⚠️(Pre-FOMC) SPY Foundations pt. 3

Gap closes, back tests, premium drops, and levels into FOMC

1. Today: principles in action

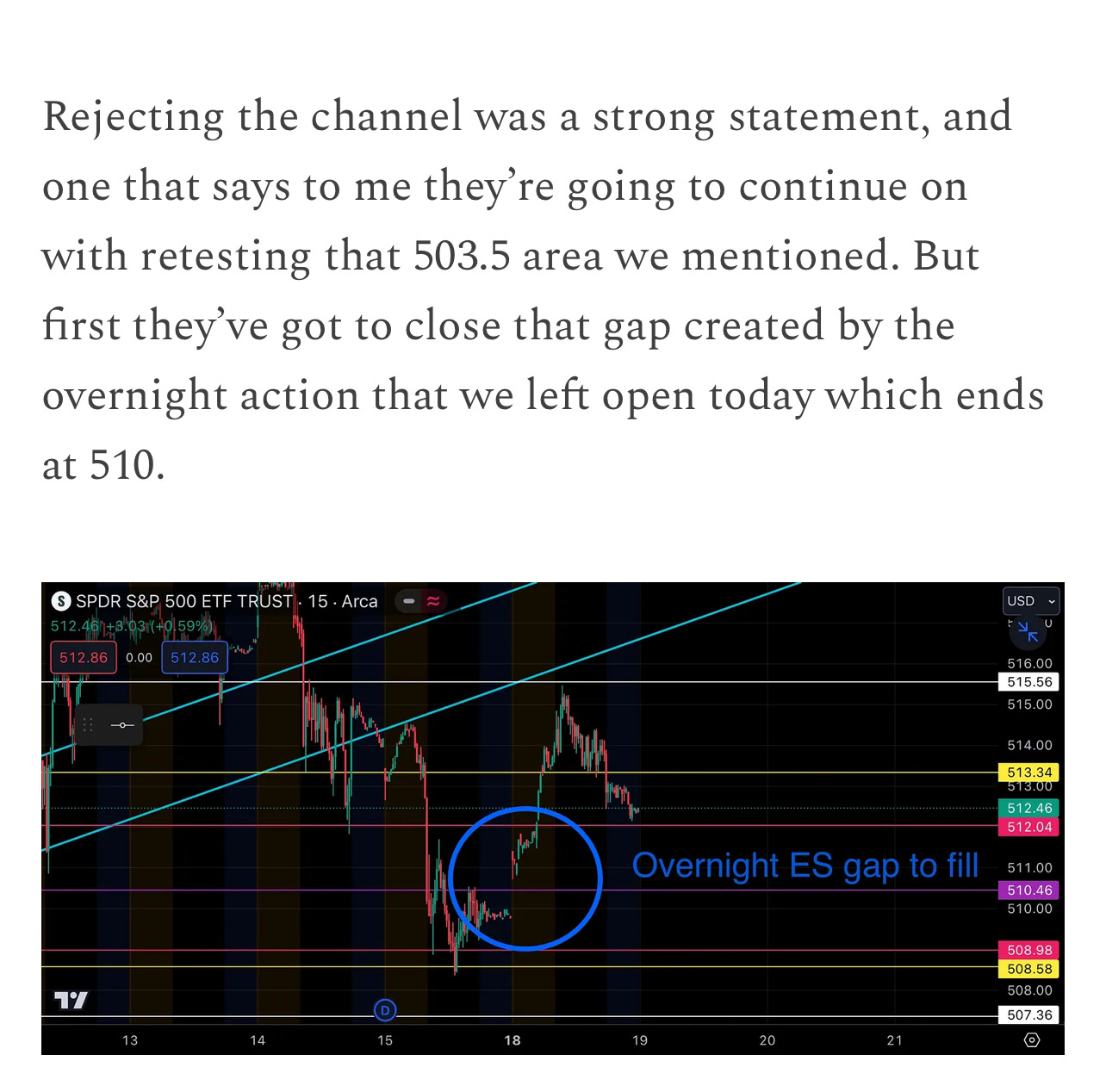

You got to see something come to fruition that I’ve been harping on for the past day or two now which is that downside ES gap fill👇

So, you may be wondering, why didn’t we bite with early puts chasing that downside movement? This is a good example of how you use the Net Premium Flow with your price action charts.

Price Action-wise, when you have a gap fill test you’re either going to bounce like crazy out of it or fall through, but we had a hunch yesterday based on the activity of the whales what would likely happen:

Anecdotally, what I’m finding is that into the end of the day is when the most powerful use of the net premium tool is for SPY movements. So far the end of the day read has been correct on the next day, movement—tomorrow is a big test with FOMC .