📖Book of Flow Chapter 1.1: The (not so) Secret Life of SPY Whales

Baseline Data for our upcoming adventure, SPY Alert Whale Habits revealed, and filter for YEET Plus

Welcome To The Truth.

What this is:

🐳The Book of Flow is designed to be a comprehensive look at Options Order Flow truths using the following data:

Options Alerts Data

Options Flow Feed Data

A variety of filtering to come up with unique insights

🐳 What You Get Free:

Roughly one chapter per week (about 8 Chapters total)

Comprehensive data analyzed and explained on Options order flow

Myths verified or debunked to help you trade flow without assumptions

A better understanding of how flow responds to and even affects the markets

🐳What You Get with YEET Plus:

The above

Chapter Expansion Packs (additional, nuanced data and filters), Workbooks, and Summaries

Unusual Whales filters that come out of each chapter based on the most critical findings with Chart Strategies to play them

Access to The Garden: a private room in the Free YEET Discord where the restricted data can be discussed

Video explainers for the filters and chart strategies to come out, and a library of them on YEETvPlus

🐳This Week Is: Chapter 1, Part 1: The (Not So) Secret Life of SPY Whales

Note: This book is split into two “testaments” if you will—Alerts and Flow Feed. The data here is from the Alerts, largely unfiltered, with Volume > OI, ask-side single-leg orders, and excluding ITM orders. We will expand to include more robust data more inclusive of those metrics in particular sections as we go. For now, we are looking into the more straightforward data sets before getting crazy.

🚀Upcoming Expansion Packs for YEET Plus from Chapter 1:

0️⃣ Zero: An analysis of SPY Whales 0DTE habits and filters from the learning

🦢 Black Swan: Seeing if the data holds predictive value which will help us create predictive indicators for Black Swan Market Events

🧨Volatility Day Apocalypse Survival Pack: How SPY whales move in relation to FOMC and CPI, looking largely at predictive value and filtering before the event.

📓 Then Chapter 2 will focus on: QQQ and IWM Whale Alerts, both in conjunction with and independent of our SPY analysis.

SPY Options Order Flow in 2024 – Market Context & Whale Activity

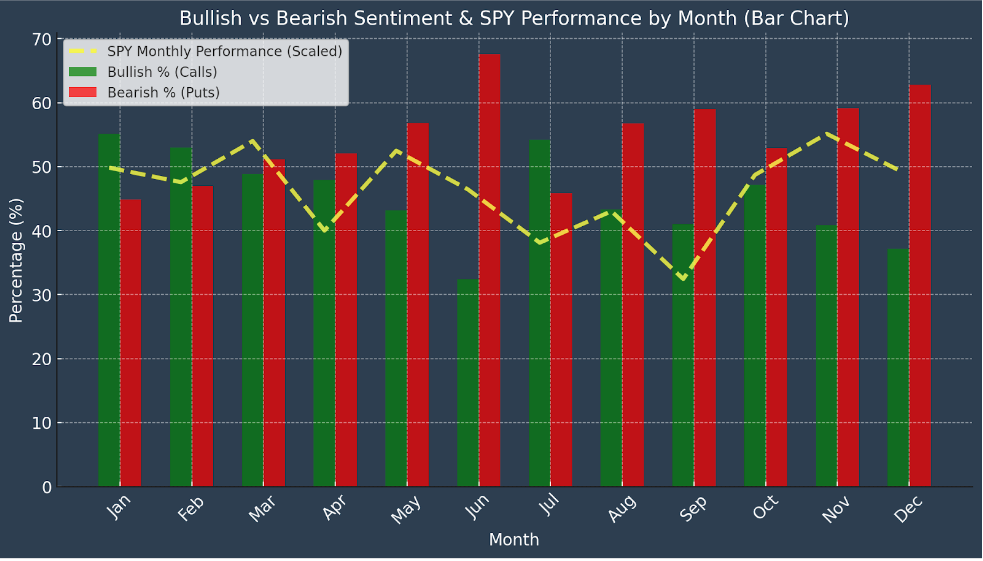

Market Overview: Bulls Were In Control But Puts Ruled the Day

The S&P 500 gained over 23% in 2024, marking its second consecutive year with returns exceeding 20%--bullish! The main sectors responsible were Information Technology and Communication Services, which we’ll dive into the flow of in a later chapter.

Despite this beautiful bullishness, the data shows a higher volume of put options compared to calls. This suggests that while traders participated in the rally, SPY was mostly a hedge for Whales.

