📖 The Book of Flow: The Trapture pt. 1

The presence of absence sparks some whale theory....

📖 The Book of Flow: The Trapture pt. 1

🌀 Part 1 — The Setup

Something’s forming that looks like the final trap of this leg — and whether it catches bulls or bears will define the next few weeks.

On ES, the megaphone we’re testing right now tells you everything: widening volatility, swings expanding both directions, liquidity being yanked from either side. It’s anyone’s game until the next decisive tag.

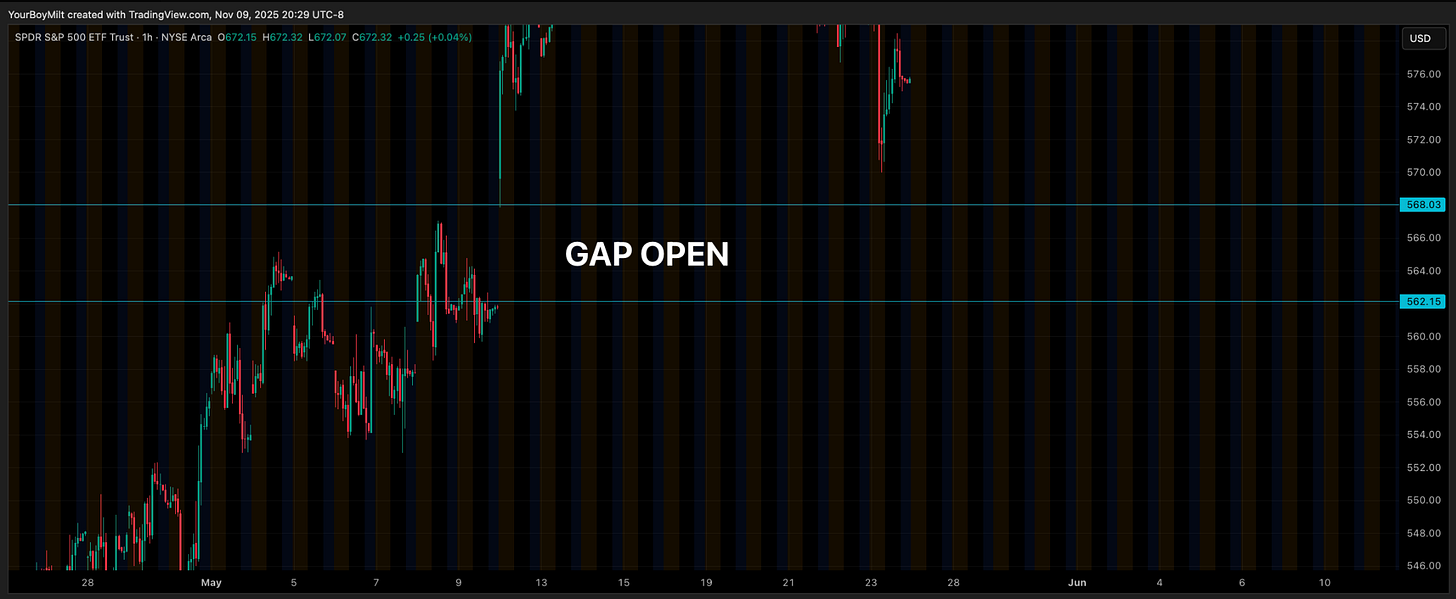

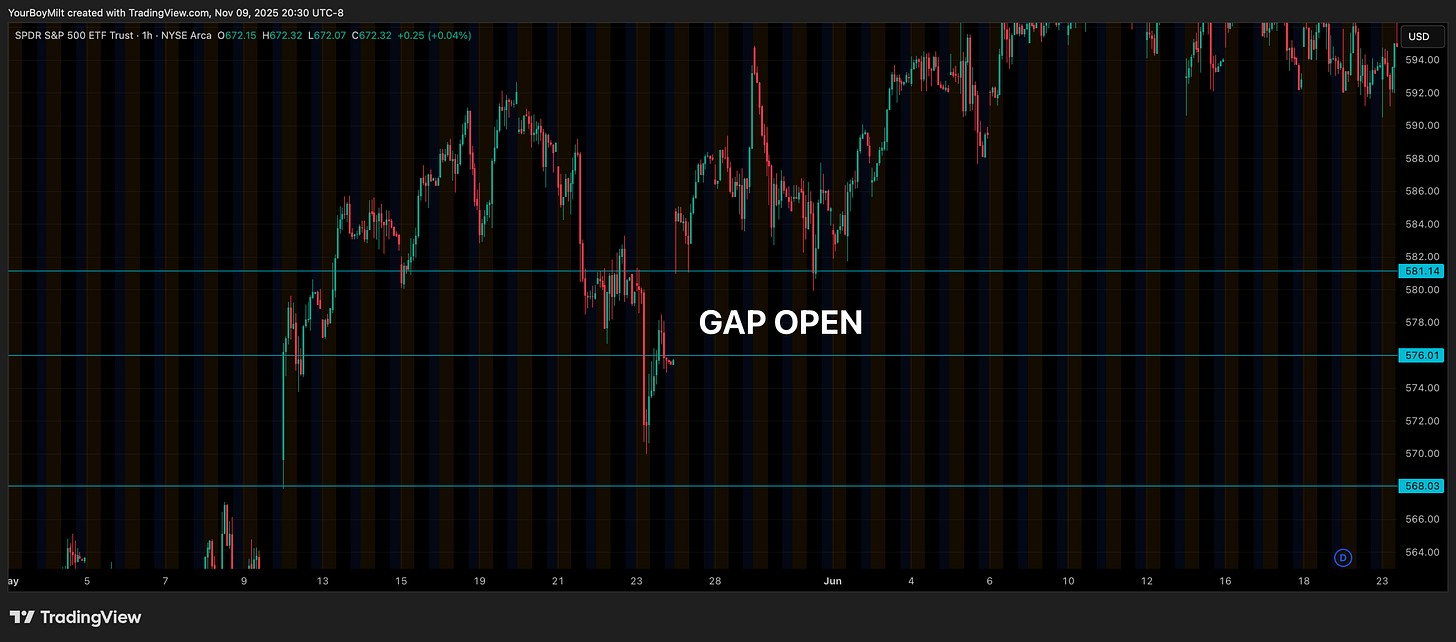

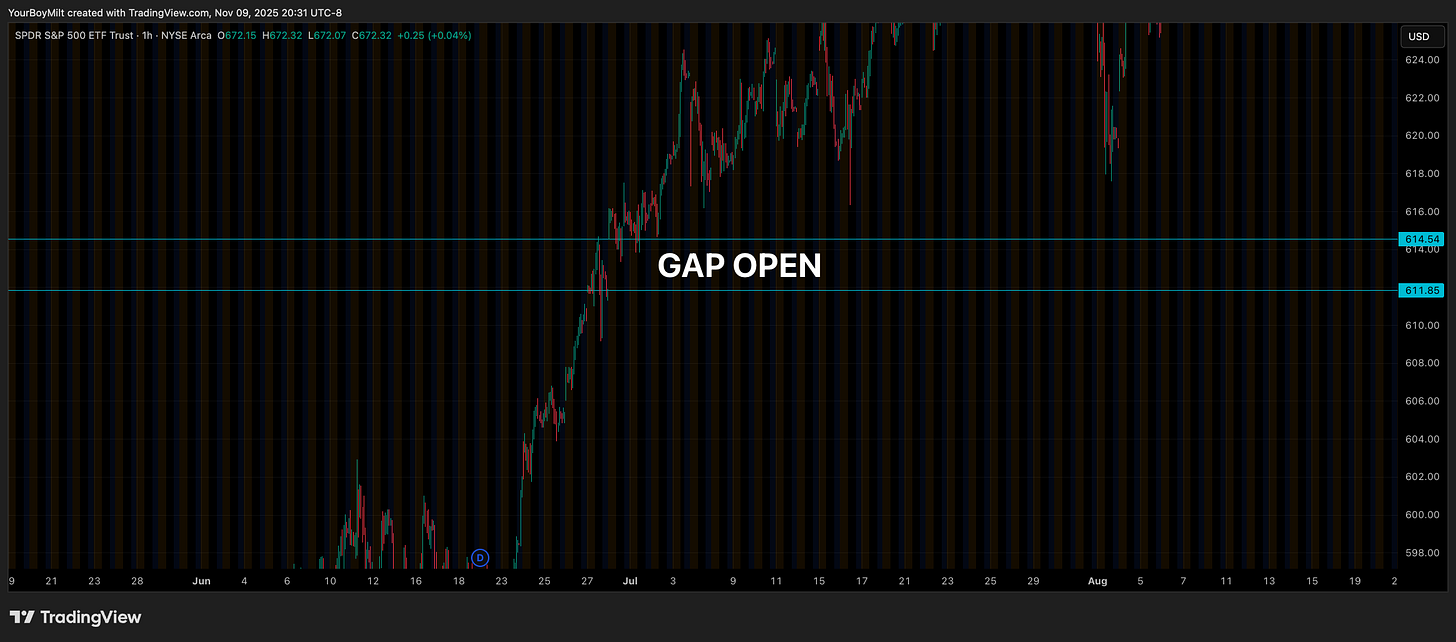

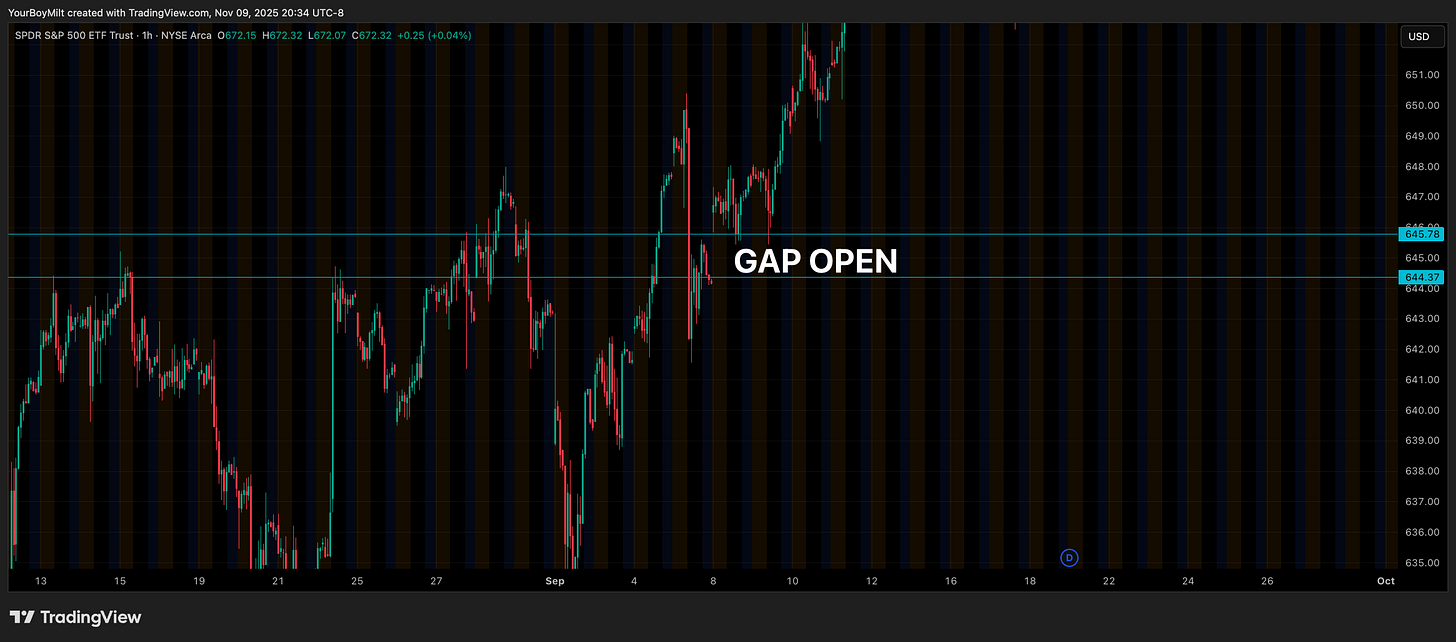

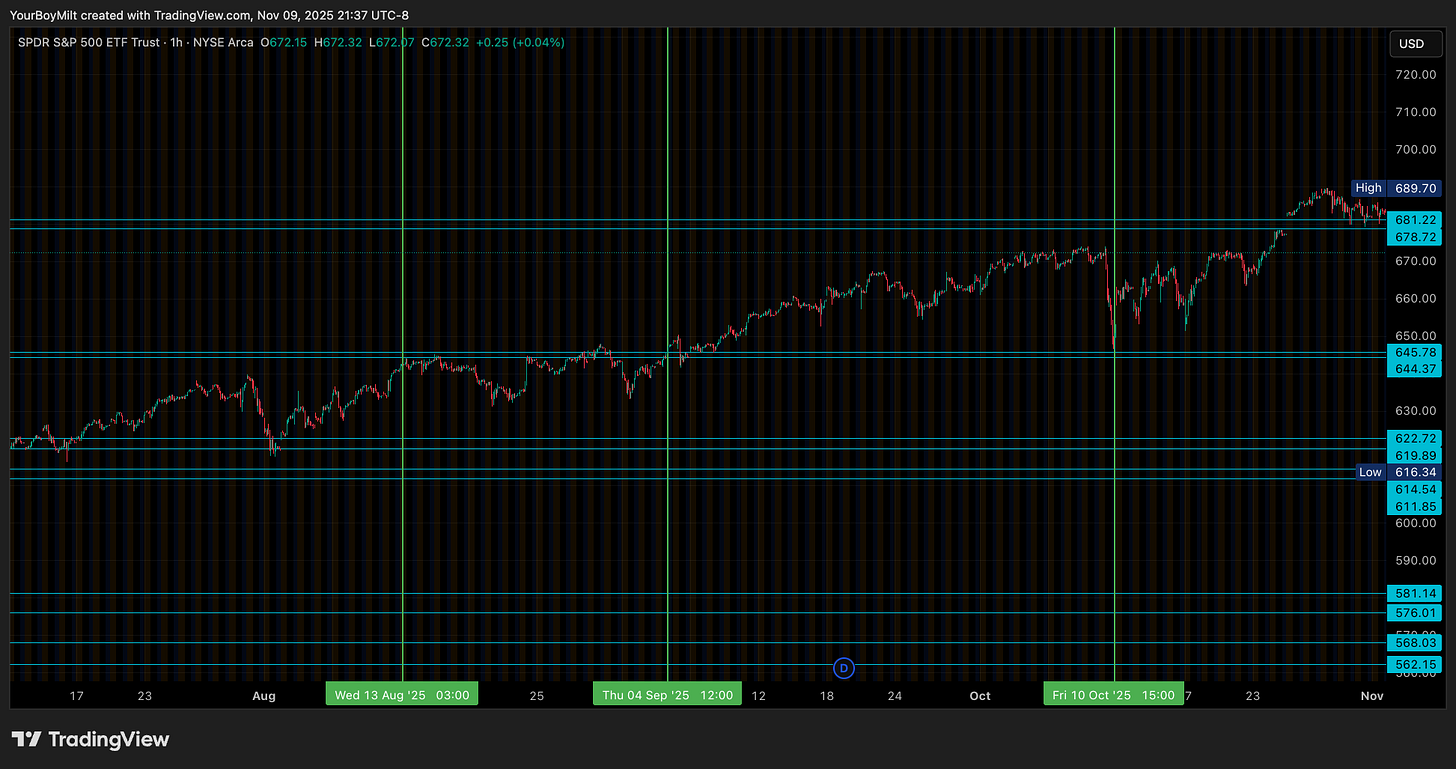

But what’s really setting up the Trapture is the hourly gap map on SPY.

