🛡️SUIT pt. 1: Flow Armor

Building your flow power suit to use each day

Today is Part 1 of SUIT, designed to help you create a system for identifying and evaluation trades before, during, and after trading hours. This is a basic framework I’ve found works for me.

Part 1 today will focus on the flow—tomorrow will focus on the Price Action and PARI tools.

YEET Plus—check the end of the article for your Present.

🦾 ASSEMBLING THE YEET POWER SUIT – MARKET FLOW DOMINATION MODE 🦾

The market is a battlefield, and most traders are running in blind, unarmored, and unprepared. Not us. We’re building the ultimate trading exosuit—equipped with the best tools for scanning market sentiment, tracking stealthy institutional flows, and anticipating volatility before it happens.

Every component of this suit is a weapon against uncertainty, allowing us to execute with precision and move before the crowd.

SUIT STATUS: INITIALIZING…

1️⃣ The Market Tide Scanner (HUD System) – Detecting Market Regime Shifts

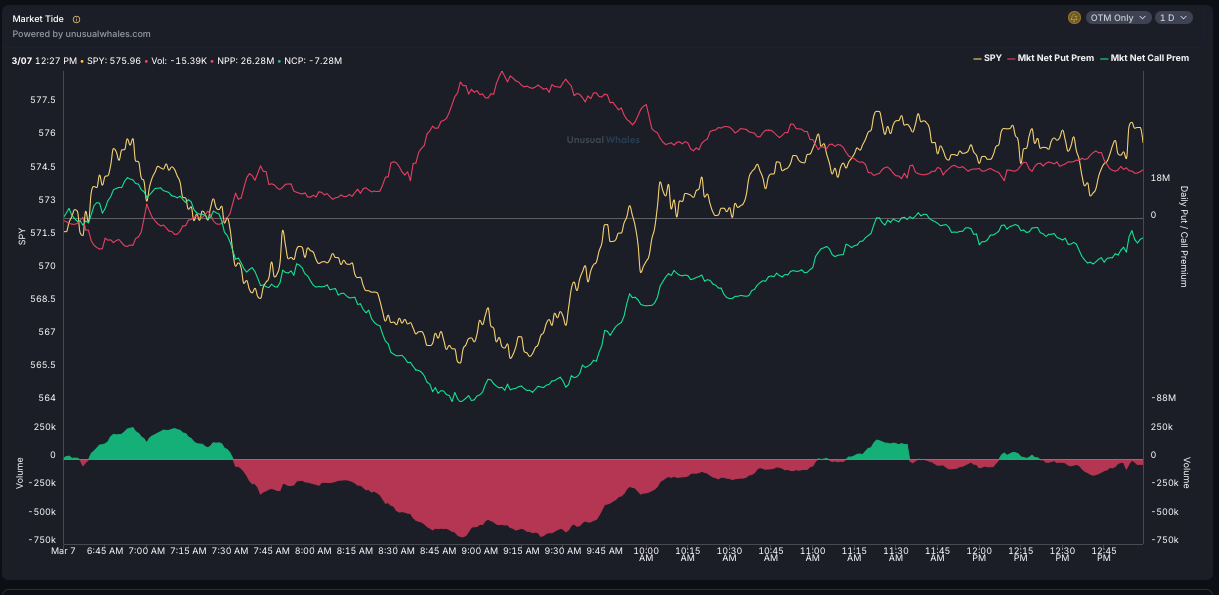

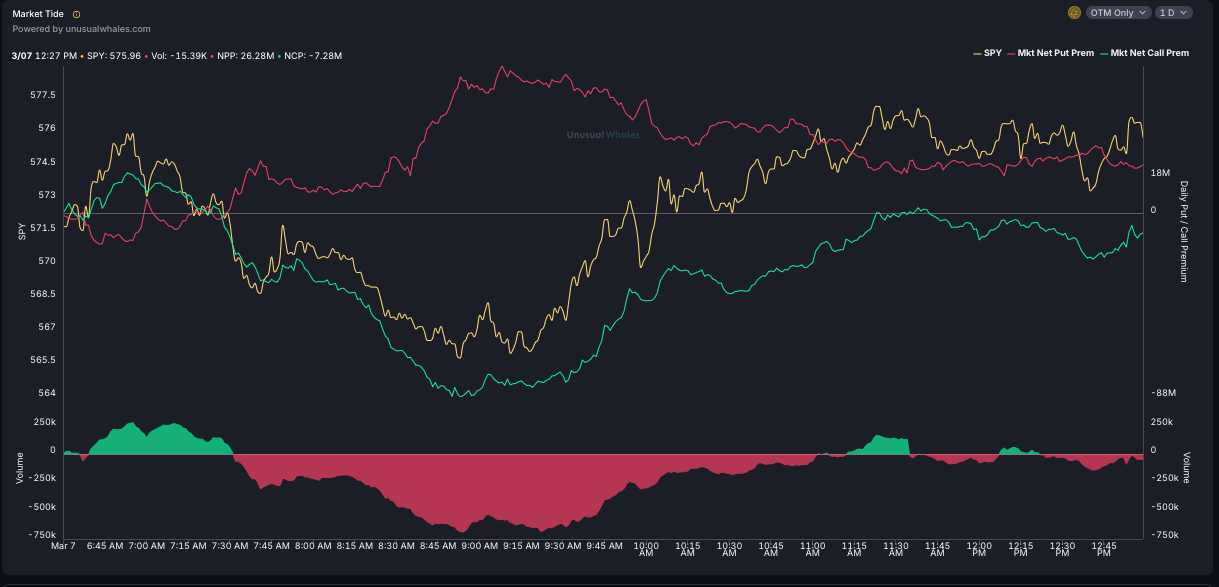

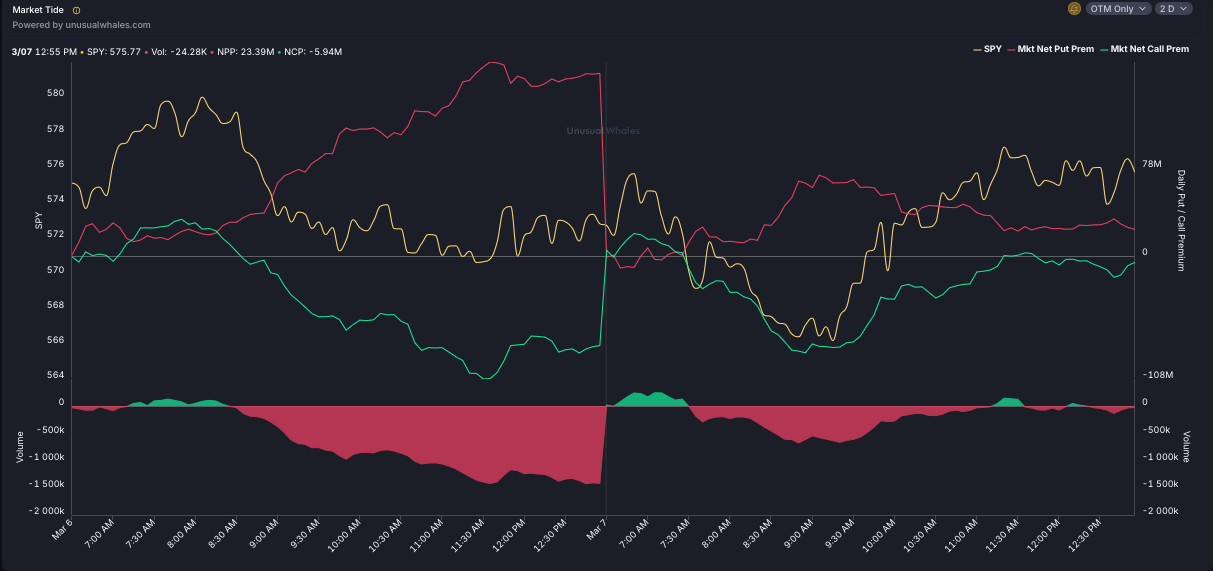

🐳 SPY Market Tide Page

🛠️ What It Does

Before we do anything, we need a HUD (Heads-Up Display) that gives us real-time intelligence on the market’s true direction. This means tracking the Net Call Premium (NCP) vs. Net Put Premium (NPP) over multiple timeframes.

