🏎️MAD MILT: Santa Rally Road (Newly Unhoused YEET Population vs Imperator FEDerosa)

An exciting final test that puts a years worth of learning into play at once

⭐️PLUS: you may want to skip ahead if you’re short on time today because there are THREE signature trades with time

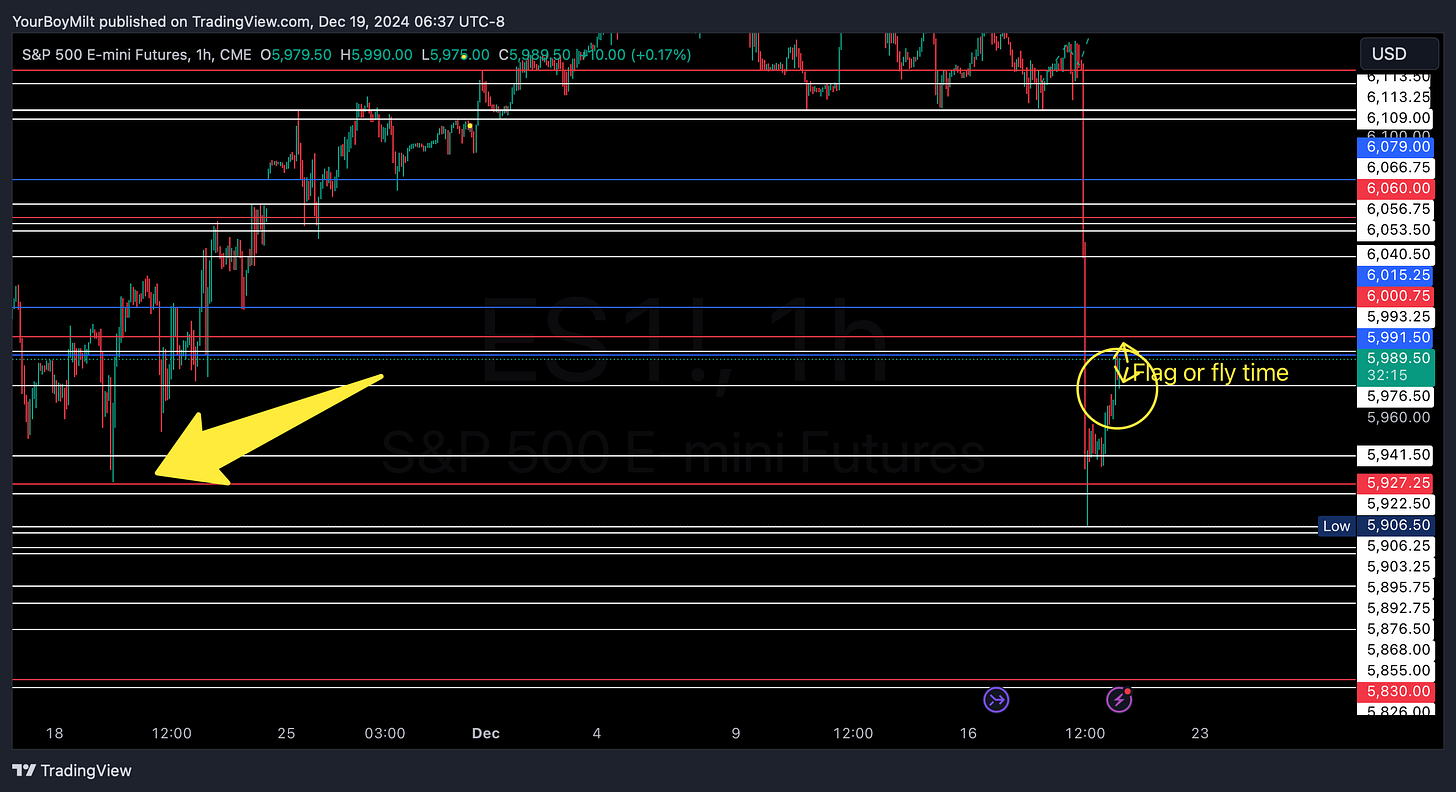

FOMC Review: The Prologue

A Simple Monthly Level Break Brings a Reign of Bear Terror Upon a Prosperous Land

The easiest way to understand the FOMC drop is to not overcomplicate it—we broke a monthly level, and the break that level brought us to the next monthly level. This is actually the same volatility strategy I’ve taught in countless pre-FOMC/CPI YEET; what maddest different was this monthly had a 20 points differential—nob way they’d go for it within 90 minutes…right?

