❤️$ome $exy $etups 4 u

Let the sultry sounds of flow degeneracy ease yo mind, girl.

In honor Drake seemingly clawing back from career annihilation in the wake of the Kendrick beef with “$ome $exy $ongs 4 U”, we’ve decided to drop one for degens.

This is…

PS im back on my “find news pops or big sector moves” grind after a hiatus getting my sea legs in the current PA—so all choices from this issue are from the Freelance Five. This filter was created in response to a challenge from a Plusser to create a filter that finds low-risk 5 baggers lol. So far it’s had some nice bangers.

🚨Freelance 5 flow filter link is included with a subscription to YEET Plus. Access to all 9 filters I use with explainers is provided for those who have been members for 6 months OR sign up for the annual sub🚨

💻 DELL 127c 4/4 (Supported by the 130c 2/21)

Dell is the type of play that shows you you have to look at the Historical Options Chain Activity, the chart itself, and try to Sherlock Holmes your way to whether it’s a hedge or not.

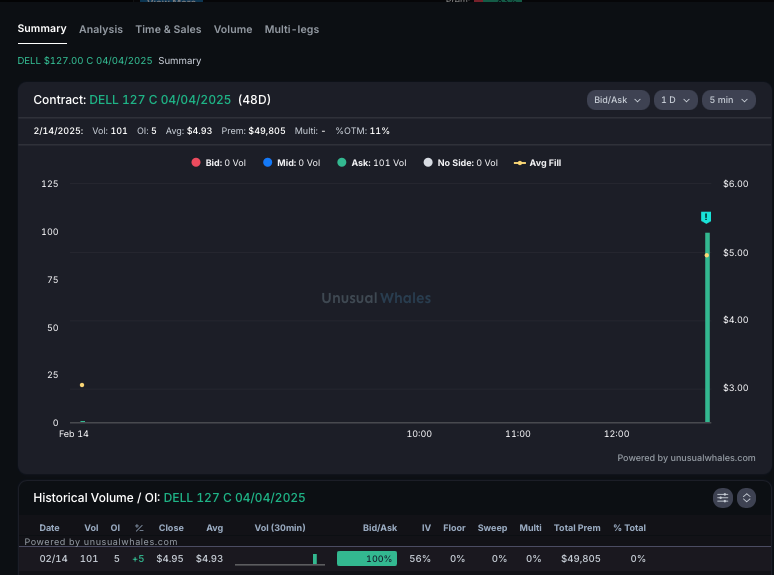

I first noticed these 127c 4/4 come across the Freelance Five filter on Friday.

Clean little 50k order, but what’s important to me here is also the time of day it came in: rolling in 4 minutes before close means somebody felt that EOD urgency often.

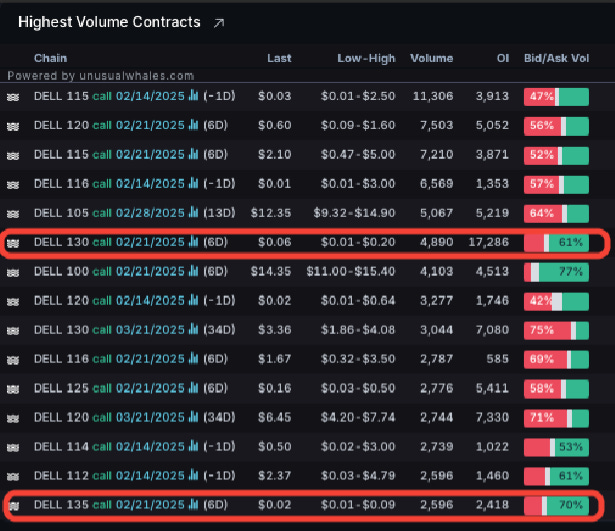

This led me to take a look at their options chain activity from Friday, which was, well, off the chain!

Further research would show that this was a lot of moving around in contracts—plenty of rolling indicating a fever pitch of activity.

The chart is where it gets interesting—typically when you see OTM activity on an options chain like the one on the 2/21 130c

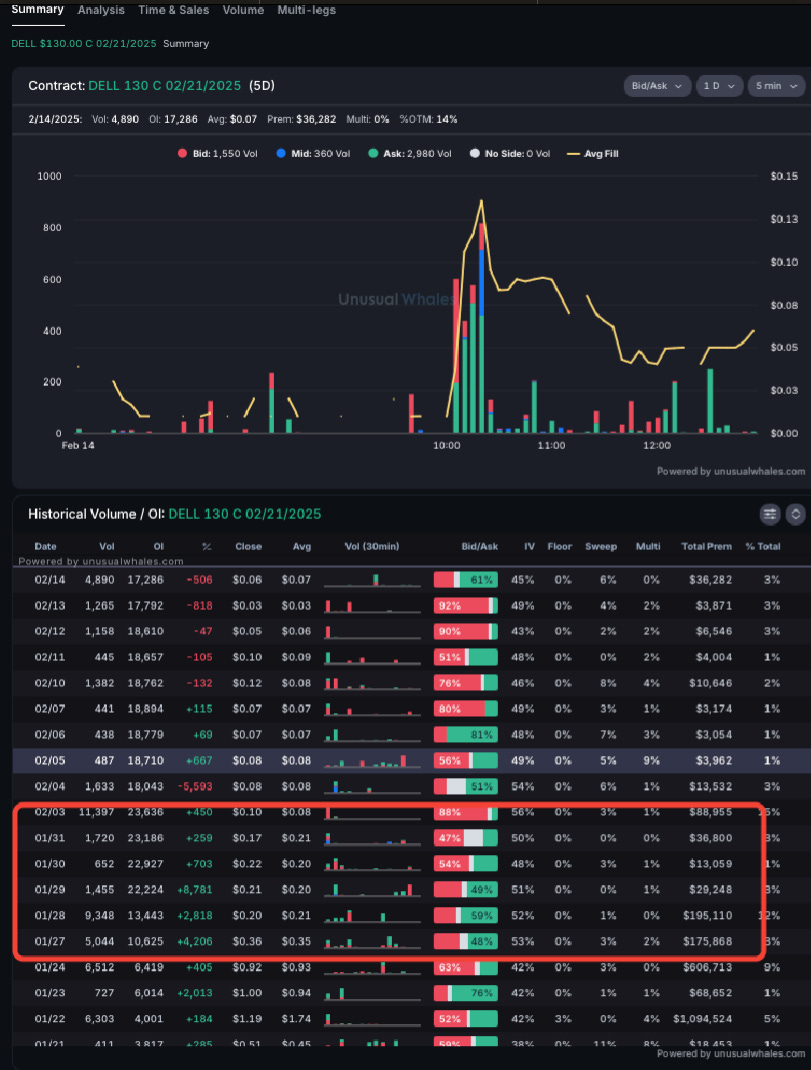

You’ll notice significant building into the position above between 1/27 and 2/3

But if you look at the chart in that same time frame, you see it was trading even LOWER than where it is now when that building occurred—earnings aren;t until 2/27, so its unrelated.

Chart Setup: After backtesting the upper gap and holding support, we now have a clear launch signal with a stop of with a stop of 112.20 if you’re playing them with closer risk-on lottos, and 110 for the March calls.