✅Free Game: How YEET+ Caught 3,200% $LNTH Move and $IREN Short Report for 173%

Crazy couple of days--let's learn from it and forget about Milt getting mauled at the unending market top!

Editor’s Note: Sorry if there are typos I’m running out the office for plans but wanted to get y’all pumped for Friday!

So, every play isn’t like this—I want to be honest off the bat and anybody who tries to say flow is easy is selling you a bill of dreams—but we do know what we’re doing when it comes to the flow and try our best to remind folks that flow is never mastered, but it can always be understood better and made into a profitable style.

After chasing flow since being the first person to do a UW Tutorial—on Reddit, before there was even a UW flow service and it was only alerts, which is just crazy to think about—there are a few tricks I’ve picked up that I feel benefit others. We are sharing some with you free tonight.

Yesterday we hit on $LNTH—our alerted entry and exit at YEET Plus was for 1,500% and contracts are currently at 3,200%

Today our IREN callout from alerted entry to exit went 173%

Although YEET Plus gets the levels and the callout entries for these types of plays, The YEET believes education should be something that is free for all. Here are the two key factors that led to both of these hits on back to back days:

Short-dated, deep outside the money filtering:

We want to know how urgent this is to the whales, right? The name of the game on these multi-baggers is finding something out of the ordinary, and nothing screams “I AM NOT A HEDGE” like money placed on an options order expiring within a week or two that is far outside the money.

If we’re only looking for something with say, 2% OTM within the same time frame our filters show this:

But if we extend that to 5% OTM we get much more tantalizing results:

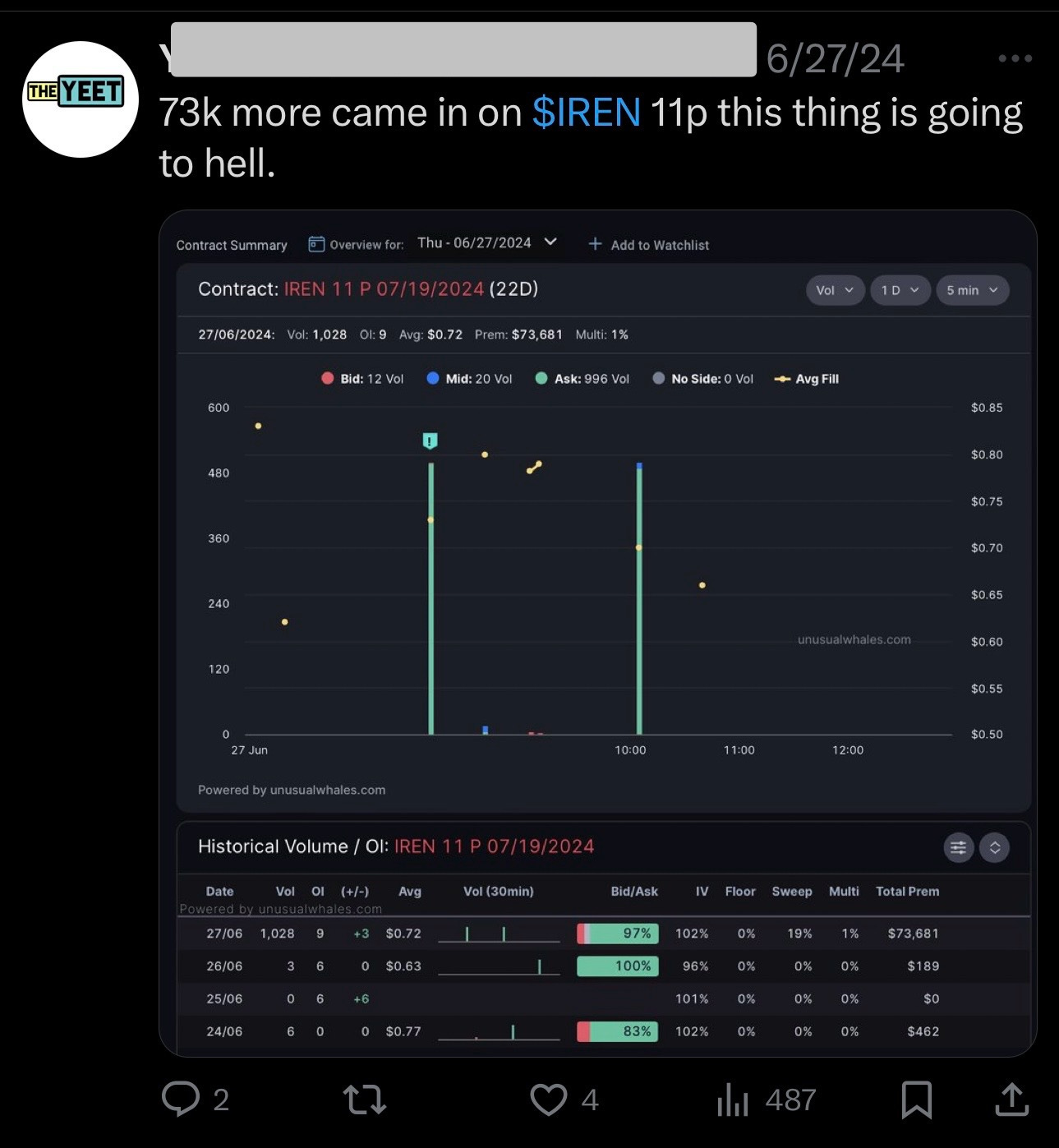

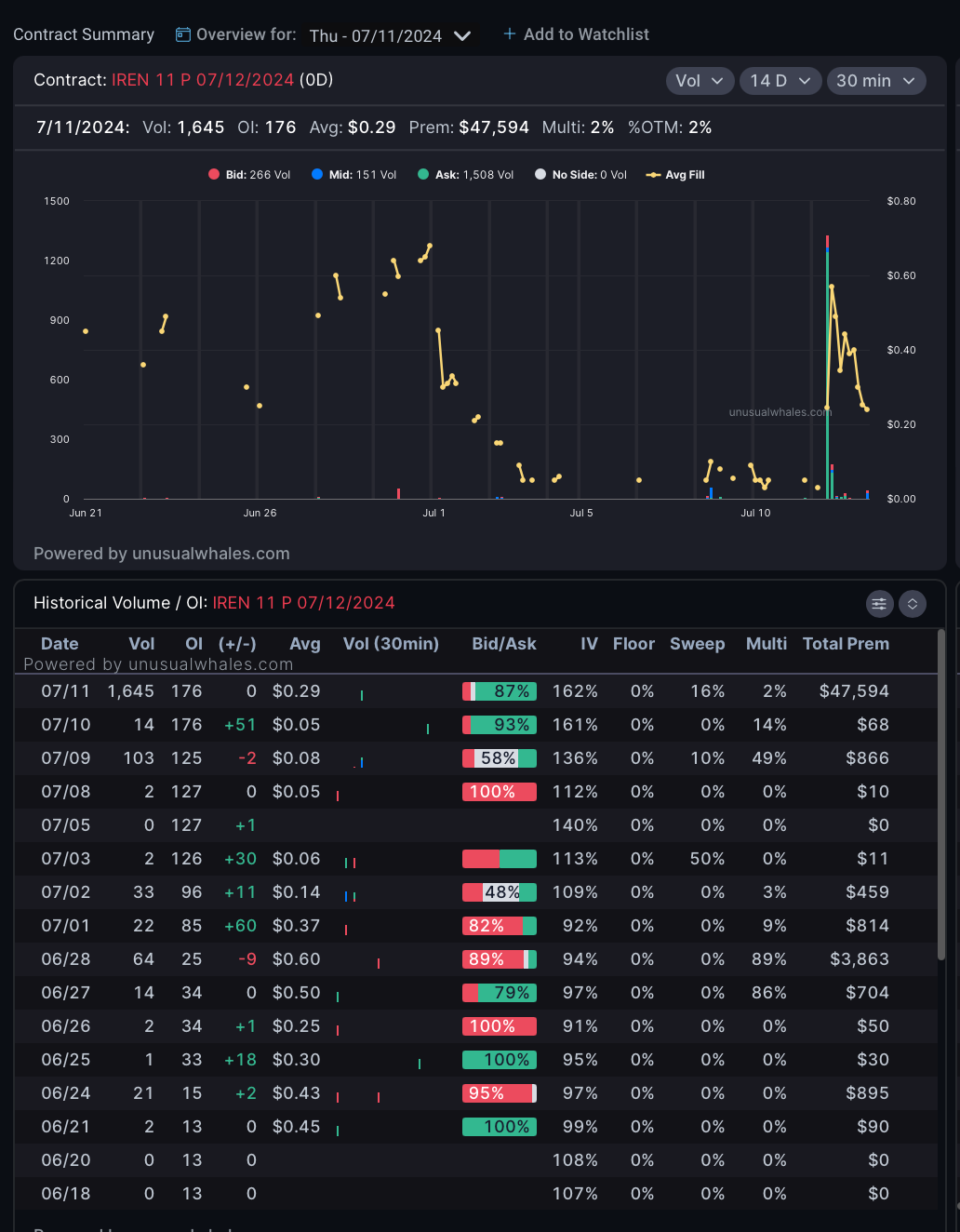

And there you have a young degenerate rolling into IREN 0.00%↑ with about 3 days until expiration. Quick research would show that this is not a stock that sees a lot of options activity—nor does it have a huge market cap—so you should be thinking “hm. That is a weird…weird hedge.” What was this degenerate chasing….?

The whale wins, we win, IREN loses. (Sorry if you work at IREN but it’s a cold world, baby girl—grab a coat. We’re here to make the moneysssss, your feelings are your own personal thing).

BUT! We actually beat whoever this whale was to the news…which gets into our second portion featuring LNTH.

Monitor for repeated buying on the same contract:

There’s no replacement for hard work (luckily for my lazy YEET Plus fam we do that hard work for them every night), and a part of the work of hitting a 32 bagger is meticulous tracking—every day—for movement into and out of your contract

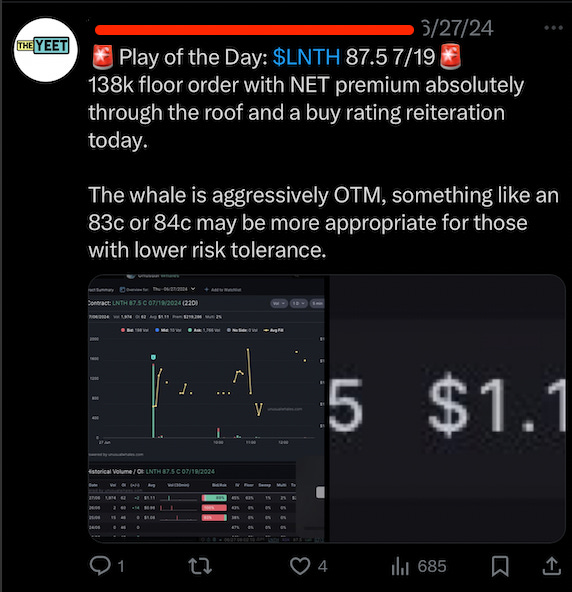

With LNTH we found this contract with no sleight of hand or special tricks—just me playing around with the OTM levels and time to expiry on contracts like I showed above on our YEET Plus filters. Here’s the original tweet:

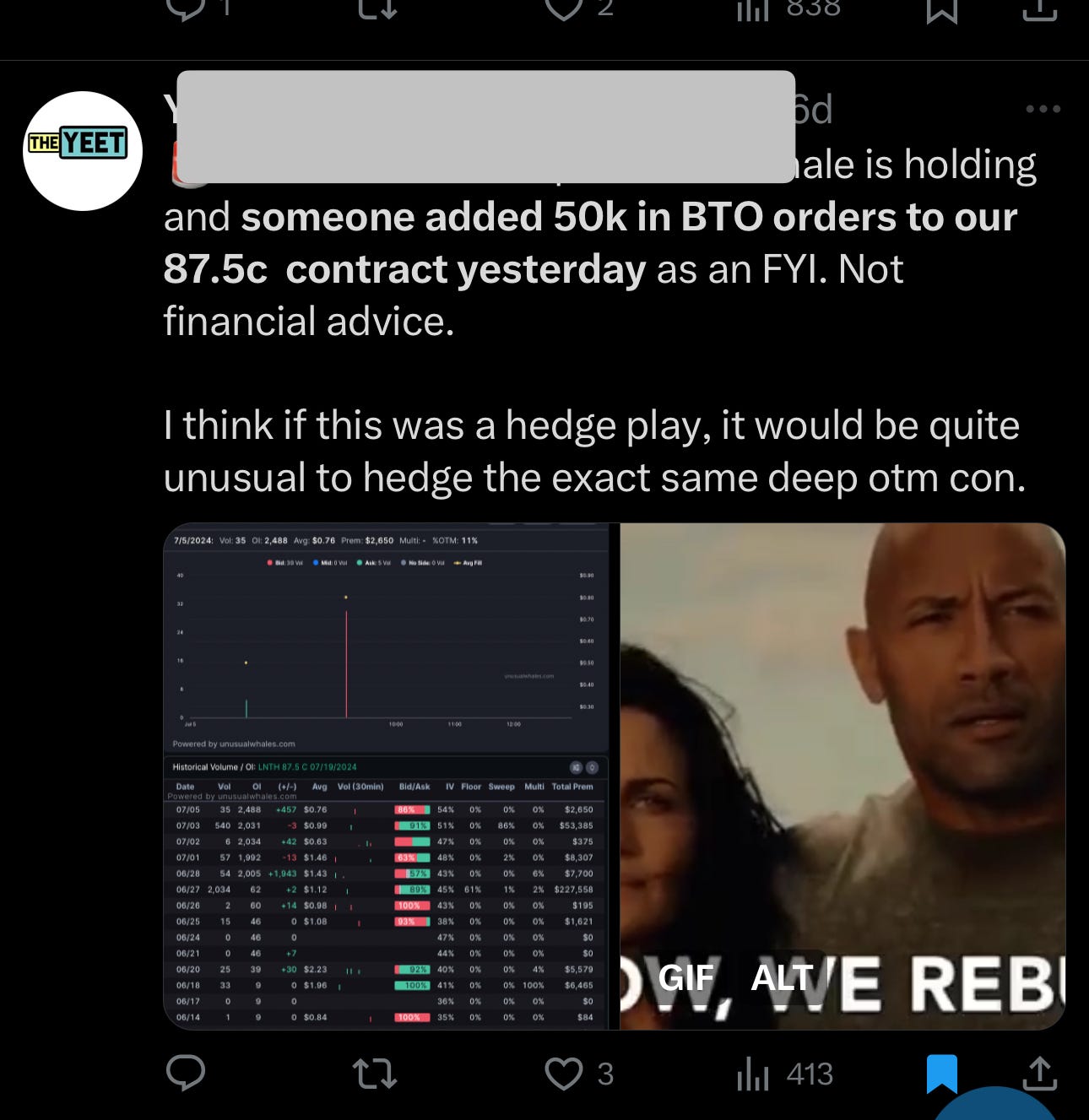

Nothing groundbreaking—just a large money order placed deep outside the money on a monthly. But the key was in following up on the contract—by checking it religiously I was able to find this on July 3rd:

Notice here that this was the same contract we’d been eyeing with an additional 50k order added in while it was significantly down—quite unusual for a repeat hedge to occur. That’s when we knew.

THIS IS YOUR MONEY! WHEN YOUR MONEY IS IN A TICKER YOU GOTTA HUNT THAT THING DOWN LIKE A RABID DOG TO KNOW WHO IS IN, WHO IS OUT, AND WHEN!

Prime example of this was IREN, which we hunted for over like a week and a half. Here are some of the tweets about it, notice that I’m watching my contract and other contracts to see if there is any indication of movement:

Juggling a lot of contracts is a lot of work, but you get used to it. We’re currently tracking NFLX, which we are up 80% on as well (that was provided free to all):

🚨YEET Plus: Here’s our new signature trade from today

And guess what—I’ll be watching it like a hawk. Like a broke ass, degenerate Batman looking over his city 😭