🗞️Sunday YEET: The Whalematic

New inventions from YEET laboratories, trade reviews, charts, flow

📰HEADLINES (the free section): New YEET Invention, New Flow Filter Catches 2 10 Baggers How-To

🐳YEET Presents The Whalematic: Automated Twitter alerts when flow hits Entry Levels including Targets, and Stops

The Problem: There are so many banger YEET whale contracts to choose from that appear valid, but it’s tough to always choose the correct ones—especially with limited BP.

The Current Best Solution

Providing charts for plays so that you know when to enter and exit. But that’s hard to track, even for the most diligent flow follower.

Now (and by now I mean Tuesday), there’s a better way: The Whale-Matic

On any given week between YEET nightly, EOD Reports, the Plus Twitter, and the main Twitter, there are several tickers mentioned.

After some backtesting one thing is clear; whale contracts that a) pass a looming backtest level or b) complete a reclaim have a very high chance of succeeding.

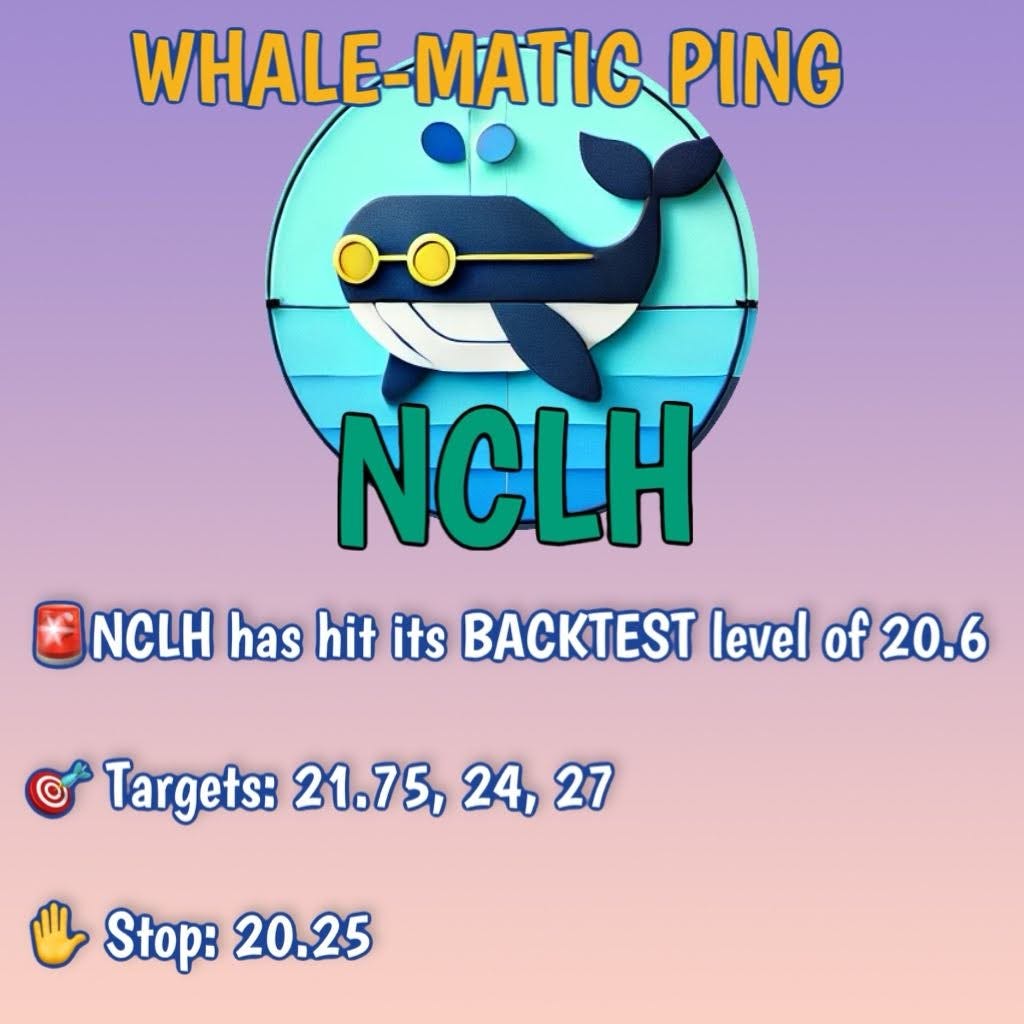

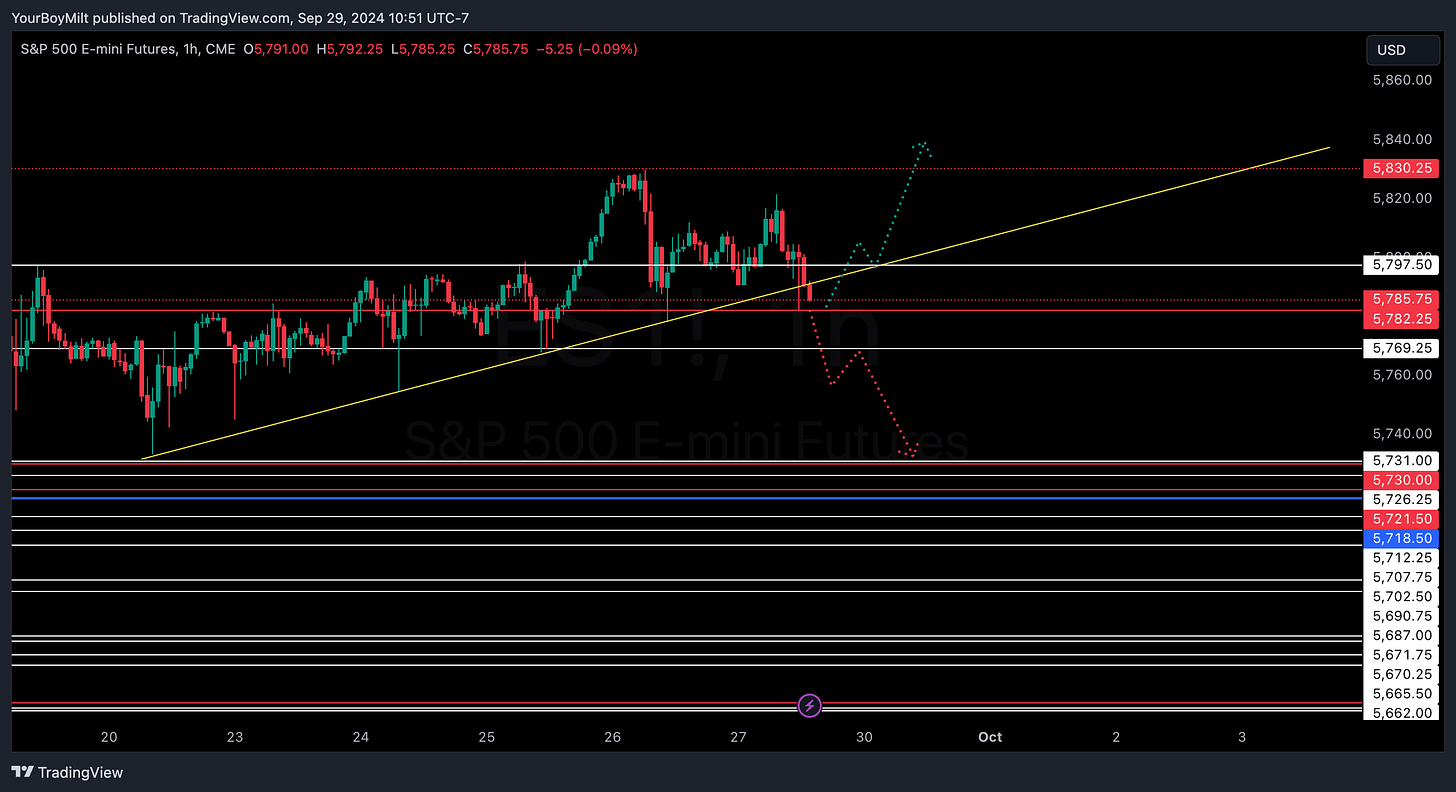

I’ve rigged some chart software to give me automatic alerts on those levels on the charts accompanying the flow I put out on various platforms for YEET Plus; I then Automated that to set up an alert format that sends it to the YEET Plus Twitter. So now instead of wondering what we may get in or get out, or what’s valid, just wait for the tweet with the info above when it’s actionable.

