💡Book of YEET Chapter 1.2: Concepts in Action

Following up last night's Mega YEET with some of the concepts in action

As the weeks go on, I’ll be placing the real-time examples of what we learn in here from The YEET and YEET Plus for educational purposes. Let’s review some of yesterday’s lesson:

📝Chapter 1 Learning: Key Settings, Candles Pt. 1, Horizontal Lines Pt. 1

Key Settings:

Timeframe, Planning: We plan our trades primarily on the Hourly Timeframe

Timeframes, Day Trades: While Day Trading we will also examine the 15 Minute Timeframe.

Timeframes, Additional Planning: When planning trades we will use the Daily Timeframe to look for gaps and other Price Action indicators, but it is not a primary tool.

Color Preferences: Use Dark Mode, but not just for the obvious reasons. When we eventually add weekly levels in WHITE, flipping from Dark to Light Mode will be an easy way to get a look at only monthly levels quickly.

Products: Unusual Whales for Flow. Trading View for charts. I don’t use Promo Codes for either, just go ahead and sign up.

⌚Timeframe Planning:

This was a littledo as I say not as I do today, but bittersweet because it showed the BTA Principle was correct—it’s always correct. Here, BTA stated that an hourly rejection of the Weekly level meant we were taking a bath:

Hourly decision-maker: The close of the hourly is always your decision-maker with our method of trading—whether it’s about trendlines, levels, or entry. I actually jumped the gun on a wick thinking we were still bullish, and paid the price.

YOU ONLY PLAN AND ENTER TRADES ON THE HOURLY TIMEFRAME

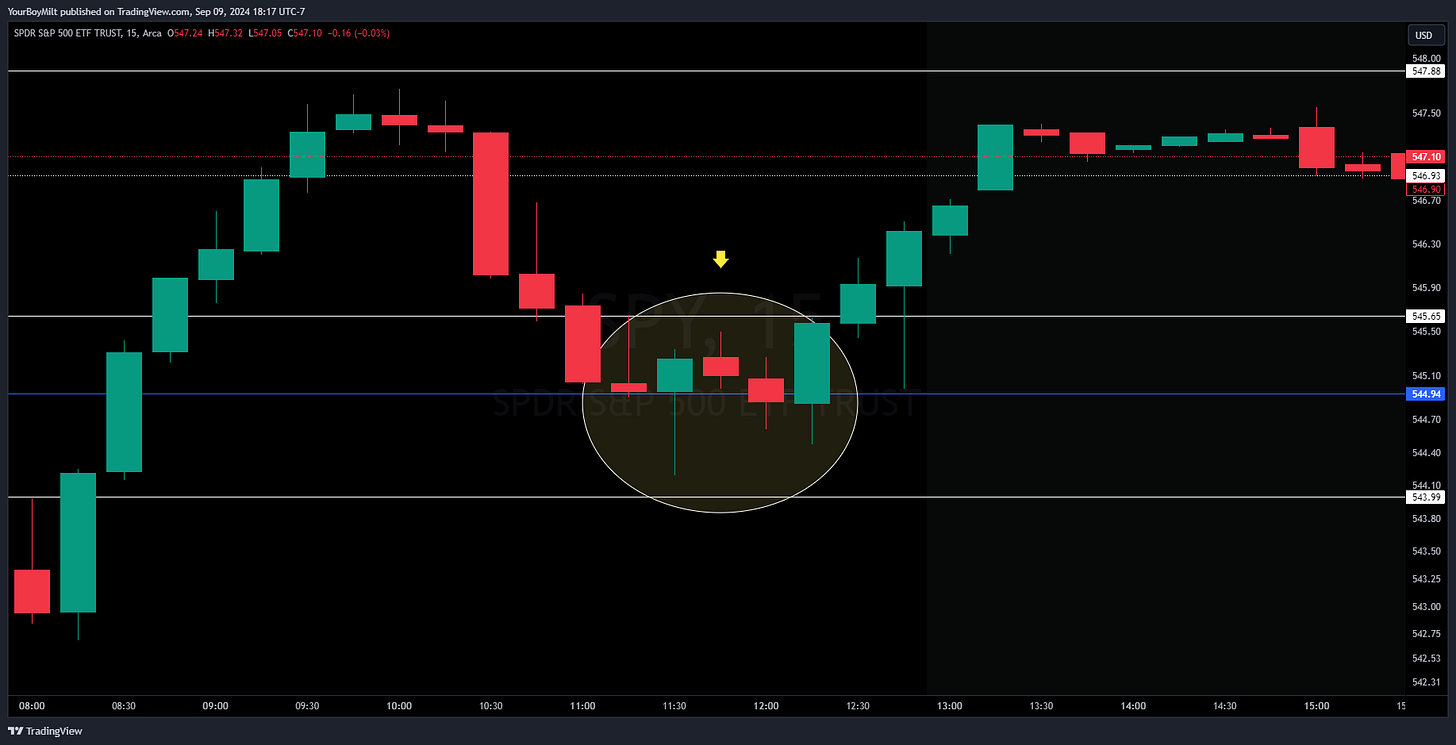

⌚Timeframe Planning: Using the 15 minute for additional analysis when in a trade

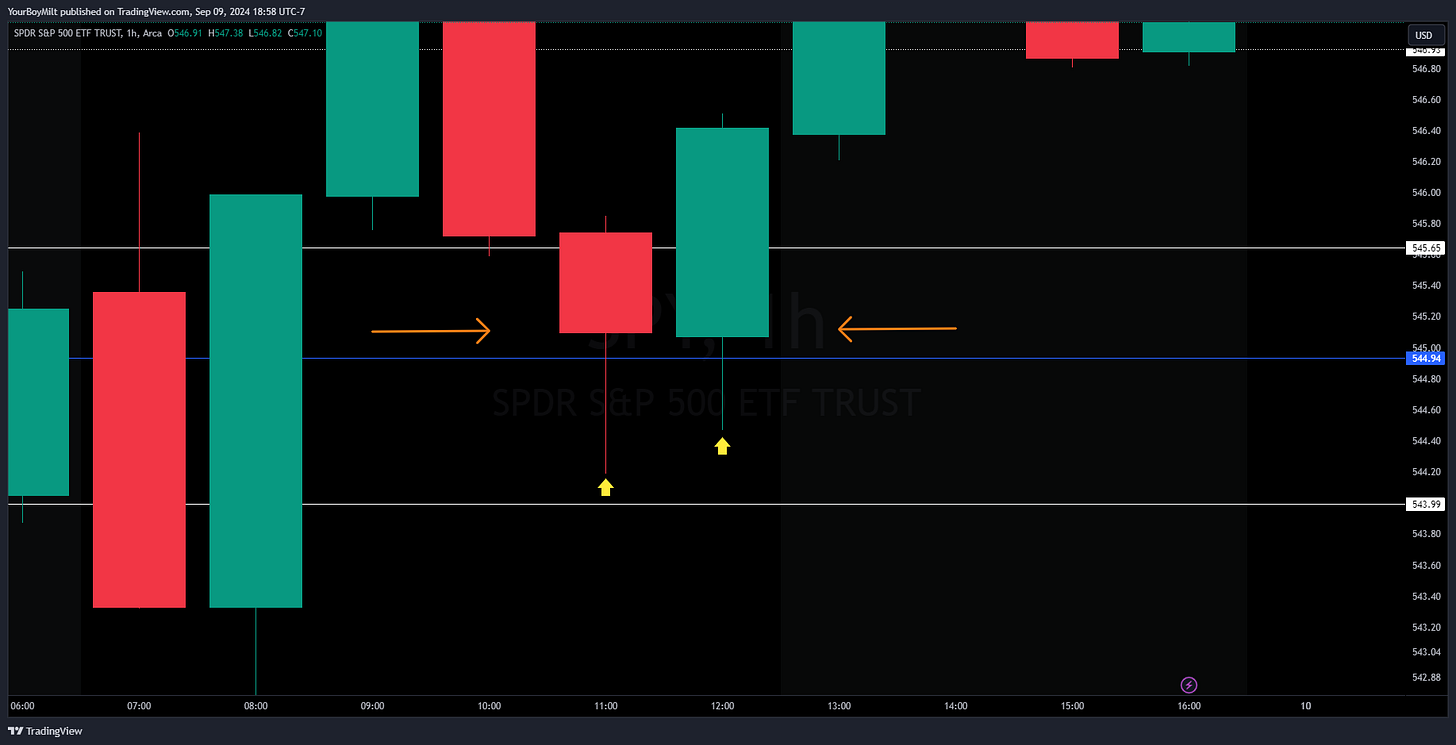

While in today’s trade, we really only had a couple hours left until the close for moves to happen. Here you can see the 11 am HOURLY candle close above the blue (gap) level—you don’t need to know what it means yet. You just need to know blue levels are important. When you’re that close to the end of the day, how can you get some more info aside from the hourly close?

The 15 minute is never definitive on entering, but can give us clues on directionality on trades we’re in. Here, for example, we saw multiple 15 minute holds of the gap level, a sign that SPY was reversing upward.

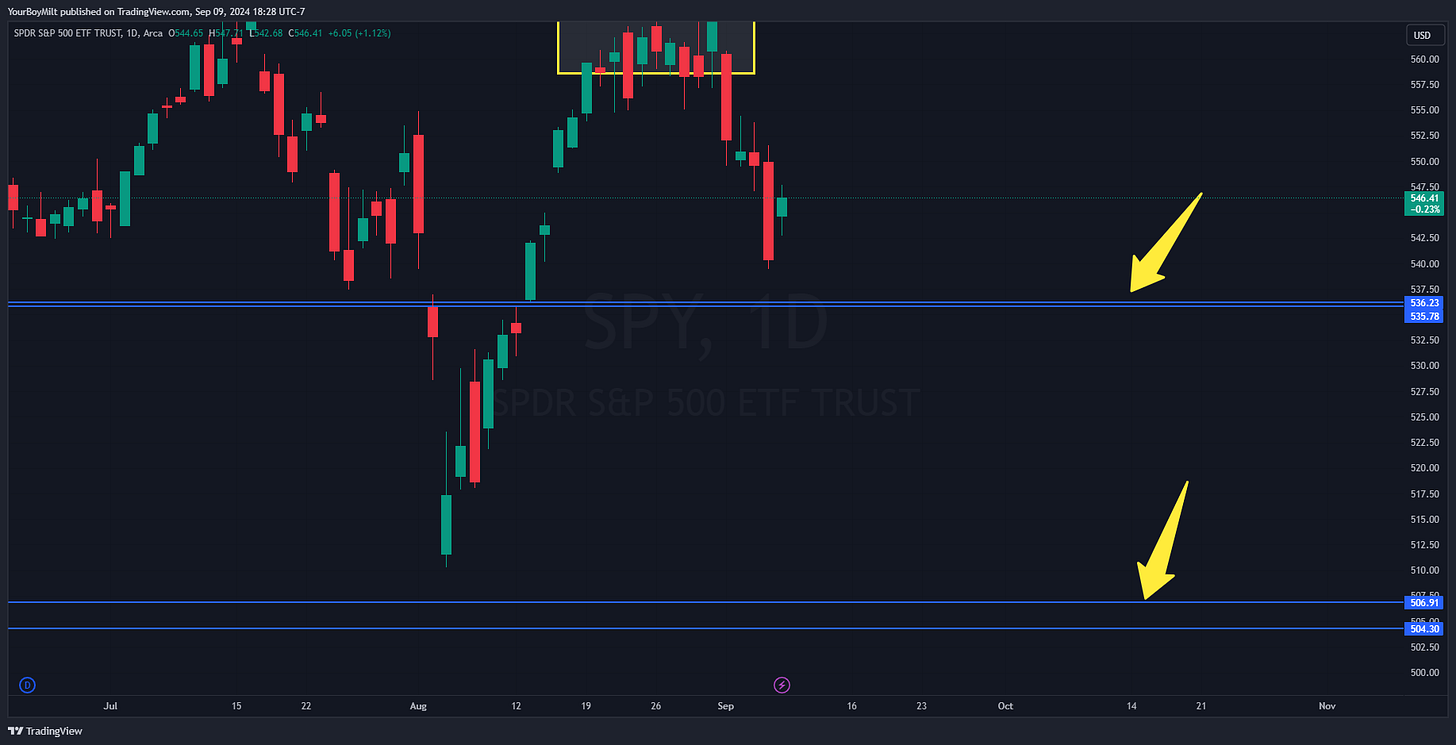

⌚Timeframes, Additional Planning: Using the Daily

In last night’s YEET Plus SPY analysis, we had an example of how the daily can be used to find gaps, as well as in our flow play. Here, you can see SPY has two gaps on the daily to the downside—one small and one large—which can inform our decision making going forward. If we have a CPI fall, for example, that first gap set is a target. Longer term, the second gap set is:

Candles at Work: Yesterday we said…

It will make more sense later, but at the CLOSE all that matters is where the body is when you’re in a day trade.

So, for analyzing setups: on trendlines we use WICKS

For analyzing setups: drawing levels we use WICKS

For timeframe closes indicating a level’s validity during day trades, we use THE BODY CLOSE

Trendline: SPY currently attempting to breakout off the trend set at the WICKS

Body Closes: Here we can see that although the wicks dipped down on the hourly (yellow arrows), the bodies CLOSED (orange arrows) above the gap level (blue), and resulted in a rise for SPY

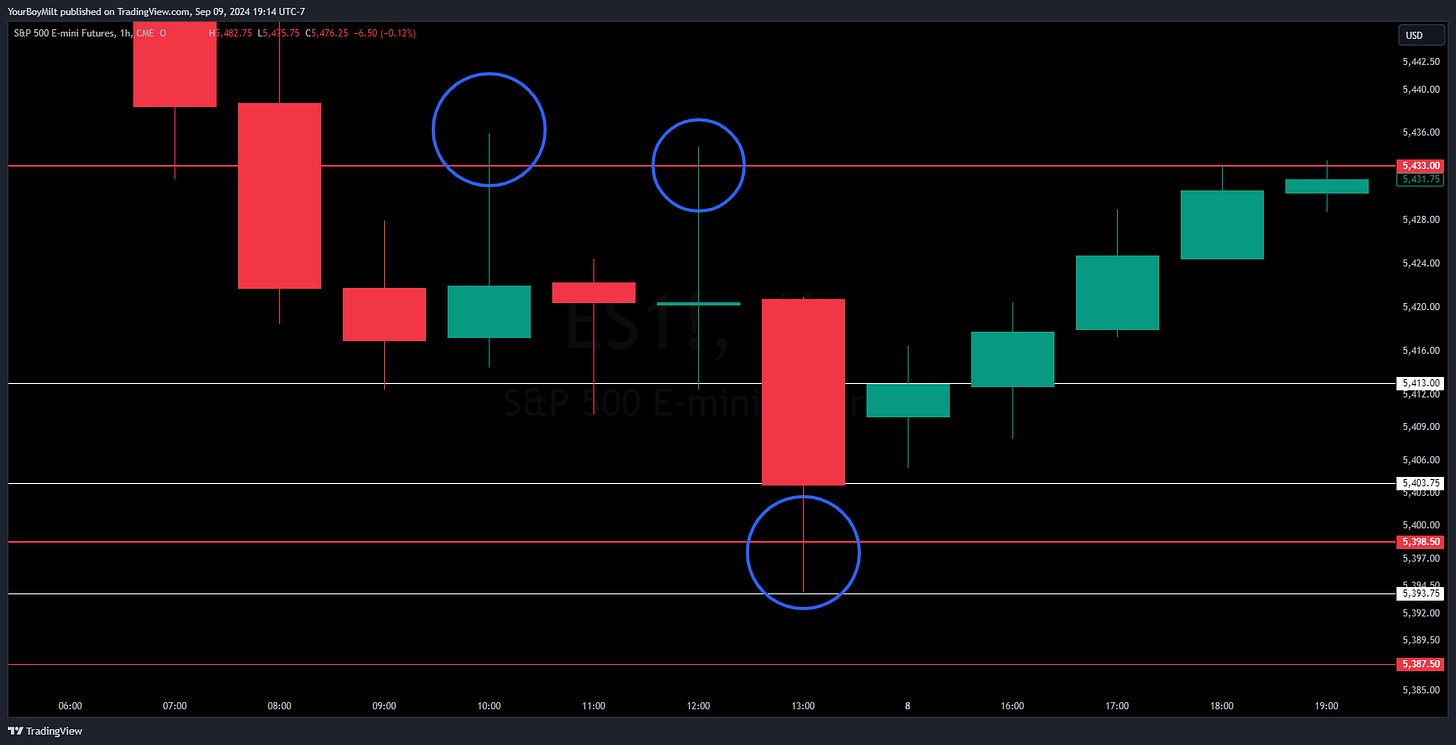

The Monthly Timeframe in Action: Friday and into Sunday we saw the WICKS of ES (blue) respect the monthly levels (red)