🚨 SPECIAL: Bear to the Future— A YEET Adventure in the Time Whale Continuum

Buckle up, we're going into the past to explain the present Marty!

🚨 SPECIAL: Bear to the Future— A YEET Adventure in the Time Whale Continuum

PS YEET Plus is very affordable and it’s good. Join us.

Let’s enter the time warp

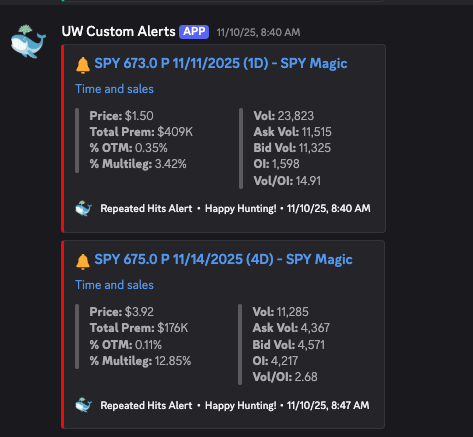

📅 Monday : The First Warning Shot

Bears started buying 675p and 674p into a clean index gap-up.

At first glance? 🧴 Just hedging, nothing unusual.

But then Monday afternoon hit — and they kept going. More sizing. More repetition.

More 11/14 puts as the market pushed into the close. Foolish… misguided…

so we thought.

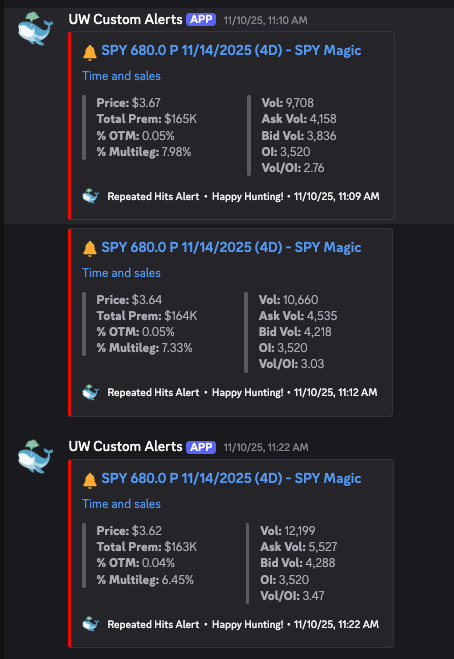

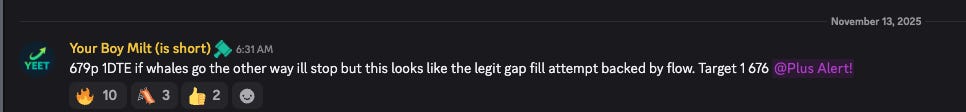

📅 Tuesday : The Defiance Continues

🚀 Another morning rip. Calls everywhere. Spirits high.

And in the middle of that? 🐻 Bears quietly loading more puts.

Not fighting price — timing something.

The divergence grows.

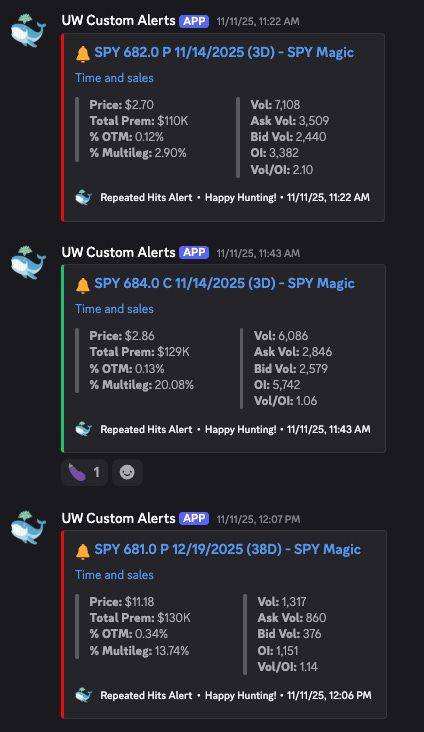

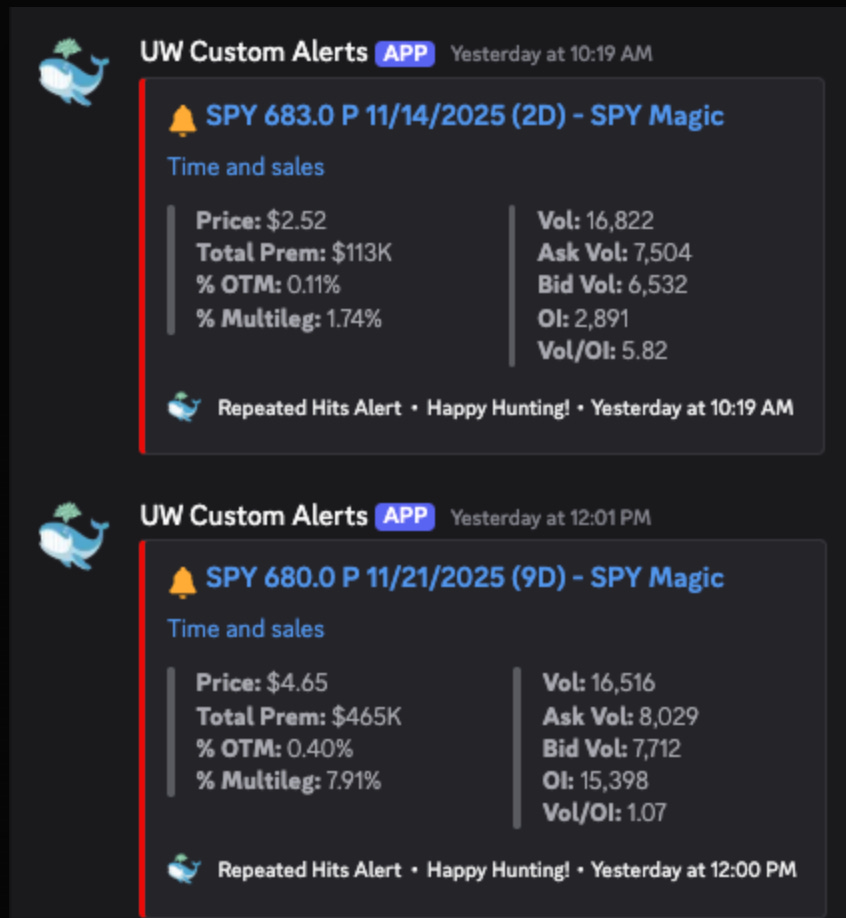

📅 Wednesday : The Impossible Fade

By Day 3, surely no one would fade another gap-up, right?

Right?

A cluster of 680p hit SPY Magic —one order carrying that eerie “I know something you don’t” aggression.

This wasn’t hedging.

This was positioning.

🧪 Meanwhile, Under the Hood…

While all of this flowed through Magic:

🔴 Ballistic printed its most bearish cluster in months

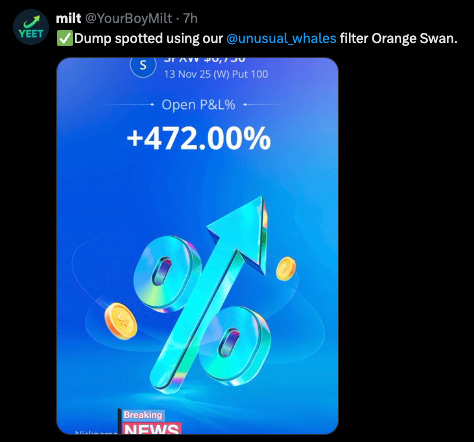

🟠 Orange Swan collapsed from 2.8 → 0.38 in just two sessions

📈 SPY kept ripping…

❗But Swan said: “Danger is rising.”

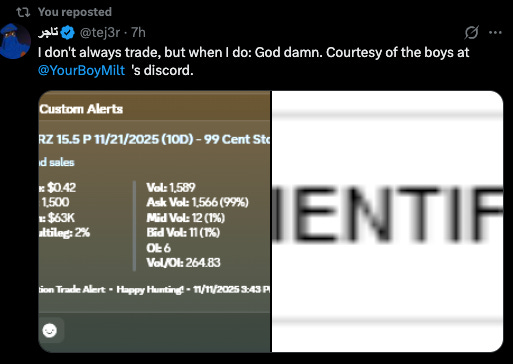

⏳ The Secret Sauce: Whale Contracts with comparative TIME

Here’s what separates: Basic hedging from Back-to-the-Future bear foresight:

👉 TIME.

They weren’t buying same-day YOLOs.

They weren’t chasing price.

They were buying puts with enough DTE to be early —the kind of trade that looks stupid…until it’s not.

Scan every SPY Magic alert above —almost every bearish order had what the bullish orders lacked:

**⏳ Time: almost every bearish order this week expired 11/14 or later.

And then? Every single one of those puts went in-the-money.