\This tells us who’s in control—the bulls or the bears.

📡 How We Read the Market Tide:

NCP > NPP → Bullish Tilt (More call buying, hedging shifts upward.)

NCP < NPP → Bearish Tilt (More put buying, dealers must short to hedge.)

Shifts over 1, 2, and 3 days tell us if sentiment is changing.

📊 Market Tide Breakdown ( we ALWAYS use OTM tab, not ALL)

1-Day View: Put premium dominated early, but call flow increased steadily into the close—a sign that institutions may be repositioning long.

2-Day View: Yesterday’s session saw aggressive put activity, but today had the strongest call premium increase in 48 hours.

3-Day View: We are seeing the first clear signs of a potential sentiment shift, with bearish pressure losing steam.

🧠 J.A.R.V.I.S. ANALYSIS:

✅ Put premium dominance is fading → early signs of dealer hedging adjustments.

✅ Call premium inflows increasing → possible reversal signal.

❌ Not fully bullish yet → needs volume confirmation.

💡 SUIT UPGRADE: HUD System for Equities.: don’t forget to check the Intraday Analyst page to see if the flow page for the ticker on Net Premium tab is locked in with the SPY Net Premium.

Ticker Page

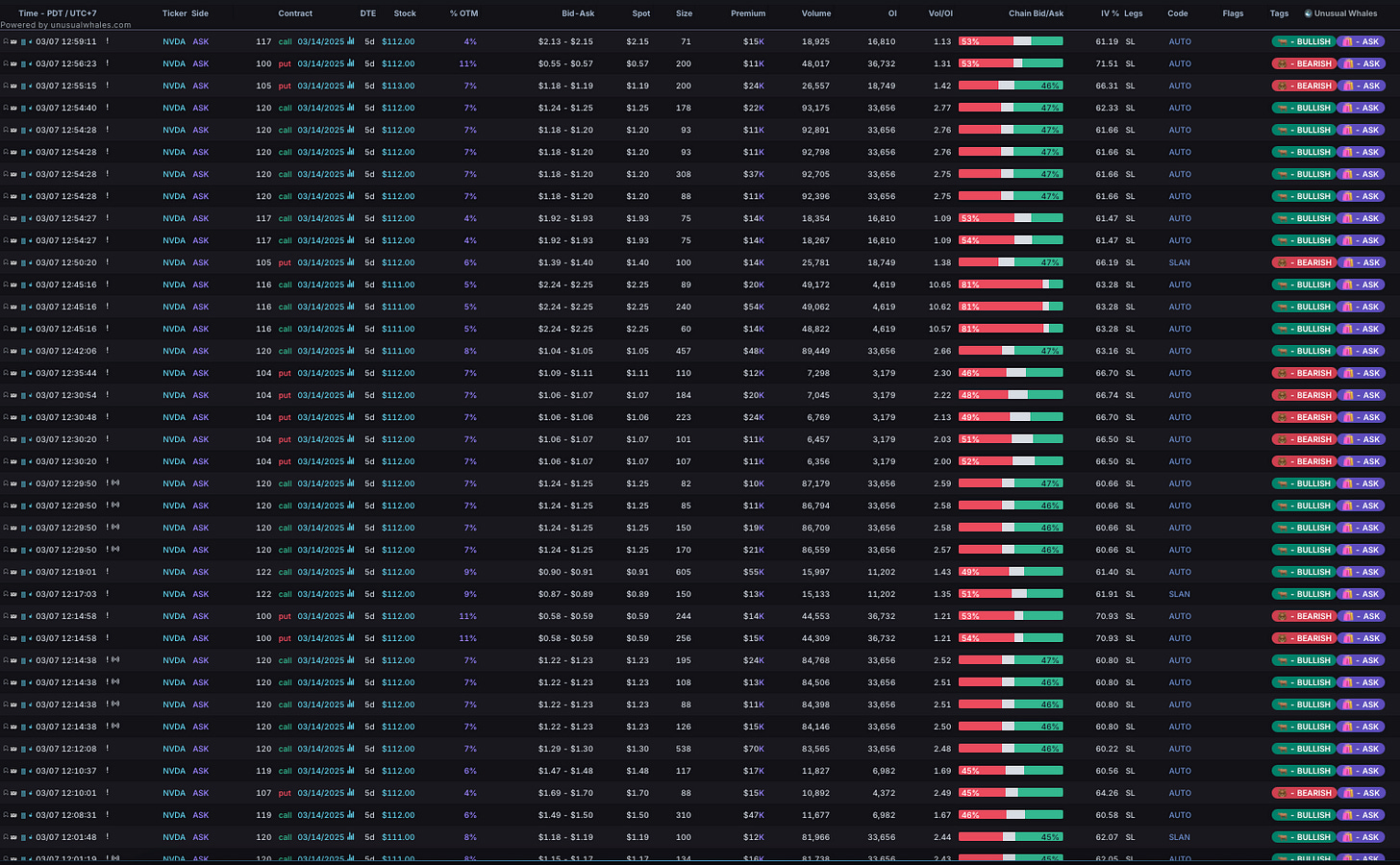

When analyzing options flow on Unusual Whales, understanding the different filters is crucial for identifying actionable trade signals. Premium size helps differentiate retail trades from institutional “whale” activity, where large premiums often indicate conviction. Sweeps vs. Blocks show whether orders were aggressively filled across multiple exchanges (sweeps) or executed in a single transaction (blocks), providing clues about urgency. DTE (Days to Expiration) is essential—short-term trades often signal immediate momentum, while longer-dated contracts suggest a strategic outlook. ITM vs. OTM positioning reveals risk appetite, with deep OTM contracts reflecting high-risk, high-reward bets. Bid vs. Ask trades can indicate whether buyers or sellers are driving the move. Finally, filtering for dark pool prints and stock correlation can offer insights into underlying equity sentiment. By combining these filters, traders can isolate meaningful whale activity from noise and refine their strategy accordingly.

🎯 1. The Intraday Sniper: Short-Term Filters & Precision Detection—Key Setting, Premium Size

The Education

Short-term filters focus on immediacy and rapid pattern recognition. These tools help traders detect subtle but crucial shifts in positioning before they fully develop, making them essential for catching early-stage accumulation or aggressive short-term plays. The advantage of short-term filters is their speed—they provide near-instant feedback on what’s happening in the market. However, they also come with risk: they generate more noise, and without proper confirmation, they can lead to false signals. The key to using short-term filters effectively is recognizing stealth accumulation, high-frequency trading (HFT) impacts, and institutional day-to-day flow shifts.

YEET’s Intraday Sniper focuses on identifying small, repeated premium orders that hint at institutional accumulation in progress. This tool is best suited for uncovering stealthy entries, where smart money is gradually building exposure without moving the broader market.

🛠 What It Detects:

🎯 Pinpoints repeated positioning at key levels—an early indicator of hidden institutional interest.

🔍 Differentiates between high volume & OI mismatches, revealing whether trades are genuine positioning or short-term churn.

📡 Identifies bursts of activity before retail traders react, giving insight into sudden liquidity shifts.

📡 Situational Use Cases:

Strength: Great for spotting fast-moving shifts, particularly in sectors where news catalysts are developing.

Weakness: Can produce noise—many small orders don’t necessarily mean a large move is coming, so context is key.

Best Used When: Market conditions are indecisive, and you need confirmation of whether institutions are quietly accumulating or rotating out.

