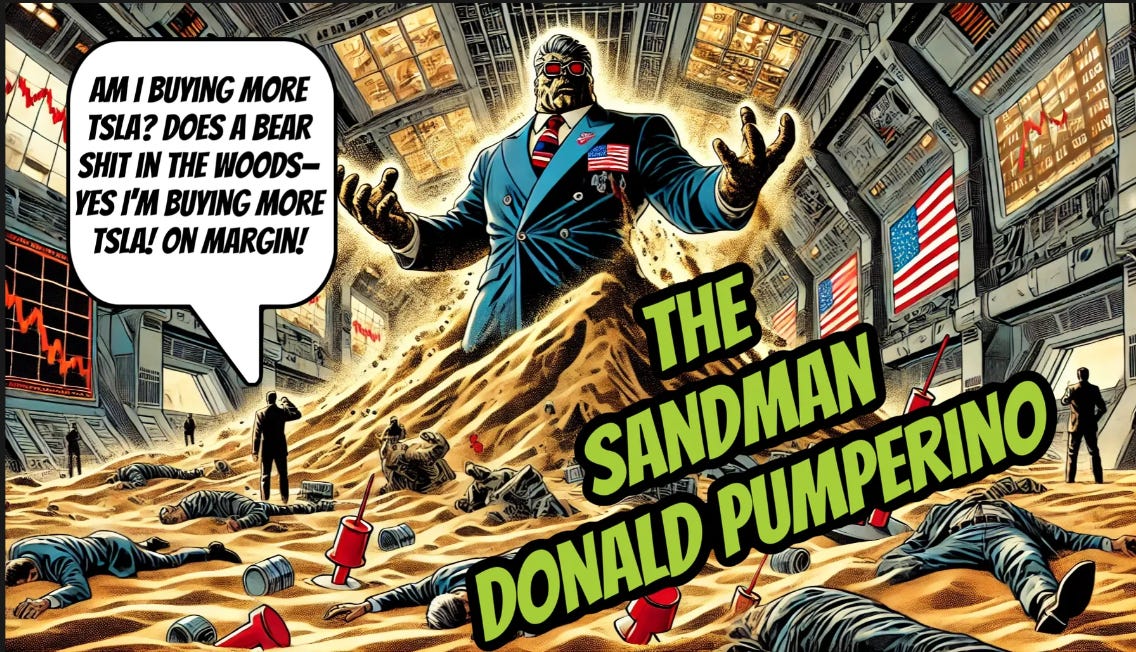

⏳Enter The SANDMAN: GUH of Future's Past!

A primer on Price Action Leveraging and an ANTIDOTE?!

⏳Part 1: Enter the Sandman!

In Price Action Leveraging bulls continue to ratchet up the Price Action while ignoring the system of checks and balances present in backtesting that keep things from going off the rails. See, come here:

When SPY closes and ES (futures) have an overnight ripper, it creates a GAP in the Price Action between the SPY previous day’s close and the next day’s open

Typically, Price Action self-corrects with that gap being closed by the session’s Price Action during the next couple of sessions, maybe a week…

CHAD: well the one you just showed me—it looks like it took a couple of weeks for the gap to close, back in august.

That’s because sometimes they have gaps to close to both the up AND the downside. If you look at the last example you can see they closed an upside gap in that time frame:

As time marches on, traders are put to sleep by the bullishness in a sick, twisted, LEVERAGED LULLABY until they forget all about the Backtest Ecosystem, and just keep buying calls. But I’ve only seen one creature able to create such a wide-reaching sleep with multiple gaps skipped in a single month…when he’s elected the market forgets bearishness ever even existed…

It’s the ultimate trap. You can’t buy calls because at any given moment the whole thing could teeter over, resulting in significant losses at the drop of a hat. You can’t buy puts, because you’re going against the trend.

There are only two ways to know when the madness will stop.

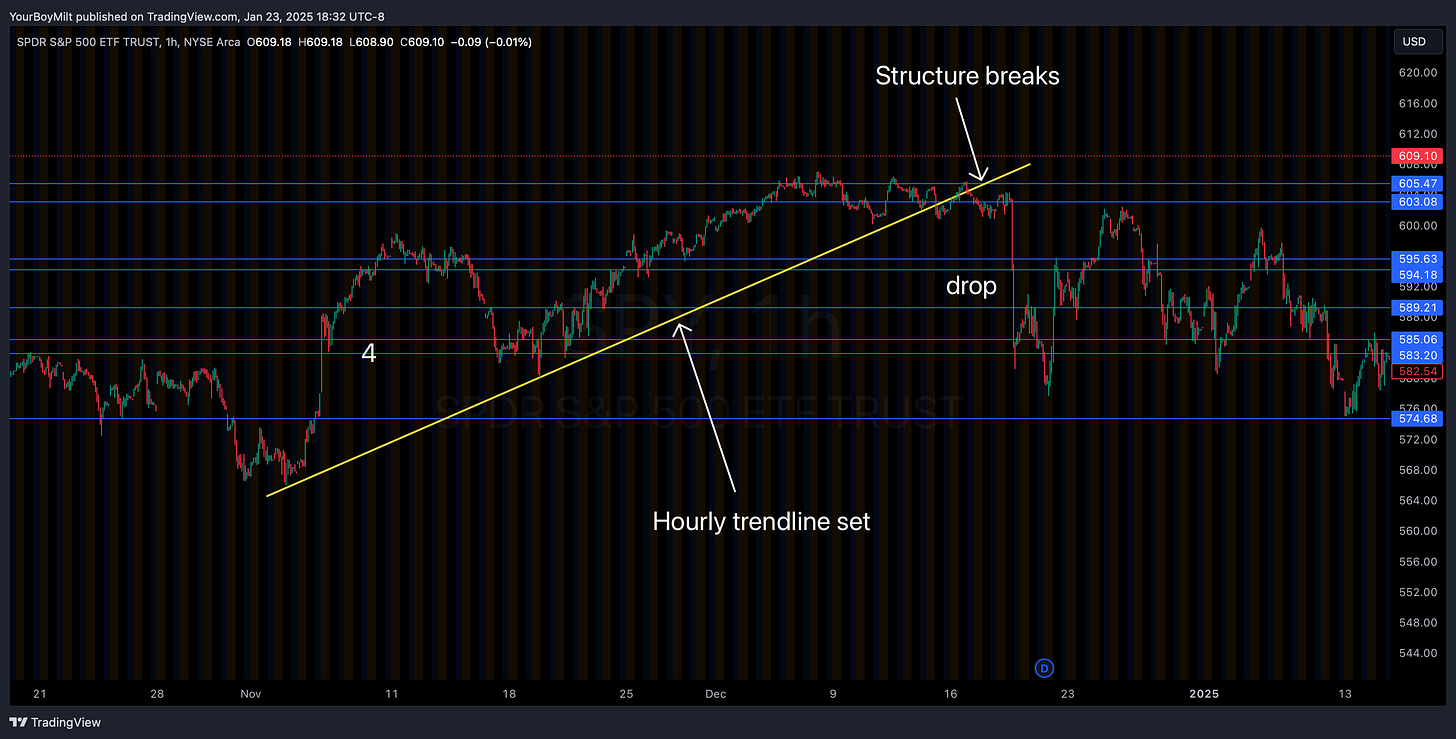

Multiple failed reclaims at local highs on the hourly. Here’s how that looked using out July/August example:

A break in structure: a long established channel or trendline on the hourly timeframe