🖤 ABSOLUTE YEET No. 1: BLACK MAGIC

ABSOLUTE YEET is a four-day YEET special event set in our alternate-volatility universe

🖤 ABSOLUTE YEET No. 1: BLACK MAGIC

Credit where due: One Day Elk Camino in the Garden Discord mentioned putting SPX into a filter of ours and shared his experience. That set my mind on a path once Volatility arrived… this YEET series is dedicated to the Elk!!

ABSOLUTE YEET is a four-day YEET special event in an alternate-volatility universe

For the next four days, the YEET ecosystem steps into this bizarro market — an inverted world where volatility expands, structure distorts, and several classic tools have been taken over and repurposed by darker forces.

Not to confuse you. To sharpen you.

The goal of Absolute YEET: to prepare you for a market that behaves like a shadow version of our own — widening, snapping, drifting, and punishing certainty.

Here are the corrupted versions of your familiar filters:

🦢 Black Swan : Orange Swan logic applied across sectors to catch more moves like NVDA

🃏 The Joker’s Deck: the countertrend nature of the BAT Filter expanded for volatility and degenerate whales and earnings

🧿 Black Magic — the dark mirror of SPY Magic

👁️ The Unseen — the People’s Screener tweaked for news pops and drops only

This is Day 1.

🔥 PART 1: SPY Video: Absolute YEET

This is the briefing — a walkthrough of the YEET universe inversion and how volatile behavior reshapes intraday odds.

