🧠ESSENTIAL YEET: SPY Whale Gap Insurance Co.

A mandatory read for retail

🧠 ESSENTIAL YEET

SPY Whale Gap Insurance Co.

Like Absolute YEET is specifically geared toward volatility, Essential YEET pieces are about structural whale behavior. These are the concepts that either make you a bag or save one.

This issue introduces a concept we keep running into during strong rips.

We call it Gap Insurance.

📈 The Long Thesis

Why We Were Long on Thursday

We went long in the Garden on Thursday for two initial reasons.

1️⃣ Hourly Downtrend Breakout

SPY broke its hourly downtrend in a structure that closely resembles the Flying V concept introduced earlier this fall. The key was not just the breakout candle itself, but the follow-through and the reclaim of prior resistance.

That shift in structure signaled a change in control rather than a simple bounce.

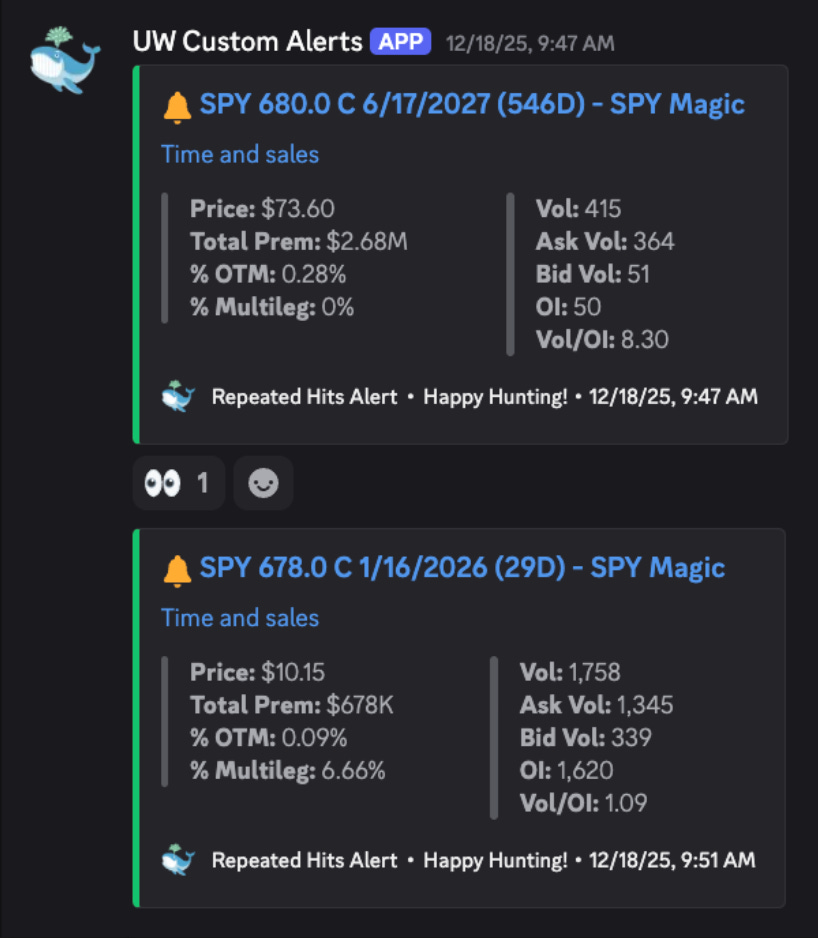

2️⃣ Persistent Call Whales

Throughout Thursday, SPY 680c whales continued to hit on every dip. These were repeated, ask-side executions rather than isolated prints. On Friday, 682c came in as confirmation.

This combination justified staying constructive, and price followed through accordingly.

⚠️ Why We Were Still Cautious

Even as price confirmed the upside thesis, something else began to appear.

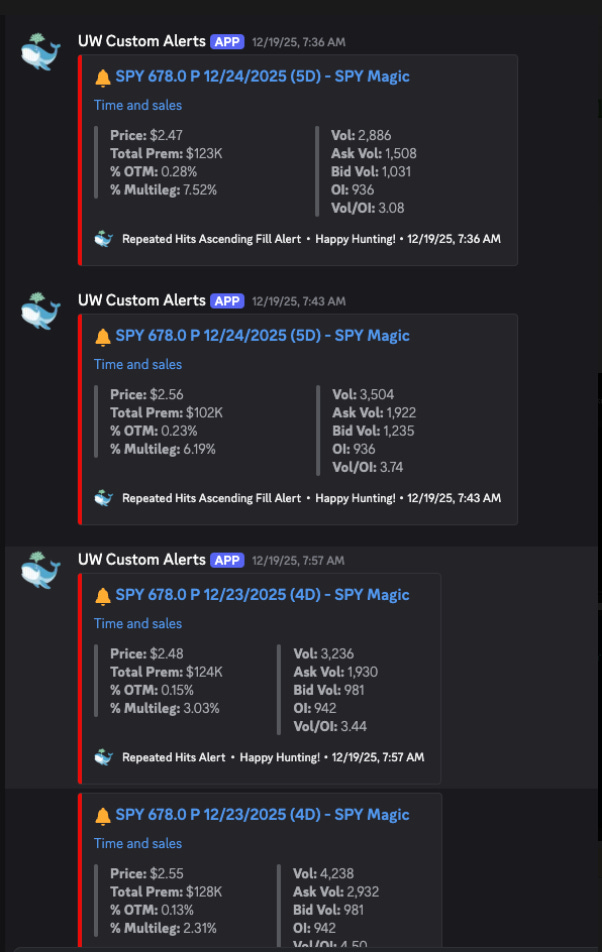

Starting Thursday afternoon, we saw:

Increasing 677p and 678p activity

Mostly expiring mid-week

Becoming more frequent as price pushed higher

At first glance, this looks like dissonance. Why would downside whales step in during a clean upside move outside of CPI or FOMC?

We had seen this pattern before.

🧱 The Concept: Gap Insurance

As SPY ripped higher, it left behind small but structurally important hourly gaps, most notably around:

~671

~675

Whales see these gaps. When price moves aggressively, they often respond in two parallel ways:

They allow momentum to continue via calls

They begin layering downside exposure tied to gap fills

This is not bearish conviction in isolation. It is insurance.

If price pulls back, those gaps are high-probability targets. Downside flow exists to monetize those retracements, even while the broader trend remains constructive.

This behavior is what we call Gap Insurance.

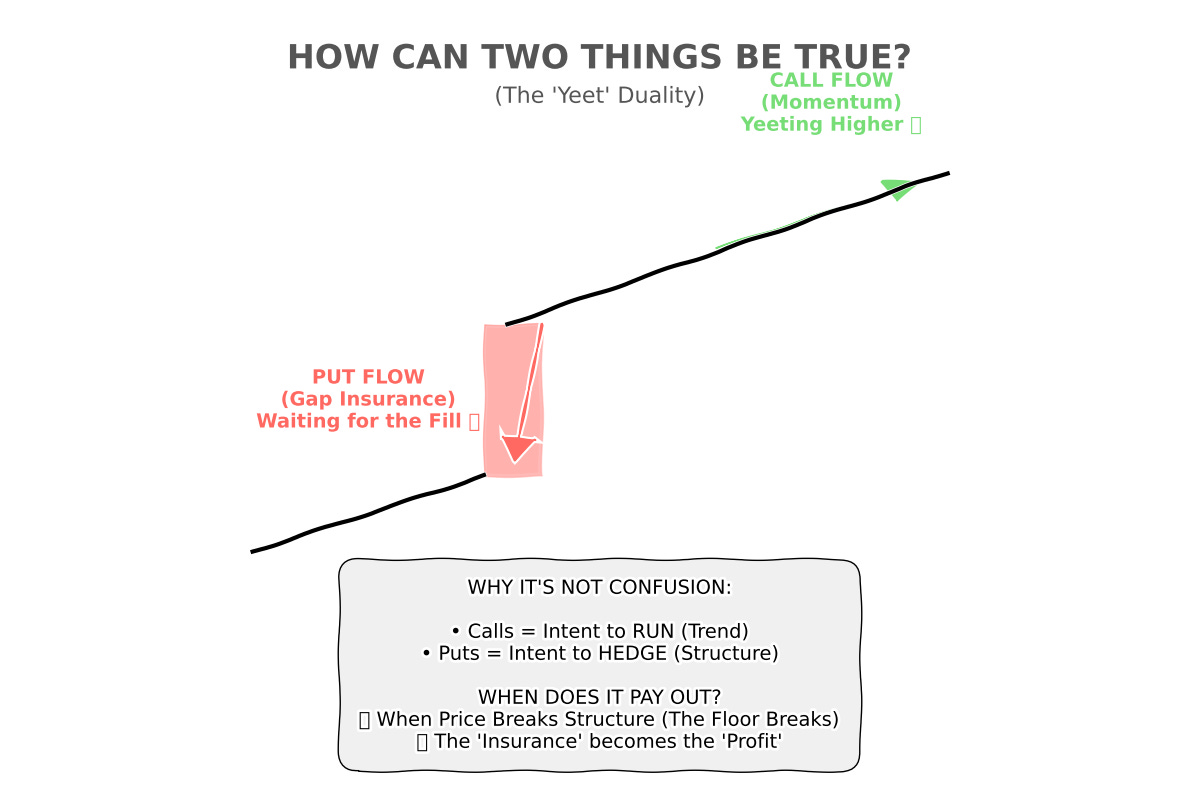

🤔 How Can Two Things Be True? AND HOW DO WE KNOW WHEN GAP INSURANCE PAYS OUT TO PROFIT OFF THIS

At first glance, this setup feels contradictory.

We had call whales pressing higher strikes as SPY broke structure and moved higher.

At the same time, we saw increasing put activity stepping in underneath price.

If you treat flow as a single signal, this looks like confusion. It is not.

Both sides can be correct at the same time because they are expressing different intents.

Call flow was expressing directional momentum and continuation.

Put flow was expressing protection and opportunistic downside targeting around known structural gaps.

This is not disagreement. It is layered positioning.

🔐 YEET Plus: HOW WE KNOW WHEN THEY PAY

This is why YEET Plus exists; I found the answers in one of our most used tools so far.

YEET Plus members get:

Automatic alerts across all YEET filters

Real-time Discord delivery so you do not have to watch the tape

Full Orange Swan reads updated daily

Access to the evolving Book of Flow as these concepts are formalized

Flow without context creates confusion. Context is what turns flow into a framework.