🔥 MAX SPY WHALE PROFITEERING: A GUIDE TO USING THE TOOLS

User’s Guide to the YEET SPY Flow Suite

🔥 MAX SPY WHALE PROFITEERING

User’s Guide to the YEET SPY Flow Suite

🧠 Intro – I Finally Put a Guide Together

Me, Kai, Nate, and a few others in Shoot the YEET and The Garden keep getting asked the same thing:

“Alright Milt… we’ve got all these filters now — how do we best use them together?”

Fair question. We’ve built a small degen-pire of flow.

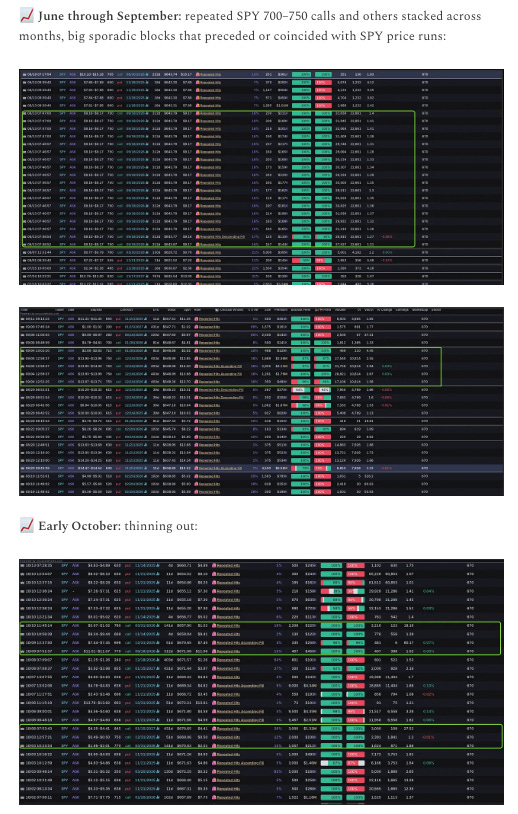

⚡ SPY Magic is hitting around 90% in-the-money when traded right. Unicorn backs up it’s moves to tell us if a day trade should become a swing.

🦢 Orange Swan has now caught three separate 1%+ dumps in six sessions.

💣 Ballistic has been front-running Powell moods like clockwork.

So yes, fellow nerds, it’s time for the full rundown.

These are the best-usage tactics I’ve learned for using these together.

💎 YEET PLUS FILTER SUITE ACCESS

Before we dive in — all the filters below are live right now inside the YEET Plus Filter Suite.

Once you’re subscribed, you get:

Full access to SPY Magic, Unicorn, Orange Swan, and Ballistic

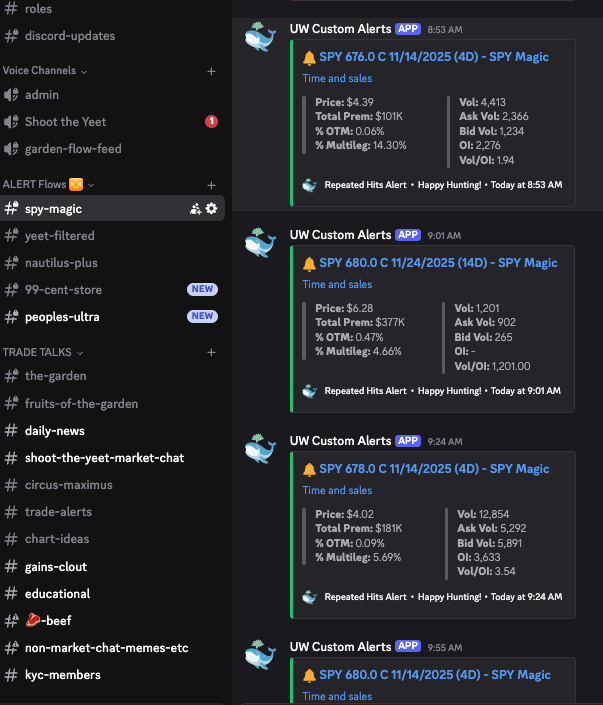

Automatic Discord alerts from SPY Magic streaming straight into The Garden

The Orange Swan filter code, ready to run

Every new filter drop as soon as it’s released

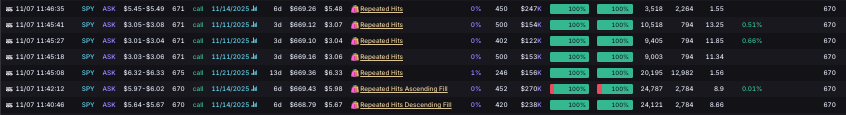

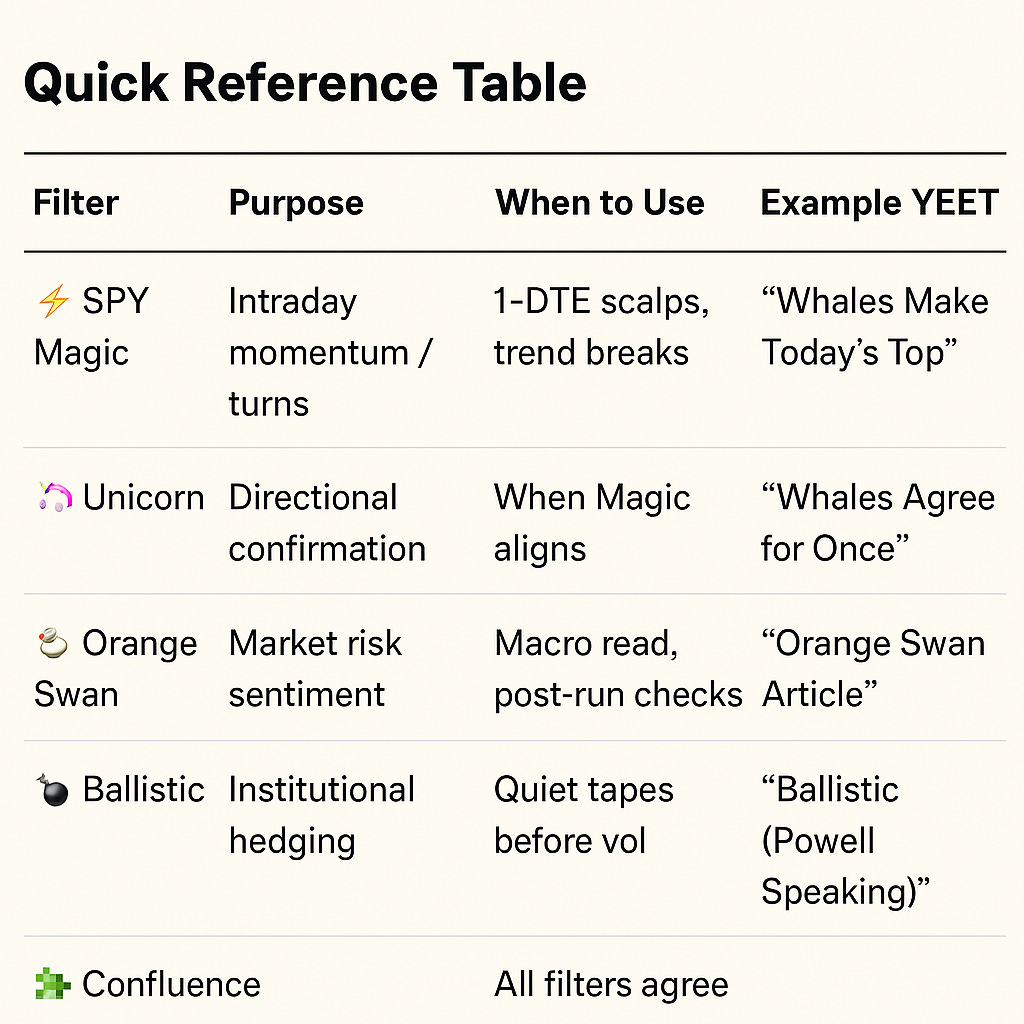

⚡ SPY MAGIC – The Heartbeat of the Market

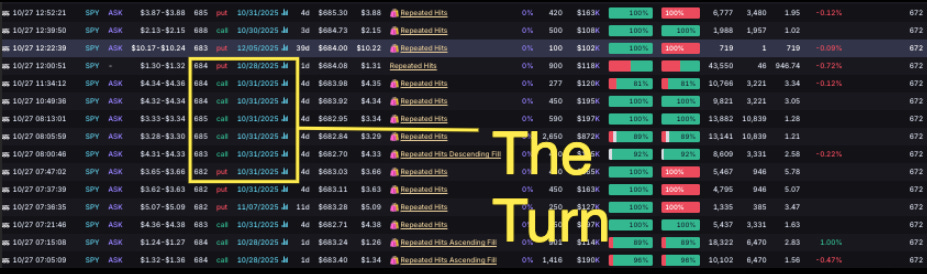

Magic tracks where the real whales are pressing right now. Built for 1-DTE scalps and intraday turns.

