🏈ShortsCenter: The Sunday YEET

Duh-nuh-nuh, Duh-nuh-nuh

📺Welcome to ShortsCenter

This market is rumbling…stumbling…bumbling its way into all-time highs. If there’s any Bear left in you, let me break down some stats this past week:

🚀TSM beat on AI demand

🚀Banks beat

🚀NFLX beat

🚀September retail sales beat

🚀Insurance beat

🚀Johnson and Johnson beat off a strong Q2 performance in….Manhattan?

Numbers don’t lie. Every signal in every way is pointing to a market that wants to go up—like, the CEO of NVDA is out here signing boobs! Is this real life? The S&P 500 and the DOW also closed at new highs. While the Daq Prescott didn’t quite set a new high, NVDA roared to a new high on Friday.

What makes the continuous market rally even more impressive is how hot we’re running while taking into consideration the likelihood of a less dovish Fed in the face of stabilizing employment.

Oct 4 (Reuters) - U.S. job growth accelerated in September and the unemployment rate slipped to 4.1% from August's 4.2%, further reducing the need for the Federal Reserve to maintain large interest rate cuts at its remaining two meetings this year.

Well apparently it don’t matter because shit is going up and to the right.

So when we look across the markets we see highs, bull flags, lowering bond yields, and general bullishness. As this is happening, we have left behind several downside gaps, retests, and other price action checks and balances that prevent an overheating from getting too hot. Even our beloved SPY, in addition to multiple unfilled hourly gaps, has a 3 point daily gap down at….503?

So what could possibly put a breather in this rocket ship? What zany group of hosts could talk us out of an unstoppable rocket ship to Valhalla? Of course, it’s our loudmouthed friends from The Fed, known to The YEET as ShortsCenter

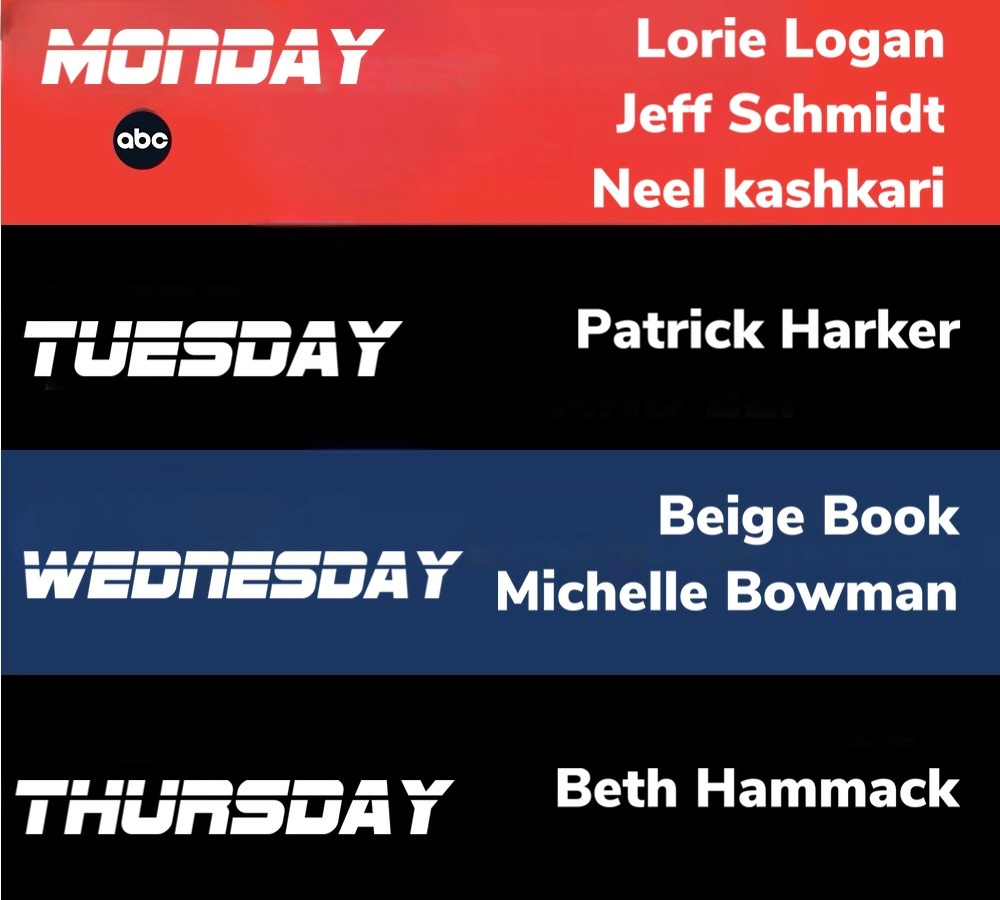

This week’s scheduled to have a host of Fed members talking in the midst of what is an uncertain time around whether or not we will see an additional 25bps cut after the one we’re virtually guaranteed at the next Fed meeting. Should make for some good gaffes:

The reason the Fed has blackout periods is because their words carry weight, and all these Fed muckity-mucks will be using their remarks to drive home their vision of future rate cuts—essentially giving a voice to their spot on The Dot Plot.

Between that and a slate of earnings including TSLA and AMZN reporting, make sure you play it smart—buy time on contracts and check the YEET for index flow. Otherwise, you may end up on Bad Beats.

🏈Welcome to The YEET, brought to you by Unc.

