💿The Blueprint Vol. 1: The Flow/SPY Logic Sessions, ELF 800% Flow Callout, What's Next

This is nerd sh*t straight up

Editor’s Note: this is not for everybody. I started this one yesterday and it accidentally—somewhat fortuitously—ran into today. This is a lot of Price Action and Flow theory that we’ve kind of bent into our model.

If you’re just here for a SPY read and stuff, head to the end. If you’re looking for something more, hopefully you enjoy.

💿 THE YEET: THE BLUEPRINT VOLUME 1

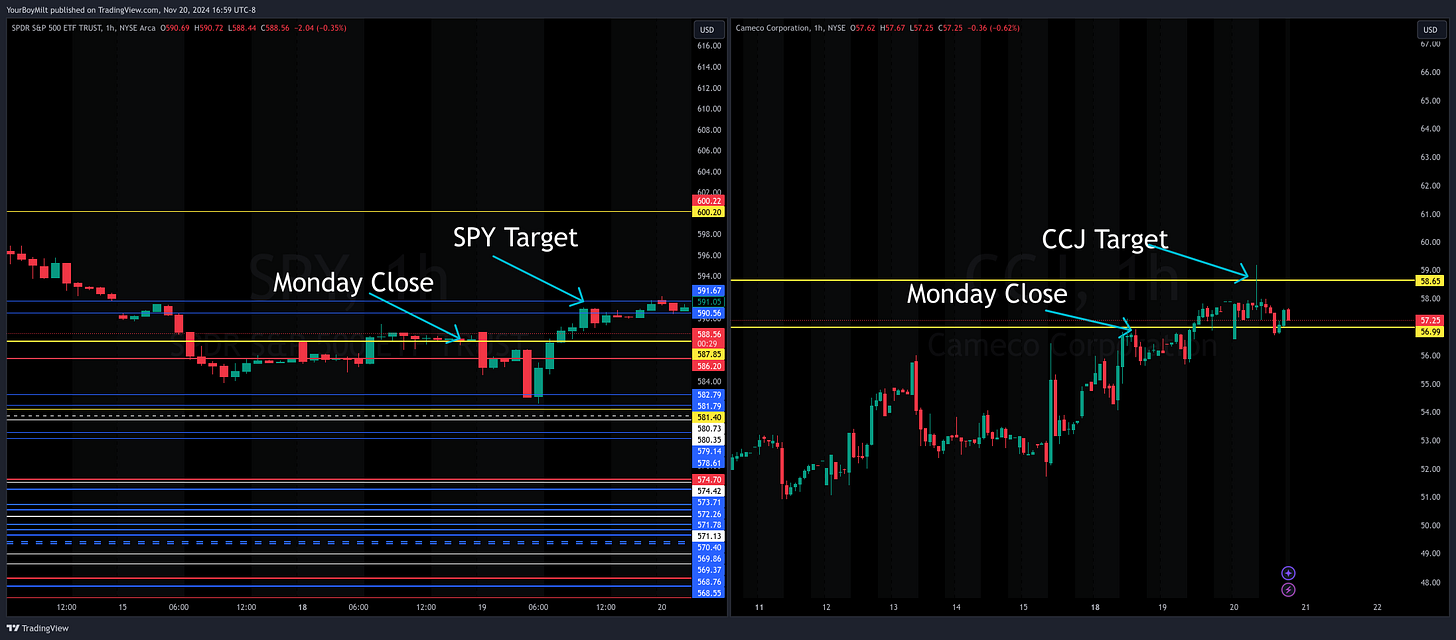

Yesterday we had SPY calls run 500%, and closed out a slew of bullish contracts end of day including CVNA at 40%ish, CCJ contracts in the 30s, and PDD at 60%.* We also had two bags we finally dropped. Today we took SPY on the chin—but we had an 800% trade in ELF that made things feel a-ok.

These cluster days are the bread and butter of our trading style. I have big plans for what The YEET evolves into at the beginning of the year (I haven’t told a soul yet but it’ll become clear over the coming weeks), and it requires me to be uncharacteristically meticulous and organized.

The benefit is that those who want to go deeper on trade theory and practical applications will have our thought processes readily available.

This is the Blueprint Volume 1. Track List:

👨🔬Logical Interpretations of Price Action and Profitable SPY/Flow Applications

So far this week is illustrating the importance of thorough index preparation on Sunday, which gives us a set of scenarios (shout our to the Best Trade Available days) that are validated during the week. When we know it's validated we 1) make the index call and 2) pull the trigger on the appropriate directional flow we’ve researched when it meets its unique condition in sympathy.

It’s a cycle. After aggressive market moves--though the fast money is of course fun--we have to compose ourselves to a neutral and evaluate the new scenario set withoutbias. How we're running it right now is with the understanding that there are:

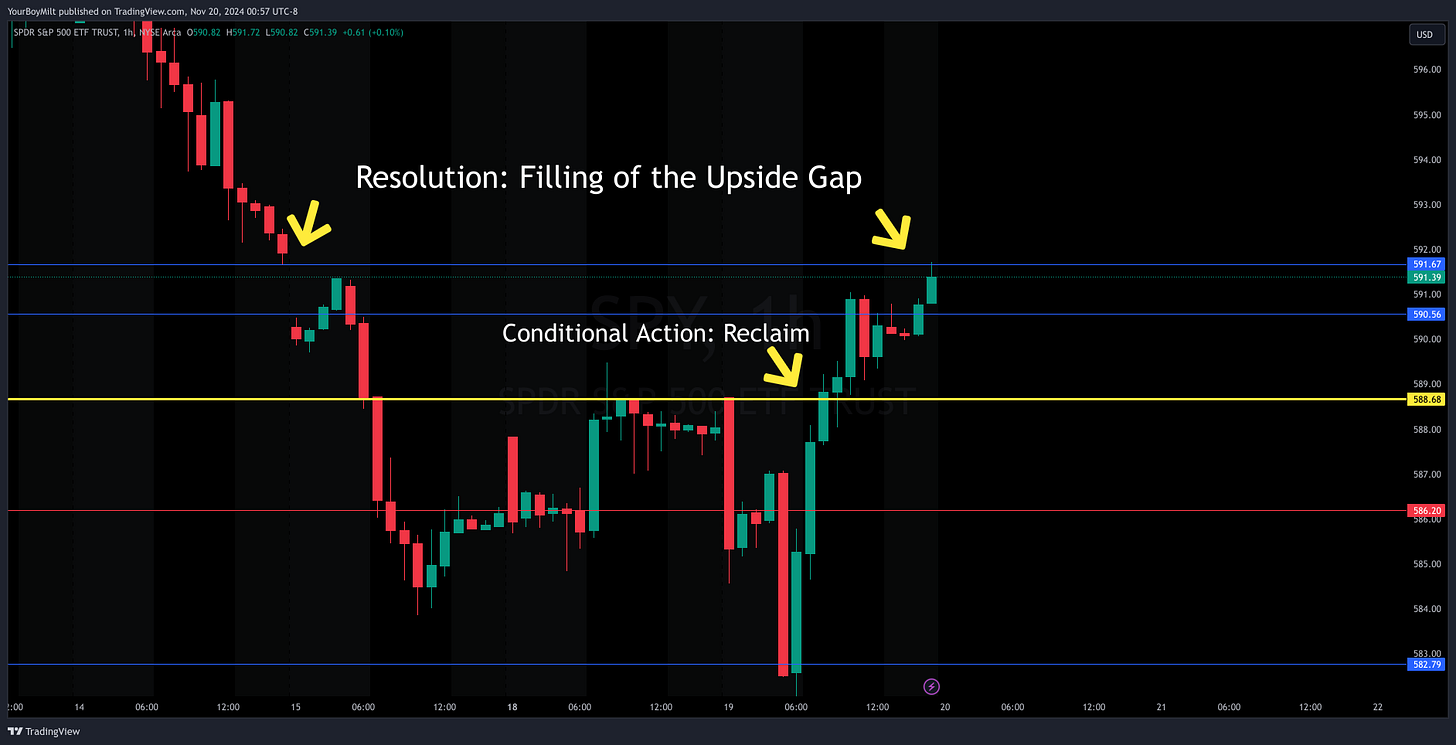

💡Conditional Actions, which when validated/activated/triggered achieve a predetermined “resolution"; it’s best to view market actions at key Price Action level as meeting a need. Basic If/Then logic chains using levels and trend lines.

Looking at SPY today (Tuesday not Wednesday)...

Conditional Action: a reclaim of the 588.7 level

The resolution: a closure of the gap to 591.63

We immediately reversed at the resolution, validating our thesis. For practice--what would the bearish Conditional Action and Resolution have been? For me:

Conditional Action: A confirmed loss of the 586.2 monthly level

The resolution: A retest of the 574.2 monthly level

🌑Wen moon? Timing and Resolutions

One thing that you pick up with screen hours is the timing of resolutions and risk/reward diagnosis. When do you go for 3 points out the money on a squeeze vs waiting in a swing? Trial and error unfortunately, even when you’re certain.

For example, Monday I missed on an SPX trade because I knew we'd hit the condition, and expected a squeeze. We got slow played instead with a little backtesting for drama. I went after it aggressively again today because I knew that resolution was coming, so the r/r was in our favor.

🐳 Flow Gliding and Index Logic Dependencies

Flow gliding: Once we are certain on direction, we deploy our directional pick (s)

Our CCJ rocket Monday was nice--why did we swing them Monday into Tuesday?

💡SPY had met it's condition but not yet Resolved; if our index directional hasn't completed it's loop--and our flow play hasn't hit the target--then probability dictates that we still have more to go.

Wednesday through Friday Analysis:

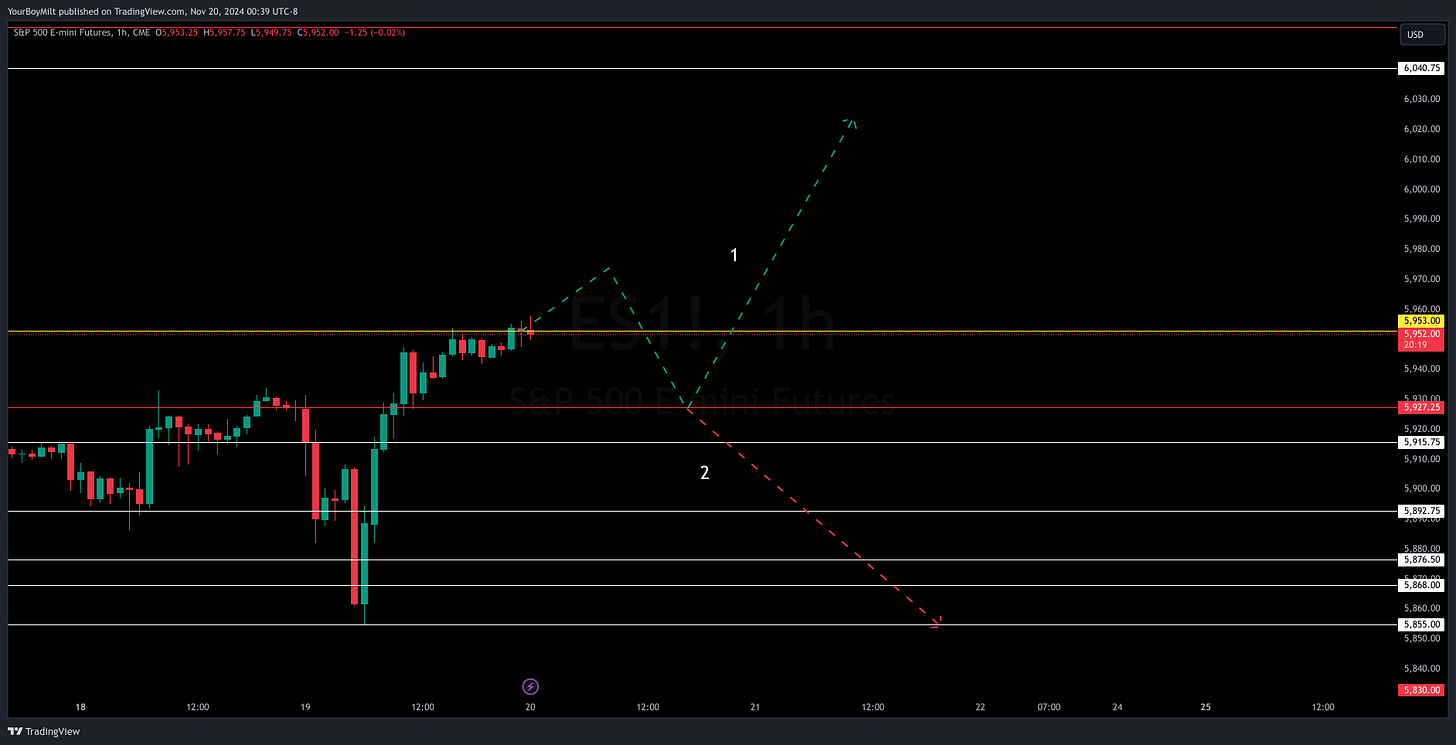

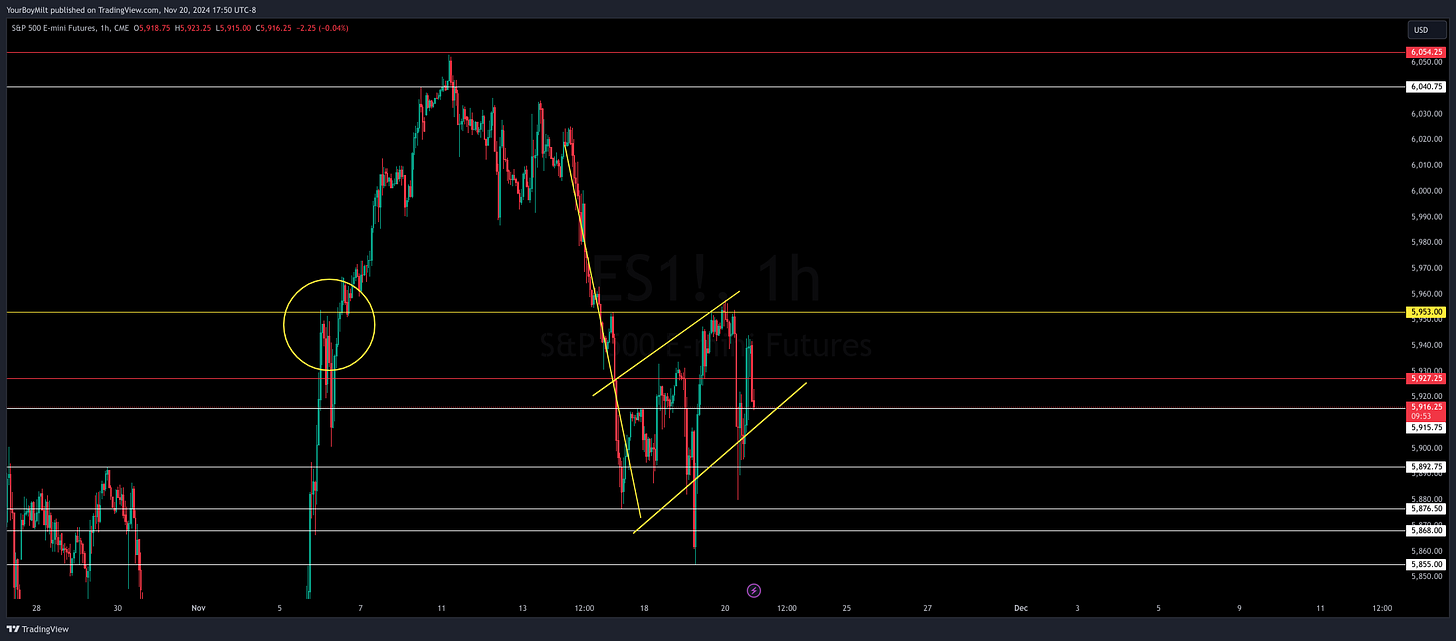

✌️Two possible scenarios I see into tomorrow (written Tuesday night)

(NOTE: this ended up being today so we can see how it played out!)

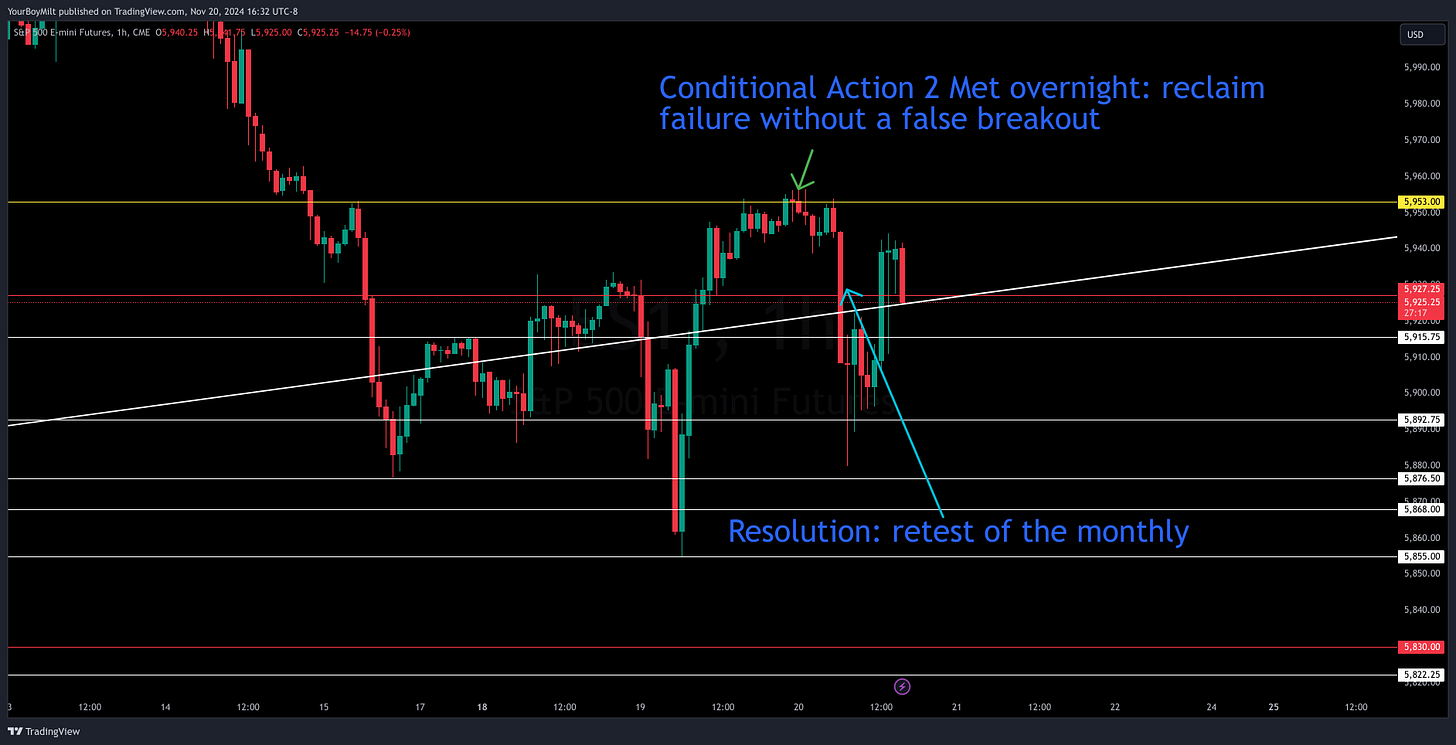

1) False upside breakout--1) the quick disintegration would be if it can't hold a pump above ES 5955 (gold line), 2) the slower breakdown would be if it does become a bullish move at which point the backtest of the breakout would come at some point to be determined.

2) Loss of level overnight with no breakout: in this scenario the reclaim isn't on the table as SPY fails at 5953 here overnight and sends us to to a test of the monthly.

📈Which did we get?

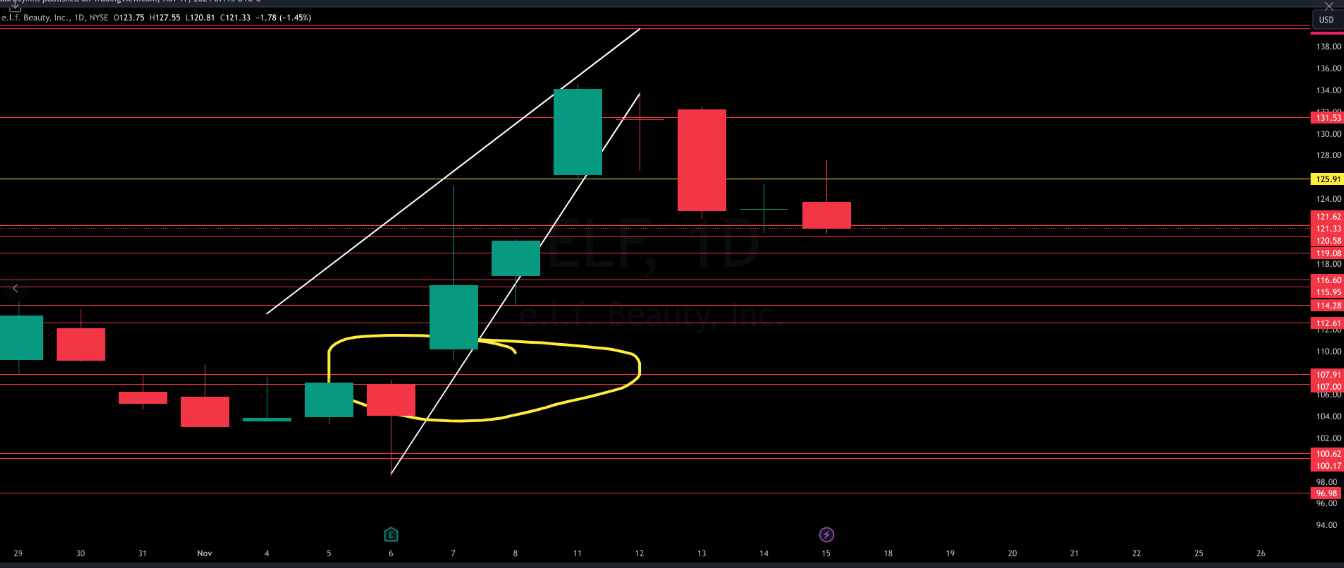

🗒Flow Gliding: Why I have confidence in our current downside flow play ELF according to our Logic Strategy

Note: this was written the night before ELF popped in the morning. It was the YEET Plus bearish flow pick of the week, and the YOLO of the Day before close Tuesday.

Keep in mind that our current theory of SPY is clearly bearish though we are not getting in over our head an keeping an open mind as the backdrop. Our flow plays are a natural extension of our directional read.

💅Our read is bearish—and there is no more bearish flow currently than ELF weekly Puts

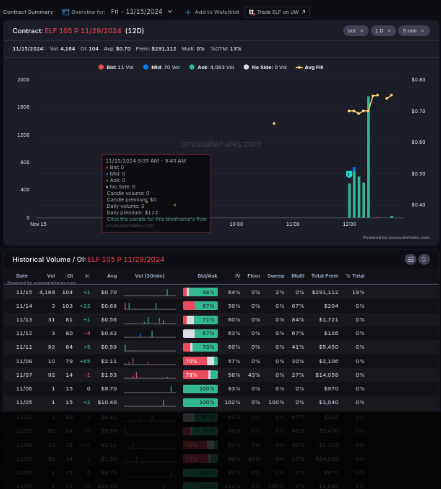

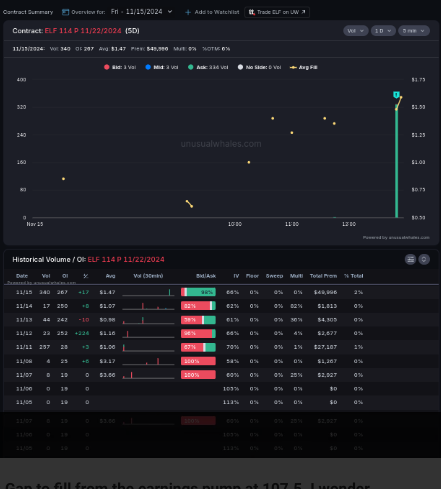

ELF Flow Revisited from Sunday—what contracts we like. What’s important to note here is the factor I’m always going on about—having TWO contracts to build confidence something isn’t a hedge. Two whales BOTH hedging DEEP OTM ELF puts on a non-news week with expiry two weeks away? No shot that’s hedging.

It's clearly got the flow, let's look to the chart. The daily Gap candle that rejected Friday is a perfect entry for this trade either way—we always preach that gap closure almost always result in opposite direction movement.

Plus—it has a daily Gap to fill down to 104/105—just enough to put the 105p whales in the money, which would be our final target

And the rest is history….

🕵The SPY Section

Why I believe 575 is coming sooner rather than later, likely by Monday close.

⚠️TLDR: It’s a bear flag my guy.