🤯SUPER SAIYAN FRIDAY FREE GAME: How we went 230% on CVNA flow, ABU 200 point NQ Long, 220% SPY (calls), 330% SPX (puts), 66% on NVLS (puts), 66% NFLX (puts) Today

For this one we are going to give you one tidbit on each, ideally something you can remember. I’m going to show you how we tracked and entered these trades on Plus in real time, so you can do it for yourself.

CVNA: 230% Trade Today

The method: Knowing the flow, waiting for the index

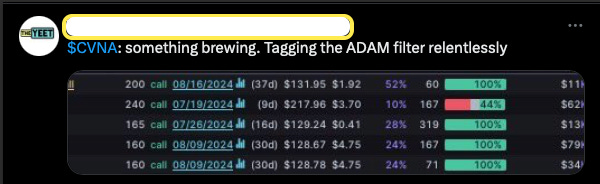

We noted the YEET Plus insane CVNA deep OTM flow yesterday (if you read last night's YEET, you should have a good sense of how we found it).

That’s right—not the flow screener, the alerts screener. Sometime you don’t necessarily need to parse an individual contract to death when you’re seeing large amounts of activity OTM on a ticker. So when four different out the money CVNA contracts pop up on a filter, you have to think to yourself

What is the totality of what I’m seeing, regardless of the details of a specific contract?

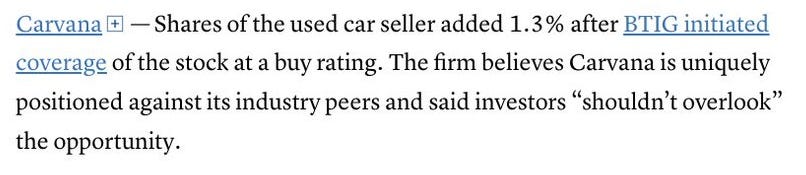

Zoom out your thinking and it’s pretty obvious. It should be fairly clear that something is brewing with CVNA at that point when we saw it yesterday. Sure enough this morning:

So when that news drops this morning and we see a muted response because the index is flat, we know if we get a sign today is going to be green then we are a GO. Luckily, we knew today would rip because of ABU, here’s the Price Action

So then CVNA becomes a simple long to the monthly targets for the ticker with a notion to take profits when SPY hits its monthly level

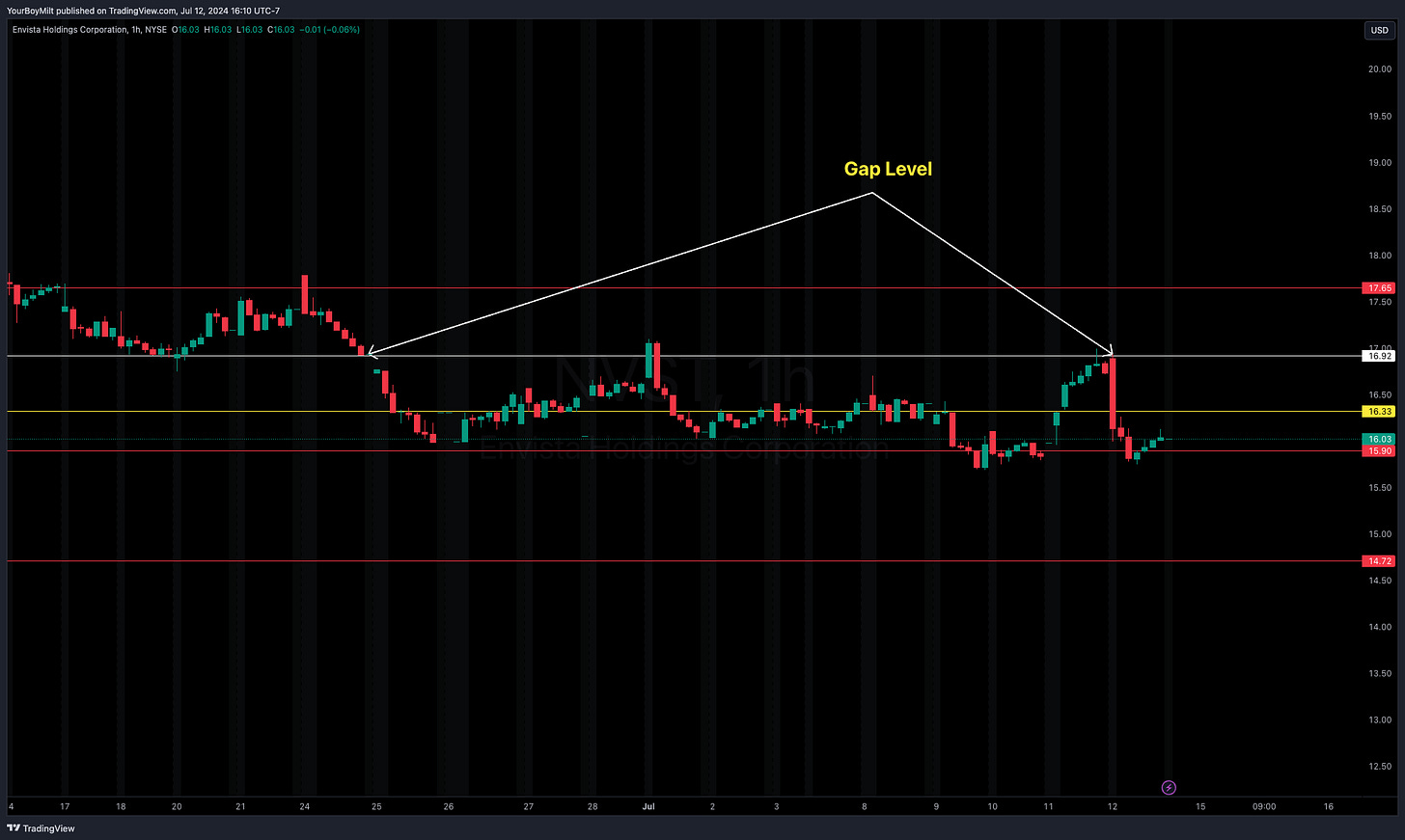

YEET Plus got into NVST yesterday because of this flow:

Chartwise I was comfortable with this because it rejected the monthly level and had a date wit the next one, and it also rejected THE GAP LEVEL (you can use these now in your Price Action arsenal with monthlies and weeklies)

With today’s SPX Puts, it was all about the hourly candle reversal at the monthly:

Resulting in: