📓Book of Flow's The Fall Off 2: A Catastrophe Lurks

Signs show instability in the data--let's have a looksee!

Note: YEETs are insanely hard to do when the market is as volatile as it is for the obvious political reasons in play. That said, the people need the YEET! So I will try my best to bring the newsletter back and just put in work to ensure that what we are saying is thorough, takes different perspectives into account, and is actionable. I was waiting for things to level out a bit—but love him or hate him, it is clear as hell there are no brakes on the Trump Market Mayhem Train right now.

What you’re going to see here is an overall theory on a drop growing that will likely be disguised first by a big pump/pop to close an upside gap.

Tomorrow I’ll check WARI for Plus (the whale metric from the first fall-off) to know when we want SPY puts. There is flow at the bottom for y’all in the meantime.

Thank you for your patience as I try to establish something resembling a work-life balance and adjust to the most insane market we have seen since Covid!

With Love and Dreams of Lambos,

Milt

📰 YEET: SPY, PARI, and the Anatomy of a Breakdown

📌 Context First: What is PARI?

PARI (Price Action Risk Index) is a composite risk signal built from three factors:

Momentum: Price deviation from 10 sessions ago

Volatility: Rolling 10-day standard deviation of returns

Trend Persistence: Rolling average return over 10 sessions

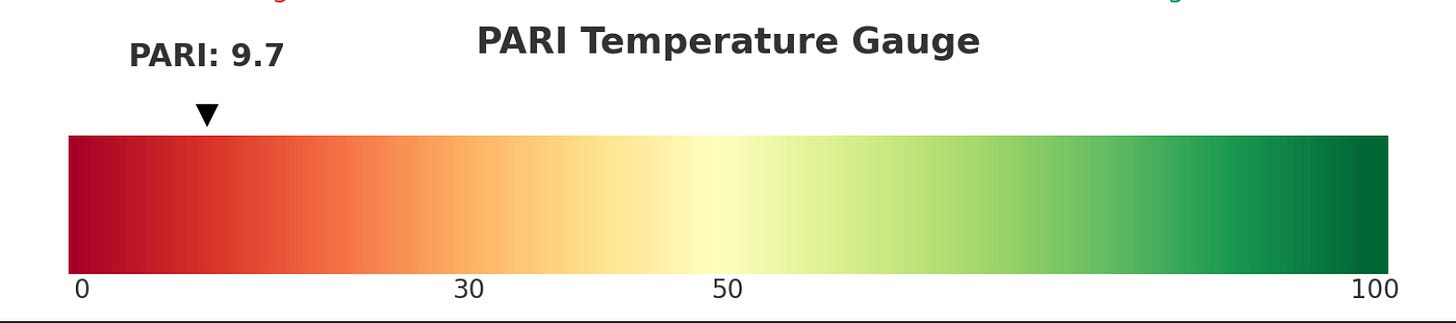

A PARI score near 100 implies strong directional conviction. Below 30, markets are fragile, momentum is weak, and volatility is climbing. That’s where we are now: 9.7 MY GOD

📉 The Last 10 Days: Risk Rising Quietly

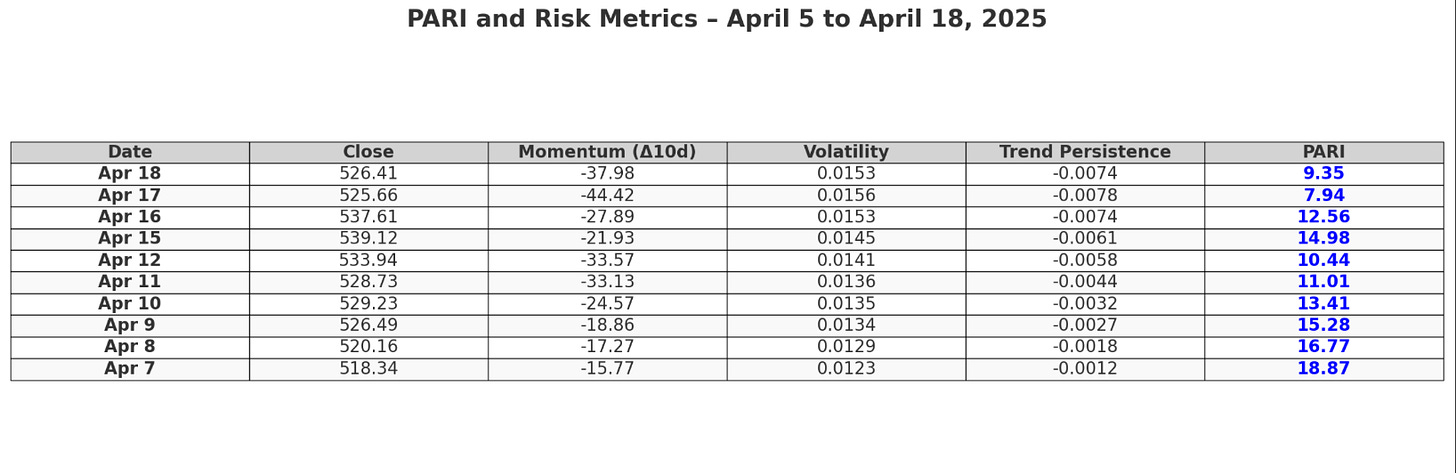

Here's what the data shows from April 5 – April 18, 2025:

🔑 Key Takeaways:

📉 Momentum has been persistently negative — price is materially lower than 10 days ago.

⚠️ Volatility has climbed steadily: 1.23% → 1.56% daily std dev.

🔄 Trend Persistence flipped negative by April 9 and has not recovered.

🚨 PARI has been stuck under 20, with 4 days under 10 — historically, this has preceded volatility expansions and market pullbacks.

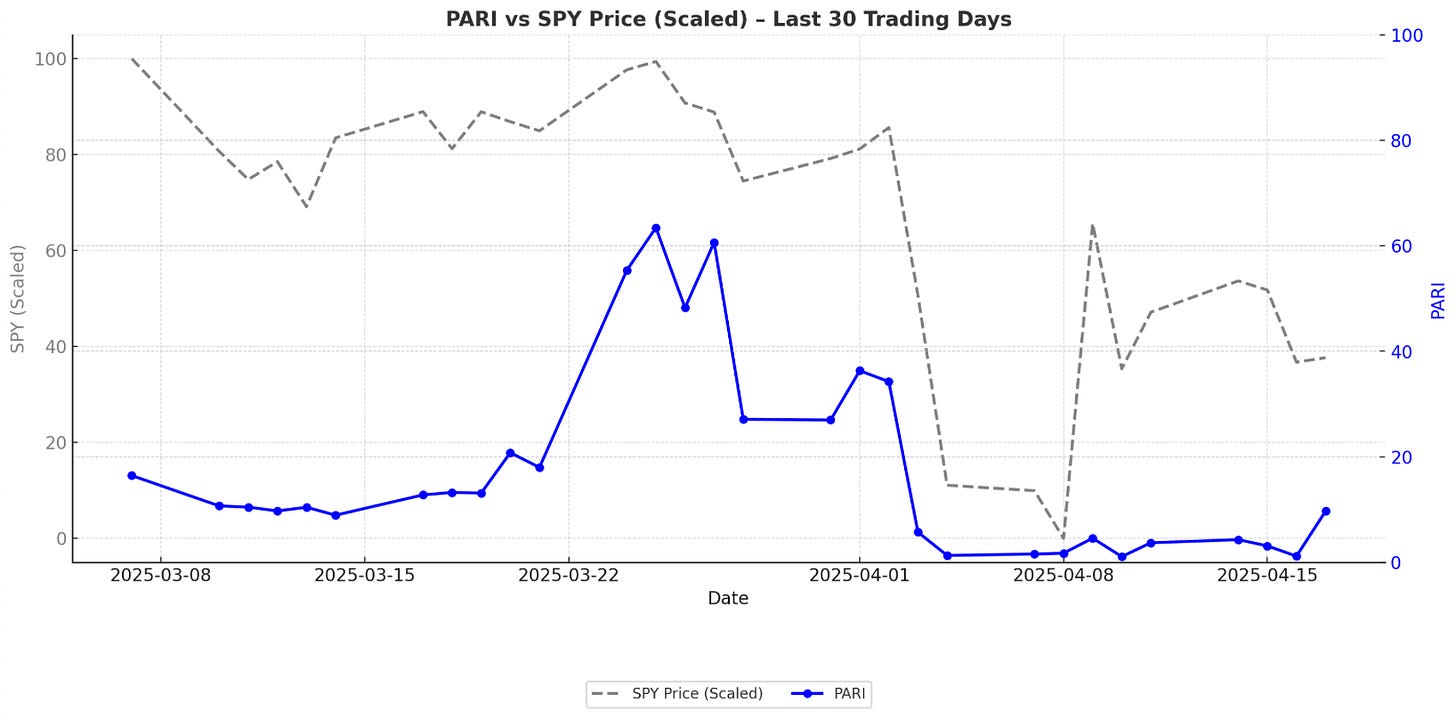

😭The Last 30 Days: A Loud Drowning

This 30-day overlay of PARI (blue) and scaled SPY price (gray dashed) highlights a key divergence in market behavior:

While SPY price has remained range-bound with mild recoveries, PARI has steadily declined, dipping deep into sub-30 territory—indicating growing fragility and declining conviction.

Notably, each PARI drop precedes or coincides with local tops in price, suggesting risk conditions are tightening before the market visibly reacts.

The current position—with PARI near its lowest point in the past month—suggests SPY is vulnerable to further downside unless risk sentiment reverses sharply.

😱Inference: Price stability is masking growing internal weakness. Unless PARI reverses upward, SPY’s support will not hold.

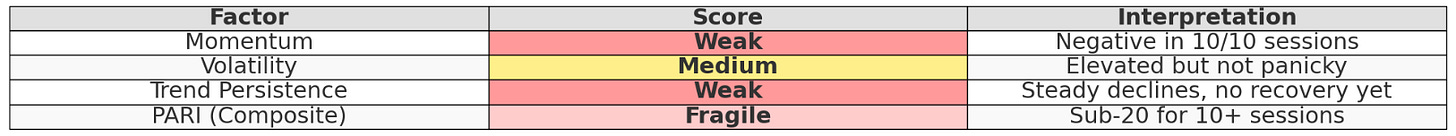

🤓Book of Flow’s PARI Quant Grade Based on PARI Composite Metrics

The Quant Grade table paints a clear picture of deteriorating market structure. Both Momentum and Trend Persistenceare classified as weak, with consistent negative returns and no sign of stabilization. PARI, the composite measure of fragility, is sitting in the fragile zone—sub-20 for over two weeks—indicating elevated risk and low directional conviction. Only Volatility remains in a medium range, but it's steadily rising, reinforcing the overall signal: the market is vulnerable, and conditions remain tilted toward instability unless key trend components reverse.

📉The Price Action: What Does the Chart Say

Gap Level Analysis: We die, but there will be a surprise upside bounce to close the upside gap level.

On the left we see some closed gap levels that were firmly rejected by the current candles on the daily—most troubling the bottom levels in pink. Where it says “open gap level” you can see that there is an upside gap left to be closed.

🚨PRO MOVE: WAIT FOR THE TRUMP PUMP TO CLOSE THE UPSIDE GAP, THEN SEE IF WE GET A REJECTION WICK. THAT’S OUR SIGNAL THAT THE SHORT PARI HAS BEEN BUILDING IS ON AND POPPING!

Trendline Analysis: Short uptrend gets stopped and chopped—look out below

BONUS: DJ MEGAPHONE ON THE BEAT?

Notice that the top of the Megaphone pattern here, which indicates widening volatility, would roughly coincide with a close of the upside gap we mentioned earlier. Hm.

🚀YEET Plus:

-a Quick Look at market tide

-Banger of Suspicion (risk trade/ YOLO of the day)

-Banger of Reason: tantalizing flow trade with a few different factors bolstering the argument