🚨It's COMPLETE! SAP --Sector Applied PARI--is here on XLF. Plus SPY Levels and SPY PARI for today

we're going full nerd.

SPY Levels

🧭 Legend

🔴 = Monthly

⚪️ = Weekly

🟦 = Gap / turquoise

🟨 = Scalp / homemade

Current price: ~645.35

🧱 Levels

Upper:

🔴 646.20 | 🟨 645.72 | 🟨 645.54 | 🟨 645.49

Lower:

🟨 645.24 | 🟨 645.22 | 🟨 644.40 | 🟨 644.25 | 🟨 643.92 | 🟨 642.85 | 🔴 642.18 | 🟨 642.00 | 🟨 641.47 | 🟦 640.20 | ⚪️ 639.87 | 🟦 639.29 | 🟦 638.56 | 🟨 638.17 | 🟦 638.04 | ⚪️ 637.64 | 🟦 637.60

THE DAILY PARI pt. 1 — SPY (preview cut)

🎯 Today’s Read

Date: 2025-08-14

Close: 644.54

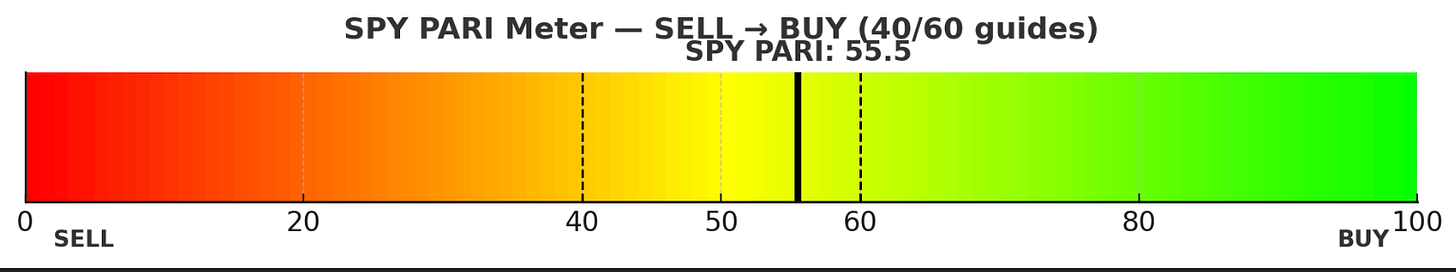

PARI (today): 55.5 → back above 50, leaning constructive but not a full-on “trend-on” (that’s >60).

Meter:

(SELL→BUY scale, dashed guides at 40/60, bold pointer)

Why here?

Momentum rebounded (10-day price vs. 10-days ago improved).

Volatility (10-day stdev) remains middling — not suppressing the score, but not boosting it either.

Translation: buyers showed back up this week, but the engine isn’t red-lining yet.

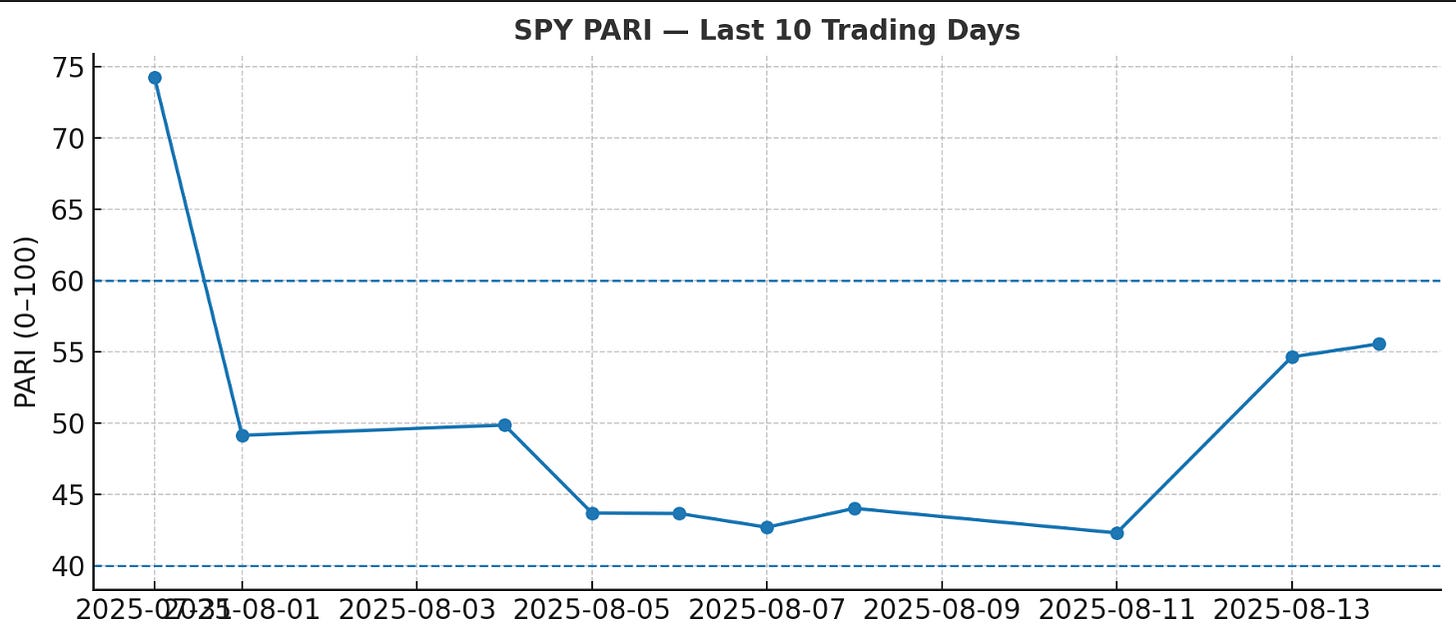

🗓️ Last 10 Days (internals check)

Sequence (PARI): 74.2 → 49.1 → 49.8 → 43.7 → 43.6 → 42.7 → 44.0 → 42.3 → 54.6 → 55.5

Read: A sharp fade from end-July peaked conditions → base in the low-40s → two-session recovery back mid-50s.

Key lines:

40 = risk-off warning; bounces from ~42 suggest sellers lost follow-through.

60 = trend-on confirmation; we’re near but not through.

EQUITIES PARI — XLF

🎯 Today’s Read (XLF)

Date: 2025-08-14

Close: 52.67

PARI (today): 49.9 → neutral. Internals have healed off the lows but haven’t flipped to trend-on (>60).

Why here?

Momentum: improving vs. 10-days ago.

Volatility: still a drag relative to SPY; caps the score near 50.

Takeaway: Sellers lost follow-through; buyers probing, not in control yet.

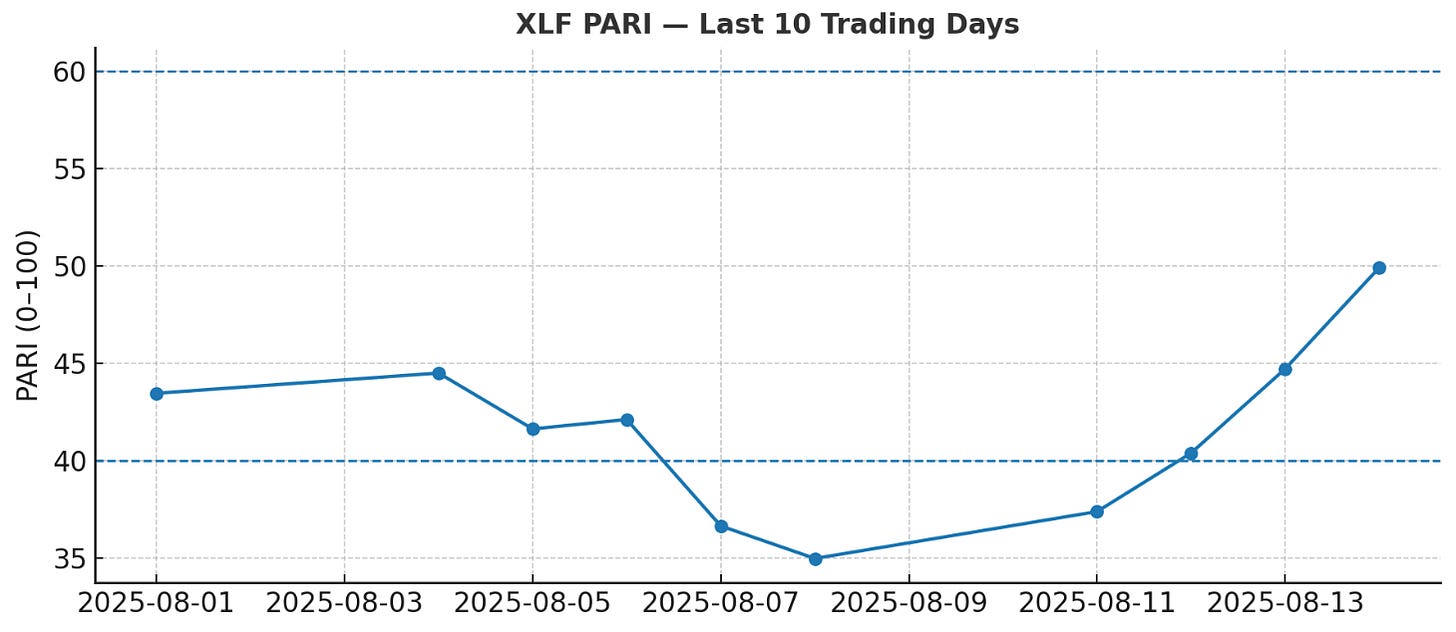

🗓️ Last 10 Days (XLF)

Path (PARI): low-40s → mid-30s flush → V-type recover back to ~50.

The 35–40 zone acted like a spring; pushing/holding >55–60 would confirm a sector up-leg.

SPY vs XLF — Comparison, Divergence, Conclusions

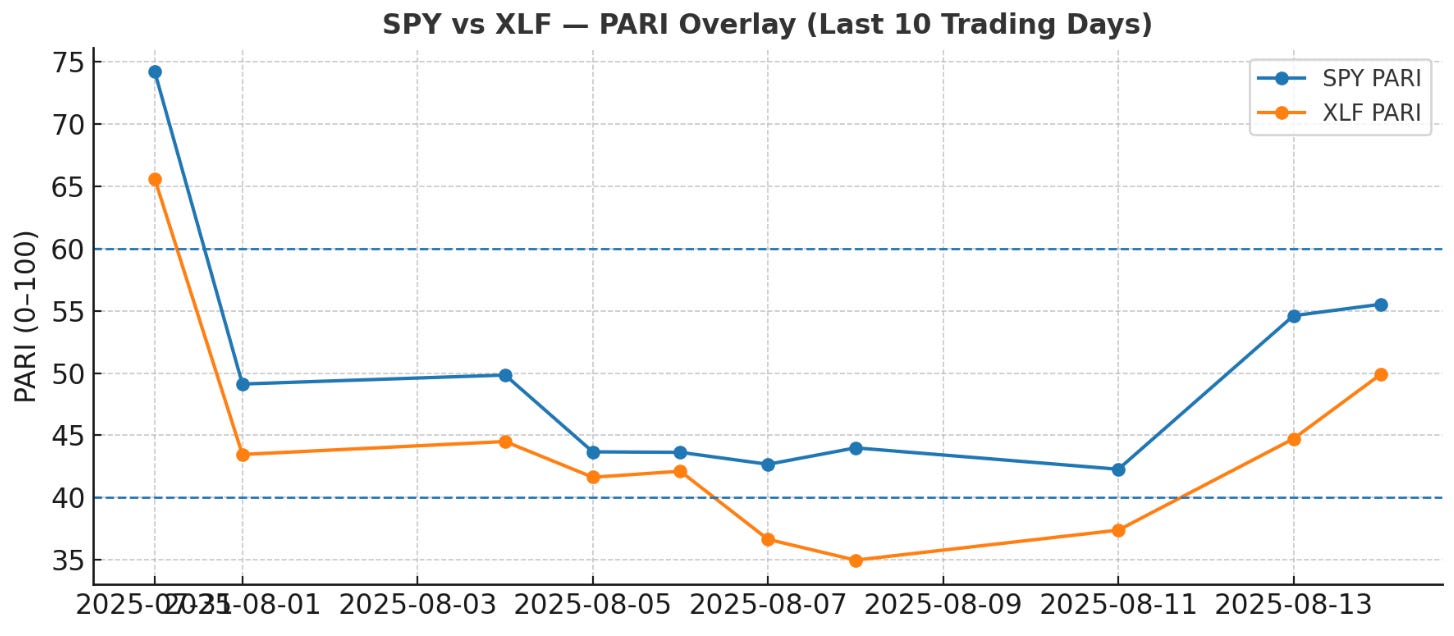

🔁 Overlay (PARI)

(same 10 trading days; dashed 40/60 guide rails)

Read: SPY’s internal engine recovered faster (back to 55.5) while XLF is still just under 50. That’s classic beta-led bounce with financials lagging.

