🇺🇸 Orange Swan: How Whales Show How High — and Low — We Go With Orders (Plus New Filter)

SPY Levels, education, and a new filter

🟠 Part 1: SPY Levels

🎨 Color Key

🔴 Red = Monthly ⚪ White = Weekly 🟡 Yellow = Homemade / Key 🔵 Blue = Gaps

🔺 Levels Above Current Price (≈ 677.25)

⚪ 678.51

🔻 Levels Below Current Price

🔴 673.99 ⚪ 672.64 🔵 672.32 ⚪ 670.50 🔵 670.20 🔵 669.50 🔴 667.32 🔵 665.97 🔵 665.37 🟡 664.54 🟡 664.19 🔵 663.89

🇺🇸 Orange Swan Part 1 — How Whales Tell Us Where SPY Drops or Pops

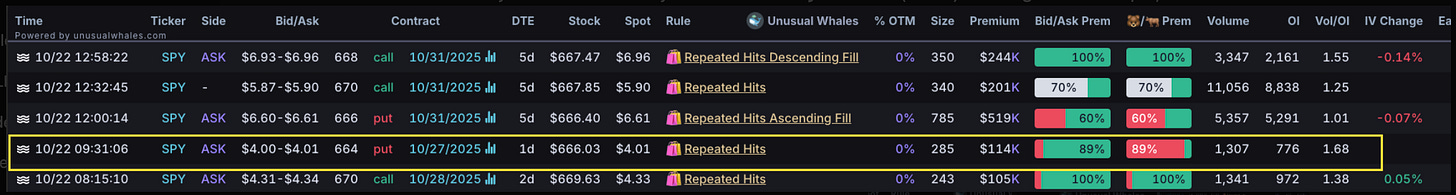

10/22: SPY Magic Meets the Trump Move

When the news hit on the 22nd — the Trump export comment that sent SPY diving — something subtle but telling was already in place.

If you looked at the flow feed from SPY Magic, whales had already drawn the map.

🧩 The Tell

On October 22, a series of stacked SPY orders built out between 668 → 664.

The lowest print of the day: 664 put, exp 10/27, hit ask with 89% bid/ask premium and $114K premium size. This metric historically runs ≈ 90% accurate (outside of hedged macro events like CPI or FOMC) in predicting which side goes in-the-money first.

That 664p turned out to be the last downside contract that week to hit ITM.

In other words the whales PERFECTLY telegraphed the floor of the move → SPY bottomed at 663.3.

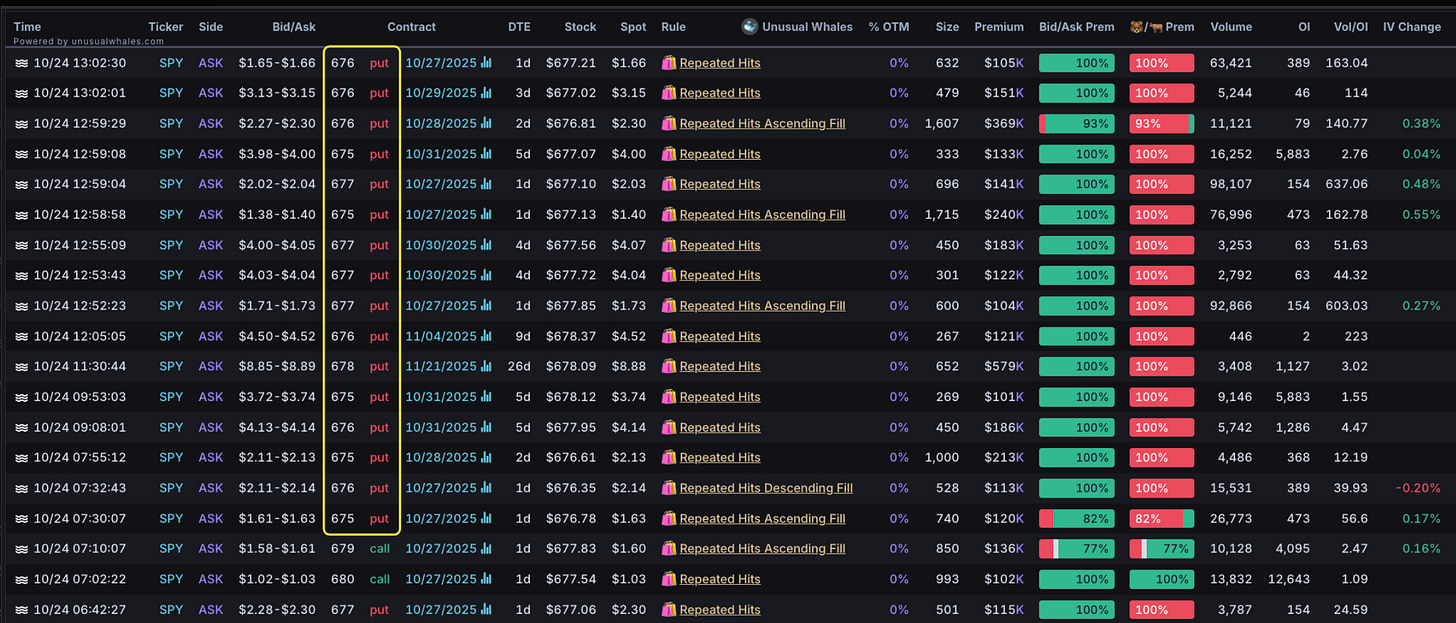

📉 CPI Day Confirmation

Fast-forward to CPI day: after the opening hour, all upside orders vanished.

The early bull ladder was erased, and SPY never traded higher the rest of the session.

That’s SPY Magic’s directional confirmation pattern — when call volume dies and no new upside hits print, trend continuation follows.

🧠 Takeaway

Whales don’t just hint direction — they define the boundaries:

The last OTM order to go ITM → the move’s natural limit.

The shift in ladder direction → the flow-confirmed reversal.

In this case, they showed exactly how low SPY would go before re-accumulating.

Orange Swan moments like this are where macro meets micro — and where YEET Plus makes its living.

🇺🇸 Orange Swan Part 2 — Orange Swan Filter Explained (link available for use below for YEET Plus)

BIG SHOUTOUT TO DISCORD LEGEND YUPPERS

🟠 ORANGE SWAN FILTER

(Based on the Original SPY Magic — Optimized for Trump-Style Market Moves)

🧭 Purpose

The Orange Swan is a high-sensitivity derivative of SPY Magic, engineered to pick up whale positioning around sudden or politically charged catalysts (especially Trump announcements, trade talk, or election rhetoric).

While SPY Magic measures directional conviction with 90 % accuracy under normal conditions, Orange Swan tilts that formula to favor:

Short-dated contracts (1–5 DTE)

Large, near-ask prints

Put-heavy or contrarian sequences

Repeated hits clustering near key levels

This means it over-weights “whale hedging or front-running” flow that typically precedes Trump-driven volatility.