⭐Essential YEET: STONKENHEIMER pt. 1

A journey into the depths of what it takes to succeed. But against whom? And my God...at what cost?

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Brought to you by: Your Boy Milt and His Sensei Abu OmegaTrigga

📝Editor’s Note: Welcome back to the movies. Initially wanted this to be one edition, but there is too much info to parse and convey and I want quality over quantity, so this is going to be part 1. Hopefully you pick something useful up.

The information in here on Algo Seasonality is and will always be free—that’s our right as retail, to know enough to even the playing field. If you want daily updates to anything you like here, or flow play entries exits and updates, SPY trade plans, etc, consider signing up for YEET Plus for 10/month. If you don’t, no worries at all, we’ll still be pumping out a ton of free content and education.

🎥 STONKENHEIMER Pt. 1: What Is a Successful Trading Strategy?

If you’ve had a system for a while that you know works, you understand the difference between luck, a streak, or true success. For me, this is the standard of determining the efficacy of a trade strategy I’m trying:

Minimum Contract Realized Gain % to Qualify as “Winning Trade”: 30%

✔️ 70%+ for 10 trades: “Could be Luck” range

✔️ 70%+ for 20-30 Trades: “Nice streak, this could work” range

✔️ 70%+ for 50 Trades: A successful trade strategy, certified

✔️ 75%+ for 50 trades or more: Excellence.

A strategy may begin with a lower return rate, but as you approach and eventually surpass 50 trades, your experience-informed adjustments can see the strategy grow to become successful—or even excellent.

My 2024 scalp strategy—LEAP—never was under 75% through 50 trades, and hovered around 80% through approximately 110 callouts—this total includes lottos, quick scalps, and any other trade that closed that same day and only considered 30% gains or more as win. So when it dipped this past month with a 4 week win rate barely holding 60% my first thought was

Ain’t no way I’m just ass all of a sudden.

🗒️STONKENHEIMER Pt. 2: Intro to Seasonal Algorithms: Basic Monthly to Weekly Change

My second thought was Summer 2023. YEET Nation was making a killing off our Price Action strategy that caught quick 0DTE movements between monthly levels. Times were good and our cup runneth over—I owned 11 pairs of Jordans and I shared a variety of rare horses I’d never visit, stabled on an Estonian property in a land trust venture with Nikola Jokic. I leased a Ford Focus. The world was our Oyster, and all we did was click buy and sell between monthlies.

Then, my previously wet shot began bricking so much a small army known as “Inverse Milt Gang” had popped from the shadows like the motherless, dickless traitors they were to heckle me. The Kingdom Burned. I tried it all using my same strat—more discipline, more days til expiry—I even gave up drinking for a few hours. But the monthlies just weren’t hitting.

