📖 THE BOOK OF FLOW: Do Whale Filters Work? pt. 1

📖 THE BOOK OF YEET: Do Whale Filters Work?

Part I: Evidence From the Tape

Availability Note:

All filters discussed in this study are currently included in the YEET Plus Filter Suite during the holiday sale. YEET Plus members also receive access to the YEET Discord, where all filter signals are delivered automatically in real time. No manual scanning required.

🧠 I. The Question This Is Built Around

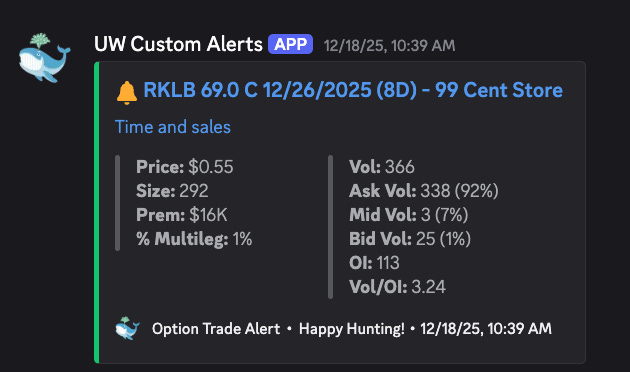

What led me to write this was seeing a couple of key things Friday—such as RKLB whcih was alerted in the YEET Discord on Thursday with 15% OTM contracts expiring in one week go for 20% the very next day.

Most traders encounter opportunity only after price has already moved.

This section of Book of YEET is concerned with whether the derivatives market definitively provides visibility earlier in the process, before moves become obvious on the chart.

The central question is deliberately narrow:

Can abnormal options flow, when filtered correctly, identify stocks that later become the day’s largest gainers before the move becomes apparent in price?

This is not about prediction or certainty.

It is about advance detection of pressure building beneath the surface.

Friday’s session provided a clean testing environment. The market produced a wide range of double-digit gainers across unrelated sectors, including both news-driven and positioning-driven moves. That dispersion allows us to evaluate where flow analysis succeeds, where it fails, and why.

🔍 II. What Was Tested (And What Was Not)

Clarity of scope matters.

🚫 This study does not attempt to evaluate:

Trade execution

Entry or exit precision

Profit capture

Whether options buyers timed the exact day correctly

✅ This study evaluates one thing only:

Did the YEET flow filters detect unusual, directional options activity ahead of time in stocks that later ranked among the top gainers of the day?

If the filters surface a majority of those names before price expansion, they function as a meaningful screening mechanism rather than noise.

📦 III. The Dataset

The starting point was the list of Friday’s top gainers, ranked by percentage move.

📈 Total top gainer stocks analyzed from Friday: 25 (the top 25 stocks in the market, not cherry-picked)

🧱 Minimum move threshold: approximately +10%

🚀 Largest outlier: +100%

Each ticker was then run backward through the tape to determine whether it triggered at least one YEET filter prior to, or during the early stages of, accumulation.

Filters evaluated (all available for YEET Plus):

🐋 Nautilus

🧹 People’s Screener / 99 Cent

⚡ FARCRY

🧠 Freelance

🦇 BAT

A stock was marked as “caught” if it appeared in any filter before the price move became fully extended and had time left until expiration on Friday.

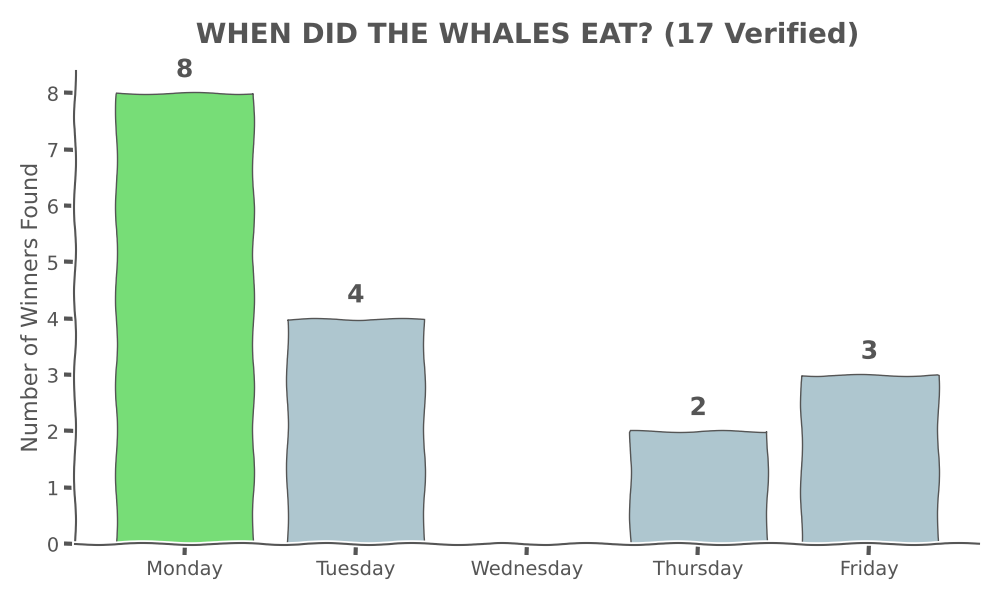

📌 BONUS OBSERVATION: The Monday Effect

One important contextual pattern stood out during this review.

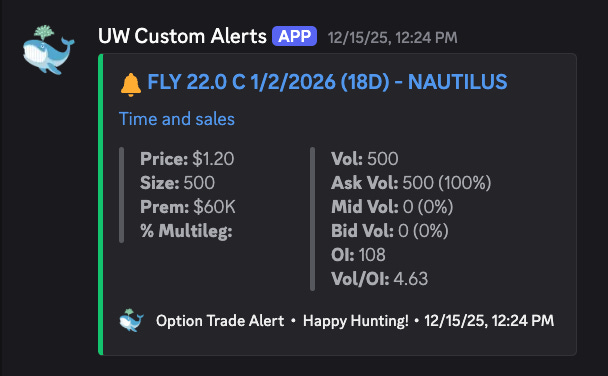

When we traced the flow history of Friday’s top gainers backward, Monday, December 15 appeared repeatedly as the origin point for advance positioning. A large portion of the stocks that finished Friday as top performers first triggered filters early in the week, often on Monday, using contracts that expired that same Friday.

Also of note, this Monday was a sginificant red dip from opening highs—usggesting whales may buy.

This suggests Monday may function as a primary intent-setting session for weekly moves, particularly for short-dated contracts targeting that week’s expiration.

We will be exploring this further and testing a day-of-week based enhancement for YEET Plus, focused on early-week flow that historically precedes late-week expansion.

ACTIONABLE: BAT Filter (Bought Against Trend, available for Plus) is likely the most valuable filter to use

🎯 IV. The Primary Result: ~70% of Friday’s top market gainers showed up with bullish contracts on filters

Out of the 25 highest-gaining stocks on Friday:

✅ 17 showed identifiable flow signals in advance

❌ 8 showed no detectable signal

📊 Advance detection rate: approximately 68%

This figure is the foundation of the chapter.

In practical terms, nearly seven out of every ten of the day’s biggest gainers were already exhibiting unusual options behavior on our filters before they became obvious leaders by price alone.

🧾 V. The Evidence Table

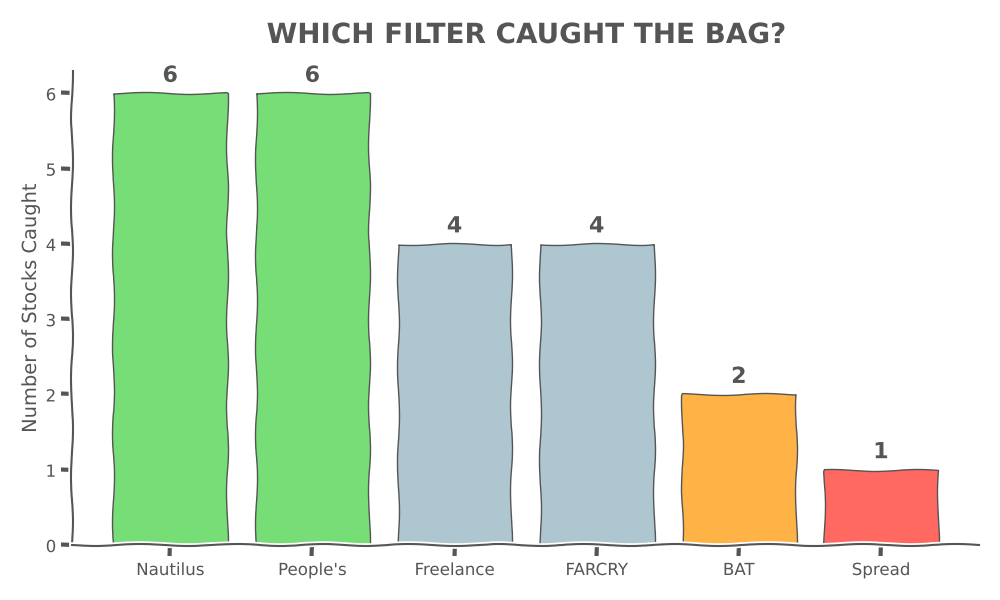

🧠 VI. Filter-Level Analysis

The filters are not interchangeable. This session shows that each one tends to surface a different type of opportunity.

🚨NOTE: The most affective filter, NAUTILUS, is the YEET’s first Super Filter and the link is not publicly available, but it gives automatic alerts in YEET Discord Private Plus channel.

🐋 Nautilus: Momentum and Rotation

Nautilus caught five of the top gainers, including FLY, RKLB, CCL, HUT, and IREN. These names shared a common trait: sector-level accumulation rather than isolated, single-stock events. Space and crypto-linked equities both exhibited repeated buying pressure across multiple names. Nautilus appears especially effective at identifying momentum sweeps and rotation, where capital flows through a theme rather than into a single ticker.

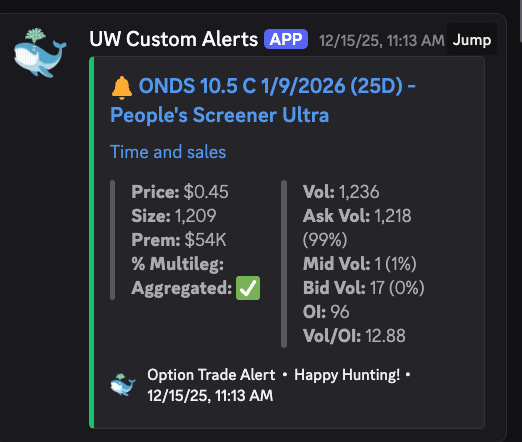

🧹 People’s Screener / 99 Cent: Under-the-Radar Accumulation

People’s Screener also caught five names, including ONDS, BMRN, ASTS, PONY, and IREN. These stocks tended to be lower-priced or less prominent, particularly in biotech and secondary momentum names. While this filter did not consistently capture the largest outliers, it demonstrated breadth and reliability in identifying quieter accumulation that later resolved into double-digit moves.

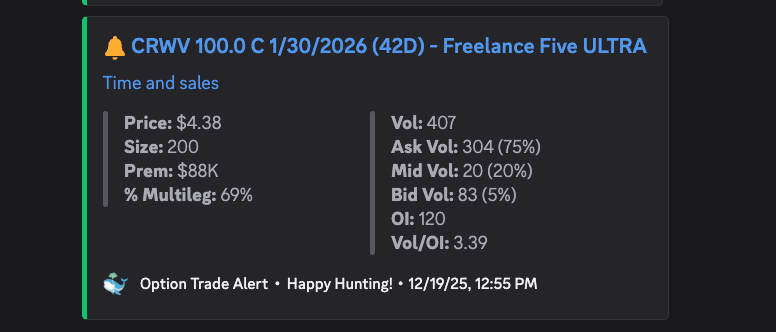

⚡ FARCRY: Volatility and Squeeze Behavior

FARCRY caught four names: CRWV, CCL, NBIS, and LEU. These stocks tended to exhibit sharper, more vertical price action. FARCRY’s identification of CRWV, one of the most significant large-cap gainers of the day, highlights its strength in detecting convex setups where positioning suggests a potential volatility release.

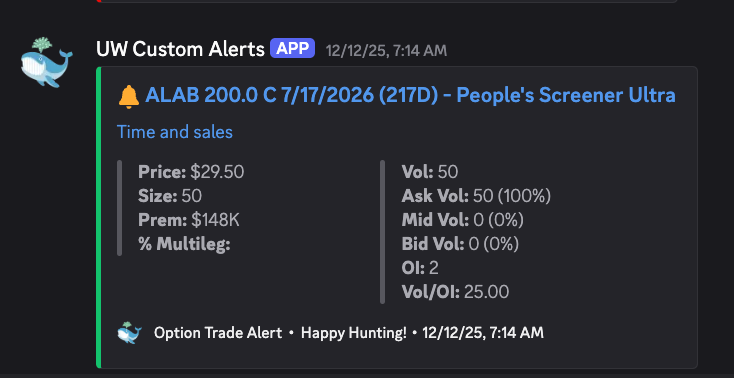

🧠 Freelance: Technology and Infrastructure Bias

Freelance also caught four names, including CRWV, APLD, LEU, and ALAB. The filter showed a clear bias toward technology, compute, and infrastructure-related stocks. In multiple cases it overlapped with FARCRY, suggesting that confluence between these filters may indicate higher-quality opportunities.

👻 VII. The Misses and Their Meaning

The stocks that were not detected include SONG, DJT, EWTX, and TMC.

These names were largely driven by news, narrative, or retail amplification rather than sustained institutional positioning. Their absence from the filter results aligns with design intent. The filters are built to surface deliberate positioning, not one-off shocks or meme-driven dislocations.

🧱 VIII. What This Part Establishes

Based on this single session, this analysis shows that:

Monday is likely the most affective day (will provide further research in coming issues)

A clear majority of the end of week’s biggest gainers exhibited advance flow signals

Different filters specialize in different market behaviors

Overlap between filters often coincides with higher-quality moves

🔭 IX. Why This Matters

If abnormal options flow can narrow the market down to a subset that includes most of a day’s eventual leaders, then flow analysis functions as a screening lens rather than a prediction engine.