🚨Book of Flow: THE FALL-OFF Pt. 1

An Analysis of the Market's Direction based on our new Data Tool, WARI

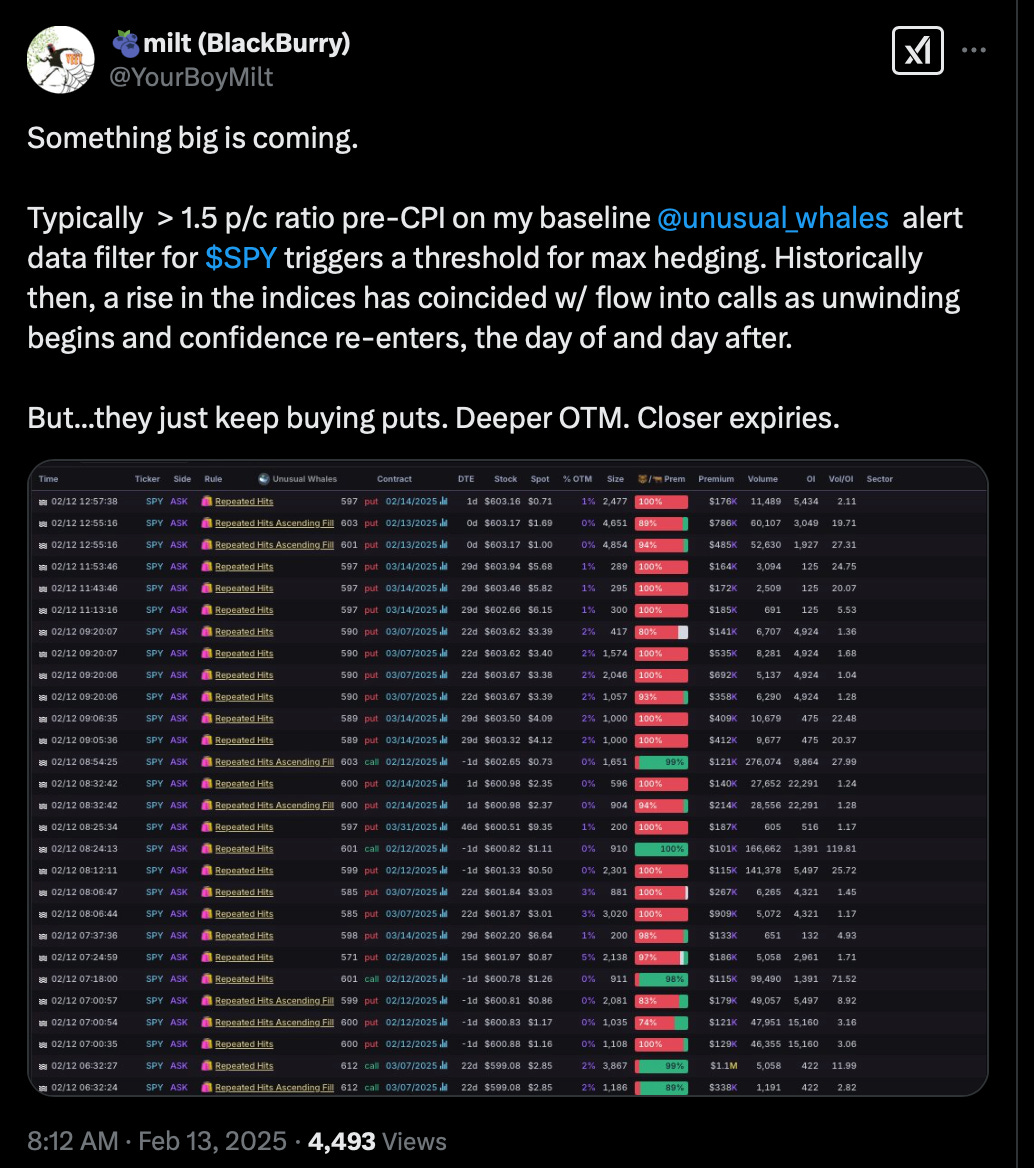

In many posts on X beginning on February 13th, I began to lay out a case for why the data was showing a large, news-driven drop coming to eviscerate markets soon in 2025.

I provided my reasoning. My toil. The sweat of my brow.

The arduous truths forged on late nights with Chat GPT and Python. The Frustrations. Pure. Living. Hell.

And yet? I was summarily ridiculed. Memed. Mocked…

Yet the first Domino fell this Friday…

I take no pleasure in vengeful boasts—tis the habit of lesser men. So I will say nothing like… “LMFAO I TOLD YOU SO YOU LAME HATERS, HOPE YOU ENJOYED MOCKING ME AS YOU BOUGHT THE TOP! MILT IS DEAR LEADER, BELOVED, NUMBER ONE TRADER IN ALL YEETYANG! GALAXY BRAIN BLACKBURRYS REJOICE!”

I certainly won’t say anything like that, it’d be small. Instead, I’ll humbly present what extensive research and data modeling says come next.

🚨This is the Fall-Off pt. 1

🐋 The Whale Alert Risk Indicator (WARI) – Institutions Are Running, Should You?

TL;DR: The Market Looks Strong—But Whales Are Quietly Exiting

SPY is near all-time highs. VIX is low. The headlines are bullish.

But beneath the surface, something is off.

Institutions aren’t just hedging—they’re pulling money out at an alarming rate.

📉 Institutional conviction is down 53.0%.

📉 Big-money trades have disappeared.

📉 Puts are dominating, even as the market rallies.

📉 Whale trading around CPI has collapsed.

🚨 The last time we saw WARI levels like this?

🔴 Before the March 2023 banking crisis

🔴 Before the Credit Suisse collapse

🔴 Before the August 2023 selloff

This time, however, the data is even worse.

Let’s break it all down. 👇

🐋 The Whale Alert Risk Indicator (WARI) – The Market’s Silent Alarm

What is WARI????

The Whale Alert Risk Indicator (WARI) is a tool that tracks how big-money traders (whales) are positioning in the options market.

It looks at key factors like:

✅ Put/Call Ratio – Are whales buying more puts (bearish) or calls (bullish)?

✅ Large Orders – Are they making high-confidence trades or staying on the sidelines?

✅ Short & Long-Term Positioning – Are they betting on quick moves or long-term trends?

✅ CPI & Event Trading – Are they active around key market-moving events?

When WARI is high, it means whales are taking on risk and likely expecting upside.

When WARI is low, it means whales are hedging, avoiding risk, or expecting a selloff.

Most traders react to the news. Whales move before it.

That’s why we built the Whale Alert Risk Indicator (WARI)—our in-house tool that measures institutional positioning.

If whales are bullish, WARI rises.

If whales are hedging, WARI falls.

If whales are running for the exits, WARI collapses.

And right now? It’s in freefall.

