🏈 TarHeels & Tariffs — When Euphoria Meets Entropy

Fourth down. What’s the market gonna do?

🚨 NOTE: PLUS Holiday Sale since we’re back in full swing— $99 for annual subs through Monday. Today is a longform YEET, tomorrow a Whales to Watch with 5 picks drops for YEET Plus.

📰 YEET: TarHeels & Tariffs — When Euphoria Meets Entropy

Every rally starts to feel the same near the end — clean charts, confident memes, and a collective illusion that this time, the air won’t get thin. It’s the sweet spot between triumph and hubris, the point where everyone’s a genius and nothing can go wrong.

And then, of course, it does.

That’s where we are right now — the market equivalent of the North Carolina Tar Heels under Bill Belichick’s short-lived college experiment.

Imagine it: the greatest NFL mind alive, gray hoodie and all, suddenly dropped into Chapel Hill, trying to run a bunch of nineteen-year-olds through pro-level coverages. The name alone got boosters fired up. The media anointed it a dynasty before kickoff. And for a few weeks, it even looked like it might work.

But genius doesn’t always translate. Eventually the cracks start showing — the playbook’s too rigid, the players too young, and the message too old. The shine fades. And suddenly, the legend looks mortal.

The market right now feels a lot like that.

🏈 First Down: YEET Homemade Tracker — PARI Was Cooling

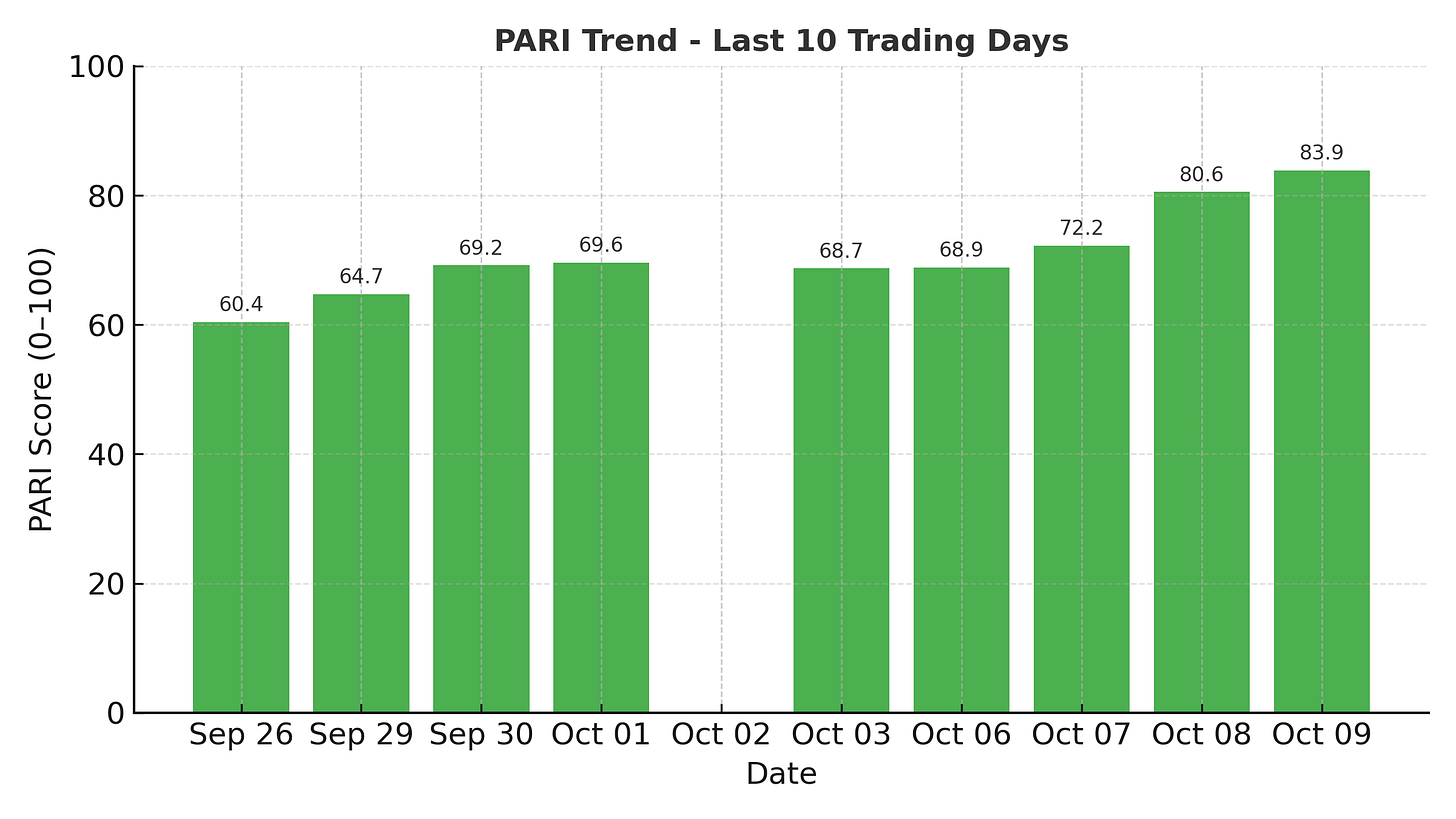

If the market were a player, PARI was the heart rate monitor — and over the past ten days, it was red-lining.

The Price Action Risk Indicator climbed relentlessly from ~60 to 84, flashing bright green on the surface, but that strength was built on hollow footing.

Momentum exploded while volatility bled out — the kind of divergence that usually precedes a stumble, not a sprint.

What looked like “controlled acceleration” was really exhaustion disguised as confidence.

By October 8-9, the readings sat deep in the overbought zone — the same area where previous tops formed — while price barely moved higher.

When PARI gets that high and flattens out, it doesn’t mean strength; it means strain.

And just like that, the next day the tape finally cracked.

🧱 Second Down: Price Action — The Triple Rejection

Then came the tape.

The drop we saw yesterday didn’t come out of nowhere — it lined up perfectly with a third rejection at the monthly high, the same zone that’s been tagged and sold each time we’ve gotten close.

You can see it clearly: every rally attempt has hit that same ceiling and been smacked back down. The red line — our monthly level — acted like a hard cap. That’s not coincidence; that’s structure.

In football terms, it’s like trying to run the same play into the same blitz package over and over. Eventually, the defense adjusts — and that’s exactly what sellers did here.

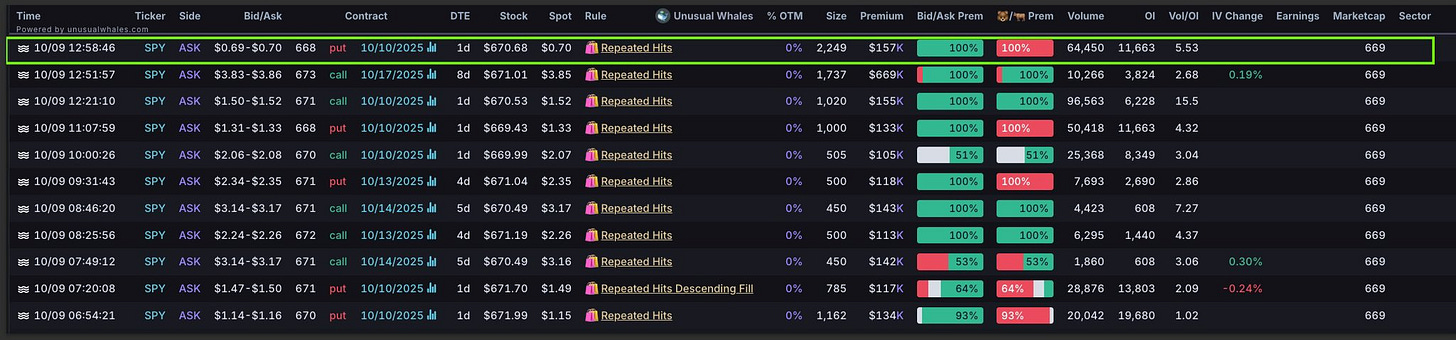

🐋 Third Down: SPY Magic Filter — The Whale Call

Our SPY Magic Filter, YEET Plus’s in-house flow detector with a 90% ITM success rate, caught the divergence before anyone else.

Thursday afternoon, while most traders were easing into a bullish weekend, one massive 1DTE SPY put order came through late in the day.

That wasn’t noise — it was intent. The order hit with conviction, at the ask, right before the tape rolled over. SPY Magic lit it up as a high-confidence signal — and 24 hours later, the floor gave out.

Whales weren’t betting on continuation — they were positioning for reversal. And they nailed it.

SPY Magic flagged it as high probability — and it was right. Within 24 hours, the market fell apart. That’s not luck; that’s signal.