🌅Breakfast Bangers: How to YEET Series with GS

Goldman Sachs (GS) - The Setup for a Bullish Breakout?

GS has been coiling in a key range, and the market tide suggests it could be gearing up for a significant upside move. With strategic call flow and technical levels aligning, let’s break it down.

SHOUTOUT TO DISCORD LEGEND COOL POKESTER WHO GETS TWO MONTHS FREE PLUS IF IT BANGS!

📊 Market Tide: Bullish Reversal Forming?

Looking at the GS 1H chart, we’re at a pivotal breakout point:

Break above the top yellow level (~548) → Reversal confirmed, triggering a bullish breakout that could accelerate momentum toward 565 and beyond.

Holding above the mid-range (535-540) → GS is finding support, which could fuel the next leg up.

Blue levels (500-502) are gap-fill zones, but buyers defended well

The structure is shifting bullish, and a sustained move above 548-550 will confirm the upside.

🔍 Flow Analysis (3/13 Focused - Bulls Taking Positions)

The options flow shows key accumulation in mid-to-long-term calls, signaling confidence in upside continuation:

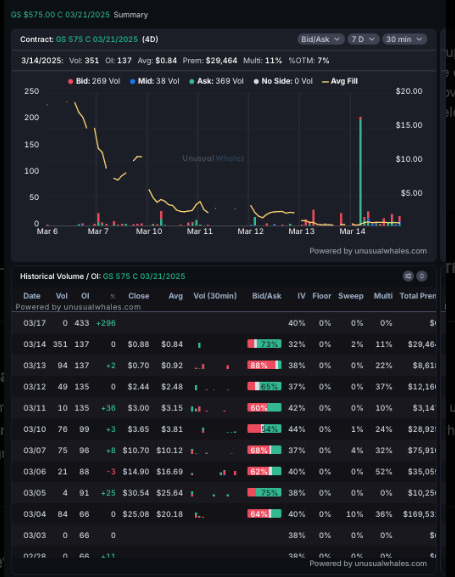

575C 3/21/25

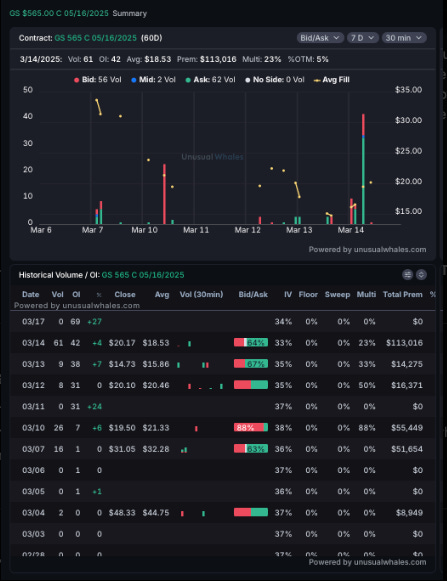

565C (5/16/25 Expiry)

600C (6/20

🧠 What This Flow Means

March calls saw some unwinding, but bigger money is moving into May & June positions.

Bulls are accumulating mid-to-longer-term exposure, indicating belief in sustained upside.

🔮 The Yeet Takeaway: A Bullish Setup in Motion

Above 548-550 → Momentum shift confirmed, upside acceleration toward 565+.

Flow shows buyers stepping in at May/June expirations, meaning smart money is not betting on a breakdown.

Whale accumulation in the 600C suggests GS has room to run.

📌 Key Watch: GS closing above 548 will confirm the breakout—get ready for a potential bullish rally. 🚀