💻The Banger of Echoes

A Free YEET!

📡 The Banger of Echoes

"When the same strike keeps ringing... somebody knows something."

Didn’t have time to put out a Sunday Yeet—so this Bangers Issue is free for all. Think of it as a midweek boost, served in our YEET+ format, now running a few nights a week for deeper plays with a tighter focus.

These setups were found using The People’s Filter, our retooled flow scanner designed to surface repeat positioning and intentional buildup. When the same contracts echo across sessions, something’s cooking—and we’re tracking it.

PLUS: the link for the slightly updated People’s Screener is available for you at the bottom.

🧠 Thesis

Most retail flow chases momentum. But real whale intent echoes. It doesn’t shout—it repeats. And on $DELL, a string of calculated put buys, placed over multiple sessions across two June expirations, signals that someone isn’t just hedging—they’re betting. Quietly. Systematically. Persistently.

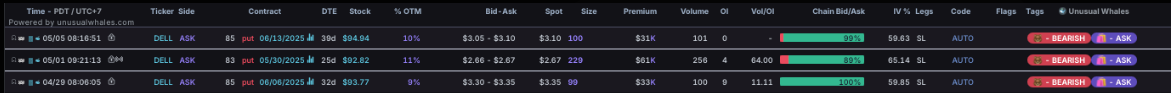

🧰 Flow Setup — Repeat Echoes Across Time

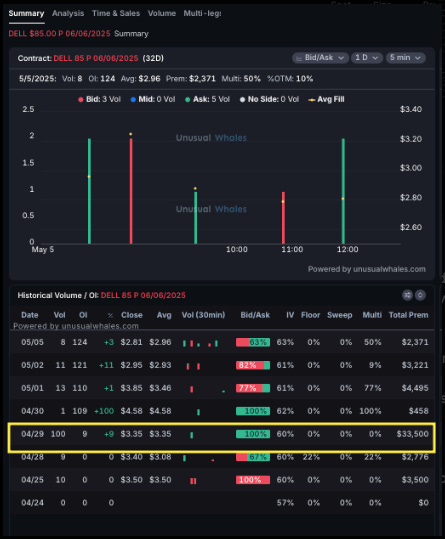

We picked this up using a retooled version of The People’s Screener, which filters for repeat OTM activity that scales across dates, expirations, and price increases. Here’s what we saw:

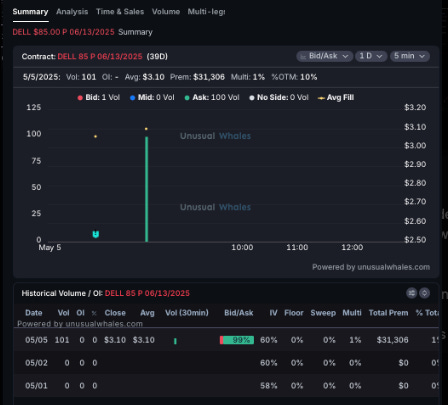

🔂 May 5

DELL $85p 6/13/25: 100 contracts, $31k premium, 10% OTM

DELL $85p 6/06/25: 124 contracts, $2.8 avg fill

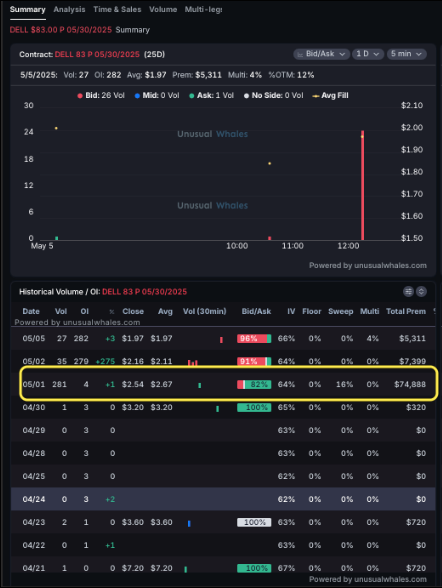

🔂 May 1

DELL $83p 5/30/25: $74.8k in premium at $2.67 on May 1, and more

🔂 April 29

DELL $85p 6/06/25: 100 contracts at $3.35 — original stake, now being built on

📈 Key Detail: The flow persisted despite Dell holding trend and attempting to break higher. This isn’t protection—it’s a conviction-driven bet on reversal.

📉 Chart Context — The Trend Is Lost

On the hourly chart, we see it clear:

Dell’s steep uptrend from April has been breached

Retest failed → distribution pattern emerging

Expectation: breakdown to fill lower volume areas, first major support at ~$84

On the daily chart, there’s a gap that aligns with prior earnings moves and gives a pop and drop entry or a loss of level followed by confirmation

🔍 Why This Flow Matters — Echoes Are a Repeat Signal Intent

🧱 Order size isn't huge but repeats across time — ideal whale behavior for camouflaging intent

💎 Price stayed stable or rose slightly while puts came in → this isn’t insurance. It’s a timed bet.

🔄 Strike repetition + matching expirations = position scaling over multiple days

This is the art of compounding conviction.

🎯 YEET’s Setup:

🎯 Entry Trigger📉 Breakdown of $93.40 with confirmation retest

🎯 Target 1$88.50 – first major support zone

🎯 Target 2Gap close zone $85.50

🎯 Trigger Invalidation Reclaim of $95.75 + trendline flip

🔁 Consider Rolling From 5/30 to 6/13 expiry for premium capture

🕳️ Final Word

When flow echoes like this, it’s not noise—it’s signal. Watch the $85 strike across these June chains and look for continued pressure below $93. This isn’t the big bang yet. But it’s the echo before the collapse.