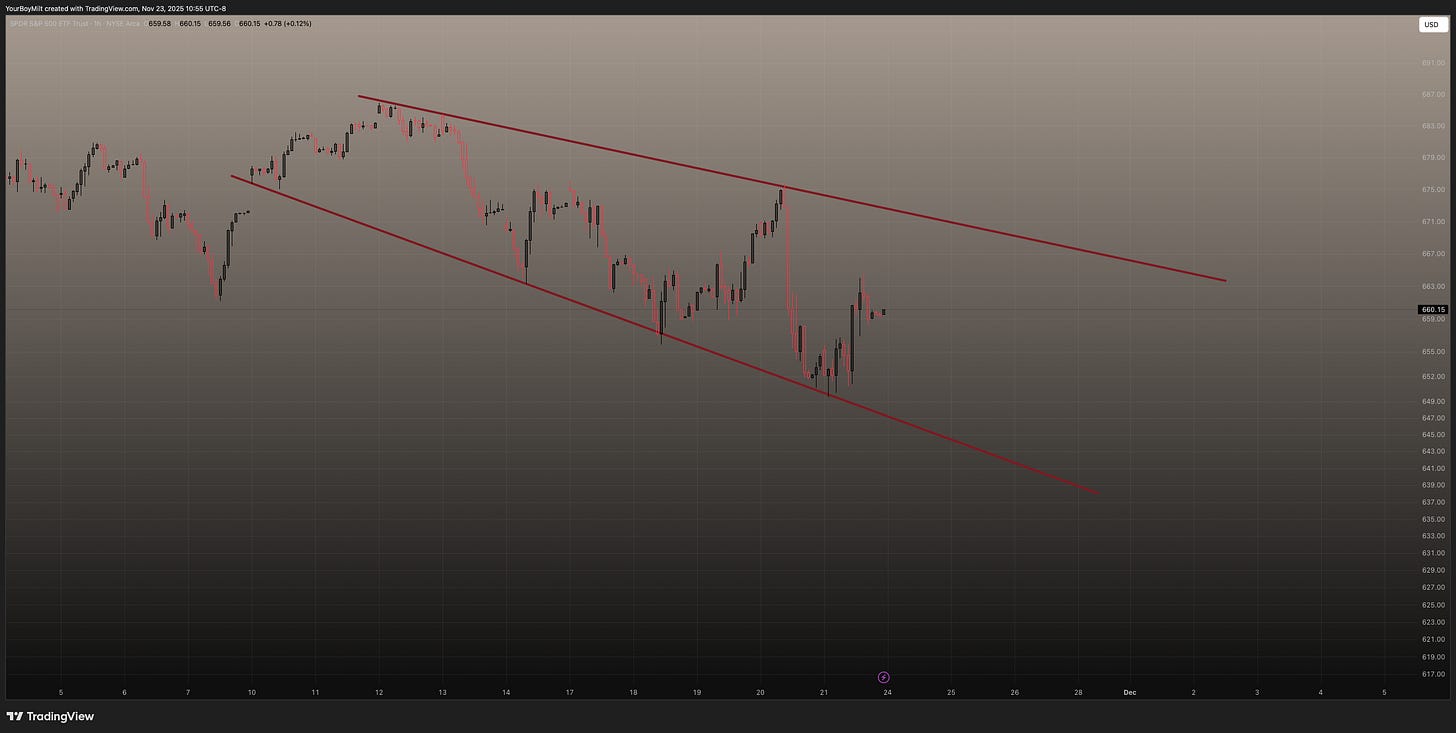

🩸 PART 2: Absolute SPY: Chaos Structure

Price action is widening. Volatility is stretching. The structure is breaking open.

Before we even get into the Shadow Grid, we need to look at how price is actually behaving.

SPY isn’t tightening., It isn’t consolidating. It’s widening — meaning every leg down and every bounce is expanding the range instead of compressing it.

This pattern shows up as:

lower highs expanding outward

lower lows expanding downward

more space between pivots

volatility “stretching” the channel instead of resolving it

This is the exact structure that Black Swan thrives in:

a market where the architecture bends, the channel widens, and the next move has room to accelerate instead of stall.

🖤 PART 3: Absolute SPY: SHADOW GRID

ONLY UN-backtested Levels ONLY: Monthly • Weekly • Gaps (Current Price: 659.03)

No key. No weighting. No colors. In the Absolute YEET universe of volatility, every unbacktested level carries equal threat. on a pop or a drop.

📊 Shadow Grid Visual

⬆️ Above 659.03 (Ascending)

669.50 | 670.19 | 671.49 | 672.33 | 672.83 | 673.34 | 673.93 | 677.34 | 678.50

⬇️ Below 659.03 (Descending)

661.25 | 660.73 | 660.15 | 658.66 | 656.06 | 655.66 | 655.00 | 654.42 | 652.83 | 651.91 | 650.88 | 647.67 | 647.07 | 645.83 | 645.43 | 644.43 | 642.49

⚙️ ABSOLUTE YEET: PARI × VISE — The Trend & Its Evil Twin

In the normal market, you use indicators made by your FURUs. In the Absolute YEET universe, everything has an alternate version built for volatile times.

That’s exactly what PARI and VISE are:

😇 PARI (Price Action Risk Indicator) = the clean trend signal

😈 VISE (Volatility Indicator of SPY Expansion) = the trend’s evil twin, the version distilled for volatility and chaos

PARI tells you how honest the market is. VISE tells you how unhinged it’s about to become.

When you look at them together, you’re reading both the market’s intentions and the amount of force powering the move.

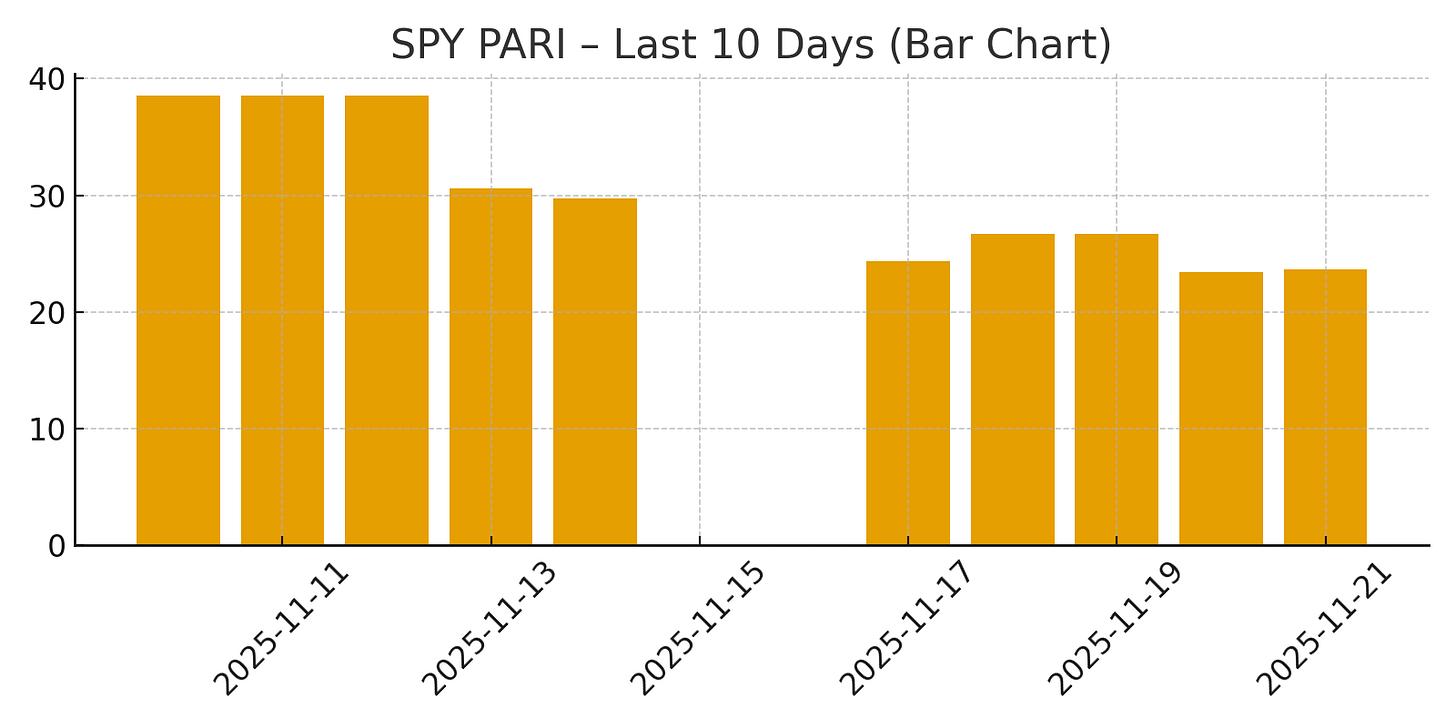

😇 PARI: The Trend’s “Good Twin”

PARI is the cleaner, calmer sibling. It measures how well SPY is behaving, how straight the moves are, how trustworthy the momentum is.

High PARI → the trend is well-behaved.

Low PARI → the trend is real but emotional, sloppy, or violent. Tends to lean bearish but can also just mean “unreliable”.

There’s no such thing as “no trend.” Low PARI isn’t neutral; it’s the bearish or bullish move without self-control.

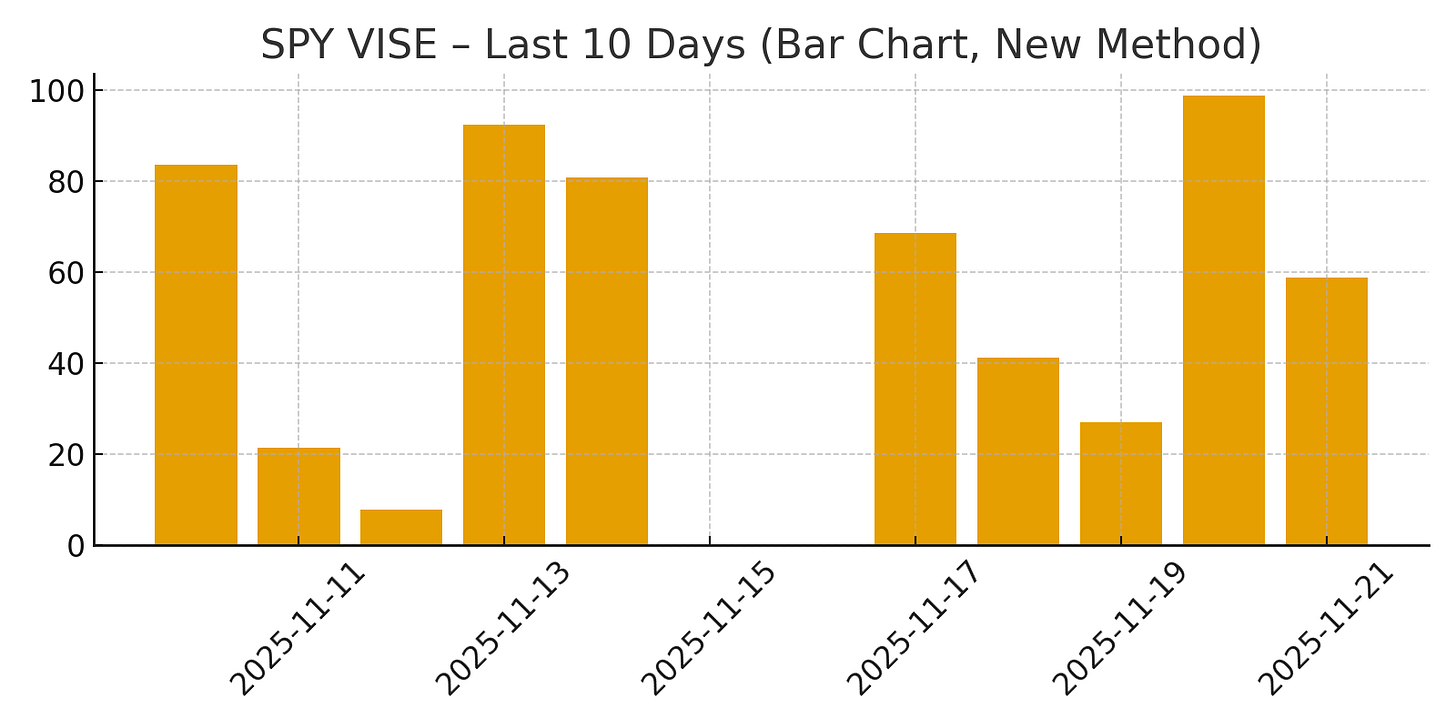

Today’s PARI (~23)

This is the dirty trend zone:

directions flip

candles get spiky

breakouts lie

you can be right about direction and still lose

This is why new traders get slaughtered: the move is there… the cooperation is not.

😈 VISE — PARI’s Evil Twin (Volatility Indicator of SPY Expansion)

If PARI is the conscience of the trend, VISE is the demon sitting on its shoulder.

VISE takes the same internal mechanics of PARI and strips out the direction, leaving only the raw force behind the movement:

tightening

expanding

coiling

releasing

Think of it like this:

PARI tells you if the trend is real.

VISE tells you how violently it’s about to express itself.

Today’s VISE (~59)

Right on the edge of expansion.

Not quiet, not explosive — just enough chaos to carry moves 2–3 candles before the market thinks again.

This is the “Shadow March” zone — where SPY starts to stretch its legs.

🌀 How to Trade Using VISE Alone (Shadow Method)

🔵 Low VISE (< 25) — The Coil (Quiet Before a Break)

The evil twin is holding its breath. Tomorrow often unleashes a big range move.

🟩 Mid VISE (25–55) — The Drift (Chop Sideways, Price Plays Games)

Moves start and stop. Fade edges. Let amateurs chase breakouts.

🟪 High VISE (> 60) — The Release (Chaos Becomes Momentum)

Tomorrow has continuation bias. Momentum follows through. Breakouts stop faking. The evil twin is fully awake.

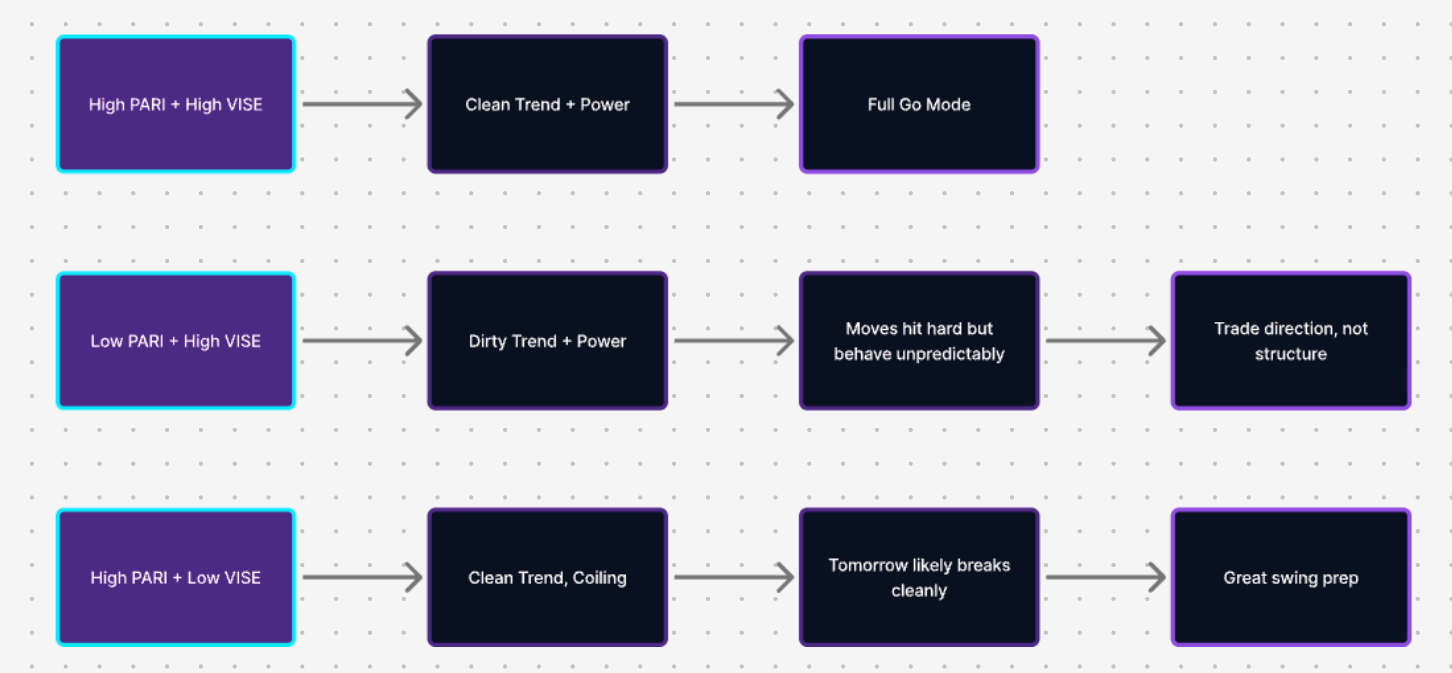

🧭 PARI × VISE — The Volatility Dopplegangers (How to Actually Trade This)

(SPY PARI and VISE will be available routinely to YEET plus subcribers before close. Please note that routinely and daily are not the same thing—it depends on if Orange Swan, PARI/VISE, etc feel more important or if they all are. Most days will be all)

1️⃣ High PARI + High VISE → Clean Trend + Power

The good twin and evil twin agree.

→ Full Go Mode

2️⃣ Low PARI + High VISE → Dirty Trend + Power

Ugly trend, strong expansion.

→ Moves hit hard but behave unpredictably

→ Trade direction, not structure.

3️⃣ High PARI + Low VISE → Clean Trend, Coiling

Trend is honest but asleep.

→ Tomorrow likely breaks cleanly

→ Great swing prep.

🧬 PARI × VISE: Free Portion of Today’s Interpretation

🧩 “Dirty Trend + Power” (DT+P)

Low PARI + High VISE = Ugly trend, big movement.

Breakouts are sloppy but powerful

Flushes are violent

Trend is unclear

BUT movement size is excellent for intraday

THIS IS WHERE FLOW TIPS THE SCALE FOR US ON SHORT TERM DIRECTION

🌑 INTRODUCING: BLACK MAGIC v1.0

When you take everything that made SPY Magic elite…

…and then inject it with volatility, degeneracy, panicked whale logic,

and filter metrics rewritten to function in high-volatility universes…

You get:

🧪 BLACK MAGIC — the volatility-corrupted version of SPY Magic.

It is designed to:

Track true degenerate direction

Identify whale bets during volatility expansion

Ignore fake noise

Focus on OTM power, time clustering, and premium distortion

Tell you what the craziest whales are really doing

This is the filter you use when VIX is rising, PARI is low, and volatility is widening.

This is your Bizarro Universe Directional Filter.

🚧 YEET PLUS 🔒 — Full Combo Read Below

👇 Everything below is PLUS-only:

Black Magic score (0–10)

Filter link

Raw orders

Directional interpretation

PARI × VISE × Black Magic combined signal

Compatibility with Orange Swan

Nicest looking whale contract on the filters