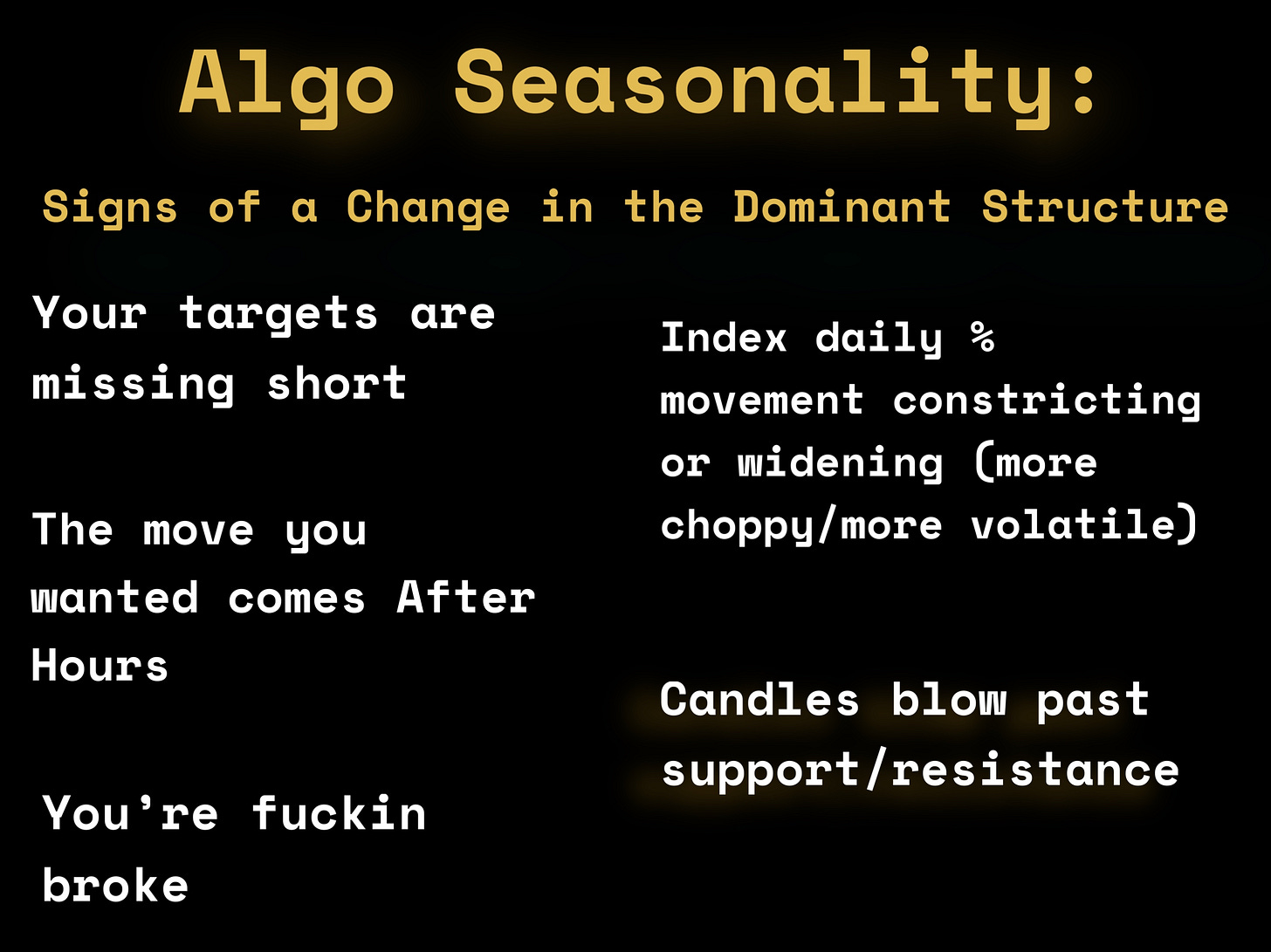

Then it hit me on a chart as clear as day, my intro to the algos was an obvious change to the dominant program: from a monthly level-dominant value metric to a weekly-dominant.*

Price Action had previously been running like this (I’ll explain my Asperberg’s Pollack of a chart in a moment):

‼️ This is what a chart looks like when the Algos are a slave to the (red) monthly level; simple. Predictable. Set to trading on the hourly candle interval, a pass and retest of one monthly leads to a test upward of the next. A rejection of that monthly level on the hourly timeframe followed by a confirmation rejection means you go back to test the lower one. Alternatively, a pass and a retest meant you went up another level. The cycle repeats.

The only decision you need to make is how greedy you’re going to be—0DTE or 1DTE. Your losses are in the rare days of chop when you go for a 0DTE. After hours action was fairly muted, so you could extend time to avoid most mistakes.

🤔 VS a WEEKLY-DOMINANT VALUE METRIC

That monthly action was seemingly opposed to what the market became, which was hard to notice at first unless you’re obsessive—algos began to adapt to a weekly-dominant value metric. If you were trading mostly on intradays like the 5, 10, or 15 for scalps—which I and most others do—it seemed randomized at first.

Above, on a standard scalping 15 minute timeframe, you see them going to the (white) weekly levels like magnets for bounces or rejections, utterly ignoring and disrespecting the monthly levels. Or so those tricky algorithms would have you think. Switching the hourly timeframe gives us a better idea of what’s happening.

Using the same boxes we have drawn on the fifteen, but switching to the hourly timeframe, we can see that for the most part they are respecting the monthlies—they are false signaling pop or fade with the hour’s initial move before wicking hard and squeaking back to the monthly. That portion of the algo change presents illusion level loss or gain as illusion but it feels like fact, and it’s one that will easily confuse novice traders who don’t have the balls or the patience to let an hourly timeframe play out.

A great example of that illusion was this Friday on a dip during trading that I swore on YEET Plus twitter account was getting bought up. Imagine the purple level as a monthly (it’s major), and the level it gets bought at as a weekly—they gave us a hint that they’re playing those games again.

The second portion of the Algo change that summer present in the above screens— that monthly retests stop being fully honored and weekly levels began to act as terminal support or resistance—is fact, not illusion.

Similarly, we’re currently at all time highs with no weekly levels—let alone monthly levels—as a true guide. Here is the current SPY Price Action with levels solely set to weekly and monthly:

Gadzooks! No guide to be seen—but luckily what I’ve been leading you is this. What is Algo Seasonality?

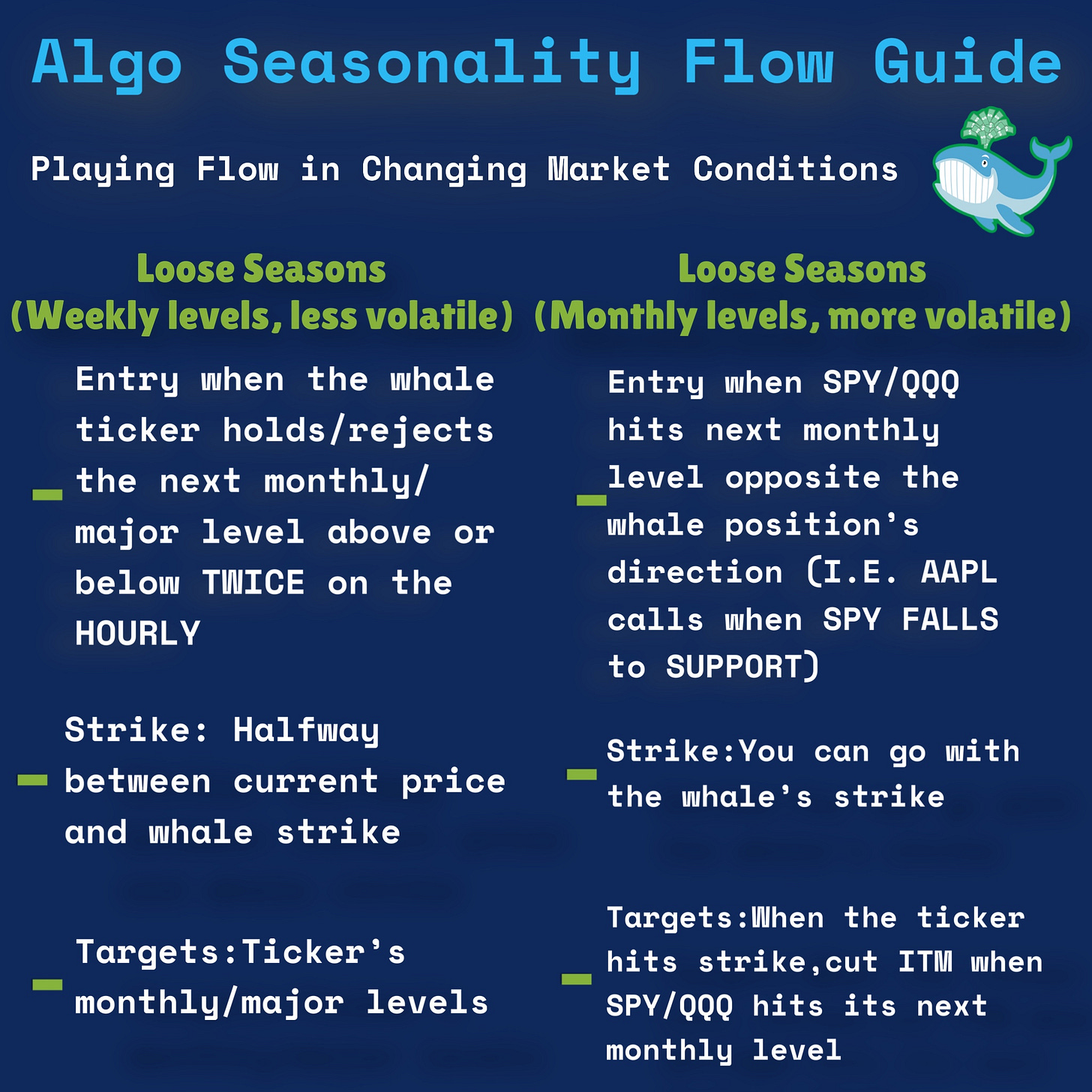

Seasonality is not a “season”—it’s a term given to Algorithm Adaptation during unknown or changing market conditions—by pattern like holidays or by event like Fed Rate uncertainty—change the way adaptive algorithms are programmed to react. For all the nuance, it breaks down to two things—Price Action becomes tighter or it becomes looser. Backtests are done with priority—so, methodically—or they become an afterthought.

*the weekly value metric mentioned above also involves ES, so does the remedy partially—which we’ll need a whole issue to cover.

⚠️ NEXT ISSUE: STONKENHEIMER PT. @ WILL FOCUS ON:

Current conditions have set up a LOOSE Price Action post FOMC news. Here’s how we’ll adjust to play it:

1) if even bother with scalping we play EACH level like it’s a monthly, since you never know which weekly is going to be Yahtzee.

2) We play longer DIRECTIONAL, at signs of confirmations (Ill update these daily on YEET Plus twitter, but the confirmations will be the typical hourly retest of the level but also also include additional confirmation via patterns, structure, and Net Premium.

3) We utilize….The Atomic Flow (when the time is right)

🕵️ Pt. 2: SPY Levels and Analysis: Adjusted for Current Conditions

We’re in an area where it makes no sense to guess what’s next given the current algo structure. Using the Principles above, I will keep the YEET Plus Twitter updated this week on my take on the day as we open and throughout. I will be using these guidelines when it comes to levels and structure.

🕵️ SPY Levels: Traditional Weekly and Daily is Out, Major Price Action Levels are IN

Upside: 531.5

Downside: 524.4 to 524.6 ZONE, 518.41

🕵️ SPY Chart/Outlook: The Channel of Destiny 2: Fate’s Follow-Up

The first Channel of Destiny was such a smash hit that the MMs ordered a Channel of Destiny Season 2. This general framework is a good tool to use when the intraday algos are forcing us to think long.

How I interpret this is a huge decision point for SPY as it wants to fly—do we retest and head up another slope, or do we lose structure here and head for the retest.

At the end of the day the market is solely this on a structural/zoomed level:

Are we continuing to go up—or is now time for the retest?

🐳 Pt. 3: Flow Play—The Unusual Bomb pt. 1

YEET Plus Last Week: Flow Play Entries That Went 100%+: 4-0

Be thinking about this chart, because I’ll be explaining and referring to it as we trade on both Twitter accounts: