🕵️♂️ SPY Foundations pt. 2

2/2 YEET+ Trade Review, Thesis Check, Data Extras, SPY Levels

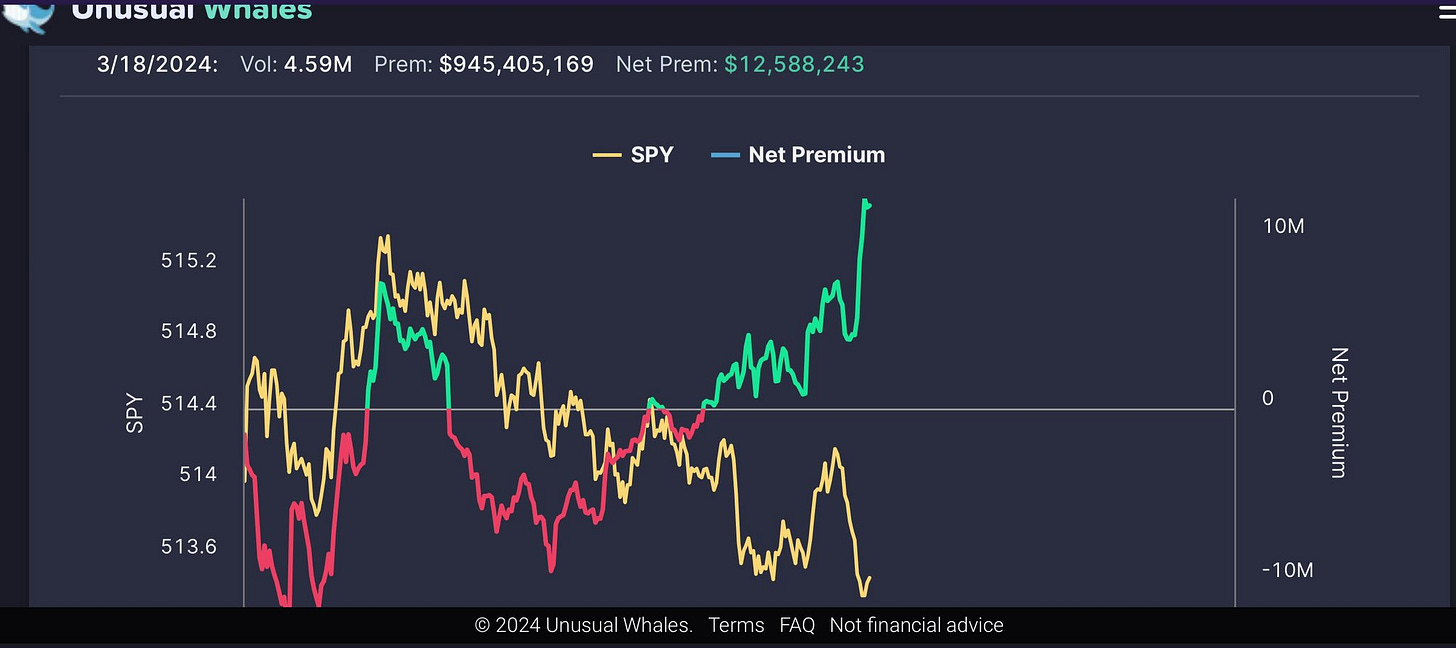

1. Net Premium Trade Review

Today we got a chance to see how the net premium tool can work really well to help give us confidence and direction of SPY int. Then toward the end of the day, we got a chance to see how it could diverge a bit. For now, let’s go back to do a trade review of the one that we explicitly used the Net Flow to enter.

✅ Trade: Review: SPY 514c 56% (screenshots from YEET+ Twitter Account)

In this trade we used chart confirmation of a bottom/double bottom in tandem with growing net premium sentiment. SPY hadn’t been able to stay under our 513.3 level all day and once we saw it hit that low again with bullish premium increasing, it seemed likely we’d get a bounce at that level.