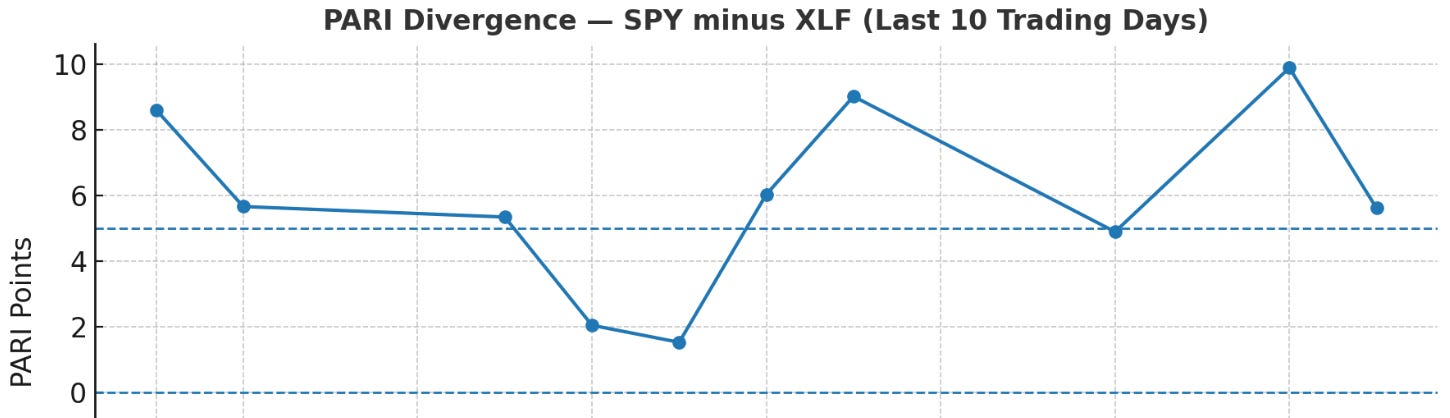

↔️ PARI Divergence (SPY − XLF)

Today’s gap: +5.6 PARI pts in favor of SPY.

Over the last 10, divergence mostly stayed +2 to +10, i.e., SPY internals > XLF internals.

When this spread widens above ~+5 and persists, XLF historically underperforms on a relative basis unless it quickly chases >55–60.

🧠 Conclusions (action-leaning)

Current state: SPY internals > XLF. XLF’s bounce is real, but behind the index.

Bull path for XLF: Push >55–60 and hold for 1–2 sessions → treat as trend-on; look for confirmation from JPM/GS/MS PARI leadership.

Risk cue: If XLF PARI rolls back <45 while SPY stays ~55+, that’s sector-specific weakness → favor SPY over XLF or lean into relative shorts in lagging banks.

Quick rule: Divergence > +5 and rising → stick with SPY; Divergence narrows to 0 with XLF accelerating → rotate into financials.

🚨 YEET PLUS: Presenting the SAP— Sector Applied PARI

I entered data of ten of the holdings in XLF into a PARI model (pretty much all except Berkshire) and ran the divergence against XLF PARI to determine which banks to buy and which to leave alone (you guys said you wanted banks in the Discord—you got em!)

🔎 Sector Divergence PARI — inside XLF

What it is (plain + practical):

We compare each component’s smoothed PARI to XLF’s smoothed PARI to spot leaders vs laggards before price shows it.

➕ Positive divergence = ticker’s internals > sector baseline (leadership).

➖ Negative divergence = ticker’s internals < baseline (drag).

🧮 Score =

|latest ΔPARI| × (1 + 0.1 × persistence_days)→ sustained separation gets boosted; one-off wiggles don’t.

Use case: we’ll do this across ETFs/Sectors to surface overweights (leaders) and underweights (laggards) systematically.