📰Chop Strategy, ENPH Quick Bagger Flow Tutorial, Flow Update, Weekly on Watch

Jam packed edition

💡BTA Update: Devising a Chop Strategy

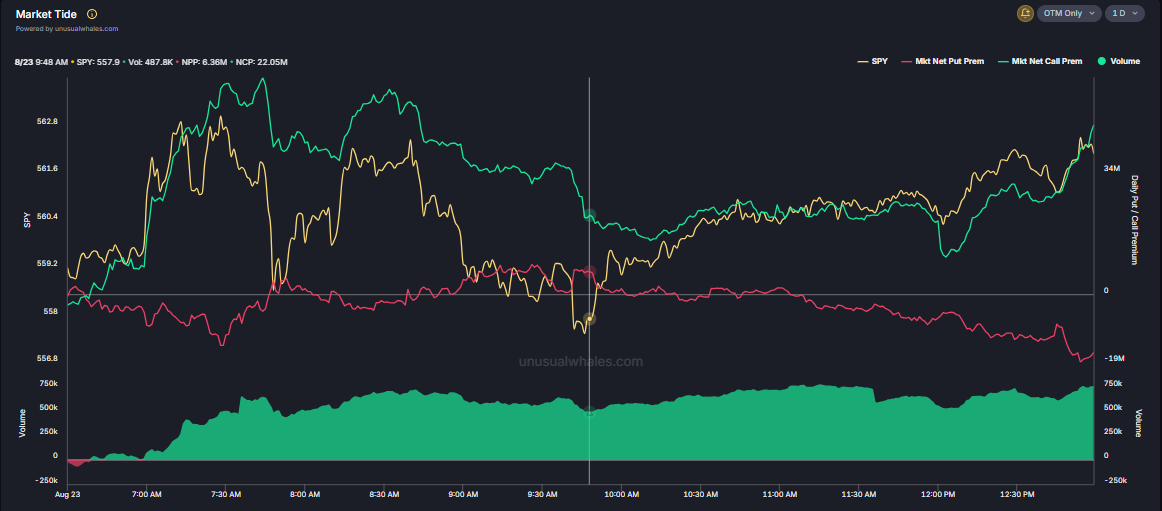

After today’s trade I did some digging, because every signal so far said it made we were headed up—even Market Tide was bullish throughout the day, and strongly so.

But all L’s are not the same, and reviewing the price action of where we got in and played the bounce showed SPY never really lost or gained—it hovered. CHOP.

After playing the bounce at 5630 we were met with the greatest of enemies—chop. I chatted a little bit with EE about what it was I was seeing, what he saw, and then spent some time thinking about how what he saw meshed with our style—and figured it out.

💡Strategy Update: 0DTE Monthly/Gap Levels vs. 1-2 DTE weekly bounces (which we will rarely take)

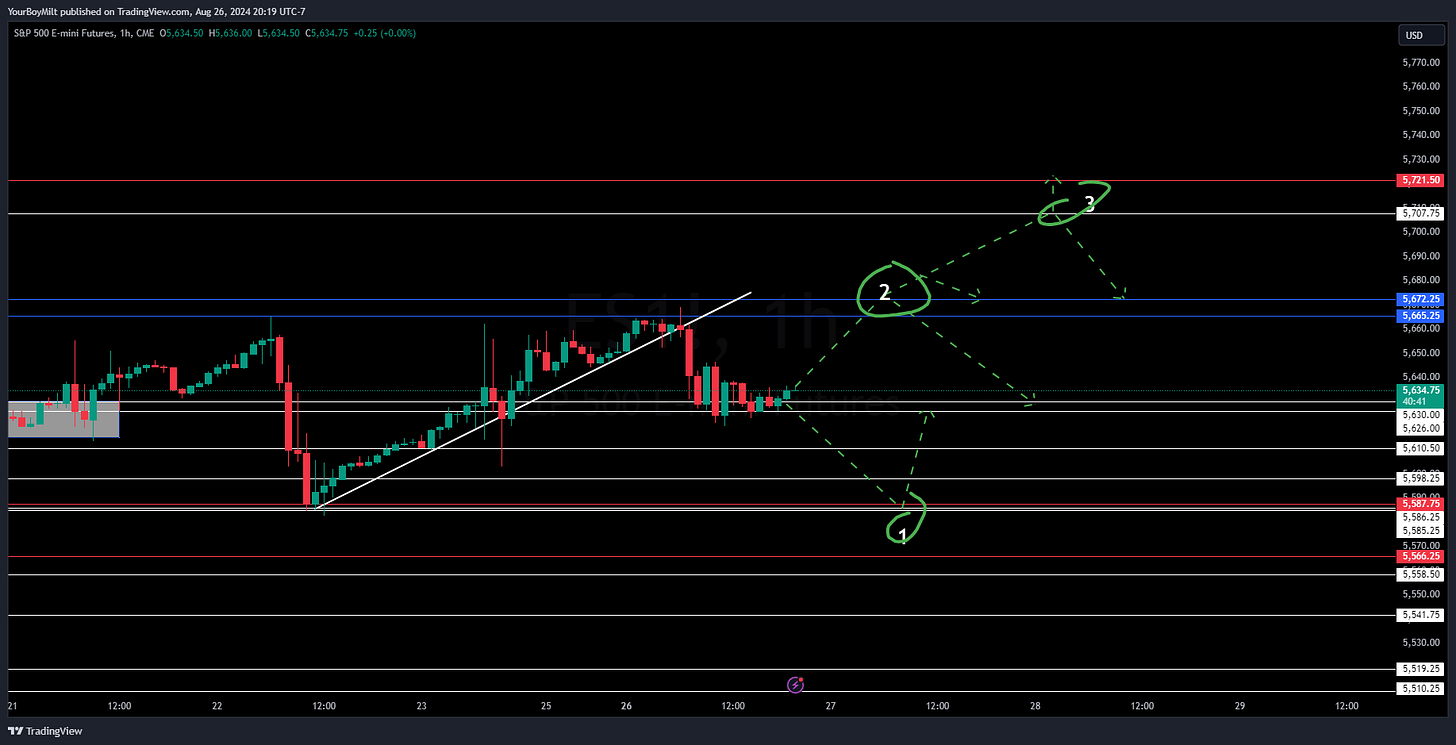

🎲Tomorrow’s Board

I’d take any of these trades on confirmation of a rejection or a bounce—NOT at the weekly :

🧗Levels of importance ES/SPY:

5588 (previous monthly, untested), 5600 (w), 5610 (w), 5626 (w), 5632 (w), 563.09 (SPY gap open), 564.24 (SPY gap close), 565.3 (recent high)

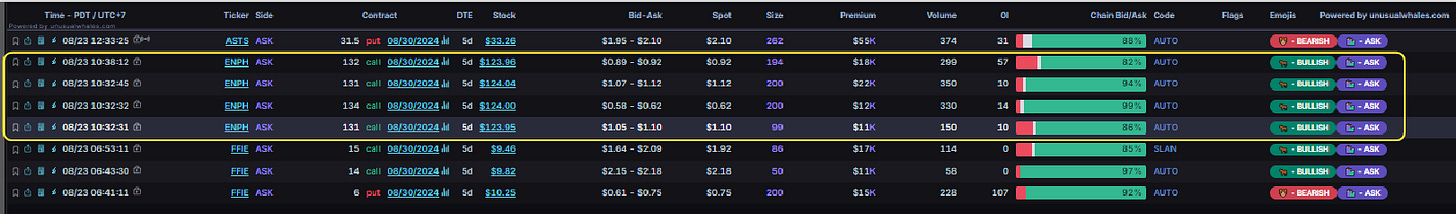

🐋Flow Review and Tutorial: How You Could Have Used Last Night’s ENPH Callout for Maximum Gain

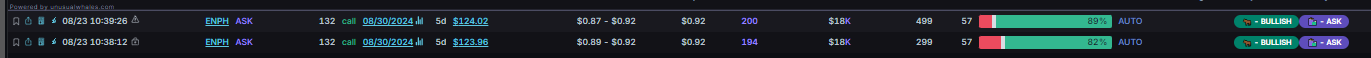

Here’e the flow posted last night for ENPH:

****Flow Portion Last Begins****

ENPH Contracts of Interest: 131c 132c 134c 8/30 // 90k in Premium

When I saw multiple ENPH orders hit my screener I decided to dig into each one because the timing was odd:

That plus 12k on the 134 in the span of 5 minutes leads me to believe that this is the same person with 90k placed on a variety of OTM ENPH strikes expiring within the next week.

****Flow Portion End****

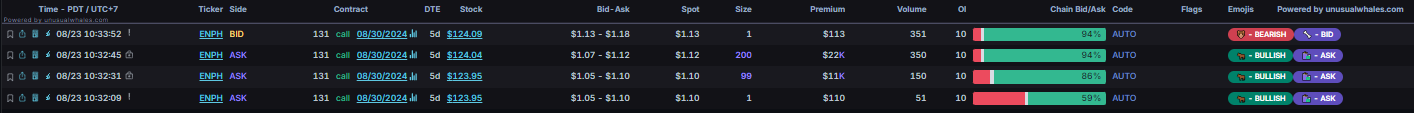

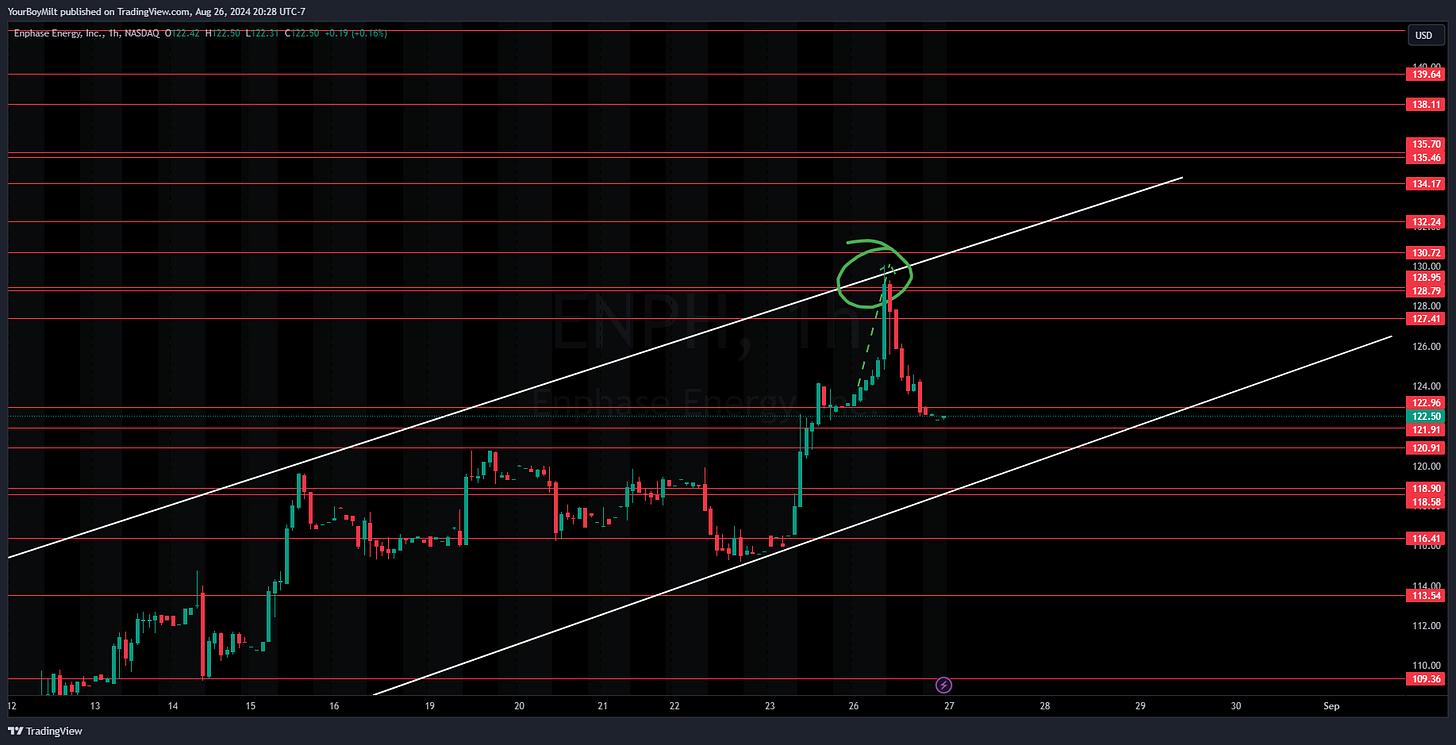

So the flow tipped us off that it was a weekly—meaning quick gains—but where the key to the trade was was in the chart we posted:

As mentioned last night, the reclaim at 123 and a hold is your signal to go on calls—and the next monthly isn’t until 127—so those were four free points off the open.

But what’s more is you have the structure—the channel—as your bumpers to either side. Let’s see what happened today:

ENPH went to the precise edge of the channel, which goes to show the importance of knowing Price Action and please people—look at the damn charts with the flow lol.