🗞️ Milt's Mentor ABU Explains the Market, Correcting a Costly Oversight, SPY back on track, Earnings Tip

Furthermore, it was a denial of the glory that was our birth rite..

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Pt. 1 ABU Explains NQ: A video breakdown Pt. 2: Flow: Levels and Analysis, Breakdown Video// Pt.1, Flow: Plays and Analysis, YOLOs, Contract Updates

🚀 INTRO: ABU the OmegaTrigga Does NQ: Milt’s Mentor Explains the Market From a Different Perspective

Utilizing NQ as his weapon of choice, the man who taught Milt how to trade is BACK, and he’s dropping seven minutes of knowledge on y’all. I’d advise you to listen.

🕵️ Pt. 2: SPY Levels and Analysis

For the unitiated—I was losing my mind trying to figure out how my recent plays missed (let’s be real, I was born with very few talents but one of them is nailing SPY day in and day out), and I found the basic error I’d made.

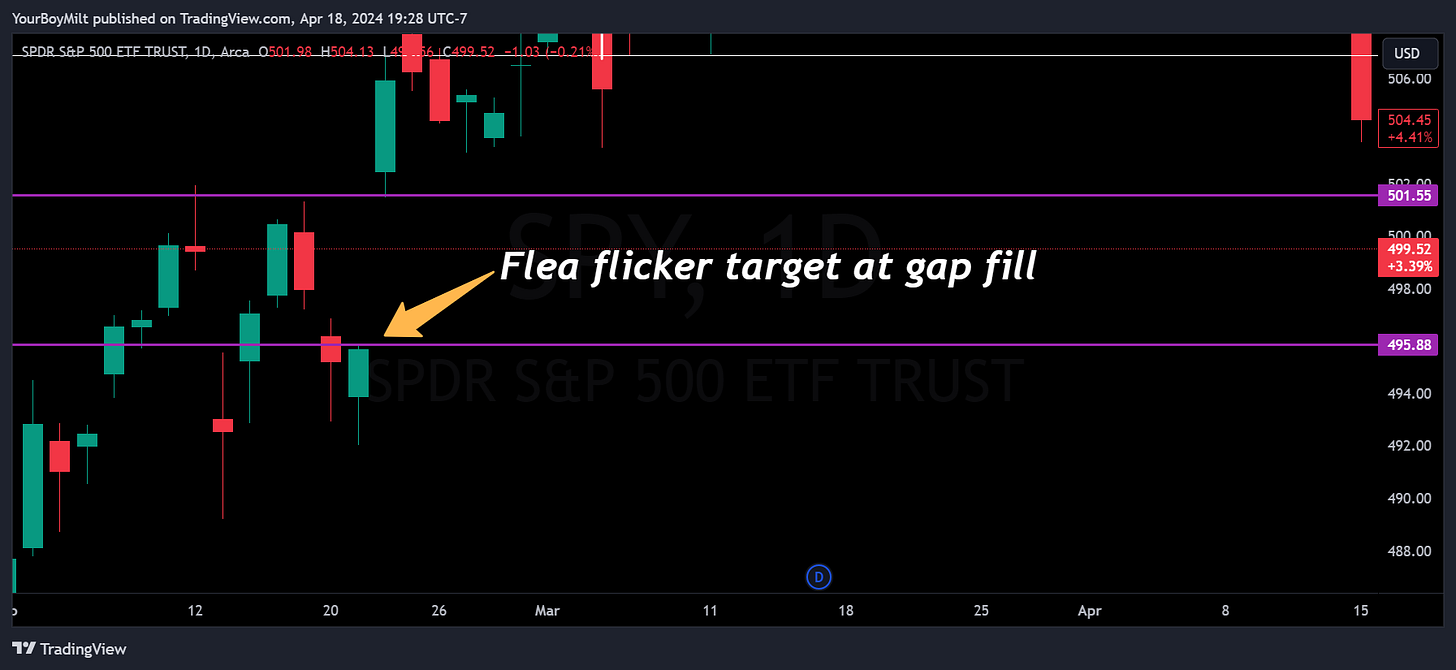

When we switched to tracking hourly gaps, I forgot to check the daily additionally which is my normal primary check. Lo and behold, a giant gap to 495.82 which—according to our own thesis on the Flea Flicker—would have been the true target on the SPY train. Sorry for the error.

This next video shows a quick overview of this concept from when I discovered it during the trading session:

Here’s a screenshot to show you with clarity—the white level below, 495.88, is the main tsrget. 491.96 , the white line above, is the first backtest target.

🐳 Pt. 3: Flow Plays and Analysis

A note on flow: today my base filter picked up almost all activity being on May strikes and nothing for 4/19, and only one contract of interest on 4/26. Interestingly, this fits into our overall thesis of a little bit more down before a market reversal.

YEET Faithful may remember the last time we were in earnings mode 2 years back and went 12 for 13 on Earnings picks—it was insanity. Because the none earnings flow is a little dry, I’ll use an ER pick I like and teach tips.