🫧 D R O W N 2: YEET Cruel Summer NFLX Exclusive

The flow and price action that now serves as a brick thrown to a company treading water

🚨Editor’s Note: What is The Cruel Summer Series? We are doing special editions targeted on specific tickers based on flow and Price Action, a little different from our normal style so folks who can’t move in and out of plays quickly can see longer term stuff, and get updates daily in YEET Plus newsletters/twitter if they want.

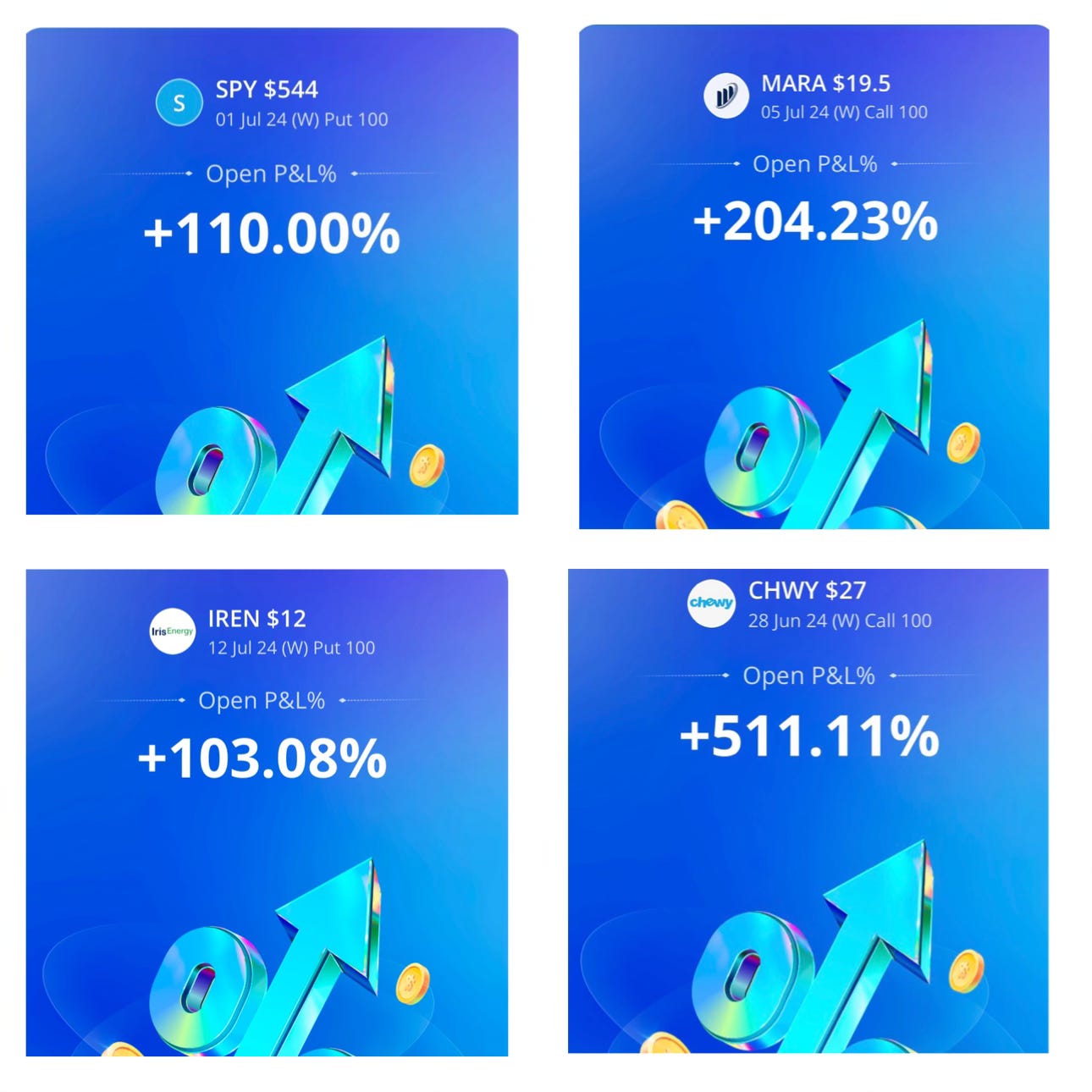

MARA was #1, which we closed today at 205%. This is #2.

Hey, you. I want to take your breath away.

Whether it’s with gains.

With the down-to-the-wire wins that are pure fun, balls, and adrenaline.

With my Mentor ABU providing you with the very same mentorship he provided me (Index Outlook/Mentorship, these will be exclusively on YEETv+):

Or with the exciting rush of an unexpected gasp. Something like that quiet moment when dinner ends and two heart beats begin, as the check comes with our hopes high and the lights low. Eyes locked and fingers crossed, all you can hear is a server’s whisper of…

So we’re going to take your breath away like you’re the S&P 500 ETF because guess what y’all?! It’s time to drown again!!!

‼️ So, what is the Drown Protocol: Read 1 here

Looking at past SPY performance, happened to notice that in the past years bullish rise when the four hour double tops at two points within five trading days on one another it’s nearly always followed by a fall of 10-12 points, with only two exceptions. These yielded the same result, but occured when there was a wick that peaked just above the first high that was then followed a subsequent lower peak roughly equal to the price level of the first—like a head and shoulders with a bodybuilder neck.

Make sense? No? Figured. Okay, it looks like this:

And mathematically works out to something like this:

And now I’m looking at the current Price Action, and I’m not violent and I try not to be, but I just. Look, I—

Probably, but maybe a better choice for now—if an index can drown, so can a ticker. What ticker is showing a bit of doomsday flow with a chart looking like it’s ready to get tossed a brick into the dark abyss.

NETFLIX!

If you want me to pretend to be a Macro guy, I can give you a few glaring reasons why you’ve gotta be higher than giraffe nuts to buy them up here, both gigantic red flags from their last earnings report:

🩸They Gave a Weak Q2 Outlook: Concerns were raised about the projected decline in Q2 net income and EPS due to price changes in Argentina and currency devaluation. Whatever the f*ck that means…

🤡 Stopping Subscriber Reports: Some analysts viewed the decision to stop reporting quarterly subscriber numbers as potentially hiding future performance issues. That’s right— NFLX said outright they just won’t report sub numbers in 2025. Imagine if I just stopped reporting our subscriber numbers to ABU? It’d probably go something like….

This is a multibillion dollar company?! How are you allowed to just do that? Imagine telling your job you’re just not going to give them info and expecting them to keep ANY measure of confidence in you

Could be useful in a few more instances I suppose…

📈The Chart:

First you can see this rounded top forming at the previous high—the key here will be using what we’ve learned from all our YEET Price Action Lessons and going for the trend break. Unless you’re like me, who couldn’t help himself and entered some puts today tee hee.

🏊♀️The Drown: Triple Top Four Hour

THE TREND BREAK: More importantly there is this trend break on the hourly of a quite long established trend. Oh, Lord!