🚨 Expert Flow Starter Pack: PARI Code, Two Filters--by Pip Boy

Enjoy!

🧨 YEET Plus Drop: We’re Giving You the Sauce

YEET fam — this one’s a TWO FREE PICKS from the filters giveaway for Plus subscribers: today they’re getting the PARI code, two live flow filters (People’s Screener + Intraday Sniper), and quick reads on sample contracts pulled from each. Bookmark this.

🚨NOTE: this has ABSOLUTELY nothing to do with the fact that maybe a certain someone didn’t think CPI was on Friday because of a WRONG Google AI answer when they asked, and as a result misread SPY Magic yesterday, causing him to swing when he almost never follows flow into CPI because it’s unreliable. And is doing this for Plus as a “my bad” gift. Absolutely nothing.

Annual sale still going because I’ve been too lazy to change it back since the holiday.

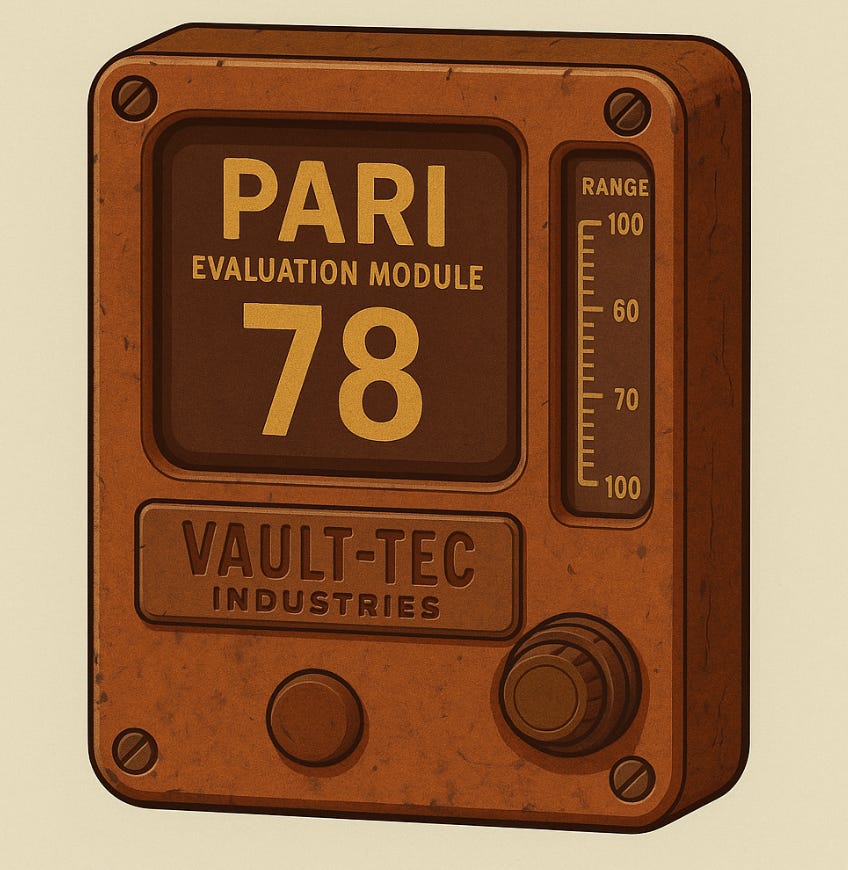

🤓 PARI — Price Action Risk Indicator (what it is)

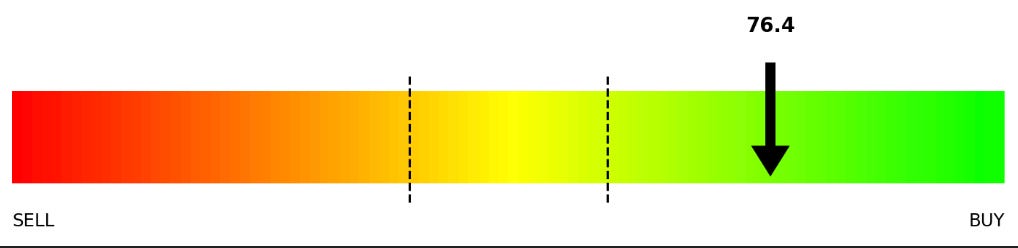

A 0–100 risk gauge that blends 10‑day momentum (↑ adds to score) and 10‑day volatility (↑ subtracts from score), rank‑normalized so ~50 = neutral, 60–80 = bullish, >80 = overheated/caution.

Today’s PARI: 76.4 (for 2025‑10‑24) → Bullish skew.

Code access below for YEET Plus.

🐳 People’s Screener — what it does

Our flagship big‑flow filter. It elevates OTM, sizey, ask‑heavy sweeps/floors with sensible DTE/IV gates — great for catching basic, directional moves and separating conviction from noise.

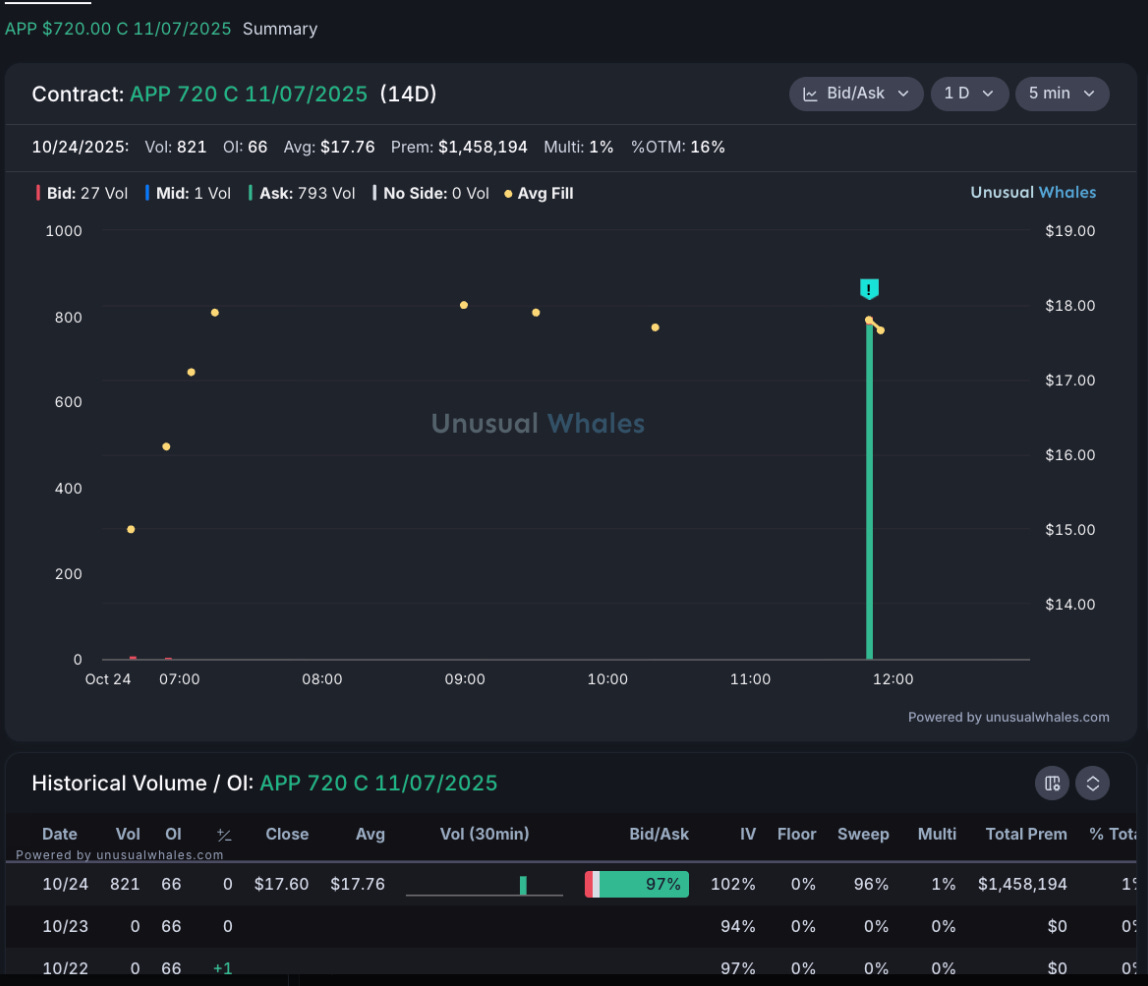

Today: APP 720C 11/07/2025 (14D)

Print quality: ~$1.46M premium; ~97% ask, ~96% sweeps → aggressive, directional buying.

Structure: 14D tenor, ~16% OTM, Vol 821 vs OI 66 (fresh vs. carry) with avg fill ~$17.76.

Interpretation: This looks like opening upside exposure, not a passive hedge. Short‑dated + mid‑OTM + ask‑side sweeps = go‑seek follow‑through (closer/laddered calls, IV drift). If the tape stalls, watch for roll‑downs to a nearer strike.

YEET move: Put APP on the radar; consider closer strike or more time when chasing to manage decay.

Filter available below for YEET Plus.

🐳 Intraday Sniper — what it does

A momentum‑tuned filter that catches smaller, sneaky orders accumulating intraday. Use it to spot early drift before it shows up as a big screener wall.

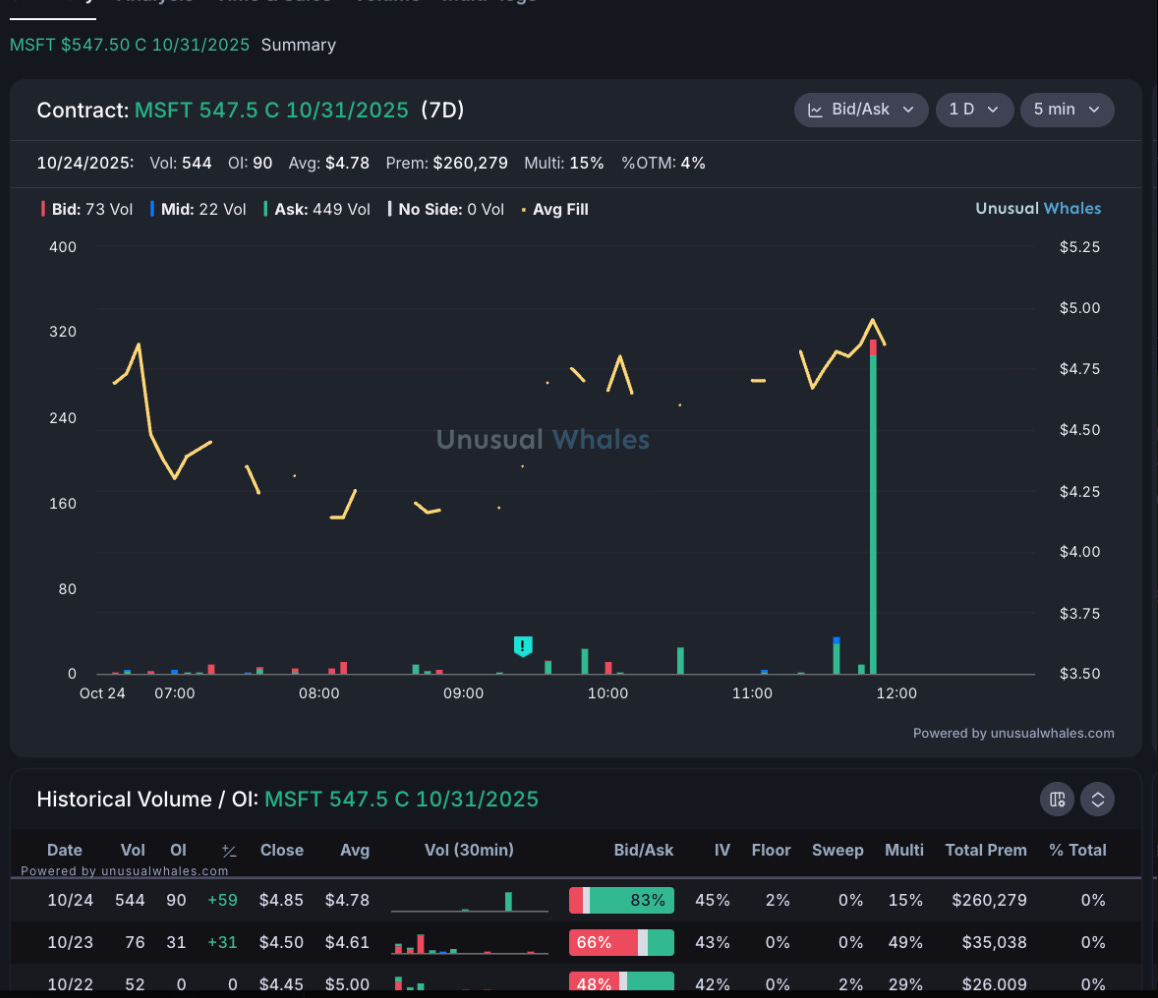

MSFT 547.5C 10/31/2025 (7D)

Print quality: ~$260k premium; ~83% ask, moderate multi‑leg 15%, IV ~45%; Vol 544, OI +59 d/d → steady building interest.

Structure: 1‑week tenor, ~4% OTM; prints cluster around midday spike.

Interpretation: Classic scout flow — smaller tickets on ask nudging IV/OI. If MSFT also appears on People’s Screener the same session → signal upgrade (momentum + conviction convergence).

YEET move: Prefer slightly more time or closer strike; look for a second burst (power hour) to confirm.