👀 Below us sit stacked open voids — 562 → 568

🤢 576 → 581

🤔 611 → 614.54

😩 644.3 → 645

😇 and above us, one stubborn gap at 681.22 → 678.72 that almost filled but didn’t.

💡 Hourly gaps aren’t theory; they’re mechanical truth. They open → they close.

The only question is which direction closes first.

If price spikes up and fills that top gap then rejects, that’s likely exhaustion — the megaphone top rail doing its job before a new leg lower.

If we flush before filling it, the unclosed gap above becomes a time bomb that pulls price back up later, meaning bears should add more time and caution but that we’re finally going down.

🐍 Welcome to The Trapture.

🐋 Part 2 — What the Whales Say

This doesn’t happen in isolation. Look back through the whale tape from summer through early fall — every major run-up in SPY was preceded by clusters of large bullish call buys.

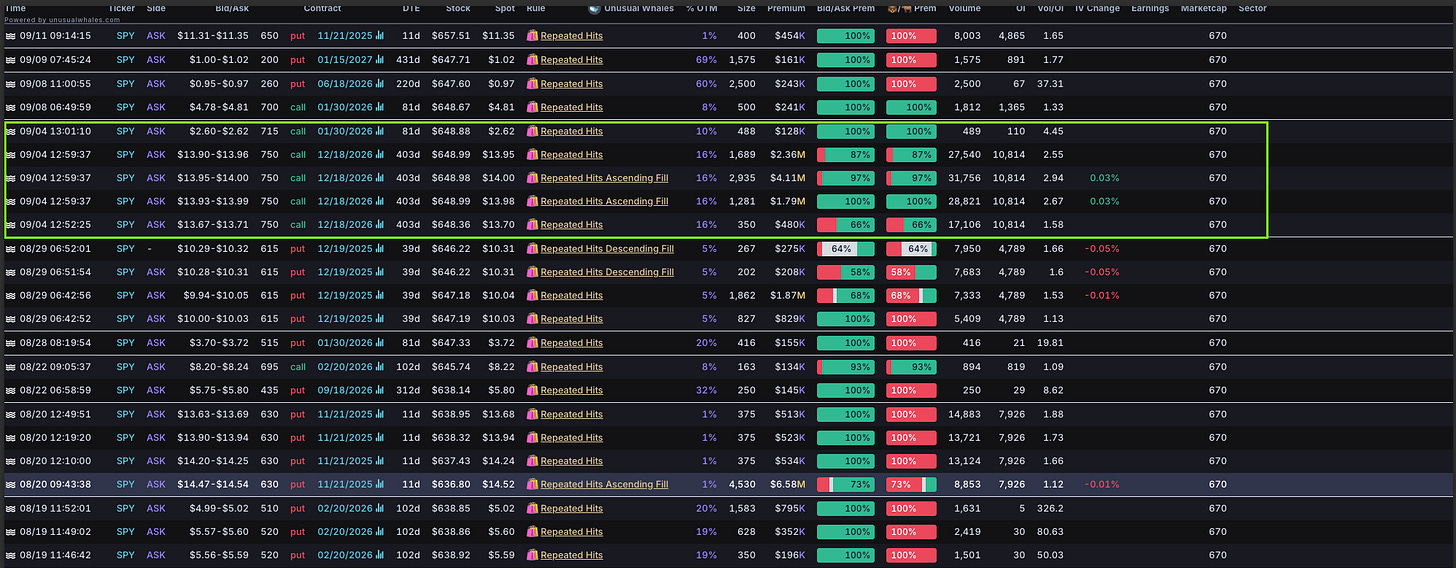

📈 June through September: repeated SPY 700–750 calls and others stacked across months, big sporadic blocks that preceded or coincided with SPY price runs:

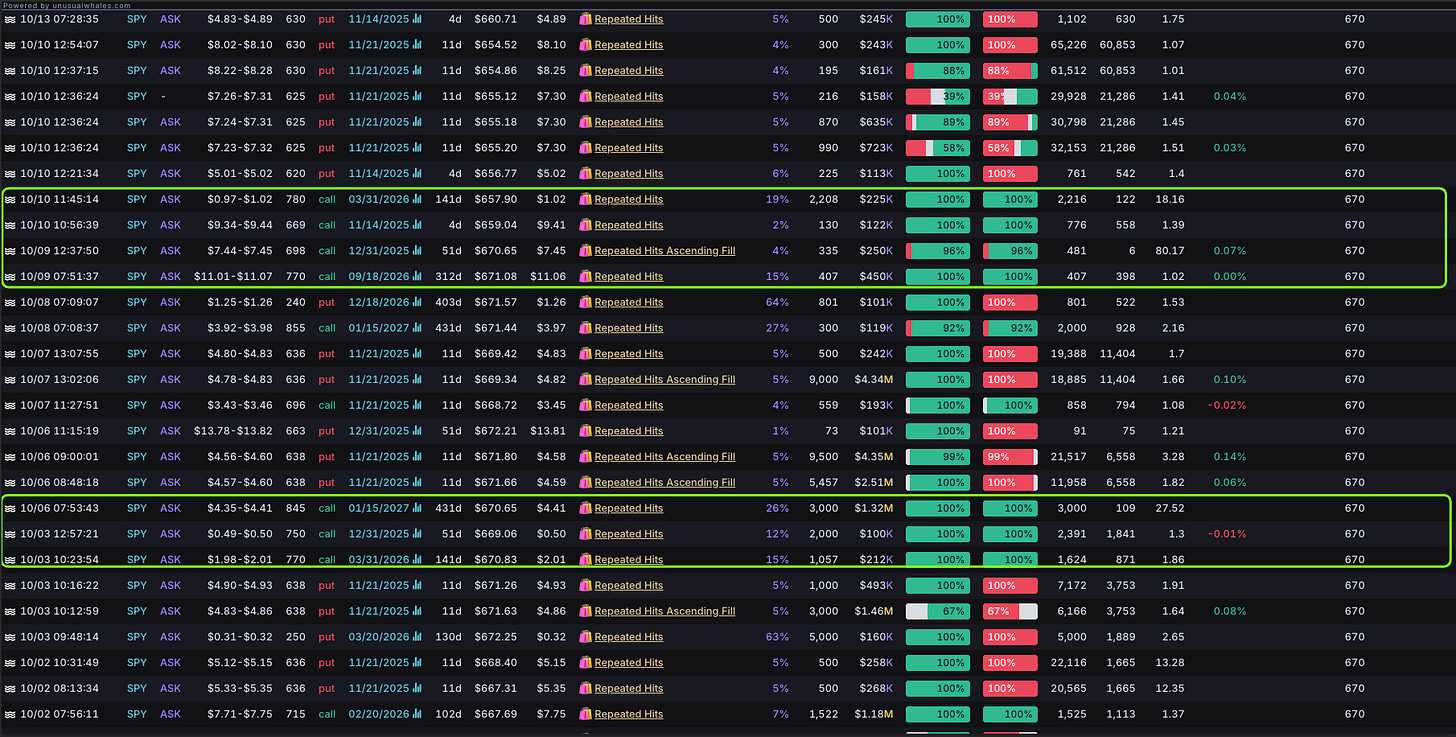

📈 Early October: thinning out:

💡 Here the largest block are visualized before price runs in SPY:

🕯️Late October into November: silence:

That’s the tell — the bulls have stopped believing in their own rallies.

When call activity dries up even as price tries to bounce, it’s not indecision — it’s a withdrawal of conviction.