🤓The Daily PARI + 🐳 Whales to Watch

What our homemade Price Action Risk Indicator says today about the index

📰 The Daily PARI — Aug 11, 2025

(for “Just tell me Uppies or Downies, Milt?) scroll down to takeaways

🧠 What’s PARI, Anyway?

The Price Action Risk Indicator (PARI) is our custom gauge for reading the market’s true temperature — not just where price is, but how it’s behaving. It blends a few key forces:

Momentum: how far we’ve moved compared to recent history.

Volatility: how wild (or chill) the daily moves have been.

Trend Persistence: whether the tape’s been grinding in one direction or just whipsawing.

The magic comes from how these are ranked, balanced, and blended into a 0–100 score where higher = stronger, smoother trends and lower = choppier, riskier setups. We don’t give away the exact recipe 🥫🔒, but you can think of PARI as a mood ring for the market — it lights up when conditions are aligned for momentum to stick, and cools off when the wind shifts or the water gets choppy.

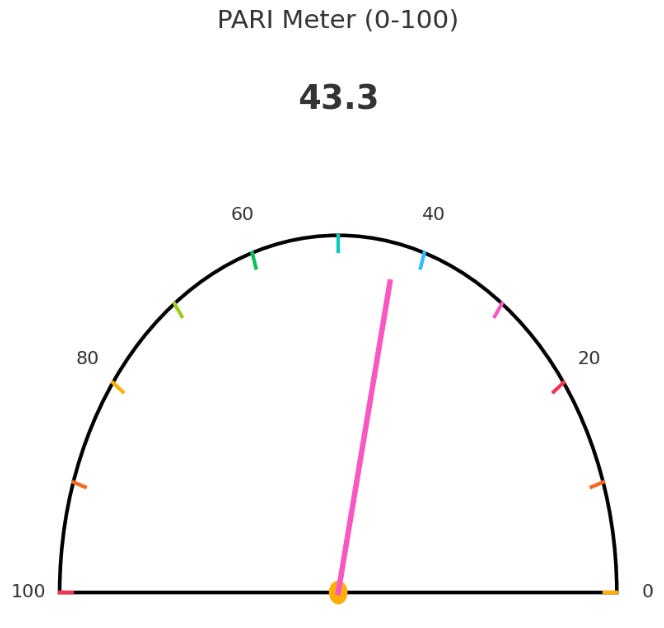

🎯 PARI Meter (0–100)

Score: 43.3 (provisional — 1.5 hrs left in today’s session)

Mood: 😐 Neutral-to-slightly-bearish — chop zone. Not a “dump it” 🚫💰, not a “send it” 🚀 either.

Why?

📉 Momentum (10d):

-0.06→ price is a hair below where it was 10 days ago → drags score down.🛏 Volatility (10d):

0.86%daily stdev → low vol historically → props score up a bit.📏 Trend Persistence: basically flat at

0.002%→ no lift.TL;DR → Fading momentum + tame vol = low-40s PARI.

