✅Midnight Bangers Vol. 2: 0 Day Double Play?

Reviewing the WOLF win and Examining an interesting potential trade with two way potential

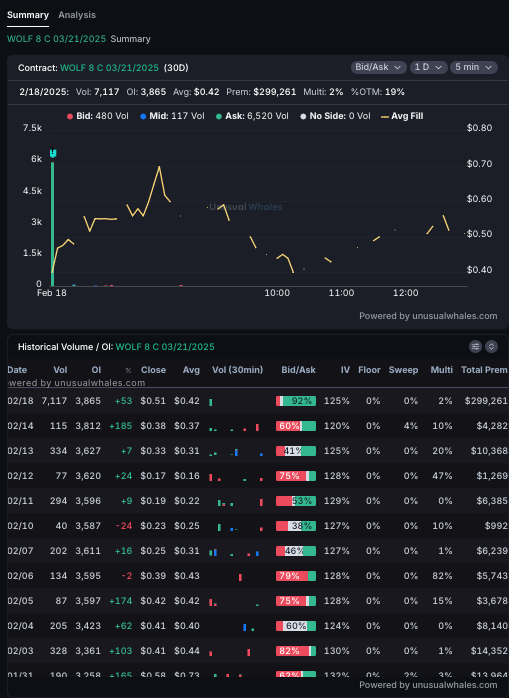

🐺🔥WOLF Reclaim Play: Flow and Chart Multi-Bagger Trade Review/tutorial

Found with: The Freelance Five Filter, included with YEET Plus Subscription

This setup on WOLF was a textbook reclaim of prior resistance turning into support, making it a perfect spot for calls. Here’s how we pulled it off starting with finding this flow on The YEET Plus Filter The Freelance Five—note the volume to OI.

Then it was onto the chart to wait for a valid entry—note that we always provide entry levels with our flow trades.

🔹 Key Level: $6.78 - This was a well-defined resistance level, as shown by the two rejection points (blue arrows). When price broke above it and then retested it as support, that was our cue.

🔥 The Reclaim Candle - A strong candle reclaiming $6.78 signaled bullish momentum.

📈 How We Traded It:

Above $6.78 and holding = Calls were in play.

Hourly candle closed above = Confirmation.

Loss of $6.78 = Invalidation (cut the trade or looked for re-entry).

💡 Why This Mattered: Whale flow was already showing bullish action on WOLF. By pairing that with a clear trigger, we stacked the odds in our favor. Always match flow with chart levels for the best setups!

🚀YEET Plus:

0DTE Potential Banger that is also a…

2/28 Banger?!

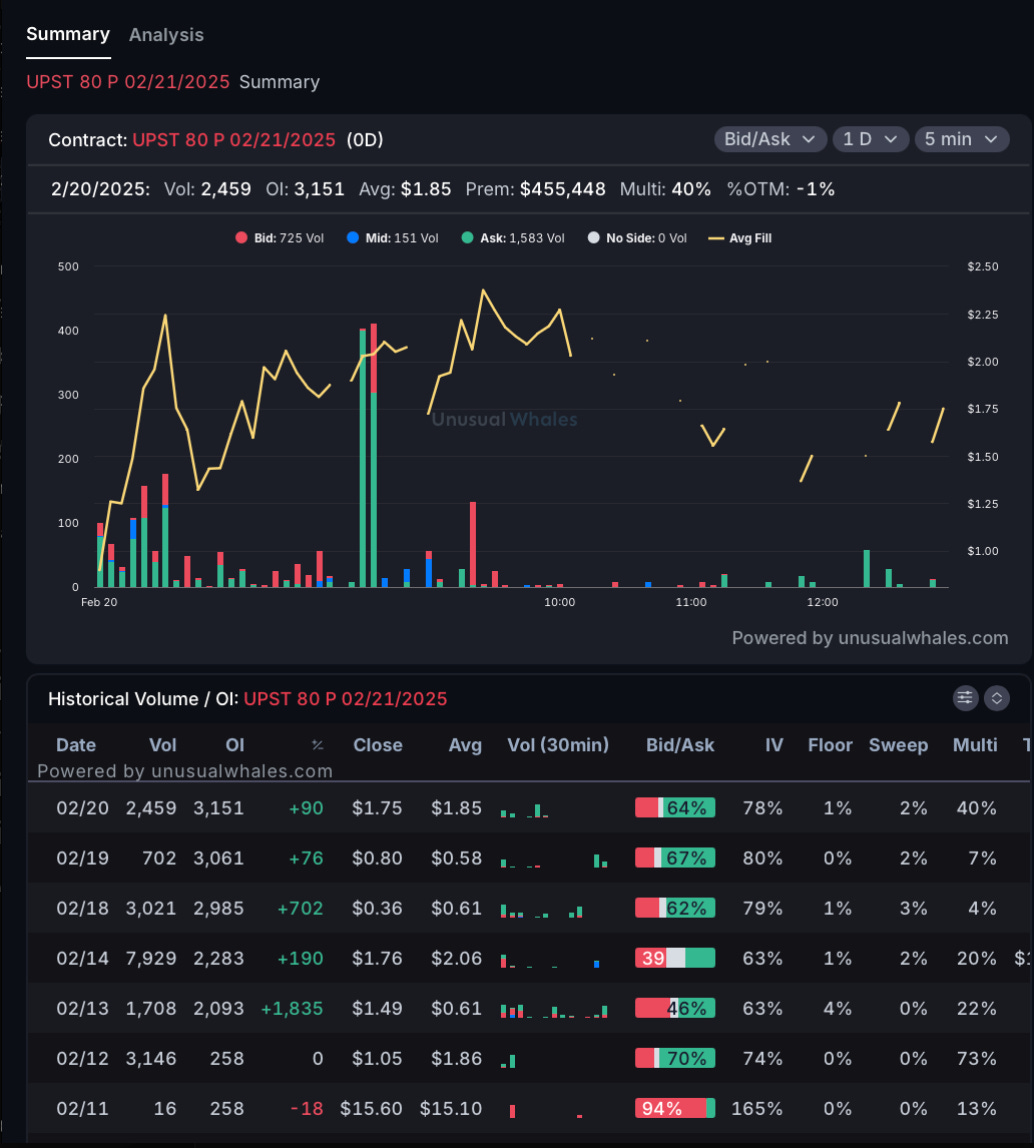

🚀💥0DTE Banger: UPST 80p 2/21 (upon confirmation)

First up, we’ve got a same-day expiration (0DTE) idea that showed some serious volume. The UPST 80p 2/21 had 2,459 contracts traded on expiration day, with $455K in premium behind it. Open interest was stacked at 3,151, meaning plenty of traders were holding on, and the volume tells us a whale was active.

💡 Key Takeaway: This kind of flow is the definition of a 0DTE scalp candidate. High volume on expiration day = fast action. If you’re hunting for quick intraday plays, these are the contracts to watch.

📈 Chart Entry for Tomorrow:

The key level here is $79.96—hourly candle closes below this level open the door for more downside. If it loses this area, the target becomes $70.52, filling the gap below. This is the first play in our double play setup, as put buyers were taking advantage of potential downside pressure.