💡 SYSTEM UPGRADE: 🛠️ Precision Detection Online. We can now track hidden accumulation before it unfolds.

⚡ 2. The People’s Screener: Mid-Range Filters & Institutional Positioning—Key Setting, DTE

The Education

Mid-range filters aim to balance real-time detection with confirmation, making them valuable for traders looking at multi-day or swing trading setups. Unlike short-term filters, which pick up immediate fluctuations, mid-range filters help confirm whether an institution’s activity is more than just a short-lived hedge or scalp. Their key strength is that they provide a clearer picture of capital deployment trends, but their downside is slower reaction time—by the time a mid-range filter confirms a move, part of the opportunity may already be priced in.

Our People’s Screener provides clarity on trades that are significant but require broader market participation to generate momentum. This filter captures mid-sized institutional orders, the kind that signal intention without causing immediate volatility.

🛠 What It Detects:

📊 Flags mid-sized institutional orders, bridging the gap between smaller speculative plays and larger market-shifting positions.

⚠️ Reveals liquidity traps, where aggressive market makers manipulate price to trap weak hands before an intended move.

🧠 Analyzes Volume vs. OI ratios, ensuring that premium flow is genuine and not just rotations or spread plays.

📡 Situational Use Cases:

Strength: Provides a clearer picture of sustained interest—when institutions are positioning for multi-day or multi-week moves.

Weakness: Can be slower to confirm; sometimes institutions hedge across multiple strikes, making the signal less direct.

Best Used When: The market is at a key decision point, and you need insight into whether recent movement is fund-driven or just short-term noise.

💡 SYSTEM UPGRADE: 🔋 Mid-Range Institutional Scanner Online. We can now track the flow of institutional capital across timeframes.

🚀 3. FARCRY: Long-Term Filters & Macro Positioning, Key Setting, IV and DTE

The Education

Long-term filters focus on deep trend detection and capital flow shifts. Unlike short-term and mid-range filters, these tools aren’t about reacting quickly but rather anticipating large-scale market movements before they occur. Their biggest advantage is trend foresight—allowing traders to align themselves with institutions moving massive amounts of capital. However, they come with a tradeoff: long-term filters require patience, and signals often take days or weeks to fully play out.

Our FARCRY filter is built to identify deep conviction trades that don’t just react to the market but actively shape its structure. This tool is key for identifying major institutional rotations, long-term accumulation zones, and macroeconomic trend shifts.

🛠 What It Detects:

🚀 Massive, high-premium orders that indicate deep institutional intent rather than short-term speculation.

📈 Early identification of macro capital rotations, where smart money shifts from one sector or asset class to another.

⚡ Tracks high-impact sweeps, blocks, and ITM contracts, signaling confidence plays with major follow-through potential.

📡 Situational Use Cases:

Strength: Offers a true macro perspective—ideal for positioning ahead of large directional moves.

Weakness: Requires patience; signals can take days or weeks to fully play out.

Best Used When: The market is trending strongly, and you want to anticipate large-scale institutional movement before it becomes obvious.

💡 SYSTEM UPGRADE: 🛰️ Long-Range Macro Scanner Deployed. We now have predictive capability for major institutional capital shifts.

✅ Final Systems Check: Fully Integrated Market Intelligence

Each of these filtering tools serves a distinct function, but their true strength comes from working together:

🎯 Intraday Sniper detects short-term stealth accumulation and early positioning.

⚡ The People’s Screener validates mid-range flow, helping confirm sustained institutional interest.

🚀 FARCRY locks onto the biggest macro moves, offering a predictive edge over long-term shifts.

Individually, they offer targeted insights. Combined, they form a full-spectrum market intelligence system, allowing traders to align their strategies across multiple time horizons with precision.

🦾 System fully calibrated. Deploying market intelligence... 🚀

🐳FLOW SUIT AUTOMATION FOR YEET Plus Video Explainer (PS—there’s a pick in the video for free if you watch carefully—MCU easter egg style):

Link Below: