🐳PAH-MAW: Avoiding Catastrophic Losses on Whale Plays

Over the course of the past month of reinstitution a commitment to flow, we’ve been able to achieve some personal goals of ours:

✅ Find a ten bagger

✅ Find a ten bagger each week

✅ Find two ten baggers in ONE week

But with success comes comes volume, and with volume comes to need to decide when to cut out trades that are not so fortunate to see the glory of the most bagger status, which begs the question—

🤔When is the proper place to stop out on a whale trade?

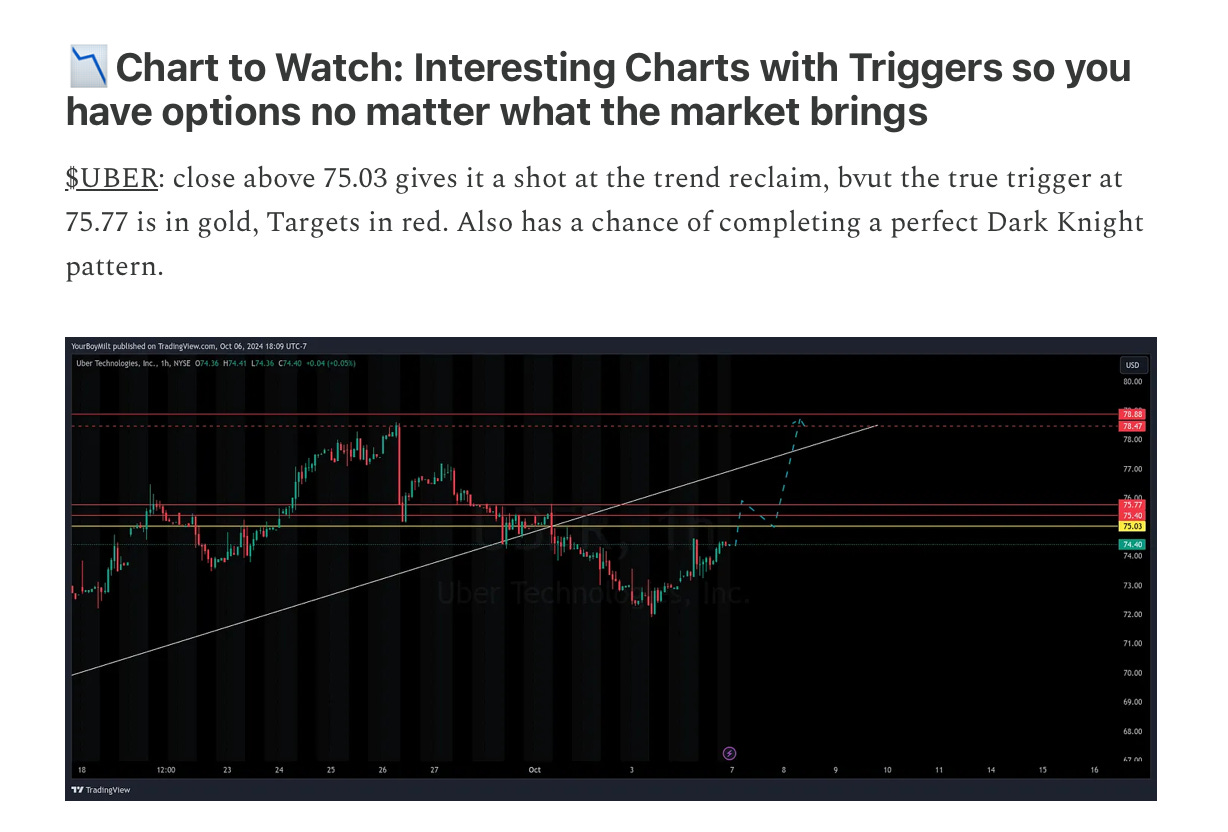

A whale trade isn’t a trade like your standard PA day trade or swing. For example, let’s take a look technical trade given from the weekend before last’s YEET charts to watch:

UBER: 73.05 trigger // 75.88 final target (10/13 Sunday YEET, Plus Section)

2. HOOD: 23.47 Trigger, initial target set at 24.28

📈Both of these are well past their targets—with weeklies and monthlies becoming minimum 100% plays since. And the likelihood is that, if you took them, you approached them as just that—monthlies, or a couple weeks out. They never retested the target.

📔Compare this with recent flow trades this week, CELH and RBLX.

*Note: the initial find on these was flow, but we’re focusing on the charts for our purposes

📝CELH we followed the whale directly: 37c 10/18—with a good start. We entered at our “trigger”—the cross of the gold line in the blue circle, with an immediate rip into end of day.

Now, follow the white line over the days following our entry. We went beneath the entry level, held it, rose above, held it, rose above, held it—the visual ride is enough to give you a turned stomach from the commotion. I feel like a Postmates driver who arrived to deliver sandwiches and refreshments to a Diddy Friday Freakout—pandemonium!

Compare this with RBLX 40p 10/25 we took the same day based on the the 36p flow.

🐳This little play is up 42% and yet it’s only .14 in the money!

What is the lesson here? Not that RBLX is a better choice, or thaputs are better than calls, but

Our recent triple option style is the right way to play—approach it like a nn0flow trade, and you will often reap the reward of a flow trade if the flow is there!

Look at HOOD and UBER—those were both non flow charts I posted that happened to have good flow behind them

CELH and RBLX are the same, but what’s the difference?

🚨NOT FOLLOWING THE WHALE ON THE WEEKLY CONTRACT THEY LIKE, BUT INSTEAD GOING FOR A MORE REASONABLE CONTRACT THAT MAY NOT BE A MULTI-BAGGER, BUT OFFERS YOU SOME PROTECTION

On each of these trades, the yellow entry line would be a fine stop out level of less than 20% if we had monthly contracts (though they never came to that because our shot is wet) EXCEPTY CELH; the only trade that tanked is the weekly—and just as importantly, the only trade that hit a non-recoverable stop out amount was a weekly.

Thereby, for the betterment of our trade accounts, be it resolved we now introduce…

📓Minus a Half (strike), Plus a Week (contract)—MAH-PAW (aka the Joseph K. special “I like time, bro")

Ifyou like a whale play weekly activity, the move is to add a week (at least) if the contract is less than three weeks out, and choose a contract that is halfway between the whale strike and the current price. Your stop is the entry level, always

This newsletter is getting out so late because I’ve ben backtesting—applying MAH-PAW to our trades. Over the past month:

No trade stopped at the entry level with MAH-PAW taken lost more than 32%

80% hit target 1 when hitting the entry level

73% of trades never closed a second hourly level above the entry

So the conclusion is, we have to apply a method that brings down the weekly-gifted high numbers (if you have cash for runners or to split-enter though, by all means play ball). But the way to profitability is—hard stops at entry levels, give the whales an extra week, bring their expiration down to halfway between the current price and their strike.

MAH-PAW.