Each alert ping will have a card (like above to save to your photos), and the accompanying chart so you can see it visually. In a week or so I should be able to link the original whale contracts for viewing too, so you can save all three together.

Happy Hunting!

Note: I was going to iron out a practice daytime run during the session tomorrow, but tomorrow I’ll be out of pocket for much of the morning on and off for an event. Tuesday afternoon is realistic to have it ironed out, Wednesday hard launch.

🎲New Flow Filter The Intraday Pickpocket Grabs 3 for 4 on 100%+ Calls in Week 1

Giving you the main ingredient to our blistering new filter that caught a 1,000%+ two day move with FUTU, and a note on size discrimination.

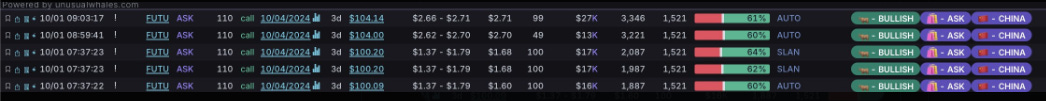

Have a look at the first set of contracts, these were tweeted on 10/1:

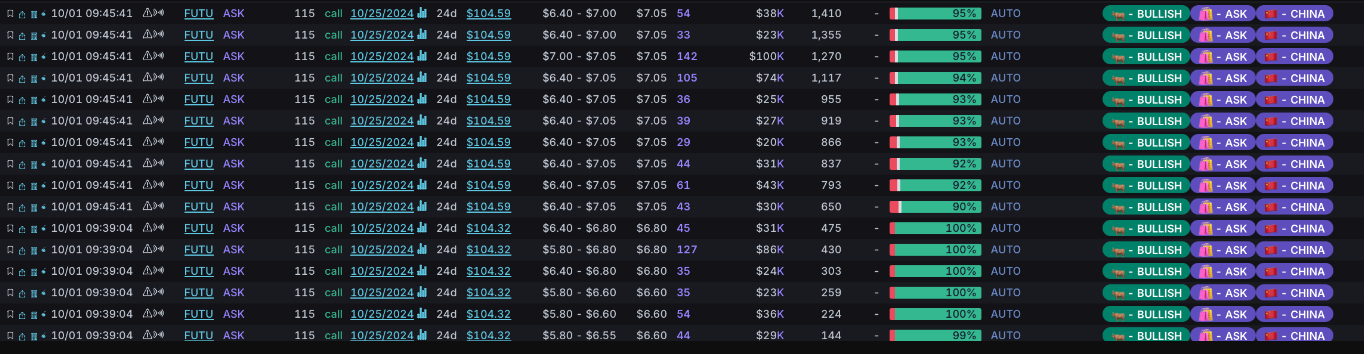

This second was sent later to YEET Plus during the 10/1 EOD Flow Report

Barring the 100k order you should be noticing smaller sizes equally larger total orders—this is FLOW in its truest sense, and the filter has been designed to catch swelling tides rather than the typical large floor order.

It also used this same principle when it caught the TSLA 140p on Wednesday afternoon, which went 100% by the following morning:

Looking closer you can see the tide was made up of several smaller orders of the 135p and 140p adding up to a damning size over time.

💻NKLA 4.5c goes 1,500%; a simple PA trick to know when to high-point a deep ball

When a stock is zooming like our NKLA 4.5c was, the hardest thing to swallow is watching the play you “took profit” on at 150% become a ten bagger.

The way we knew to stay in NKLA? Monthly and weekly levels, plain and simple.

In fuschia we have our monthly levels, and in gold we have our weekly:

What you’ll notice is that after crossing a weekly level, it never closes beneath the previous weekly level—meaning it’s setting a flag on the continued way up. As long as the previous level hold support, it’s a signal to stay put.

BONUS: DAILY CANDLE BODIES:

How else could we know to high point it with more accuracy? Make sure to check the daily chart—any place where you see multiple CANDLE BODIES give resistance (or support for puts) are a signal you’ll have the same as well.