🌗Bangers at Midnight vol. 4

Fairly self-explanatory title: They are bangers. It is midnight. Therefore...

After a long day there’s nothing better than just sitting at the computer in the search for bangers.

Sometimes this happens in the morning.

Often it happens during the day.

But when it’s 12:00 AM it becomes…

🔥NVDA: Friday Volume 101 Trade Review

Sometimes it really is just about staying locked into the simplest read:

✅ Short-dated

✅ Far OTM

✅ Volume bursting past Open Interest

✅ $700k+ in premium floating early in the session

This NVDA 116c 5/16 call setup popped through the Freelance Five filter clean — no fluff needed.

The strike was deep OTM (~5%+ out at time of entry), but what mattered more was how aggressively the volume surged relative to OI: 1,073 volume on just 421 OI early, forcing repricing pressure.

When you see short-dated, far OTM contracts getting stuffed with that much urgency — it’s usually newsfront, rumorfront, or repricefront behavior.

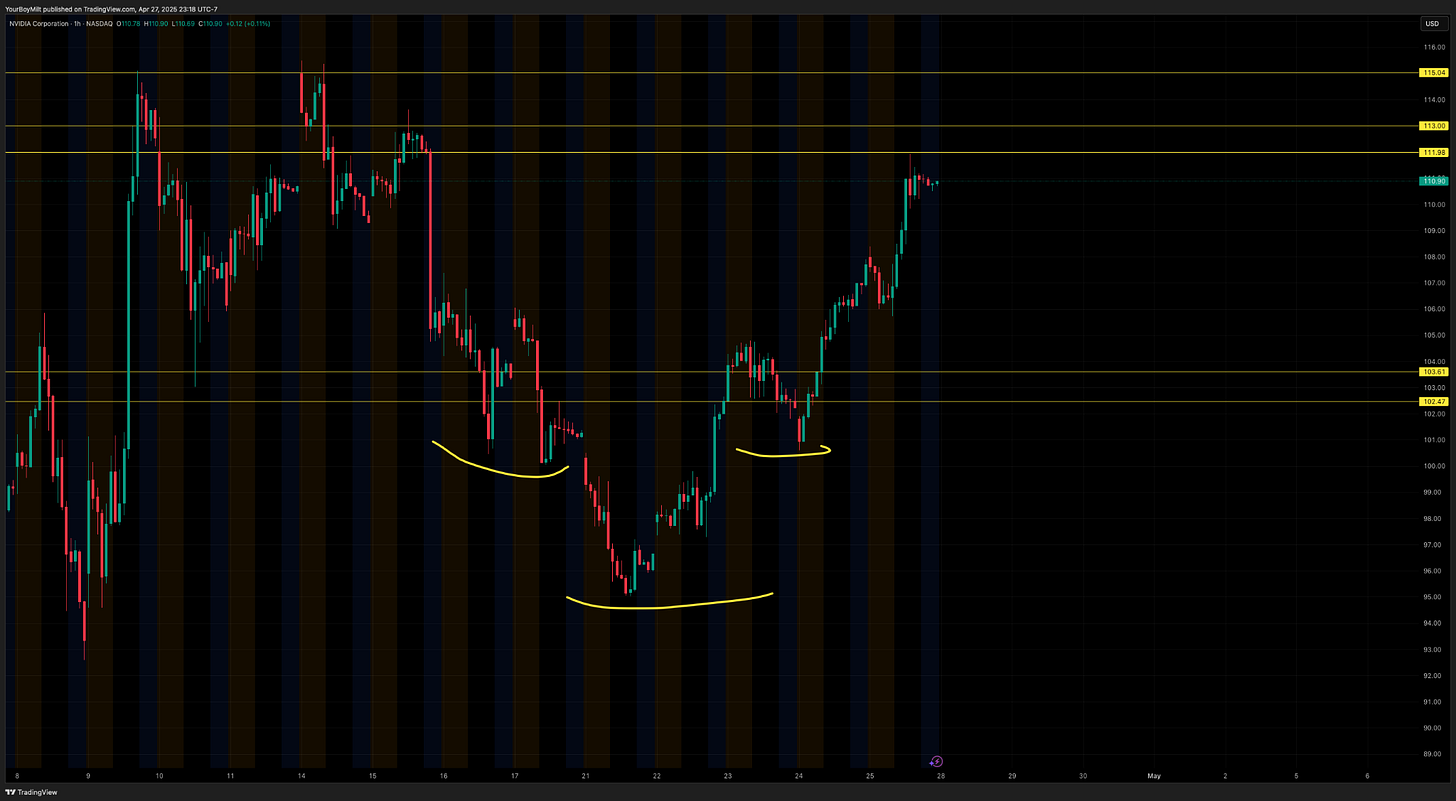

Chart Read: Inverse Head and Shoulders Forming Was A Sign — But Trendbreak Was the Key

On the technical side, the bigger, cleaner signal wasn't actually the inverse head and shoulders —

✅ The IHS was key, but...

✅ More importantly, the hourly downtrend was broken and retested into a clean gap-fill level.

Translation in the YEET system:

The trendbreak is your permission slip.

The retest is your discounted entry.

The gap zone/weekly levels are your exits.

You didn't need to overcomplicate this:

Just basic monthly, weekly, and gap-fill levels we've mapped and hammered into muscle memory every week.

The 111.90–113.00 area was sitting there like a neon sign for exits after the retest.

Why This Whale Play Worked:

🔹 Volume urgency + short-dated + far OTM = something is brewing behind the scenes (news, reprice, gamma chase)

🔹 Inverse head and shoulders gave you the shape, but the trendbreak and retest gave you the confirmation and entry

🔹 Nearby targets (gap and weeklies) made your profit roadmap simple and mechanical — no guessing.