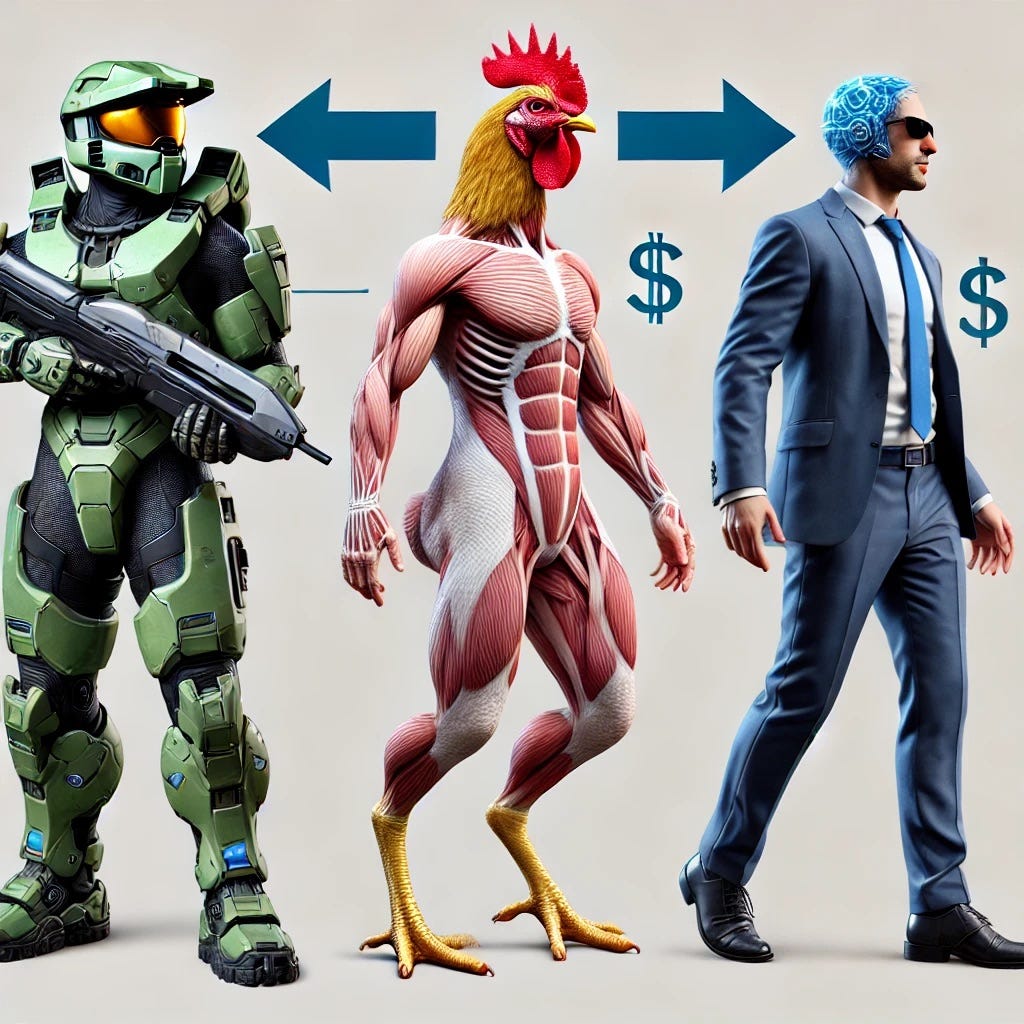

⚔️Operation Tender Spartan🐣

Can instinct be taught? Science says...yes.

The question I got asked most during the Chicken Rick and HALO runs was…”How Do?”

It seemed to be mostly based on instincts, which is why it was nearly impossible to replicate in a teachable format for YEET Plus. Until now…

Particularly during BTA, the mechanics and methodology became clear as I tried other methods and I was able to see the various parts that make up the whole. After researching, viewing literally hundreds of charts, and rewatching old videos, we have the answers to be passed on in a unique training program designed to teach you how to aim and shoot your shot with minimal thought involved.

⚔️This is Operation Tender Spartan⚔️

Part 1: Two Things That Aren’t the Same That Are the Same

Most trading methods are based in either Continuation or Confirmation.

For example, if I trade a 9 EMA/VWAP Strategy, I wait for confirmation of a close above or below VWAP for a signal to make a move. SLOW.

If I trade traditional Price Action, I wait for a Continuation of a move or Confirmation of direction. SLOW.

Read-and-React is unique in that it is an anticipation strategy, which is why it is achieves high percentage plays at a high success rate; you know the setup before it arrives, and when you see it you’re usually buying in the opposite direction of the action, leading to purchase of lower premiums that see a quick rise in value.

This is achieved three ways

Recall of Price Action to Create a Catalogue of “Moves”

Improvisational Level Setting and Structure Building

Understanding Mitigation Strategies

📝Friday YEET Plus: using Read-and-React we saw all these factors at work. This is how anticipation trading works compared to other methods:

Traditional Price Action would wait for another rejection off the level for confirmation, but how’d we know there would be a drop either way?

Move: a shallow trend breakout that fails to close the level above and heads back into the trend is almost guaranteed to visit the next major level below

Friday:

June 26th:

March 18th:

Now Friday again, uncovered:

Then you apply those moves to the Price Action you see coming, for example, SPY has an open gap level below. (red squiggles)

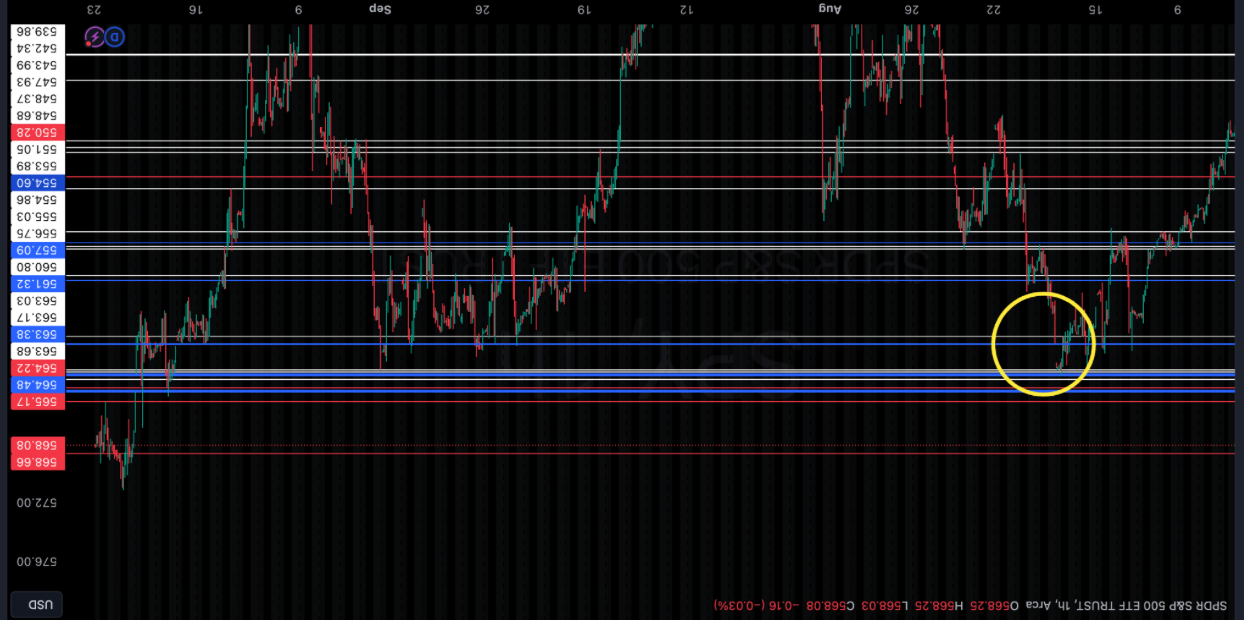

I recall when we rejected the Gap Entry level three times in early August, the lower blue line in the Yellow Circle:

When candle bodies went past the line, they tested the next level. But when they wicked off or flattened at the gap entry, it was a reversal signal. So on 3 quick day trades we applied that same move—three times in a row:

August 26th, 29th, and 30th:

Can you see it?

How about now: the blue line added is the is the gap entry level for the small gap at the far left.

Which is just an inverse image of the Price Action from early August—here I’ll flip it:

Does it apply to flow? YES.

MOVE: a ticker with a high VOL/OI whale on a weekly contract and another further out contract bought within two days of one another are a high-percentage whale trade that’s likely to be a runner.

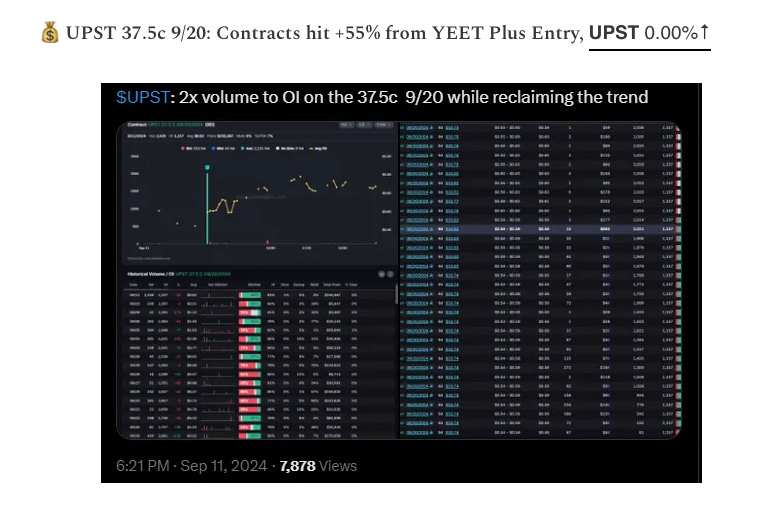

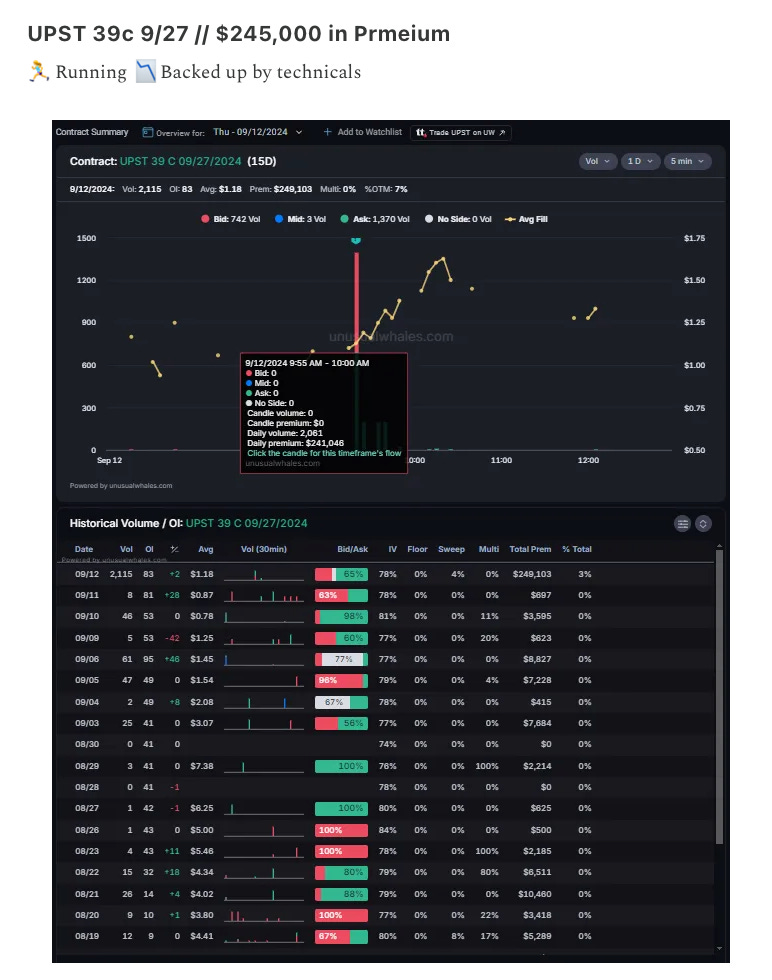

UPST on 9/14 had someone go heavy on the OTM 37.5c 9/2

The next day somebody added in the 40c 9/27

UPST hit 41 on Friday.

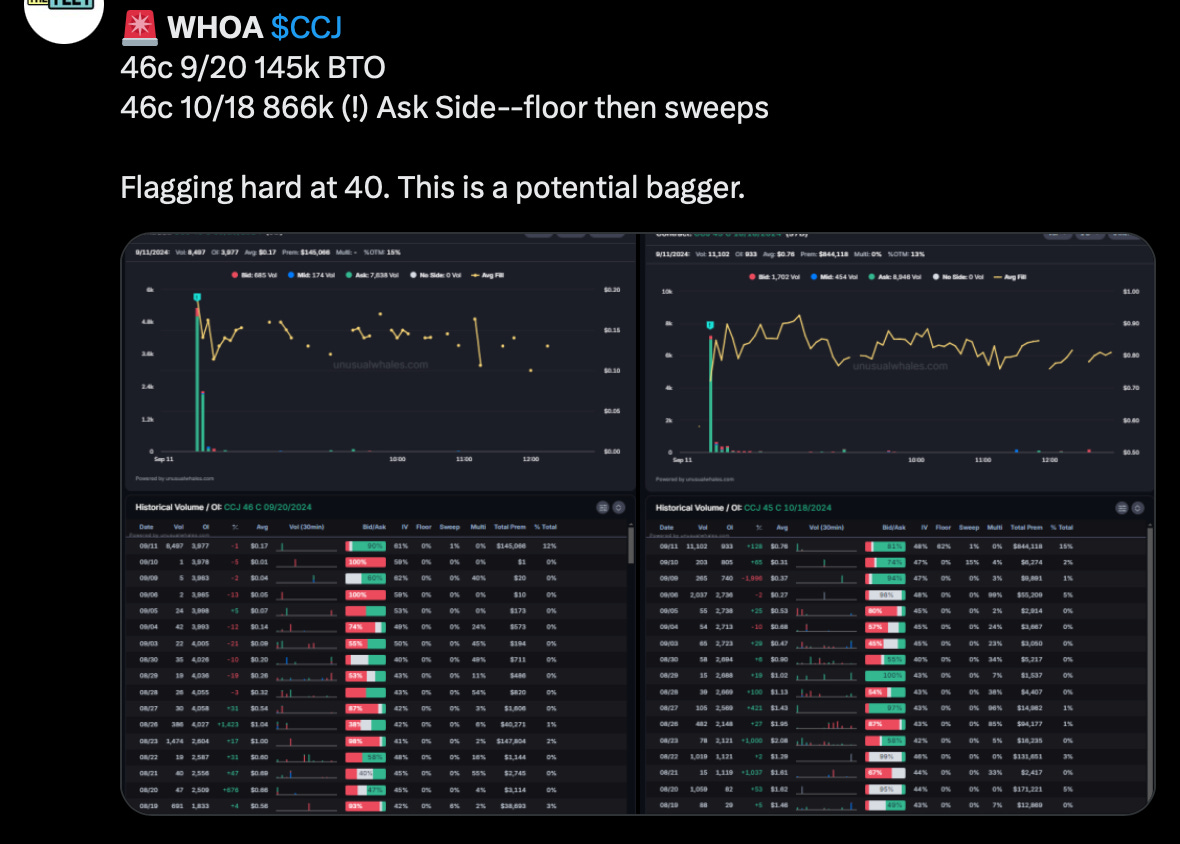

CCJ did the same thing: a whale entered the 46c weekly and the 45c monthly the same day:

When I posted this on YEET Plus CCJ was trading at 38 last week—it hit 45 on Thursday.

Operation Tender Spartan is going to be YEET going back to that trading style, but showing you the moves along the way and breaking them down into simple component parts you can commit to memory—essentially a brain transfer. The moves will be catalogued and sent out to YEET Plus—by the end of the run you should have dozens of images and video of real time anticipatory moves to add to your trading.

YEET Plus:

Your First Move

ES/SPY Outlook

Flow