✈️B E A R A I R: A MacroYEET Crossover

The friendly skies have a lot of opportunity brewing

Welcome to The Yeet, a weekly DD where we try to tilt the casino...

Hey! I’m @yourboymilt, and welcome to retail’s Sunday Paper.

I should probably let you know...This is not financial advice! We are here to entertain while giving you ideas, perspective, and angles. Do your own research, I prithee. And if you aren’t subscribed, join us here:

Pt. 1: News Brief, Pt. 2: Macro Edge piece, Pt. 3: SPY, Pt. 4 YEET Plus Flow Section

🗞️WEEKLY NEWS BRIEF FROM CHIMERA TRADES

If you’re not following YEET’s news correspondent Chimera you need to get with the program. Takes the time every morning to make sure you’re up to date on current market moving events, earnings, etc, entirely for Free.

🗞️ Data Releases + Events This Week (02/10/2025)

Monday 02/10 11:30 - 3 and 6 Month Bill Auction

Tuesday 02/11 10:00 - Fed Chair Powell Testimony 13:00 - 3 Year Note Auction 15:30 - FOMC Member Williams

Wednesday 02/12 08:30 - CPI 10:00 - Fed Chair Powell Testimony 12:00 - FOMC Member Bostick 13:00 - 10 Year Note Auction

Thursday 02/13 08:30 - PPI + Jobless Claims 13:00 - 30 Year Bond Auction

Friday 02/14 08:30 - Retail Sales + Export/Import Prices 09:15 - Industrial Production 10:00 - Retail + Business Inventories

✈️ Pt. 1: BEAR AIR

Good Sunday evening/ Monday Morning MacroEdge Community (and to the YEET Community, where we are contributing to this evening),

Where do we go from a record air travel year?

That’s the question we’ll attempt to answer this evening - for both MacroEdge and YEET Readers. Nice to join you all again for this collaborative deep dive into the airline sector with Milt and the rest of the YEET Blog team. Airline travel had a mostly stellar year last year (in terms of total passenger miles, as well as for most airline stocks) outside of the exception for the Spirit debacle and some bankruptcies impacting smaller companies like Silver Airways and Set Jet. We discussed other tariff and employment risks in the Friday evening note - which if you missed - you can catch here: https://macroedge.substack.com/p/midnight-macro-redeye-note-macro

🇺🇸We laid out the narrative behind our risk matrix, defined as ‘TRUMPETS’:

This evening instead of the usual weekly report we’ll dive into the latest in airline and travel data, and see where things are trending, after 4 years of a pandemic-revenge travel - that sent airline travel surging. Many broader macro variables could shift aggregate travel demand this year, namely on the employment and inflation side of the equations, as those are the most likely to induce pain on this high asset price environment. In addition to covering trends in air travel, we’ll briefly touch on a few airline companies themselves, as well as the JETS ETF, and broader valuations in viewing past correlations to the performance of airline stocks during periods of extreme valuations.

There’s no denying that the blockbuster 2024 air travel year was impressive. Still, we’ll dive into the data tonight to assess where things are headed from here by looking at: current trends in travel, air travel macro data, risks to air travel this year, and air travel equity analysis. The trend in air travel is on a cooler trajectory to start the year than from 2021-2024, which aligns to other travel data signals pointing towards a year of normalization and cooling with the high-priced travel environment of 2025.

If you haven’t joined our MacroEdge Community, you can get access to our cutting-edge offerings and services through MacroEdge Ozone, try Ozone for two weeks below:

📈 Current Trends and Air Travel Macro Data

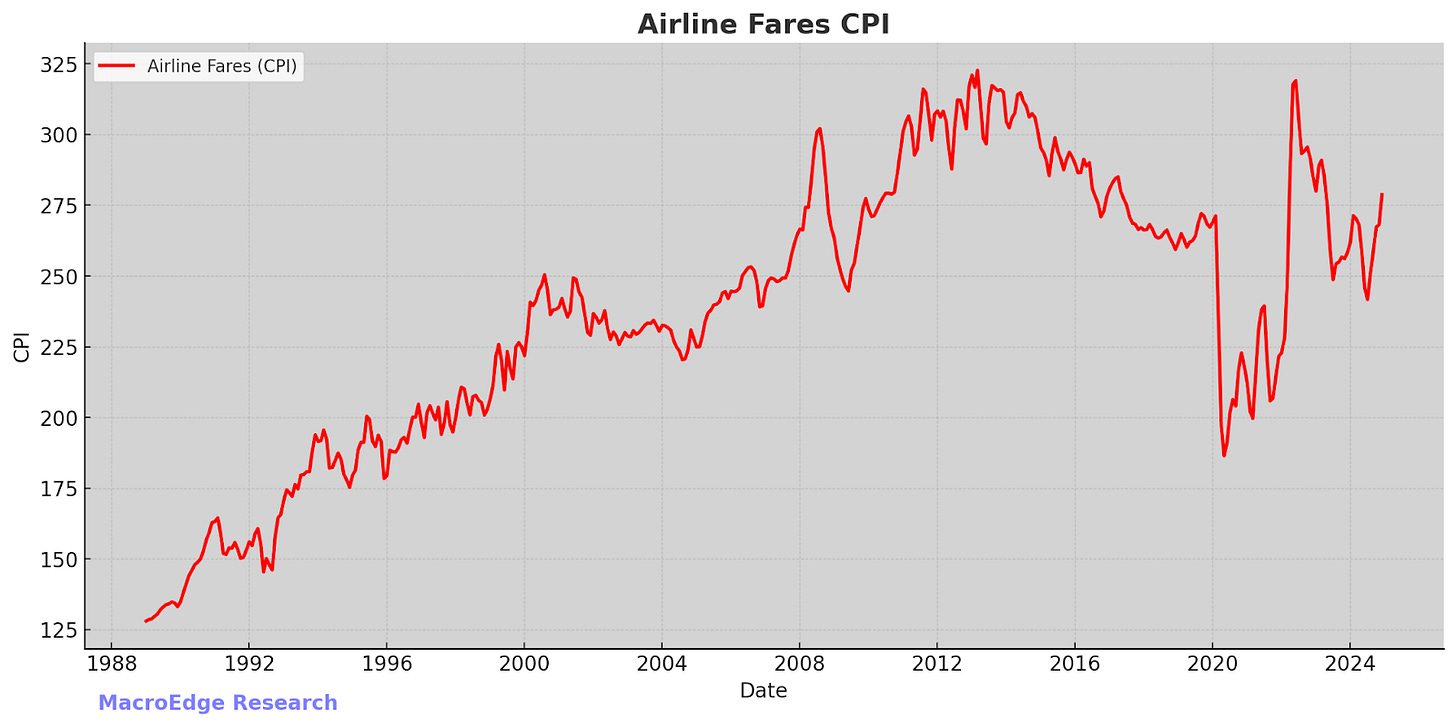

Ticket prices for flights have remained sky-high through 2024, but that trend may see some abatement if air travel demand cools. While we experienced a brief drop in ticket prices, airlines again have begun pushing costs off to consumers to compensate for higher worker pay, thinner margins, demand from shareholders, and holistically - a more expensive cost environment.

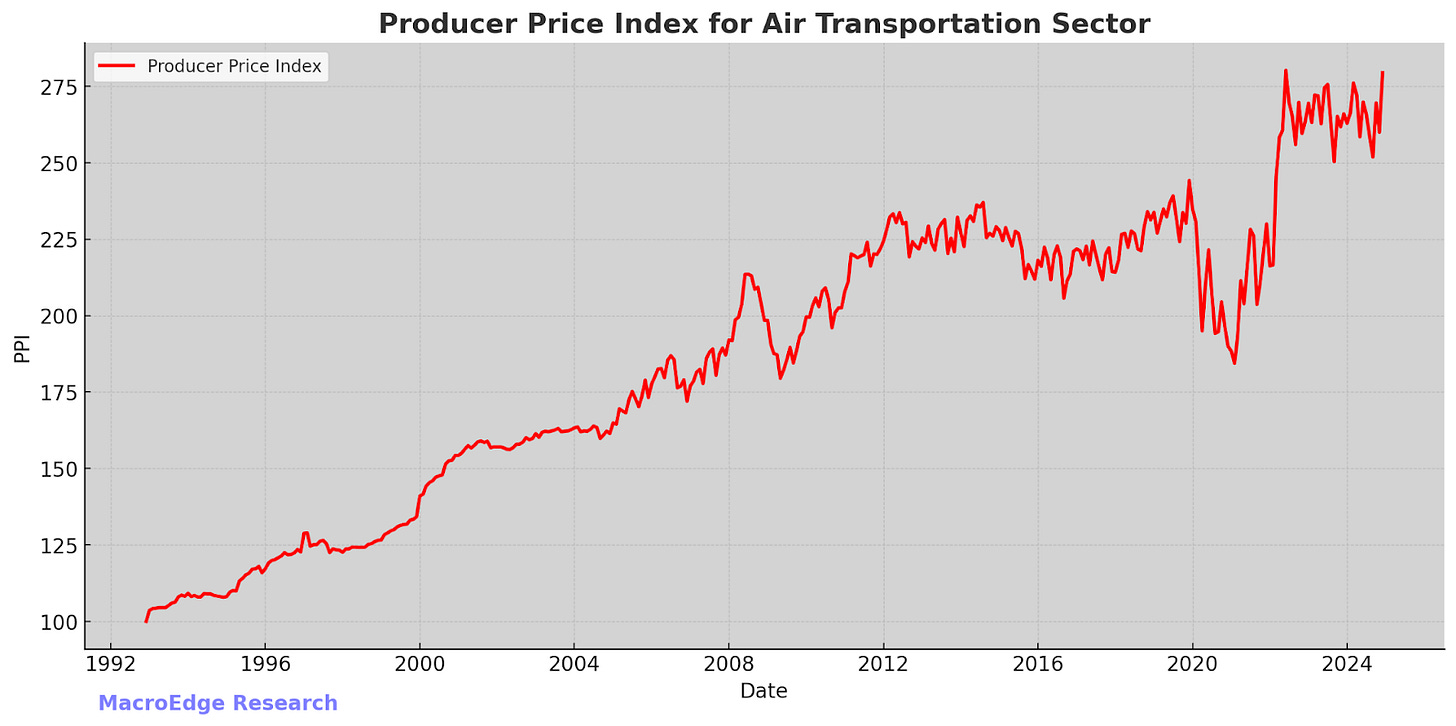

Costs for airlines are back up to all-time highs, which is why we’ve seen some of the stress outlined above - particularly among the low-cost carriers. Companies like Southwest have been forced to adopt the upper-tier carrier model (like Delta and American) shifting their seating pricing model and becoming much more expensive for consumers.

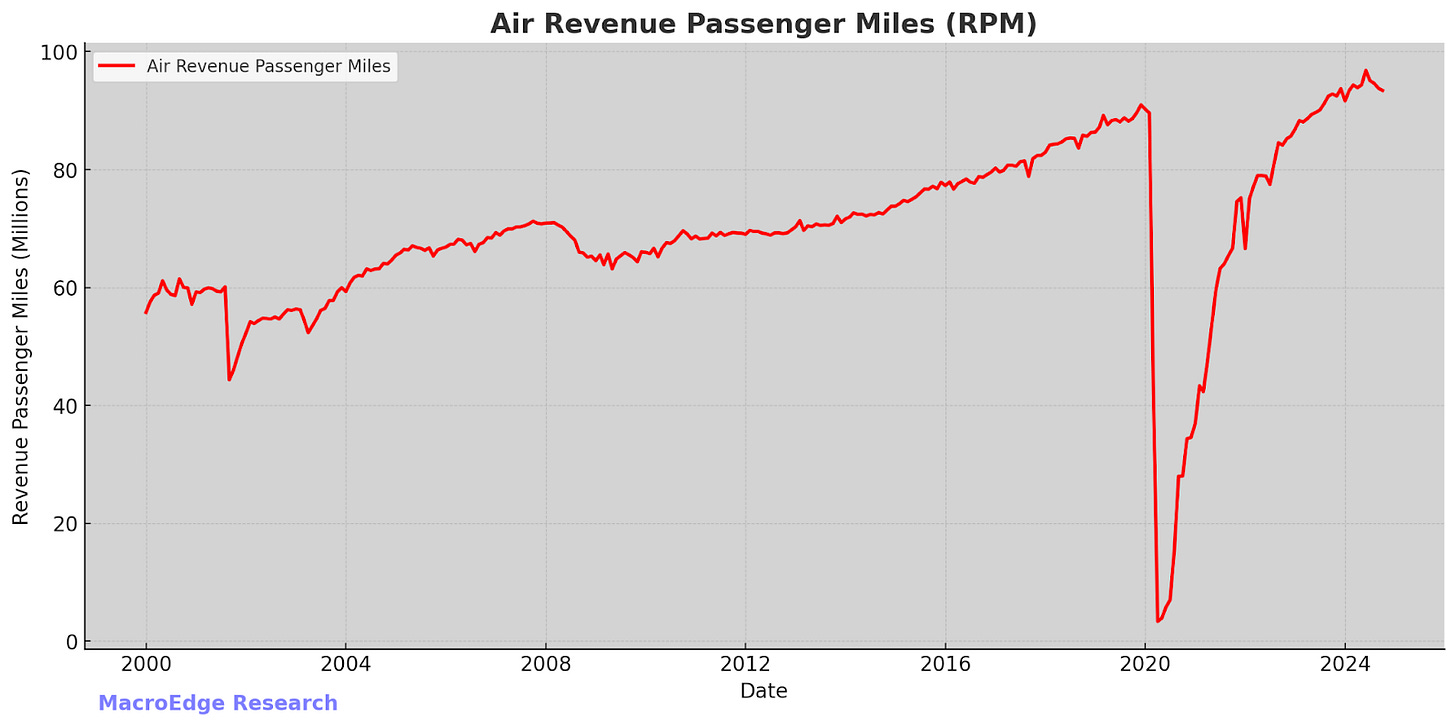

Air Revenue Passenger Miles - which measures combined passenger miles (of domestic and international travelers) hit a new high in Q3, but began ticking lower into the 4th quarter:

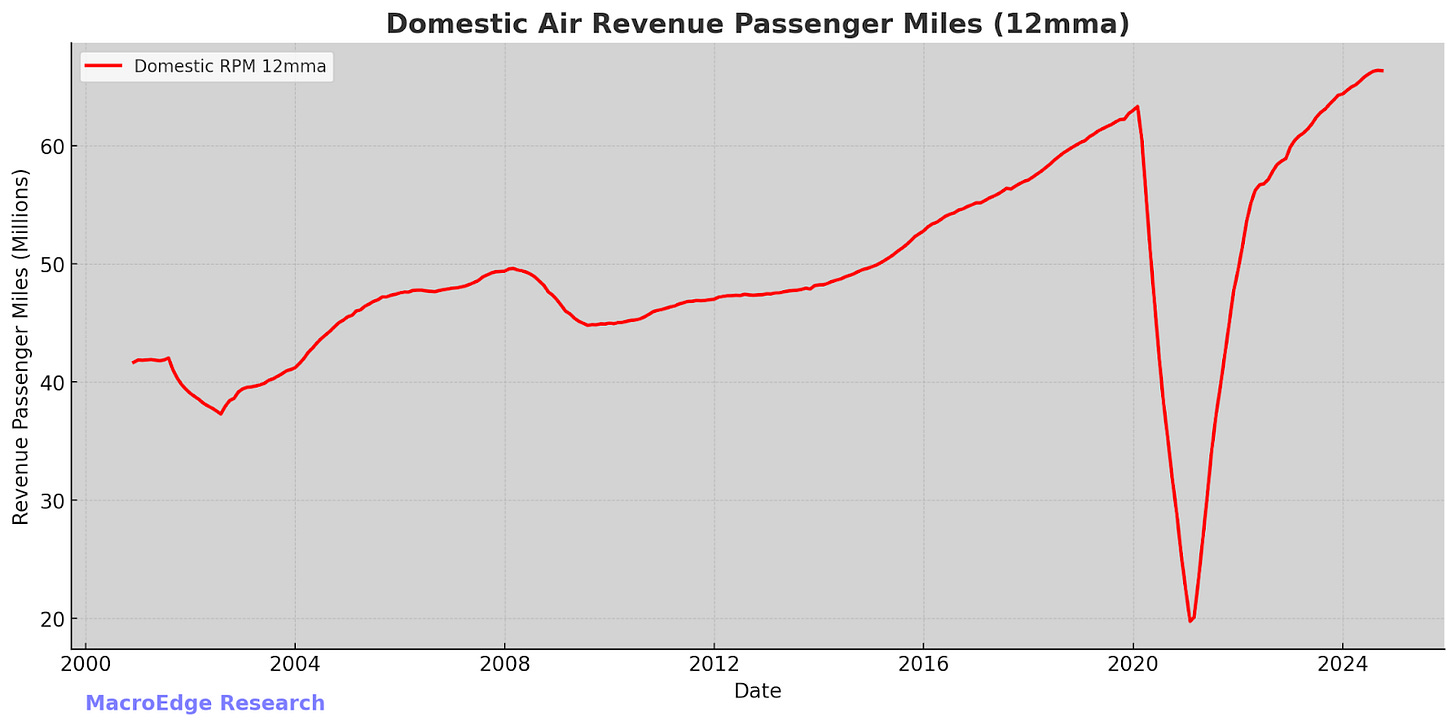

Domestic travel only:

The picture here should be pretty clear - we’re coming off a period of record travel growth from the sector - from the depths of the pandemic - and this trend is now cooling and for now, flattening out. Interestingly, this pandemic revenge travel era really wasn’t impacted by record high flight costs and costs for airlines - who pass on their costs to consumers. Airlines face a variety of price-sensitive inputs, with everything from fuel to shipping costs, and these quickly bleed into ticket prices that consumers are absorbing on behalf of the airlines.

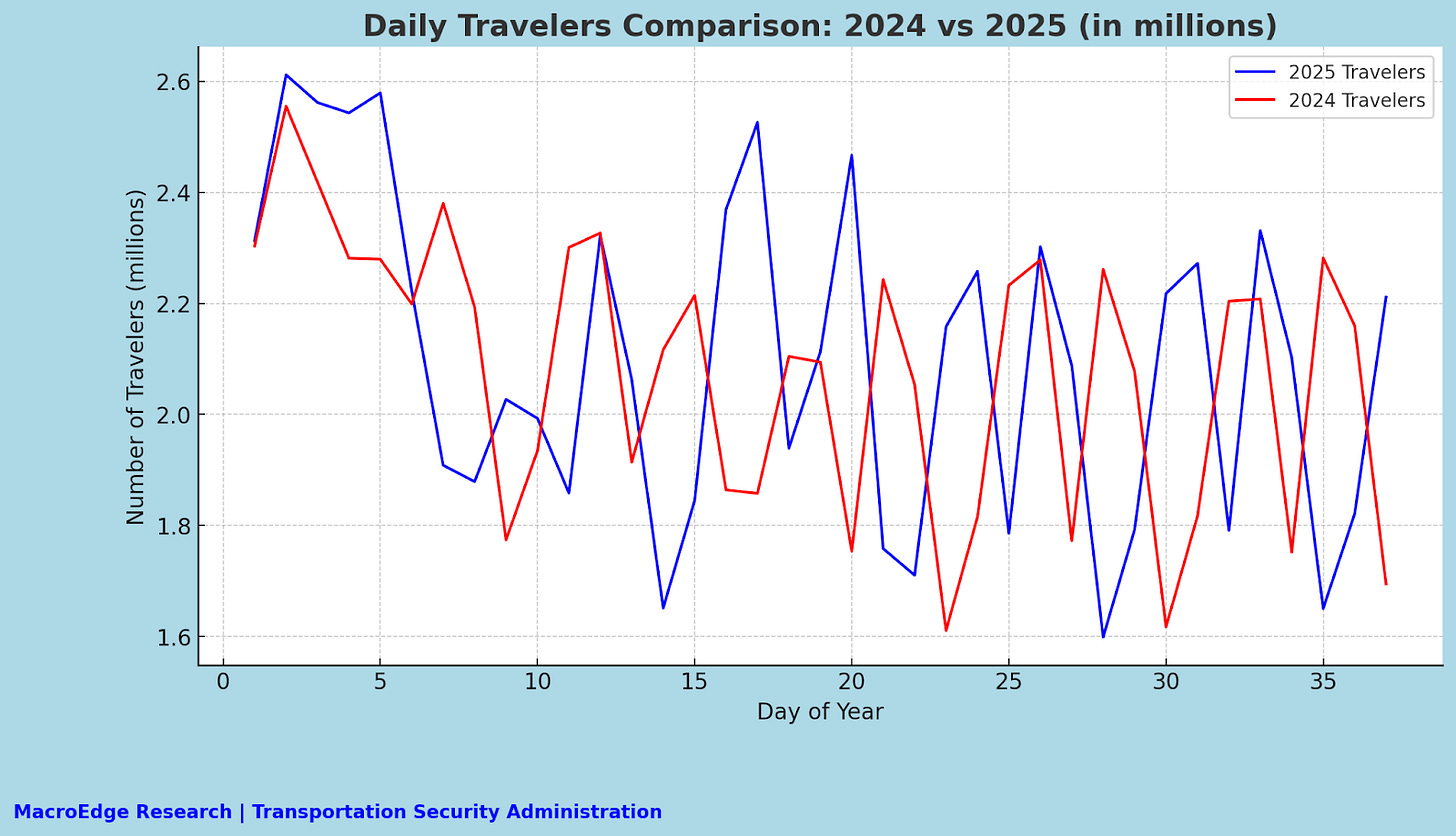

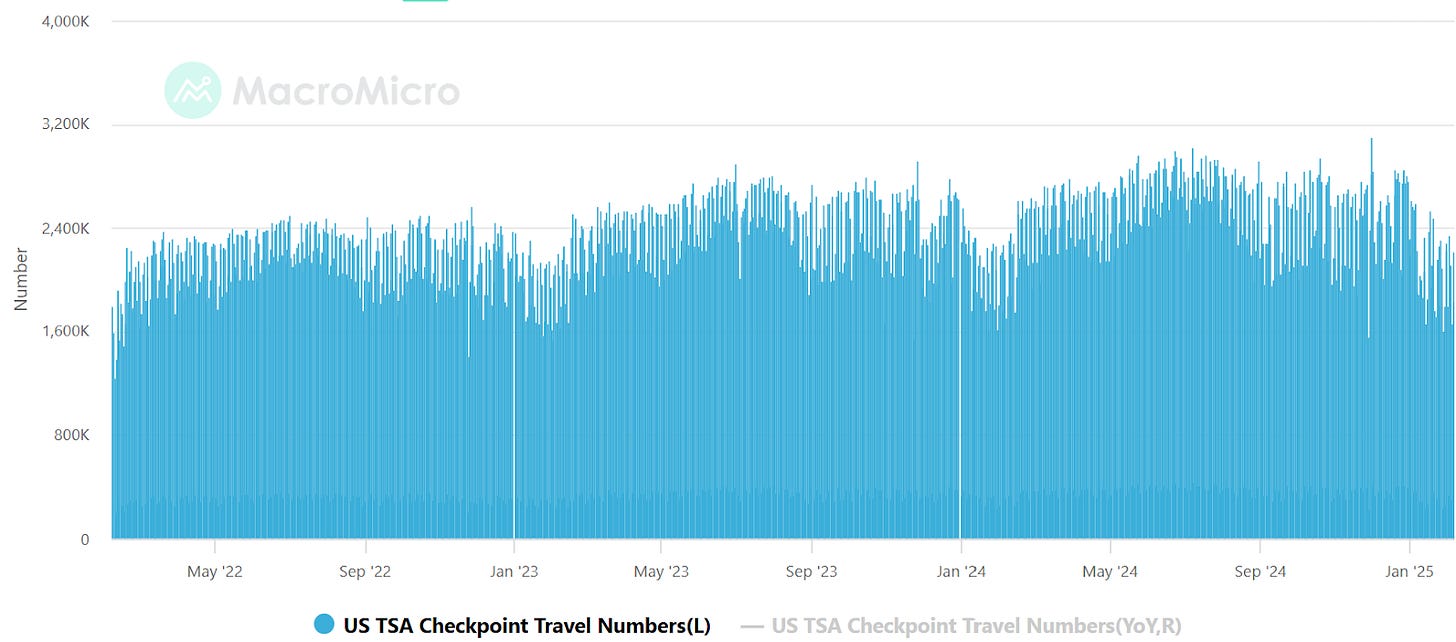

On a year/year basis - we’re running roughly in-line with last year's total travel numbers:

Viewed on a composite basis:

You can see the slightly lower start to this year relative to last.

Summer 2024 was a stellar standout year, and some factors weigh on further passenger revenue growth. We’ll discuss those below.

🚀Quantifying the Risks to Air Travel this Year

Risks to airline travel this year are dynamic, but the biggest risk is not inflation—even though that may lead to higher unemployment indirectly—there are potentially declining asset prices, maximum travel output, and higher unemployment. Just like with employment growth and quantifying a ceiling (becoming more difficult to do with weakening demographics in the United States, in addition to wild adjustments).

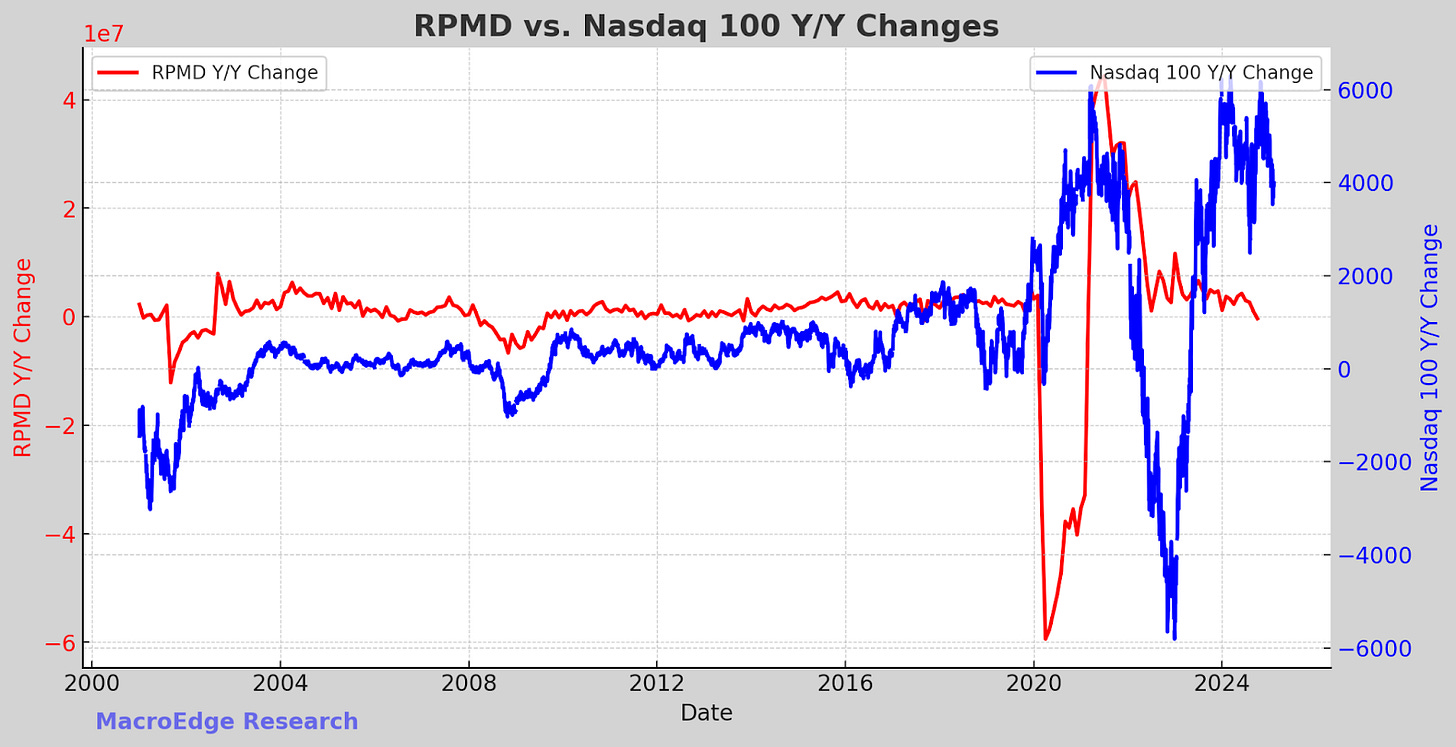

With declining asset prices, this speaks for itself; when there are large equity market declines (usually correlated with a rise in unemployment), people cut way back on air travel. Check out the Nasdaq vs. RPM (Revenue Passenger Miles) correlation:

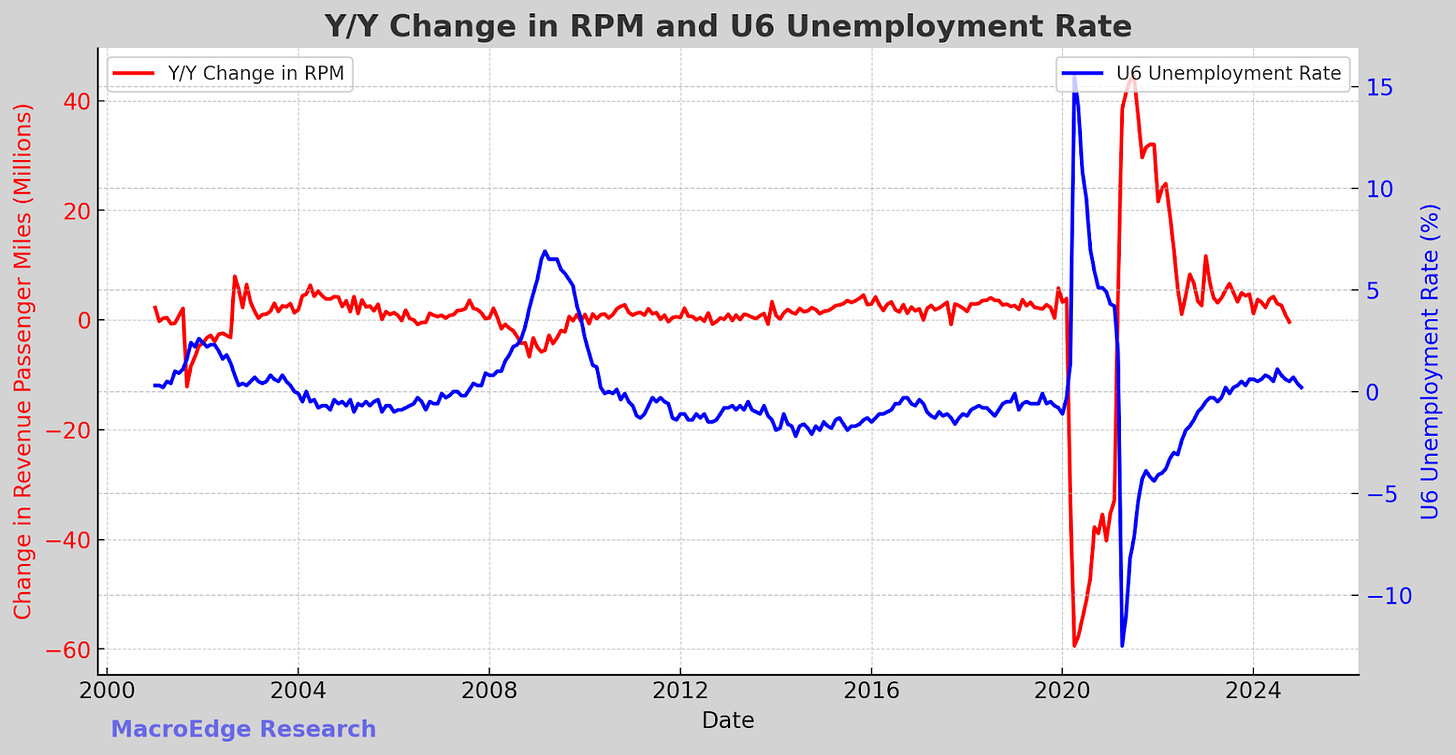

Unemployment and air passenger miles are negatively correlated:

When people’s assets decline, they pull back on discretionary travel spending.

🦢 Air Travel Equity Analysis

When looking at companies in the air travel space - it’s important to look at several things:

The territory they cover, dominance, disruption

Likelihood of acquisition

% of revenue that is passenger-sourced

% of revenue that is freight-sourced

Subsidiaries (ie: for AA: Envoy Air)

Price sensitivity

Profit margin

Total travelers serviced

Total active reward program members (very important this year)

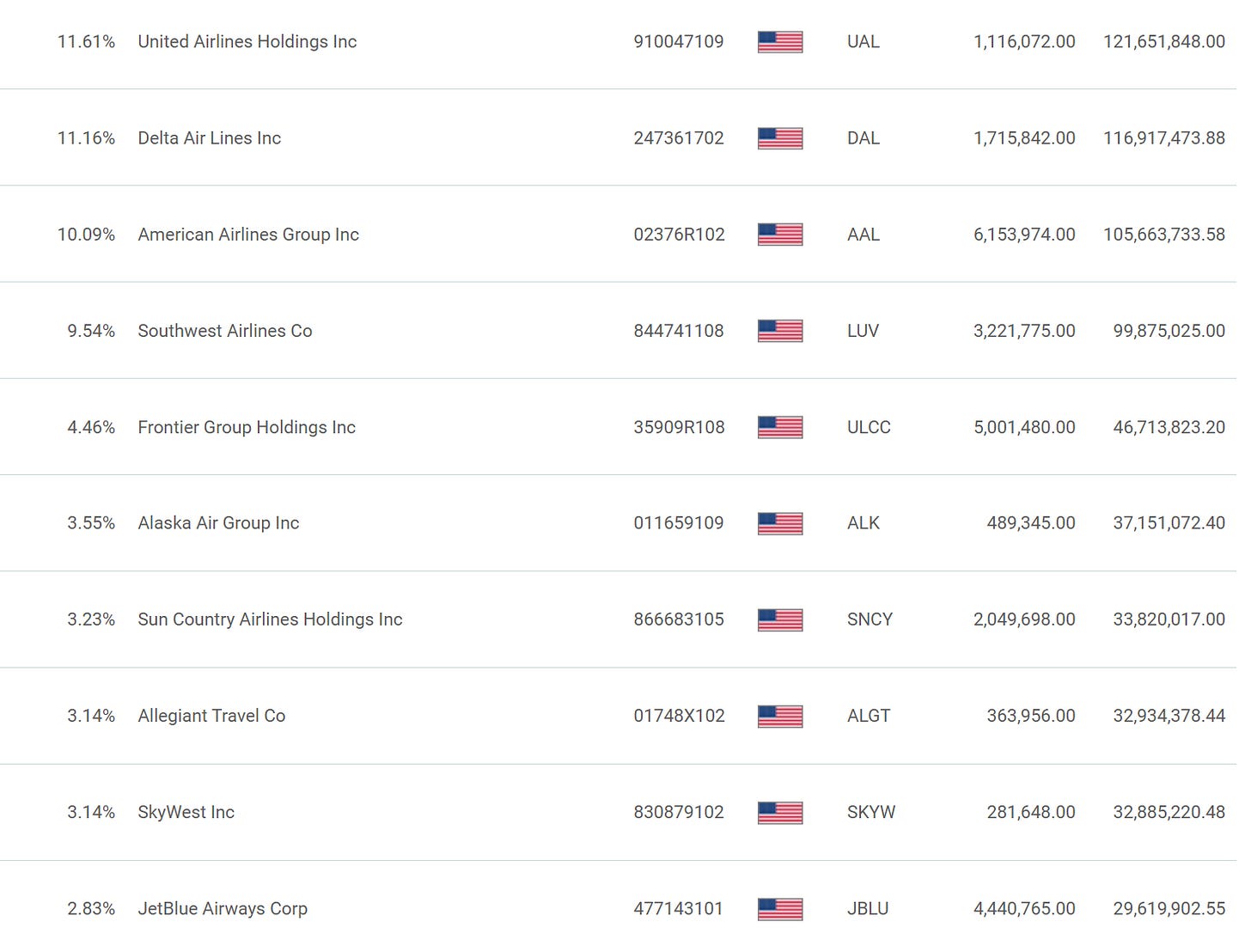

The JETS ETF, has holdings consisting of airlines (and non-travel related companies):

From a technical perspective, things are weakening and will continue to do so if travel continues at a slight decline on a year-over-year basis. In a tough margin environment, if assets decline and unemployment rises, which may be spurred by a variety of reasons, a bet against the airline sector is usually rewarded. Also, keep an eye on ‘peak travel demand,’ which is an evolving limit set by demographic and consumer limits in the United States. Other secondary risks include global currency fluctuations (such as with a strengthening of the yen) and downstream effects of what a higher 10-year yield and sustained inflation would mean for the average air traveler.

On the monthly:

I’d get more bearish on the airline sector (on the aggregate) if one of several of the following events occur:

Travel continues to run lower y/y through 2025

PPI rises for airlines and oil prices rise, which will greatly harm airlines and passengers

Asset prices, namely equities, decline

U6 rises above 8% (SA)

Once these situation(s) occur from the macro perspective, targeting the weak-sector links losing share in their markets, seeing flat or negative y/y traveler numbers and harmful debt structures will be a no-brainer. The next Spirit is currently up in the sky, waiting to turn the page in its book and accidentally land on Chapter 11.

Until then, airlines will have a mostly positive year even if travel data flattens off, and keep an eye on the above trends to identify these macro pivot points.

I’ll let Milt and the flow experts take it from here.

🌊Obstructed Airflow: A Look Around the Flow for Airlines using Cerebro

Before hopping into the flow, let’s take a look at JETS’s chart so you can see the nice setup forming:

JETS is a perfect example of using Price Action History for Probability-based trading in a chart

1) It's getting tight, but the pennant likely becomes a backtest to the hourly 25.6 level first. Why?

2) Switch to the daily--notice what $JETS does on gap closes- it checks them all off and then wicks into the bullish pattern

3) Given an open gap, I'd play that and look for signs of a reversal wick to then flip upside

🚀 YEET Plus:

JETS Flow

SPY Section

Bonus Nate Dawg and Milt Joint YOLOs