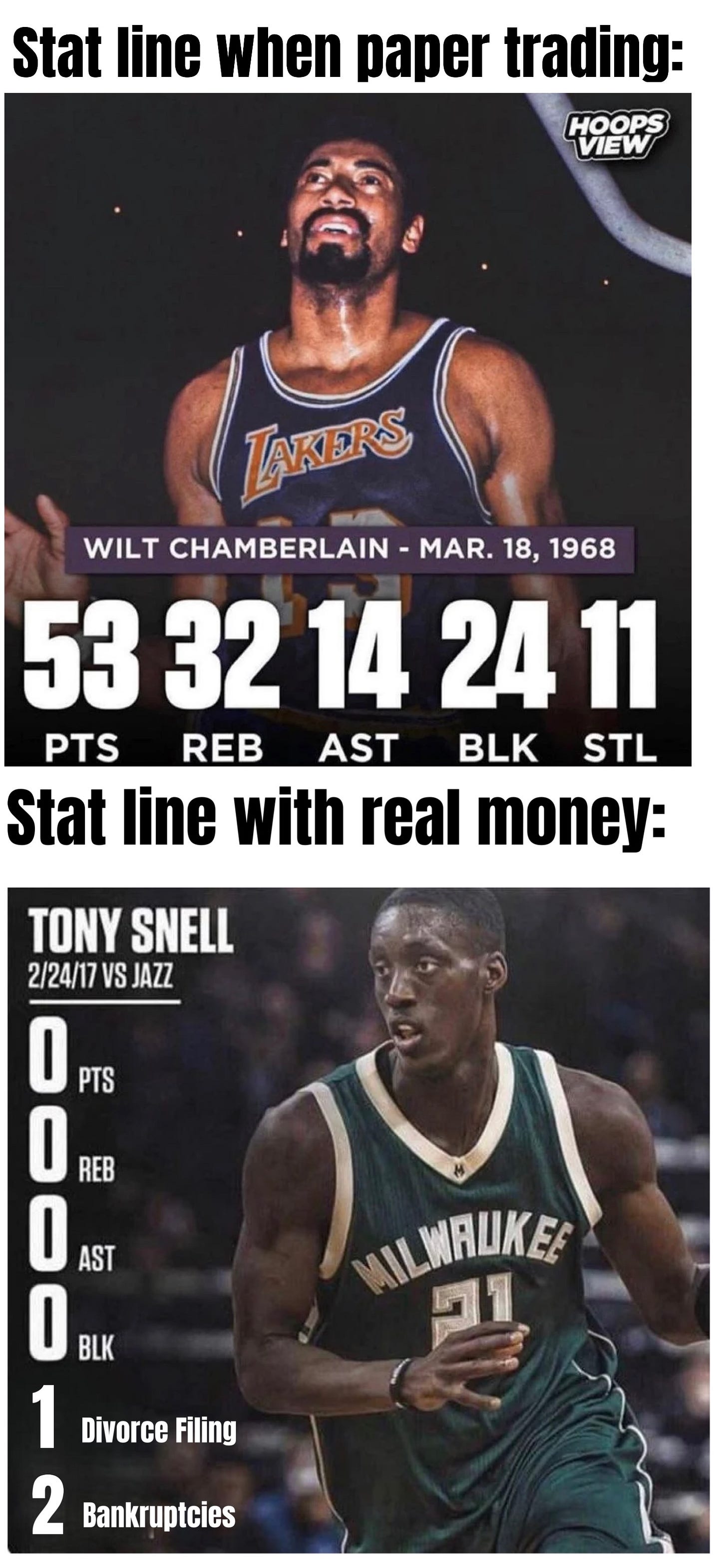

📝Bad Beats: Whale/Chart Tutorial Using ASTS 0DTE Analysis

On Friday for 0DTE YEET had an early miss with ASTS (which we then made up for by finding the HUM flow an hour before close—they announced a potential acquisition after the bell). Anyway, heading into the trading day the flow looked good, the Price Action looked good, so how did this become a Bad Beat?

Backtesting. In this trade review and tutorial we’ll look at reclaims, backtesting, and a new candidate for a two-way play thanks to our analysis of this trade.

📈SNAP Chart and Levels:

🐳The Flow Section: Link for The People’s Screener, Instructional Video, and Flow Find

“Legacy Filters” as we’ll refer to them are filters that are flagship and will be available to all YEET Plus subscribers. At a rate of probably about one every month and a half or so, these will be publicly put out with an instuctional video showing how to use them.

The other filters I’m tinkering with with will be provided in their entirety to YEET Plus annual subs—this is not a money grab, but rather because I was informed via twitter that some are paying the monthly sub, and just screenshotting/sharing the work among groups, or using trial loopholes. The fee is extremely low for the amount of work that goes into The YEET, so it grates me; I say objectively I have looked around at the other letters, and without including the alerts twitter portion (because this is not an alert service), I can proudly say this is among the better of the Substack financial educational content, at one of the lowest prices. The filter links for the annual subs are my way of thanking folks for commitment, it’s just as simple as that. Those currently are:

🔫The DTE Desert Eagle Flow Filter (updated)—finding weeklies

💥The Atomic Alert Filter—sorting alerts for deep OTM, further out whales

💅The Becky Sauce Ultra Alert Filter—sorting alerts for OTM, urgent whales

🇨🇳Weapon Xi Flow Feed Filter- Chinese ADR filter

🗞️Intraday Sniper / The News Finder (the one that has caught all those news moves the past couple weeks)

Those will arrive an hourish after this to annuals.

📝TUTORIAL FILTER, HOW-TO, and Flow Find: The People’s Screener

The People’s Screener is our flagship/base filter, and technically can be altered to meet the same criteria as the other flow feed filters if you apply critical thinking and experimentation to the education provided—so if you are willing to work, in a sense, they’re all accessible. Notable finds during its run: