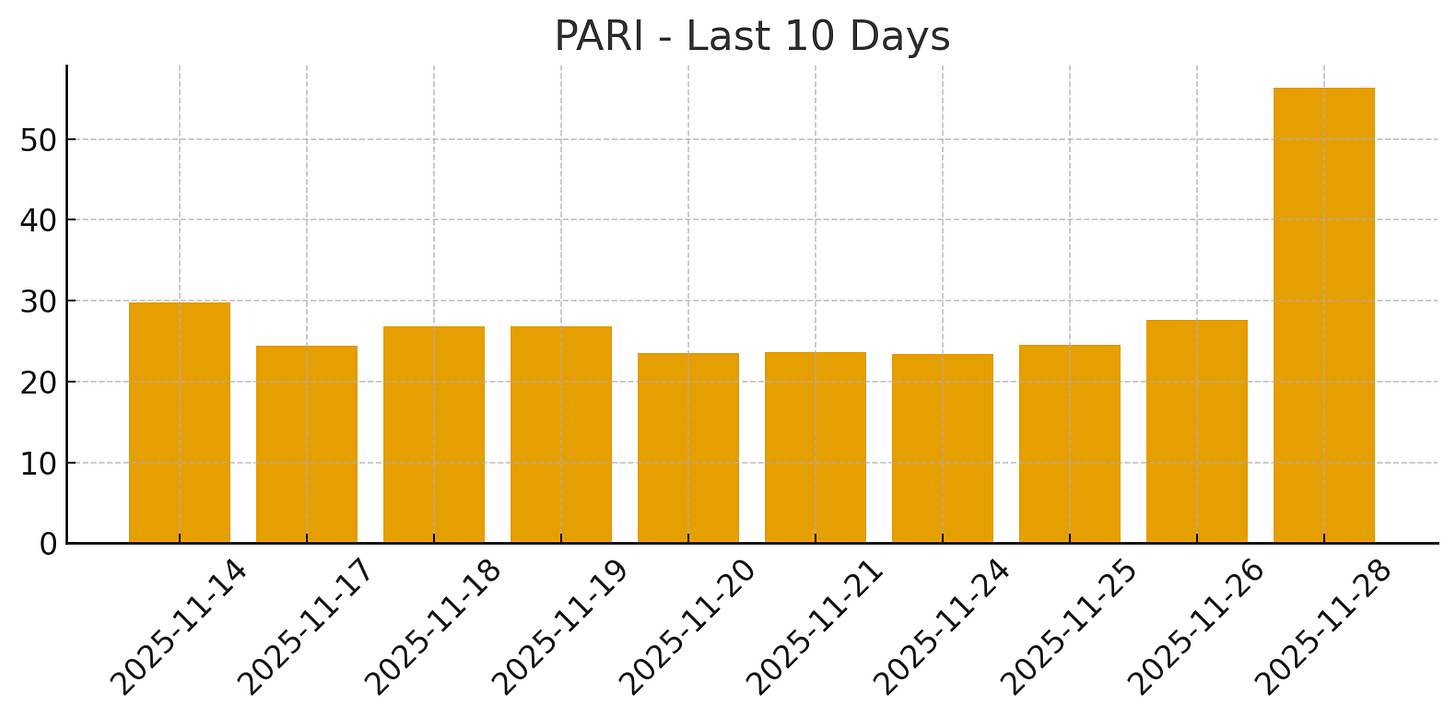

📈 PARI — 56.4

A mid-range 56.4 tells you the trend is alive, but not confident.

Under volatile conditions:

trend can break suddenly

upward drift doesn’t guarantee follow-through

chop becomes the default behavior

This is the “slow trend that doesn’t trust itself” environment.

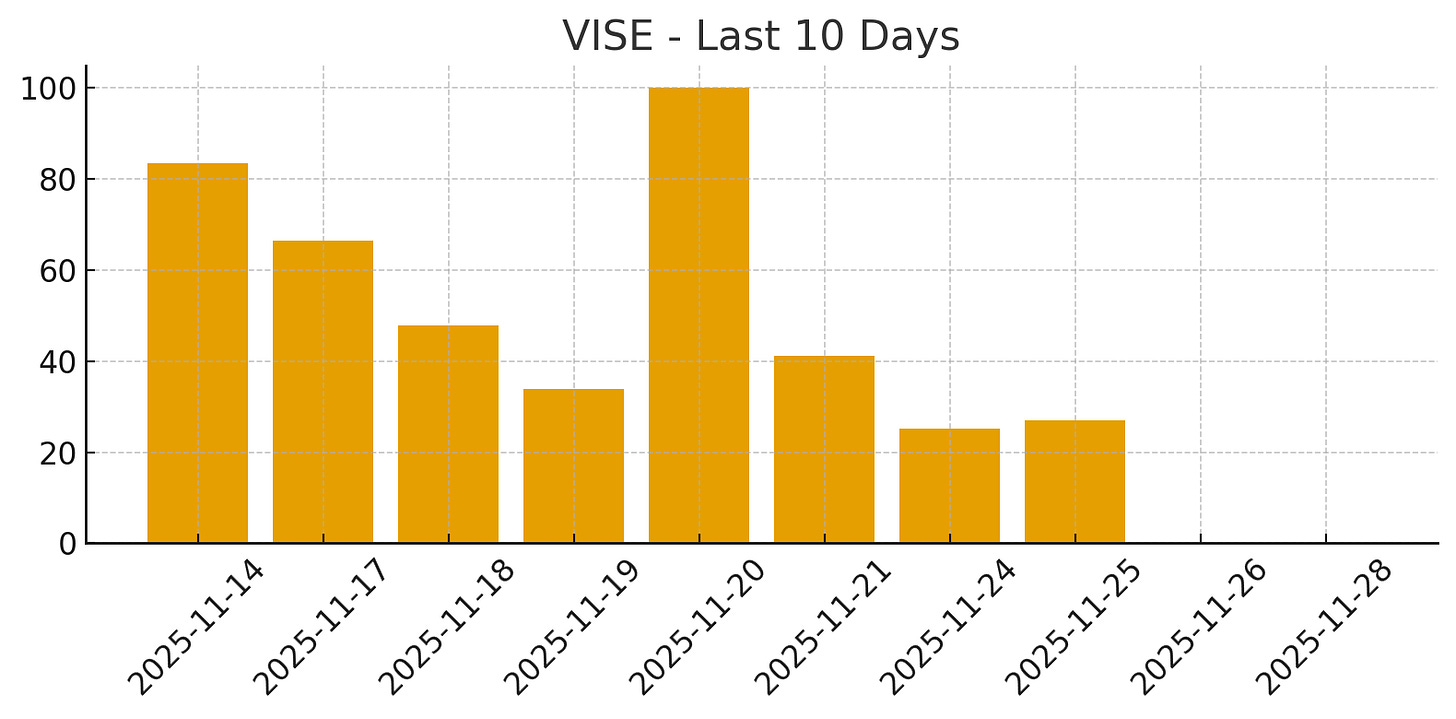

⚡ VISE — 0.0

VISE at 0.0 signals:

the volatility cycle has fully cooled

expansion energy is gone

the last big burst is finished

volatility is in its quiet phase

In volatility terms:

we are in the lull — the loading phase hasn’t started.

YEET Plus Gets 🔒

YEET Plus gets three core volatility tools today:

🃏 Joker’s Deck

our new volatility filter tracking volatility-instrument whales (VXX, UVXY, GLD, SLV, TLT)

🟣 Orange Swan

full shock-move probability using the v2 weighted call/put engine

🔮 SPY Magic

intraday directional footprints and timing based on today’s real-money flow