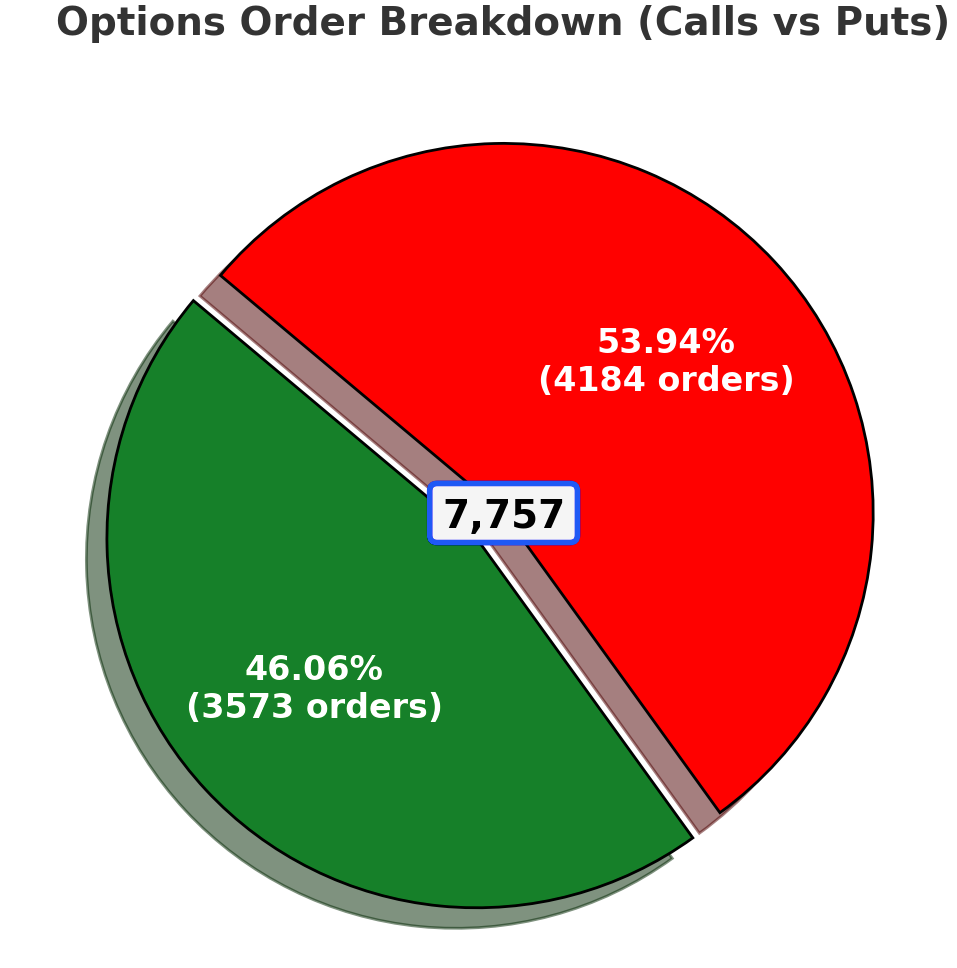

2024 SPY Whale Alerts – Calls vs. Puts Breakdown

The Long and Short of It: Puts Outweighed Calls Significantly

This analysis breaks down SPY options orders into calls and puts, providing insight into overall market sentiment and trader positioning.

Whale Alerts by the numbers:

Total Orders: 📊 7,757

Call Orders: 📈 3,573 (46.06%)

Put Orders: 📉 4,184 (53.94%)

🔎 Imbalance Insight:

Puts dominated by 7.88% despite the bullish market, reinforcing that institutions and large traders were hedging rather than outright shorting SPY.

