🚨THE BIG CPI PREVIEW--YEET DATA VS MARKET DATA, PARI, YOLOS, MORE!

Milt was laying low all day going full nerd for this one1

📊 How CPI Moves Markets & What’s Different This Time

Can we predict how SPY will behave based on data leading into CPI?

To answer this, I analyzed unbacktested gaps, whale sentiment, market tide positioning, and the Price Action Risk Indicator (PARI) to see what’s setting up for tomorrow’s event.

🐳 PART 1: WHALE SENTIMENT – WHAT ARE THE BIG PLAYERS DOING?

📅 Whale Flow Leading Into CPI

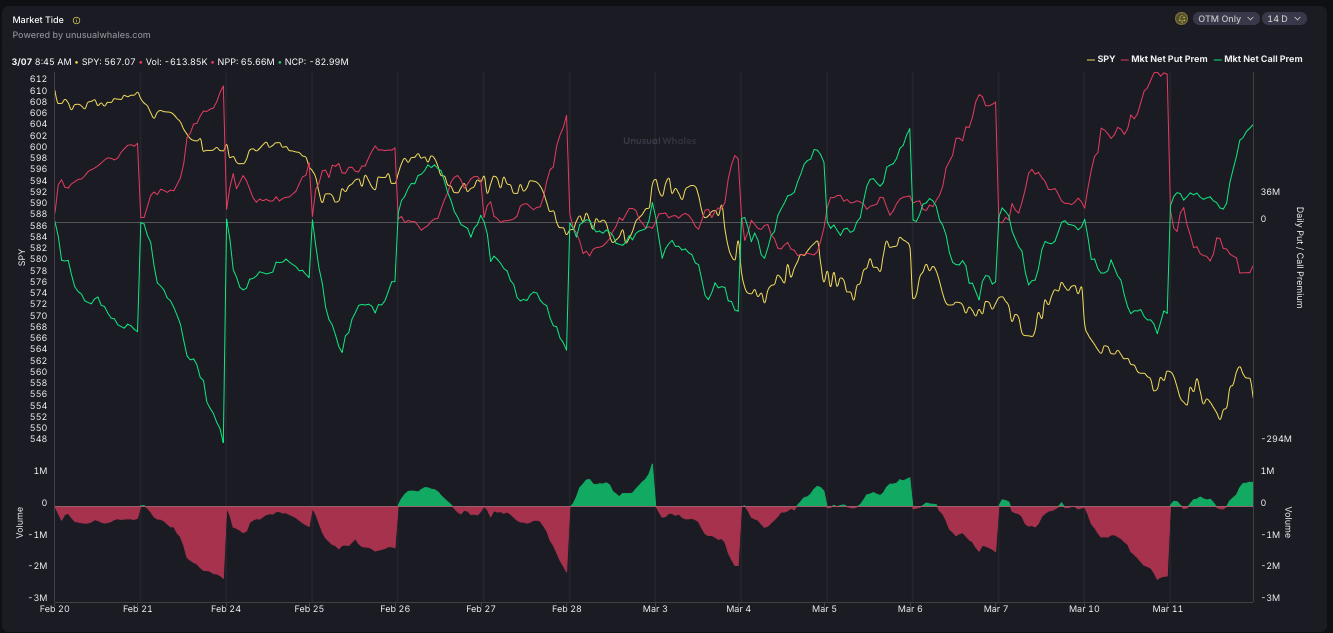

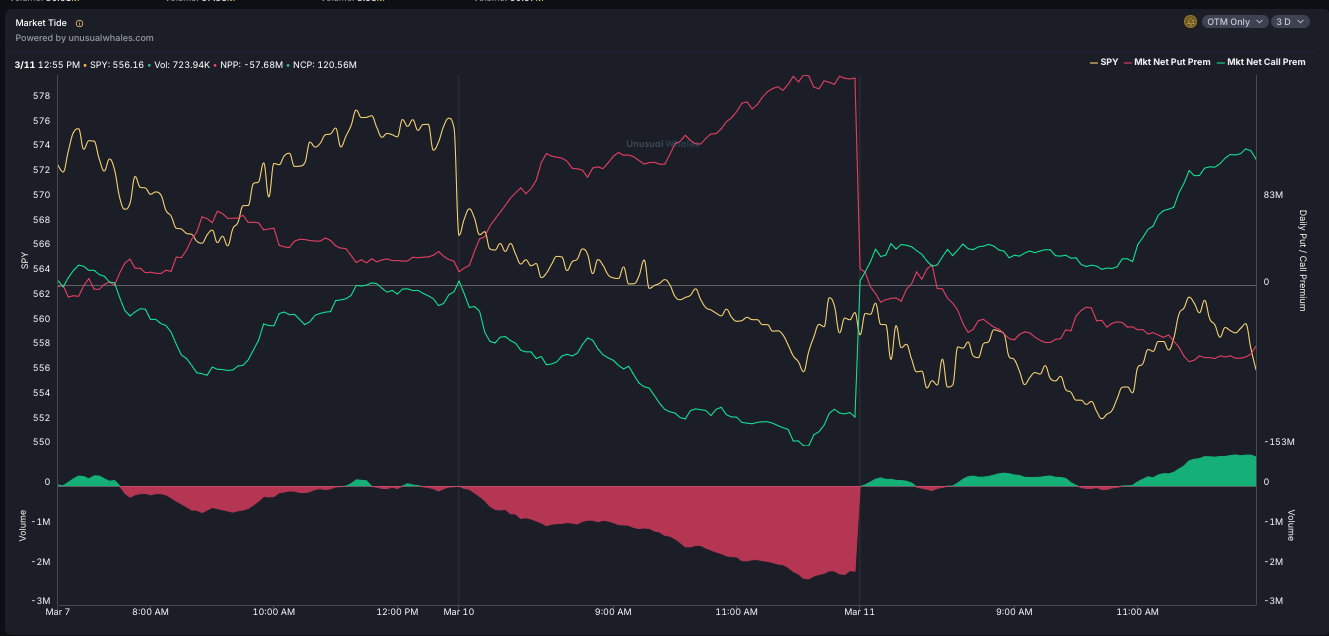

Historically, institutional order flow before CPI tells us more about volatility than direction. Using Market Tide sentiment tracking, we found:

Whale put premium has been steadily increasing into CPI. This suggests institutional hedging, not necessarily a bearish bet.

Call premium has diverged, spiking today. This signals some big players may be expecting a reversal post-CPI.

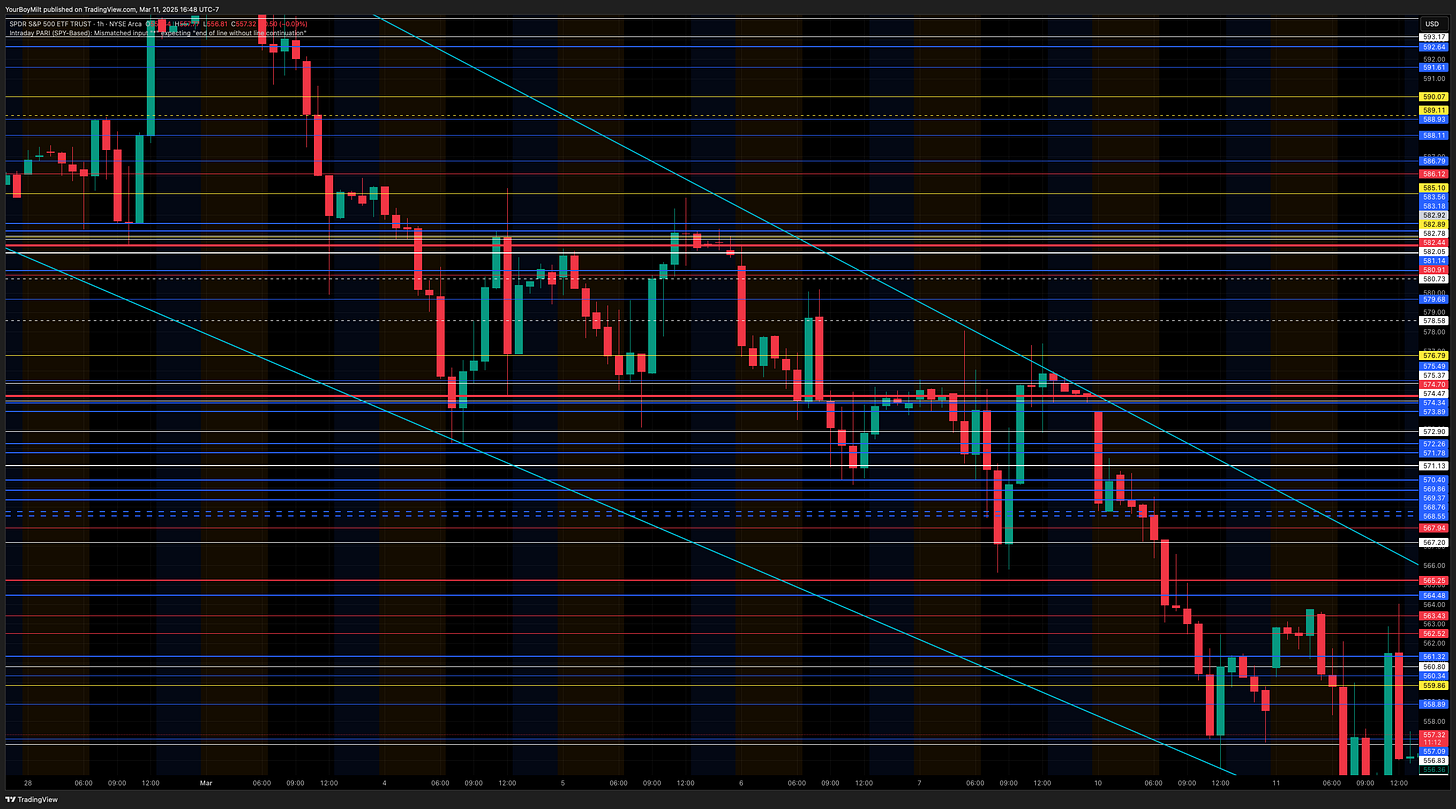

SPY price action remains locked in a downward channel. This supports the view that markets are defensive but could over-hedge into the report.

📊 Market Tide Sentiment – Put vs. Call Premium Trends (Visualization Below) 🚀

💡 Key Takeaways: 🐳 Rising put premiums suggest institutions are bracing for volatility. 🐳 Call premium spikes signal potential positioning for a reversal. 🐳 Whale activity suggests CPI will be a high-volatility event.

🎲 How to Trade It: 🐳 If whale put volume is extreme (as seen today), the next-day bounce probability increases. 🐳 If call flow accelerates into CPI, whales may be positioning long after the event.

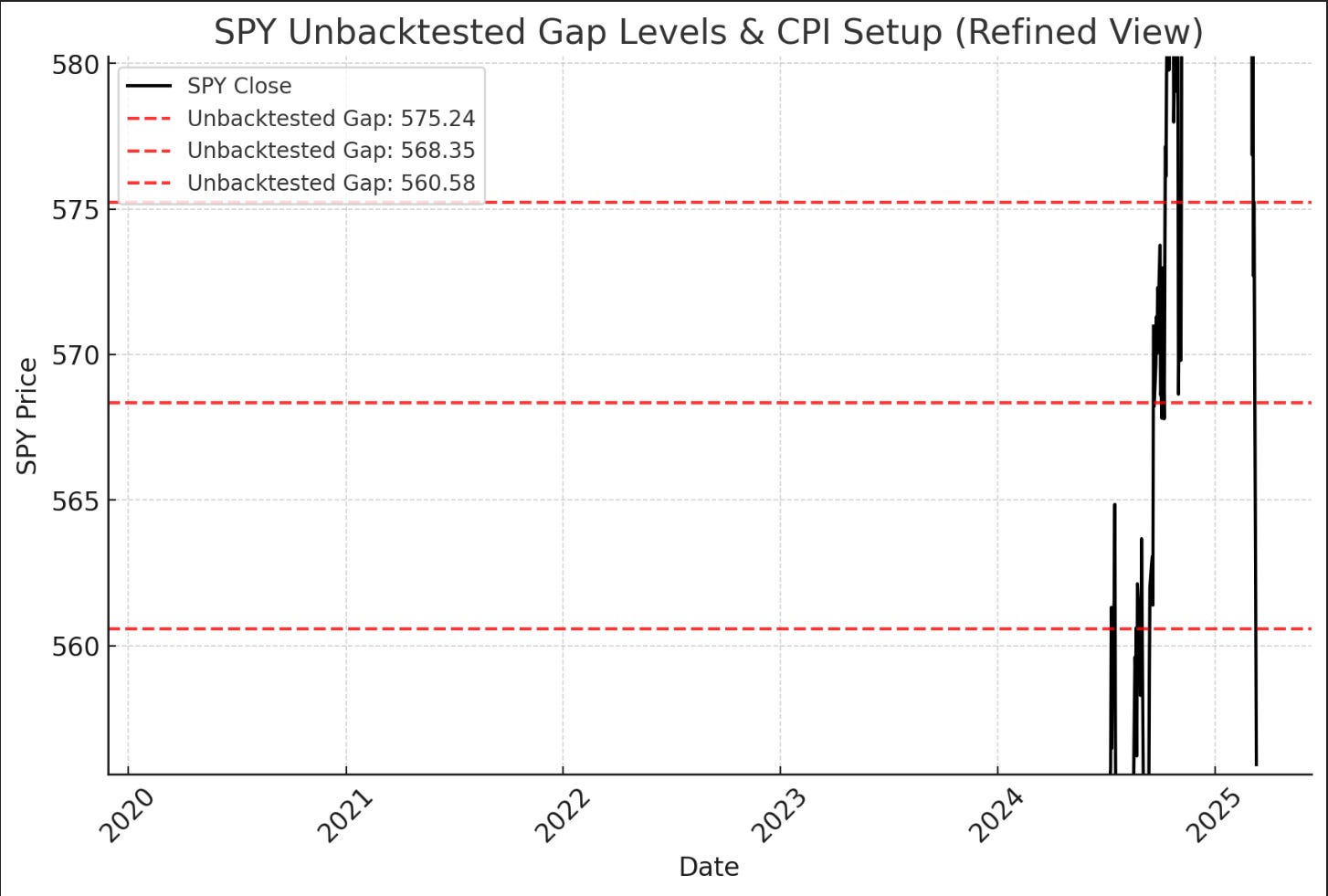

📊 PART 2: SPY UNBACKTESTED GAPS & CPI MAGNETS

CPI days often see SPY gravitate toward unbacktested gap levels, as price seeks liquidity. The biggest levels that haven’t been retested include:

🔴 575.24 – March 7th’s untested close. 🔵 568.35 – Former liquidity gap level. 🔴 560.58 – Yesterday’s close, potential CPI pivot zone.

📊 SPY Unbacktested Gap Levels & CPI Setup (Visualization Below) 🚀

💡 Key Takeaways: 🐳 Unbacktested gaps act as magnets, drawing price toward them. 🐳 SPY has a strong history of revisiting major CPI gaps. 🐳 If CPI causes a gap move, expect a test of these levels.

🎲 How to Trade It:

🐳 If CPI gaps SPY up, resistance is strong at 575.24.

🐳 If CPI gaps SPY down, expect liquidity at 560.58.

🐳 If SPY moves sharply at open, look for mean reversion setups.

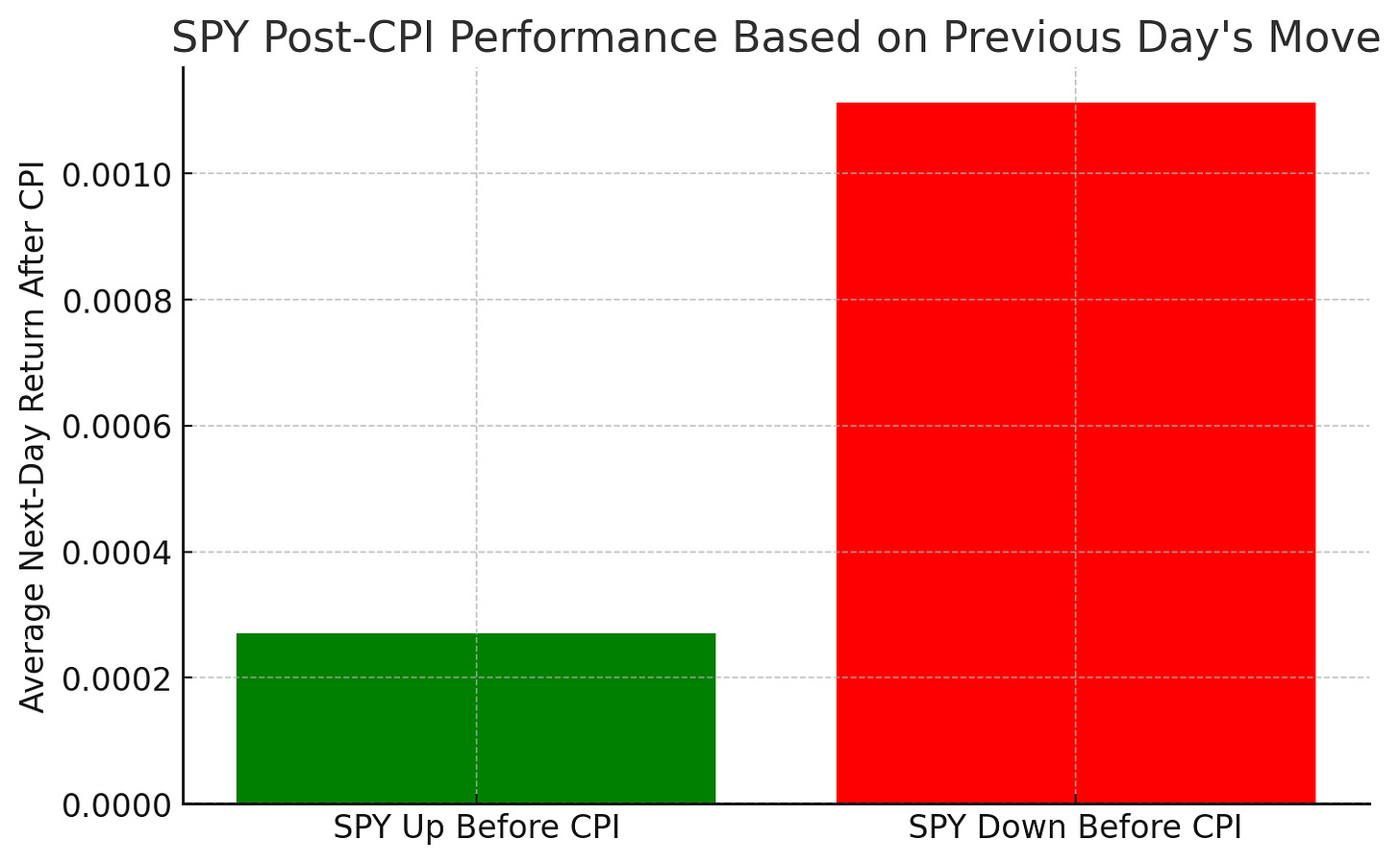

Today’s PARI read is historically low—I’m a nerd and dug into the probabilities and this is what we call…. THE RUBBERBAND EFFECT (affect? effect? more like eh-fuggit)