I normally am pretty Devil May Care, but I was holding a ton of calls—as were my people in Plus. Rather than call it quits on the week—let alone the day—and submit to Bearish bondage I’m going go lead us on a dangerous, high octane thrill ride of indices and flow at 100 mph. Because I’m mad. You could say I’m…wait for it…M A D M I L T. (So dumb lol, anyways…)

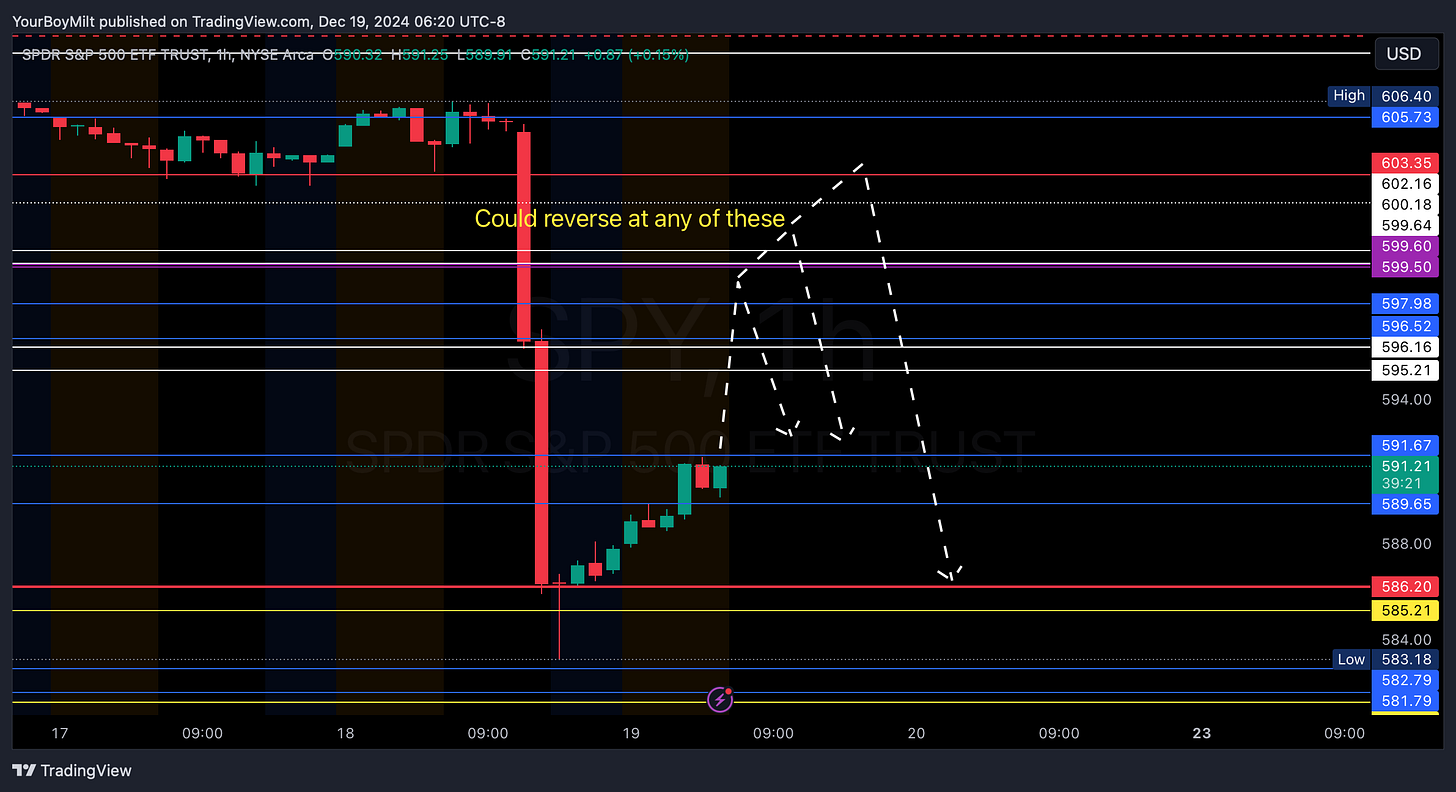

SPY: Yesterday before close we strapped into some SPY 590c 12/29 and we are ZOOMING.

Profit take determined by: Hourly close above 591.5. If you didn’t get in yesterday, a confirmed break of tnat level means you can join in

Hard Close: 595.21– thats the first weekly level and key resistance likely. Today and tomorrow we’re in the business of winning trades—no holding for style points.

⏱️The rest of the day is the waiting game. For what? For the false breakout wick of course.

Whether it’s at the first weekly or they scam up to the monthly, it’s not going to be a pure trend day. I havent quite learned how to articulate why i know they’re coming, mechanicslly, but this will be a big 2-4 hour candle wick.

If the major level loss is before 10 PST we can go 0DTE. Anything later is tomorrow expiry.

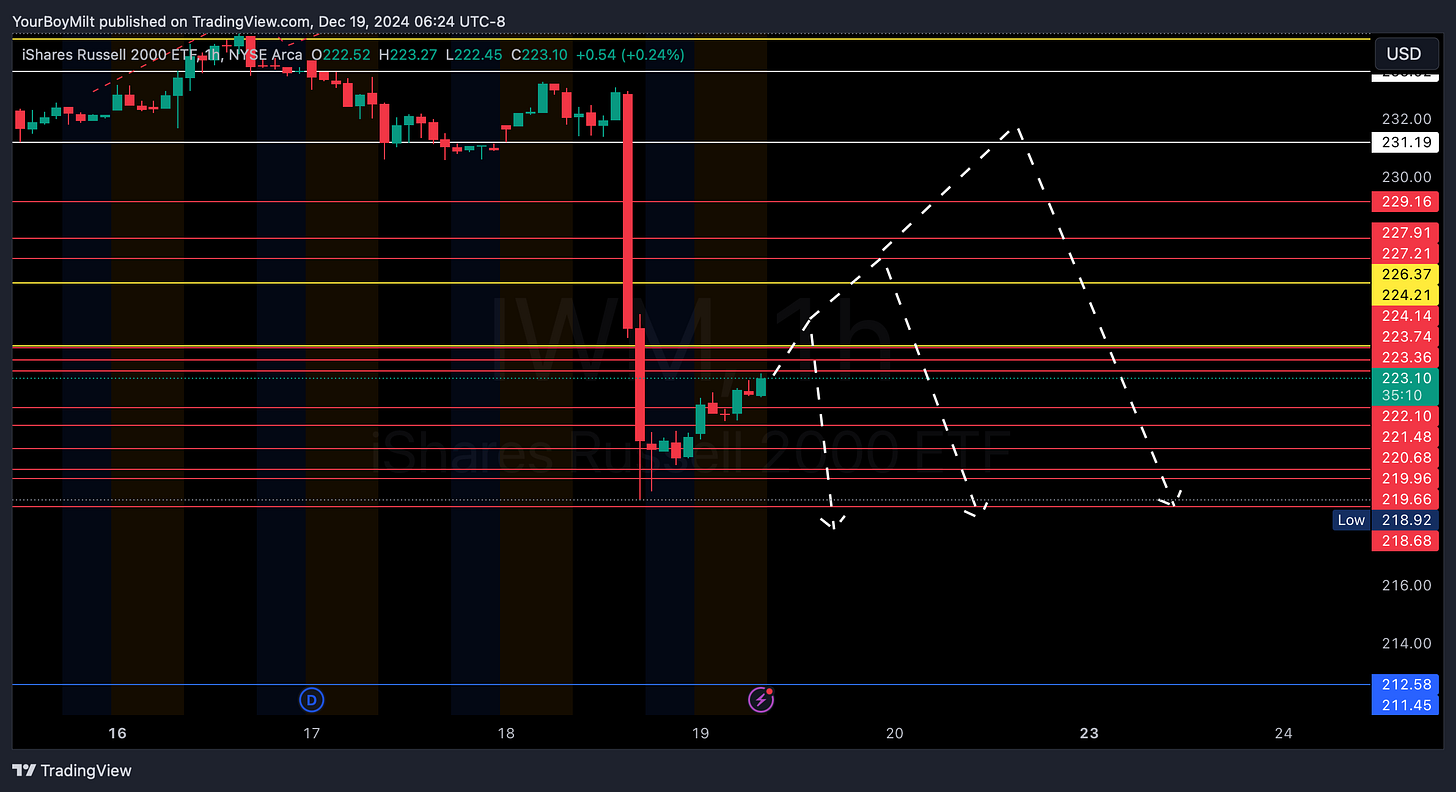

The Secret Road: IWM and the forgotten Valley of Small Caps

The same setup on the day as SPY but with much more tantalizing opportunities

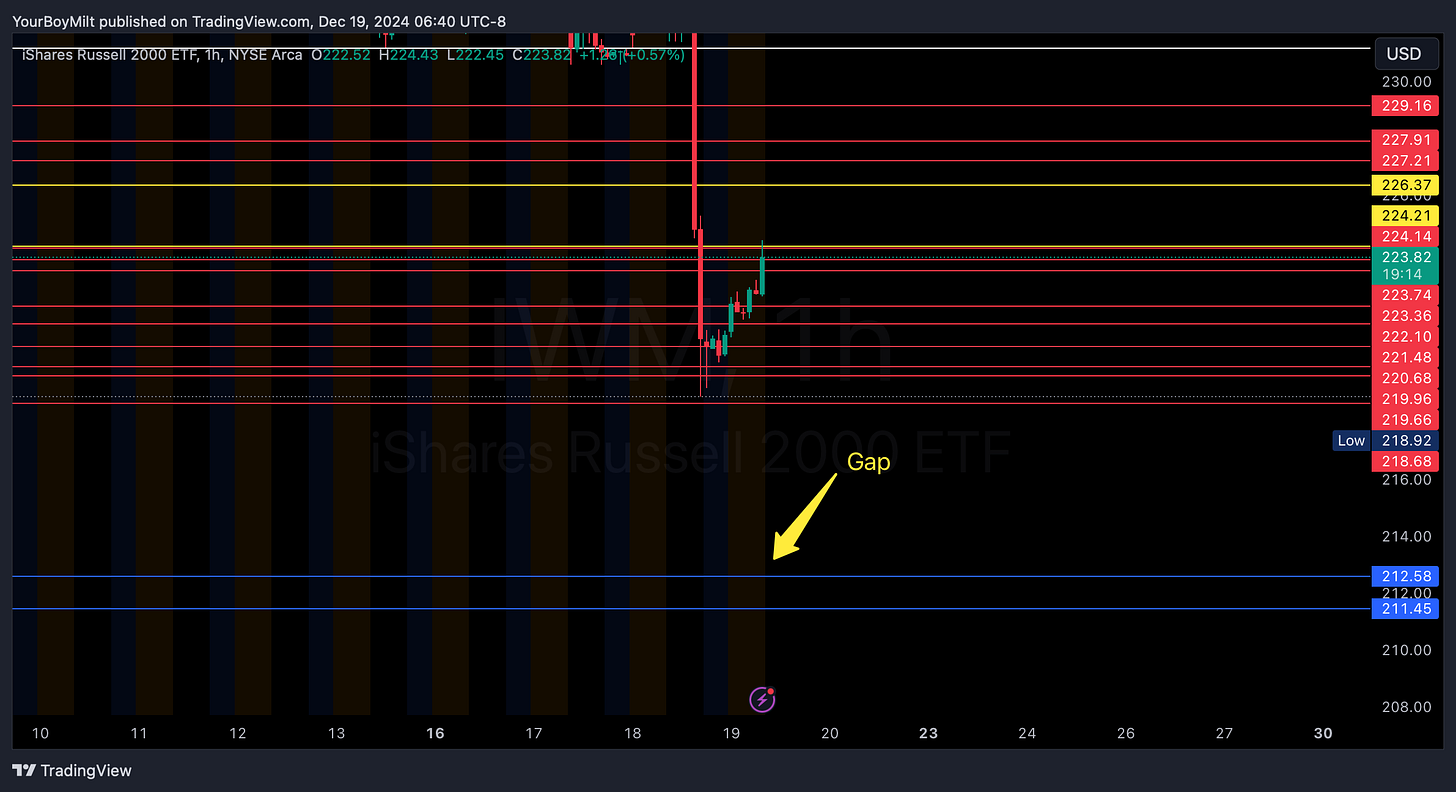

🩸12/23 puts near 216–they cheated a test of the low yesterday

😭Longer term 214s because they need to fill the gap

Then to bring it home calls at either 216 low support or gap support, whichever holds. Why?

Gap fills almost always have a strong reverse direction re

action initially

Check out this flow from Unusual Whales

-2 million poured into the 3x Bull IWM Pro Shares ETF yesterday

-A comparative look at SPY vs IWM Flow