🗞️New (Old) Look YEET!

More focus on the abstract and vocalizing the unique but profitable takes that make us The YEET.

Indices Continue the March to Retest Highs

Essentially SPY is in a chop range as everyone stares in amazement at what is now clearly a complete, immediate retest of the FOMC drop.

Yesterday bulls were able to stave off a bearish drop until the last minute with SCAM CANDLES that proved themselves false immediately in the after hours ssession.

What’s Going on with the Afternoon Incontinence?

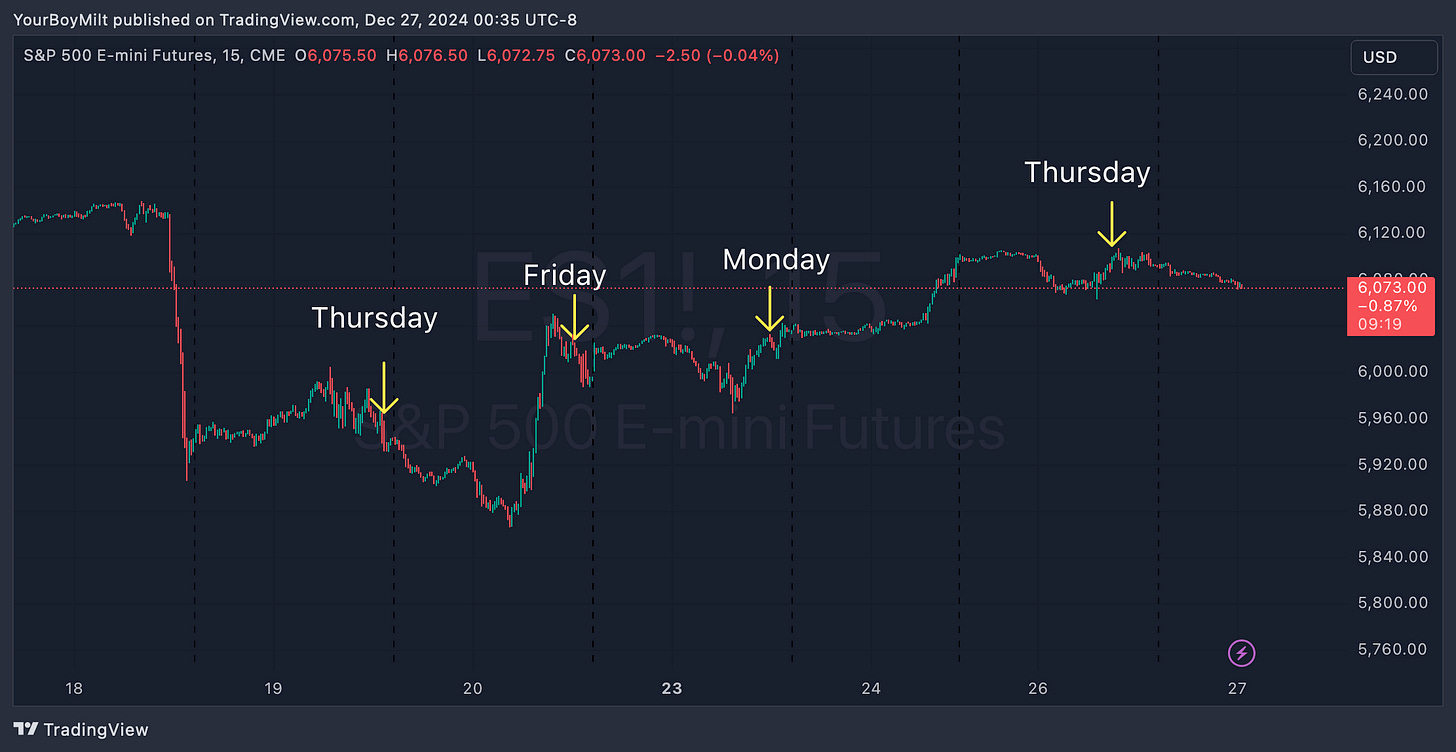

Today’s drop. which waited until retail was shaken out after 4 PM, would have been more maddening if it hadn’t become common. The picture below is ES on the 15 minute from last Thursday through Thursday, and the yellow arrows signal a point in a trding day where the index dropped 1+points in the final hour, and/or into after hours.

Wednesday was a Market Holiday and Tuesday was a half day—we’ve dumped at the end of the day every day of the past week except for the half day.