How to use it 👉

Watch for turns: when a ladder of same-direction orders snaps and new ones fire the other way. That’s your exit — the whales flipped

Consecutive bursts same direction = continuation.

Flow-price divergence (whales buying in loads the opposite direction of price movement = likely coming reversal at support or resistance

Laddering: Progressive Consecutive OTM orders in a single direction = continuation

Alternating bursts = chop. Back off.

Not a chart trader? No problem. Magic can be yo chart baby! You’ll oftentimes see the flow flip before the candle does.

📖 See: 🐋 Whales Make Today’s Top Easy to Spot with The Turn and 🧠 SPY In-the-Money Magic Filter is Back for live ladder flips and the ITM Magic variant in action.

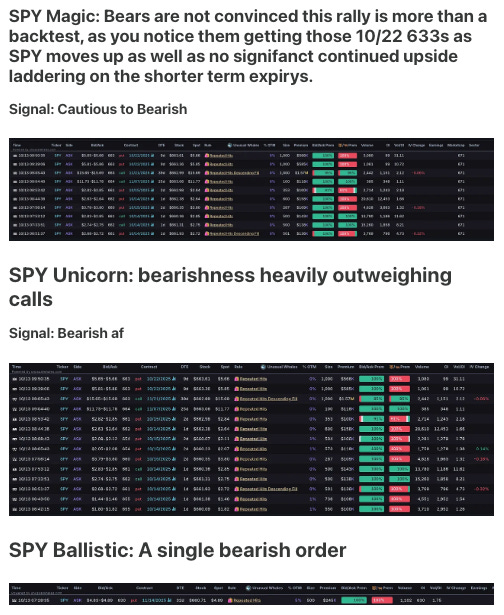

🦄 UNICORN – The Echo Signal

Unicorn = Magic’s backup singer.

Looser parameters, slower rhythm, one true goal: confirm what Magic catches.

When they sync ➡️ momentum sticks.

How to use it:

If Unicorn fires the same direction as Magic, that’s your greenlight to swing, not scalp.

If they diverge, chop city. Wait for alignment.

📖 See: 🐳 YEET – The SPY Whales Agree for Once for a real-world “dual-horn” signal that kicked off a multi-day run.

🦢 ORANGE SWAN – The Risk Thermometer

Swan reads the emotional temperature of the entire market.

When there’s no green relief anywhere, things get ugly fast.

It’s caught three 1%+ SPY drops just by reading flow imbalance.

How to use it:

If you see no green, brace for impact.

When green starts creeping back in, that’s the first hint of stabilization.

Use it to time the stop-short / start-long hand-off.

📖 See: 🇺🇸 Orange Swan: How Whales Show How High and Low We Go with Orders for full visuals and the logic behind the Swan Score.

👉 YEET Plus members: you get the full filter code in the Discord tonight.

💣 BALLISTIC – The Hedge Decoder

Ballistic shows what institutions are really afraid of.

It tracks the hedging that happens before macro moves — the quiet panic phase.

How to use it:

Volume spikes without price movement = stealth hedging.

Put-heavy = fear of drawdown. Call-heavy = fear of missing upside.

Pair it with Swan: high Swan score + Ballistic spike = vol alarm.

📖 See: 🚨 Ballistic: Reading the Whales Through the Chaos (Powell Speaking) for a perfect example of hedge flow telegraphing the move.

🧩 CONFLUENCE MODE – When Everything Lines Up

When Magic + Unicorn agree, Swan backs the mood, and Ballistic confirms institutional flow — you’re in Whale Profiteering Mode.

Signals to trust:

🟢 All Bullish: expect gap-fill runs or multi-day grinds higher.

🔴 All Bearish: that’s your dump setup. Load puts, then coast.

🟡 Mixed: scalp zone. Grab the turns and focus on magic, don’t marry the move.

📖 See: 🐳 Whales in the Eye of the Storm and 🐋 Smacking the Curveball for live examples of full suite alignment.

🎬 YEET PLUS BONUS: Video Explainer and Unicorn/Ballistic Links (others available at the YEET Plus Filter Suite on theyeet.com when you subscribe)

I’m dropping a video walk-through for Plus members soon —you’ll see each filter in real time:

Live ladder breaks and Magic turns

Confluence stacking that builds multi-day confidence

How I use these reads to size entries and time exits

This is how you move from seeing the whales to trading with them. 🐋💸