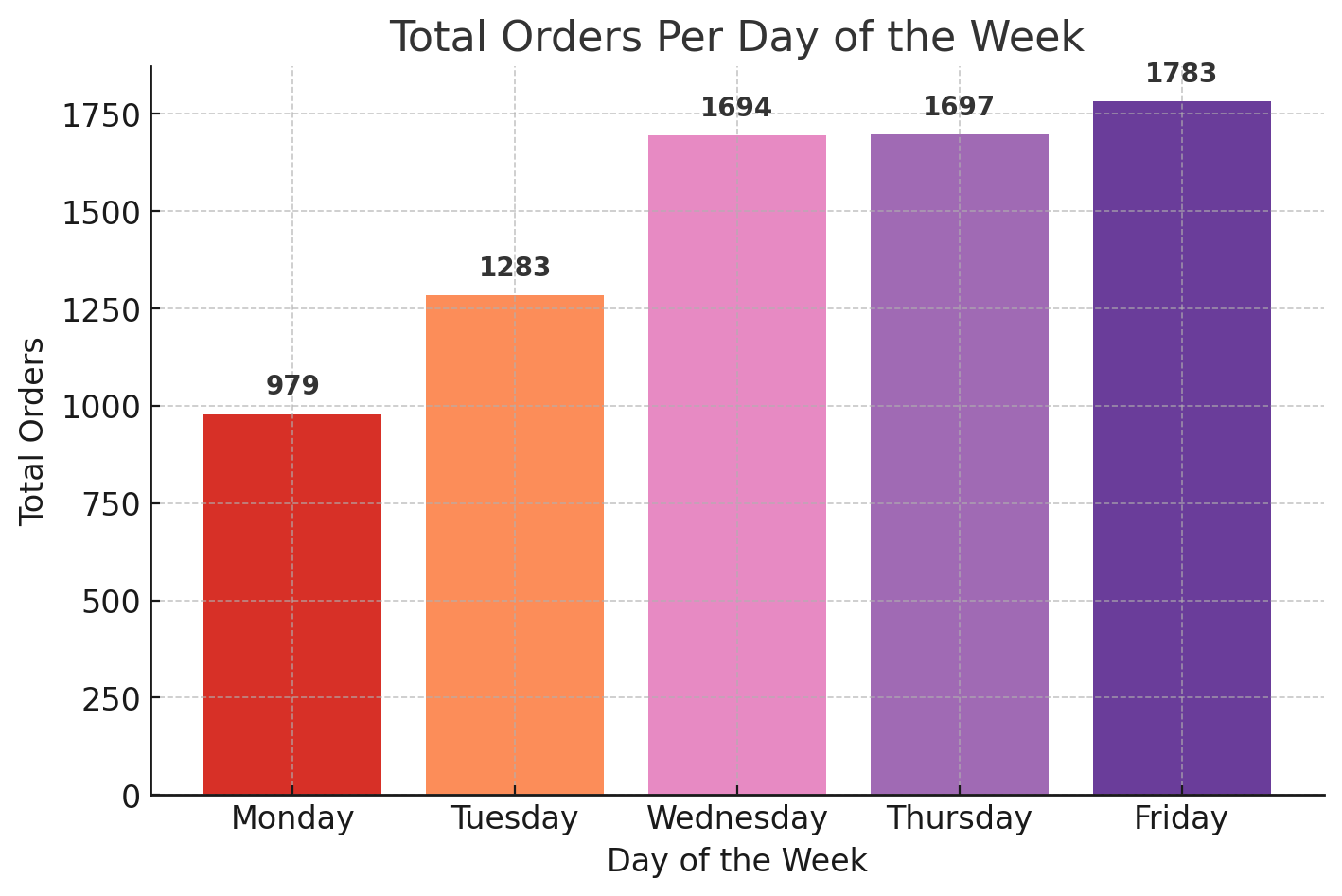

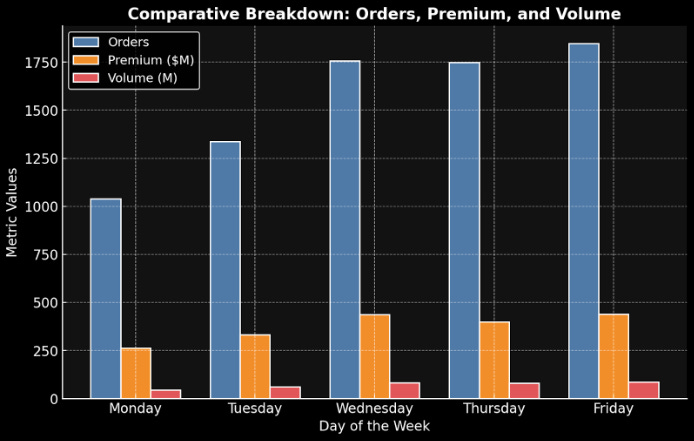

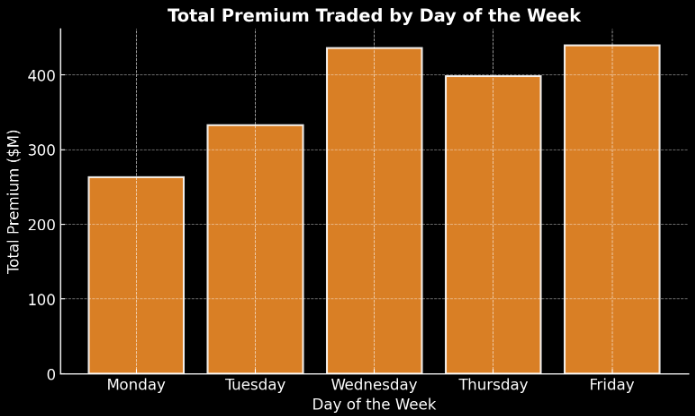

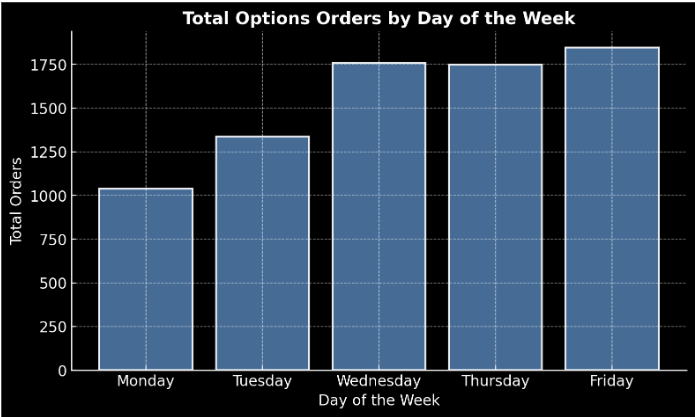

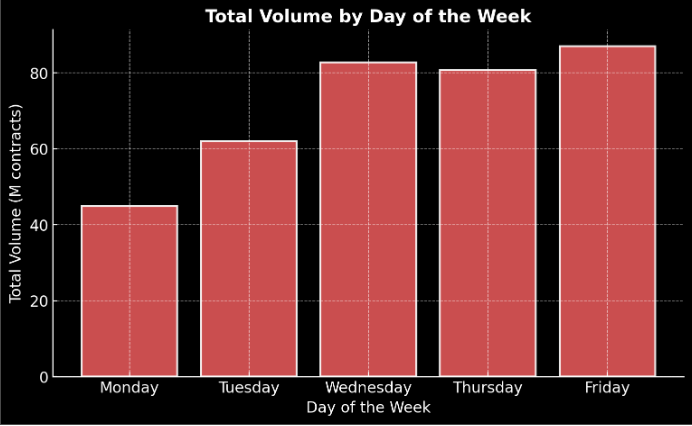

📆SPY Whale Activity by Day of the Week

The Long and Short of It

Taking a look at SPY options activity by weekday reveals when traders are most active, potentially helping you decide when to pull the trigger or decide to follow through with a YOLO–er, I mean trade.

✅Peak Activity Day by Total: 📅 Friday (Highest Order Flow)

❌Lowest Activity Day by Total: 😭 Monday (Lowest Order Flow)

🧠 Inside the Mind of the MMs:

High Friday activity suggests traders adjusting positions before the weekend, possibly

Low Monday activity may indicate traders waiting for market direction before entering

Implication for Traders: Consider entering positions mid-week to balance risk

Key Insights for Options Traders

Use Case / Trading Strategy

Strategy: Capitalizing on weekly options flow with high Friday activity

Example: On Friday, December 29, 2024, a trader executed 2,500 SPY call contracts at a $586.00 strike, capitalizing on week-end positioning.

Execution Idea: Friday’s high-volume trades make it a good 0DTE option for liquidity’s sake

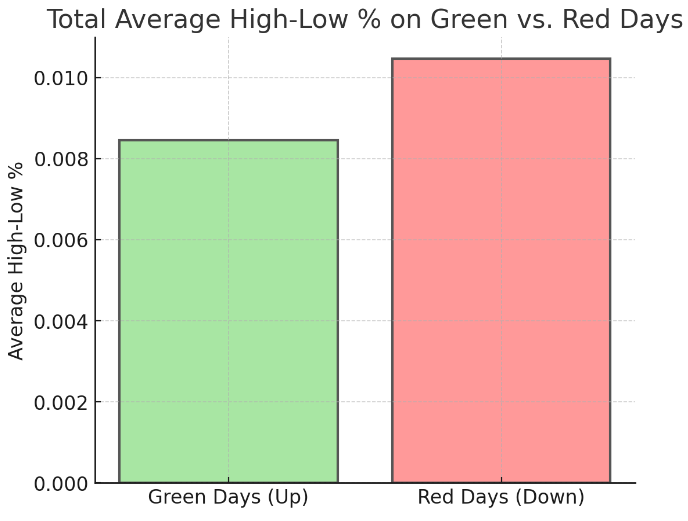

💡The More You Know💡

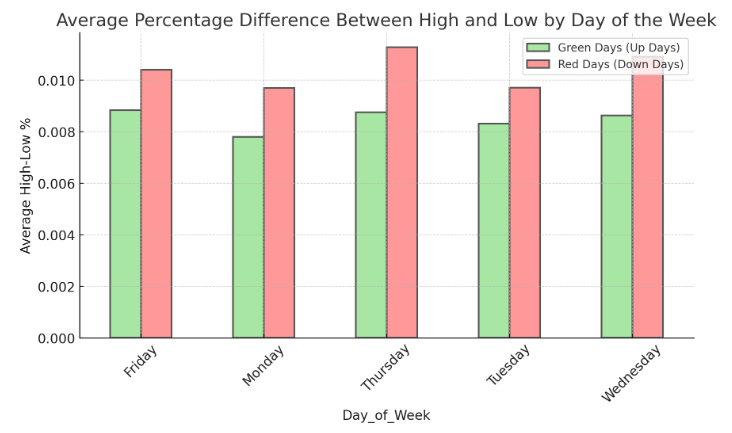

Bearish Days Drop more than Bullish Days Pop!

Did you know that in 2024 Red Days had a significantly higher distance between the daily high and low than Green Days? This means that according to the data, Red Days are a more profitable intraday move to catch than Green Days!

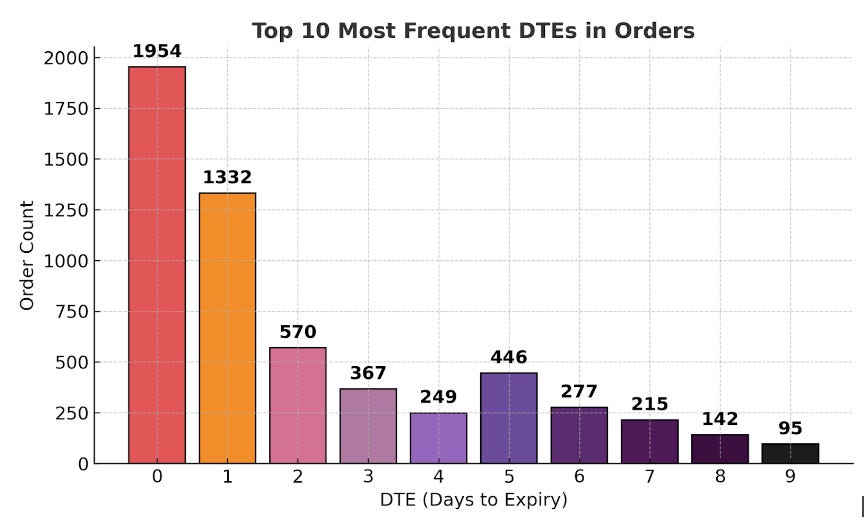

🐳SPY Whales and DTE – Top 10 DTE by Orders, Volume, and Premium

The Long and Short of it

Tracking the most traded Days to Expiration (DTE) is where we start to get to the data sets that lead us to what we’re all really here for–efficacy and practical use. Here is the Whale Alert Order Flow – Top 10 DTE by Orders, Volume, and Premium

Whales by the Numbers: All of the top 10 DTE SPY contracts favored by whales are in the top 10 DTE, dominating overwhelmingly at 73%.

🐳Whales by the numbers:

By Orders: 🔝 Most popular Expiry was 0 DTE (same-day trades dominate).

By Volume: 📊 Highest traded DTE in terms of contract volume was 0 DTE.

By Premium Spent: 💰 Largest total premium spent was on 0 DTE, totaling $322,014.00.

🔍 Why This Matters:

0DTE contracts dominate, suggesting heavy short-term trading and institutional flows.

🚀YEET Plus: OTM % Data Analysis And First New Filter SPY In the Money Magic

In this portion we will talk a little more about how SPY Whales perform based on how far OTM their orders are. The data from this leads to our first Alert Filter– $SPY In the Money Magic – which sees its orders go ITM 93% of the time.

🐳 SPY Whale Alert Order Flow – ITM Performance by % OTM at Purchase

The ITM Playbook

Tracking whale orders that successfully went ITM is where we get the juiciest insights. Do SPY whales perform best with the big OTM YOLO or do they like to simply step over the line into profits?