🐳Flow News and Noteables:

💰Tuesday’s YOLO of the Day—QCOM 6c 1/3—goes berserk as QCOM rips 14%. Not a bad bonus gift.

What’s Next for GME?

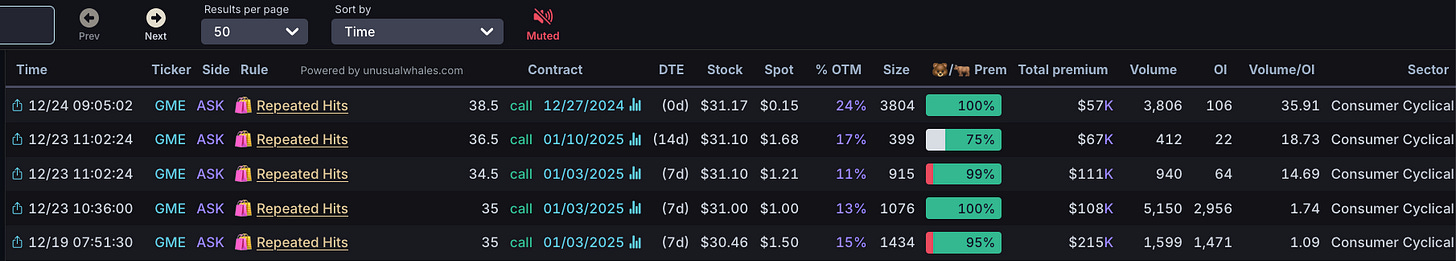

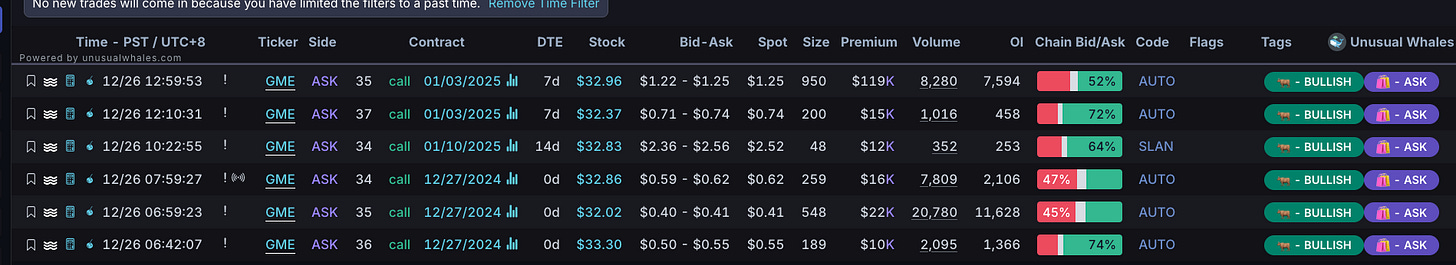

In the Tuesday issue I noted the out the money flow on GME contracts that was building, and today they opened with a nice pop that faded at the reisstance level.

The sell off at the weekly level leads into what’s next:

After rejecting the wekly where the yellow arrow is, it went down retest the lower monthly level which also happens to be a gap level. Chart-wise this means in the short-term GME has a date with 34.36 again as long is it doesn’t close premarket under 32.71

GME Flow Update:

35c 1/3 were getting rang up all day

☁️ Forecasts: SPY for all and Flow for YEET Plus

SPY: The Boomerang

There’s a trickiness to playing SPY contracts overnight—if you’re bearish, for example, and you’re so right that SPY plummets to your target after hours, they could make the move up in the morning and you’re assed out.

Conversely, if you decide to go bullish you could end up being wrong and having the pain of watching your conviction be right.

So when I swang I try to boomerang that thang. This one from yesterday was a bit off, but the general principle should work out.

First, if you have faith in a direction, throw your Directional Boomerang at close:

I was adamant that SPY was going to drop, but ran out of time during the intraday session—this is a texbook Boomerang Scenario. You keep your same targets on the move for both day trades and boomerang swings, but you allow for the possibility of whatever the next monthly or gap level is.

And using that information…you inverse yourself. What? Well really you inverse time and market mechanics—you’re essentially trying to time your movement sentiment being correct in the extended session and catching the level rebound.

Like so:

“But aren’t you guessing the bottom?”—you only boomerang when you have a strong working thesis or price action catalyst:

We know that bulls didn’t come this far to come this far—they are more liekly than not to complete the move to the upside and backtest the monthly. THey didn’t come here to check off a random gap level that had already filled

We got a gift—the Price Action left an upside gap as a catalyst to be filled