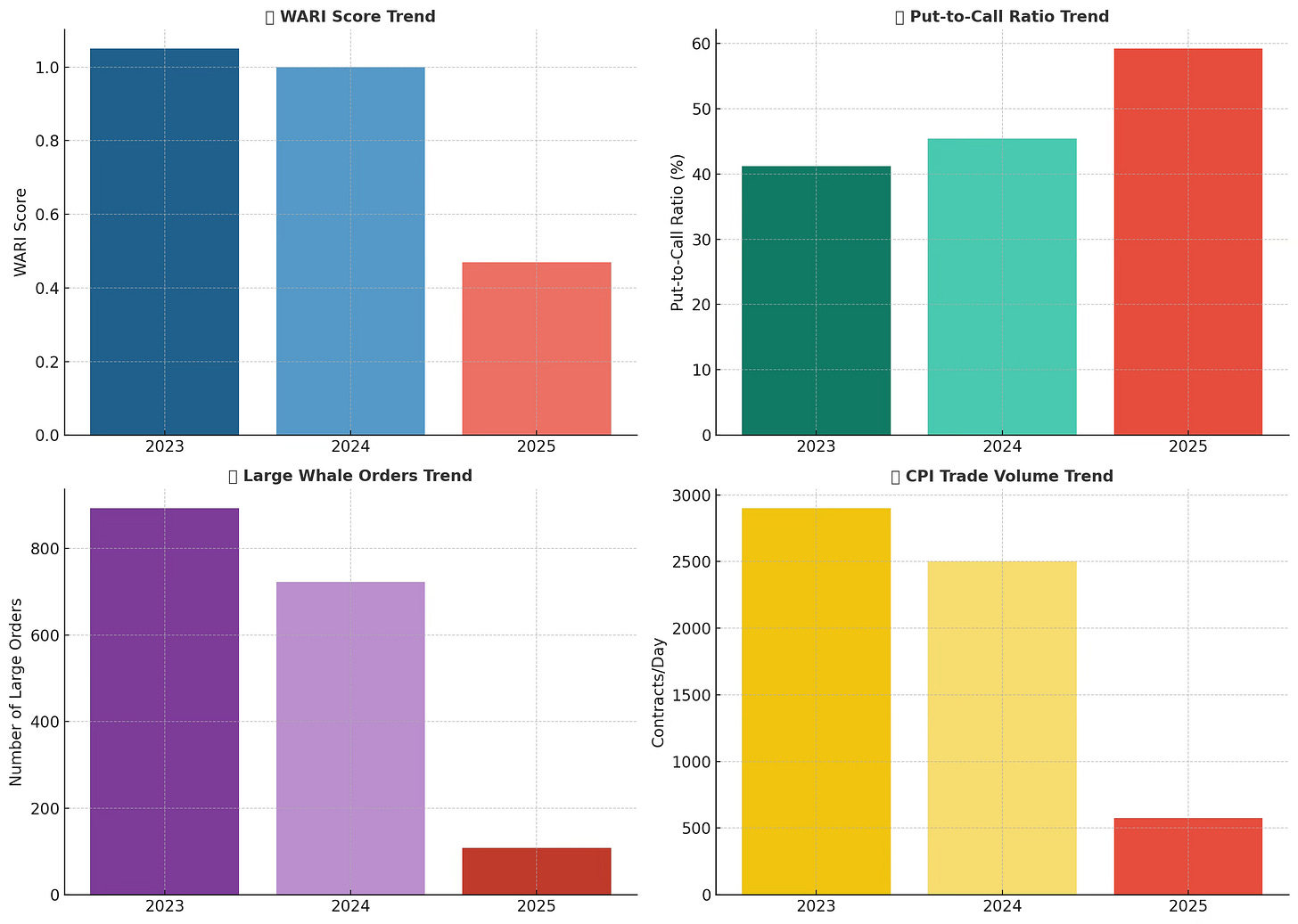

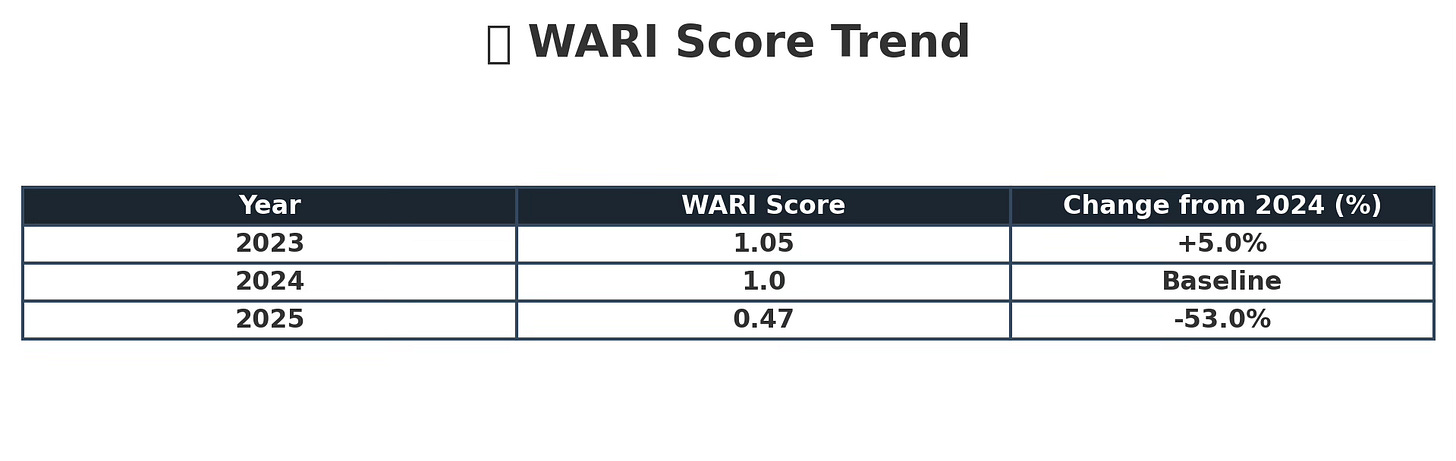

📊 WARI Score – Institutions Are Tapping Out

What does it look like when institutional conviction disappears?

It looks like this. A 53% collapse in WARI from last year. In 2023, institutions were still making bets. Even in uncertainty, they were in the market. In 2024, they held steady. But in 2025?

In 2023, institutions were still making bets.

In 2024, they held steady.

Now? They’re backing away fast.

📊 Visual Breakdown

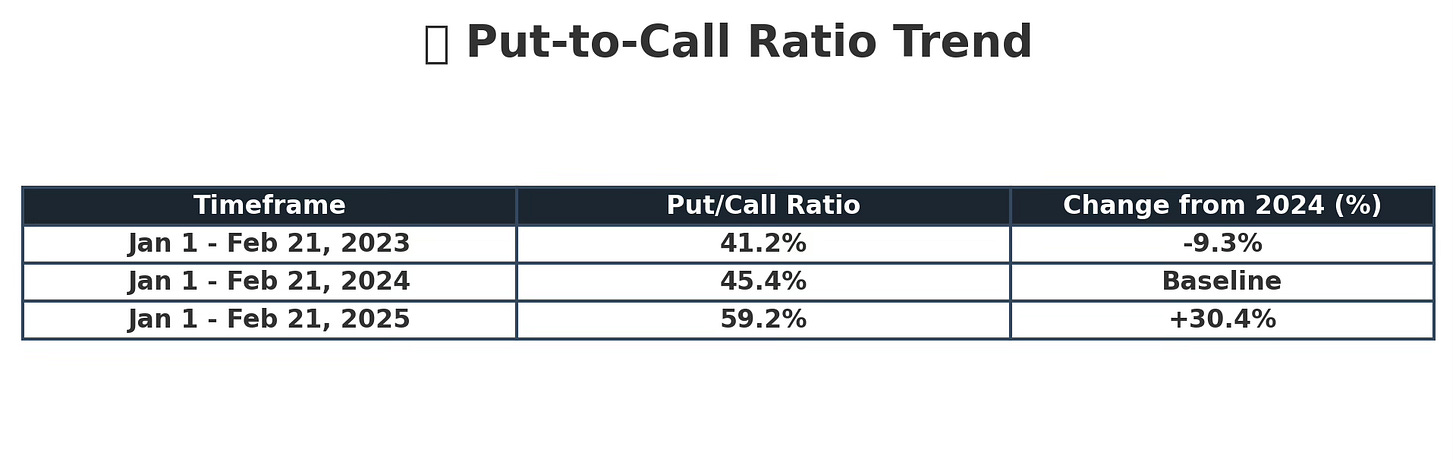

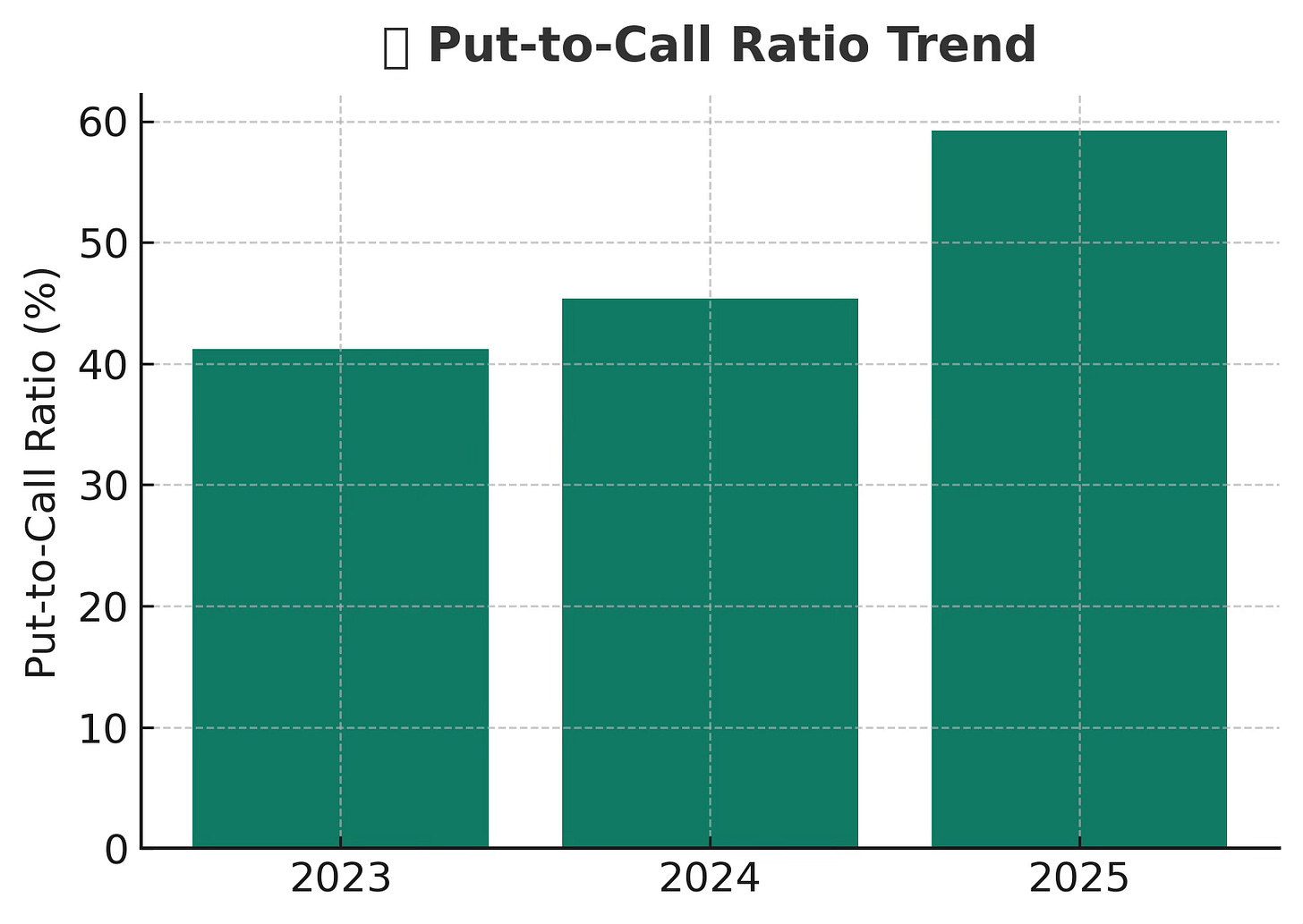

📊 Put-to-Call Ratio – Whales Are Hedging Like It’s 2008 According to Alerts

A rising market should mean whales are buying calls. But they’re not.

Instead, put buying is up over 30% from last year—the highest it’s been since before the March 2020 crash. When put hedging rises while the market rallies, it’s a warning.

It means whales don’t trust this move. It means they see risk ahead. And the last time put positioning hit these levels, the market collapsed soon after.

Whales don’t hedge this aggressively unless they expect volatility.

📉 Whales are buying puts at a rate we haven’t seen in years.

📉 A rising market + increasing put hedging = “We don’t trust this rally.”

📉 Last time put positioning looked like this? Right before the 2020 crash.

📊 Visual Breakdown

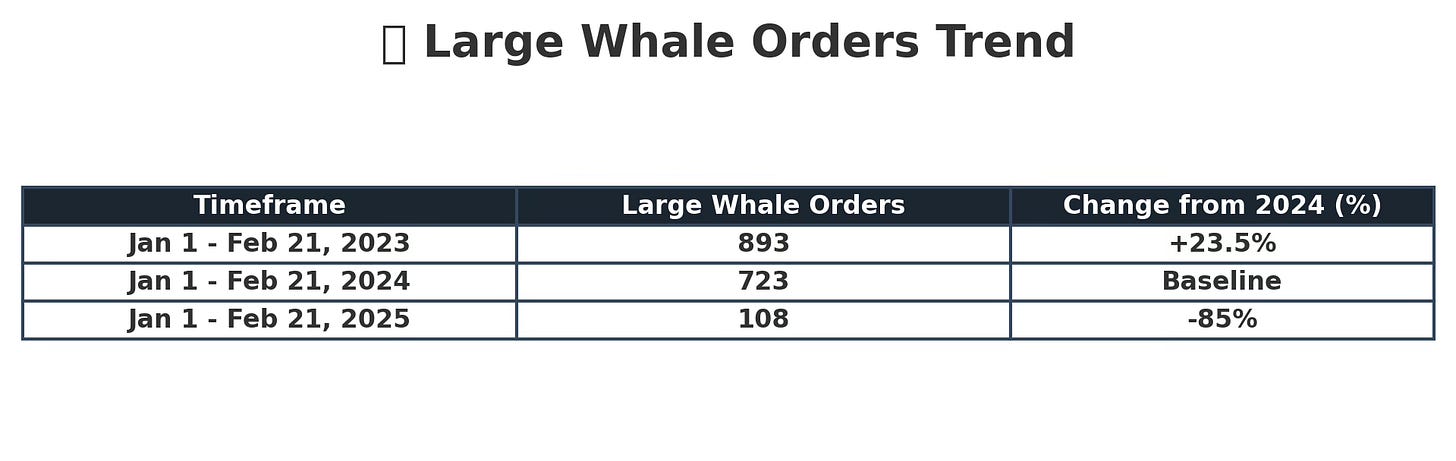

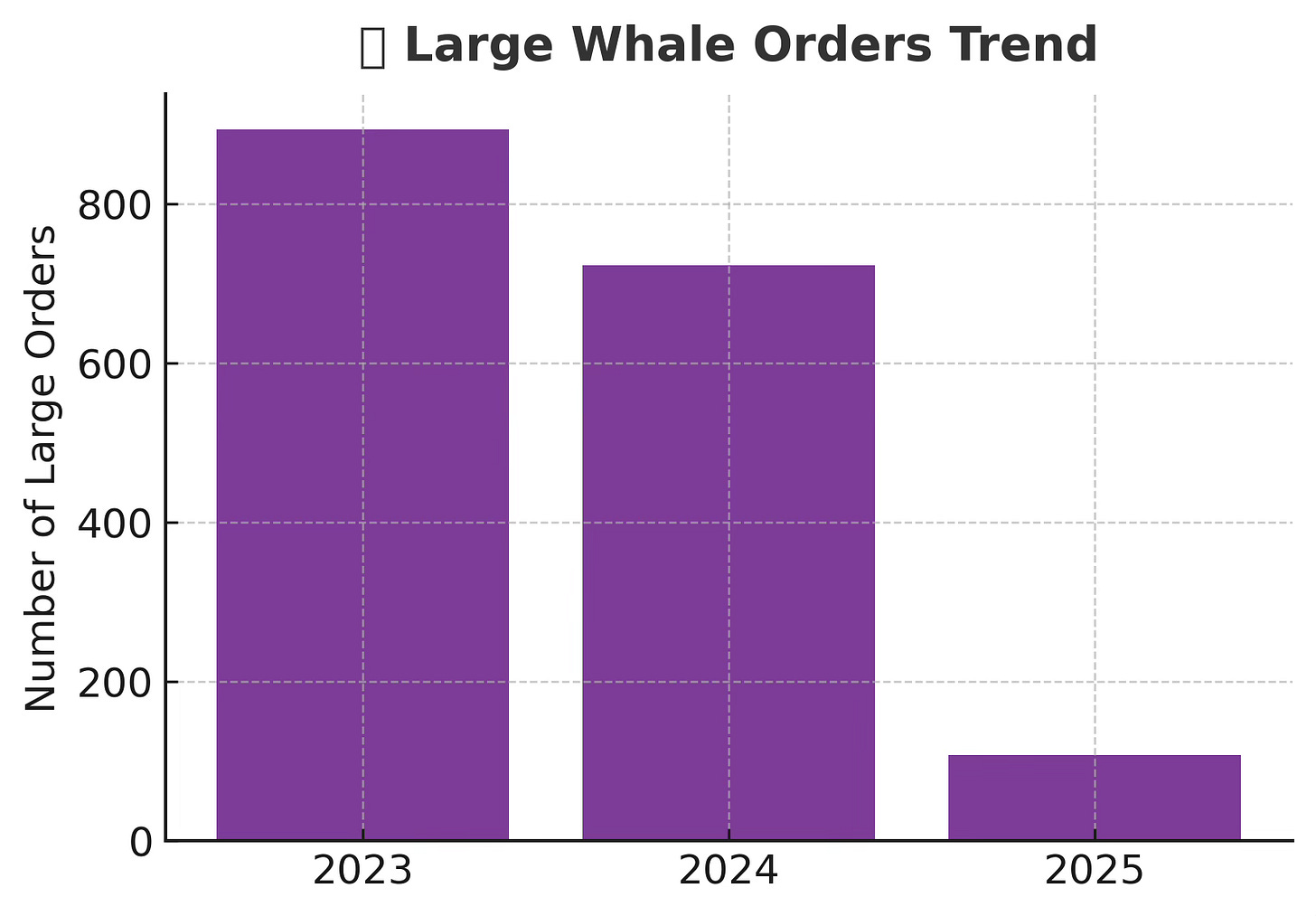

🚨 Where Did The Big Bets Go? Institutions Have Left the Building

Whales don’t place 100-lot orders like retail traders. They make massive, high-conviction bets.

But this year? Those bets have disappeared.

Large orders are down 85% from last year. That’s not just a slowdown—that’s institutions pulling liquidity and refusing to take big swings. This is how markets break: when liquidity dries up, volatility explodes.

And right now? Institutions are refusing to play the game. That should make you nervous.

📉 Institutions aren’t making big bets anymore.

📉 Liquidity is drying up.

📉 Volatility is about to spike.

📊 Visual Breakdown

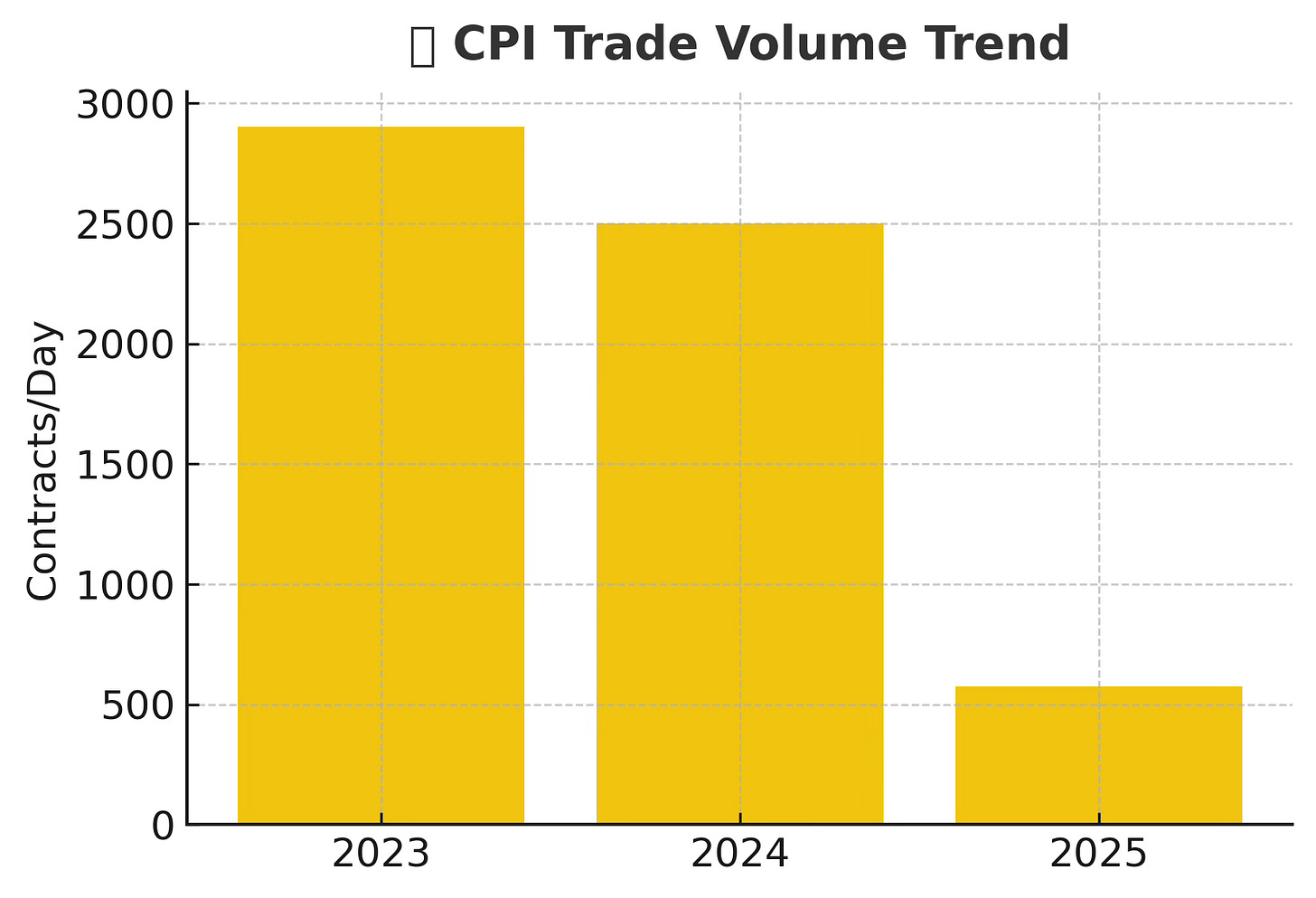

📆 CPI Trading Has Collapsed – The Market’s Biggest Event Is a Ghost Town

CPI is the single most important economic event of the month. Whales usually pile in before and after the report, trading volatility and hedging ahead of market-moving surprises.

But this year? They’re not showing up.

CPI trading volume is down 77% from last year. That means institutions aren’t hedging inflation risk—they’re avoiding the market entirely. The last time we saw whale positioning like this? Right before the March 2023 banking crisis.

If institutions are pulling back on CPI trading, it means they see risk—but no opportunity. That’s a major red flag.

📉 Whale activity around CPI has dried up.

📉 They’re not hedging—they’re stepping away entirely.

📉 The last time this happened? March 2023.

📊 Visual Breakdown

📢 Want Real-Time WARI Updates and Predictive Model Results? Join YEET Plus

📌 How low can we go? Some numbers from the Predictive Model Below

📌 Daily WARI readings will be available exclusively to YEET Plus subscribers.

📌 Get alerts on major whale moves before they hit the market.