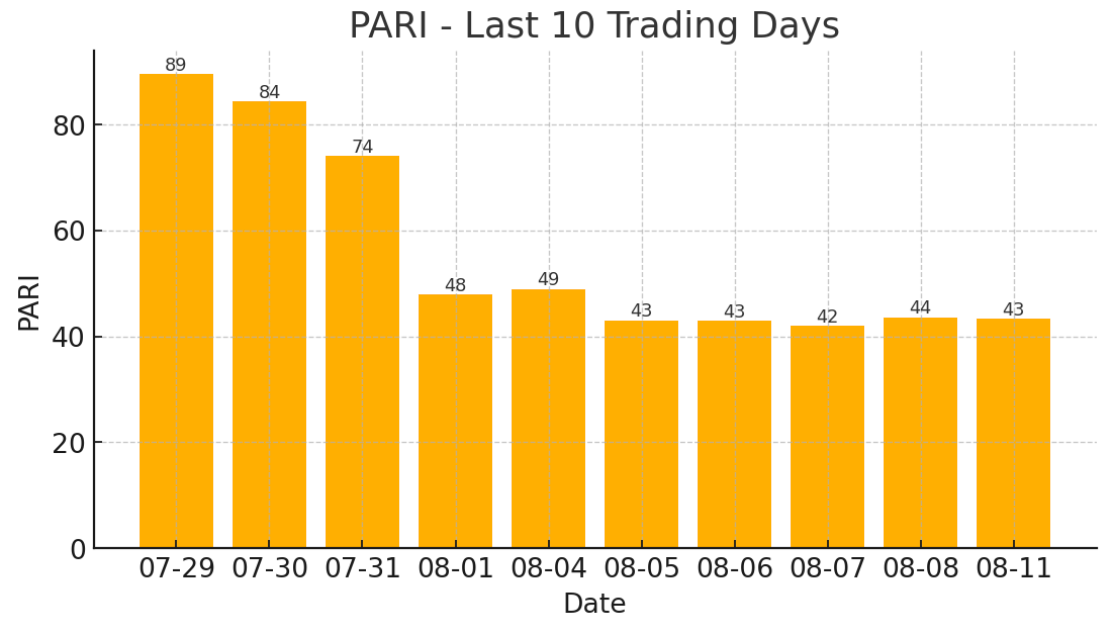

📊 Past 10 Days — Cooling & stabilizing

Recent run: high-80s → mid-40s over two weeks.

1d change:

-0.32→ tiny slip.3d change:

+0.28→ curling up again.

Read: The dump already happened — now it’s sideways healing, not fresh weakness. 🩹

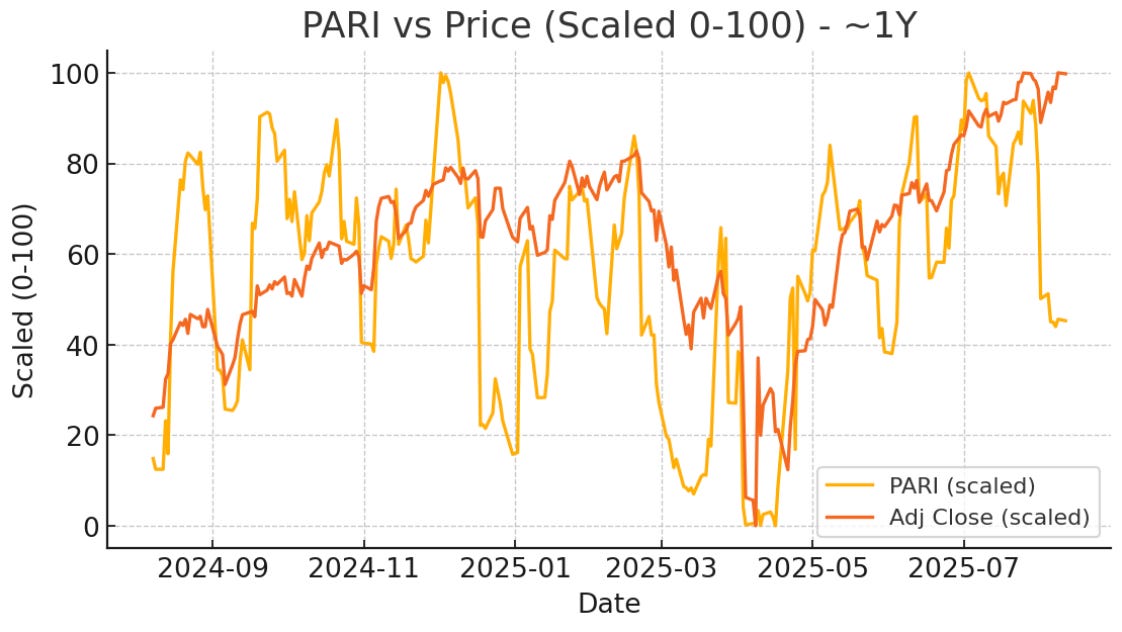

🪞 Historical Context — Price vs PARI Overlay

We’re near highs 📈 but PARI is only mid-pack.

In the past, this combo = digest mode: price grinds while PARI rebuilds.

Translation: less “rip your face off” moves, more slow-burn drift. 🔥🐢

🔮 Predictive Edge — What history says from here

Your PARI bucket today: Decile 3 (lower-mid zone).

I backtested similar conditions (+ sub-filters) → here’s the juice:

Base (just same PARI zone):

+1d:

+0.22%avg, ✅ win rate 58%+5d:

+0.32%avg, ✅ win rate 58%+10d:

+0.38%avg, ✅ win rate 63%

Same PARI zone + near 52w highs:

+1d:

+0.13%avg, ✅ win rate 54%+5d:

+0.64%avg, ✅ win rate 77% 🔥+10d:

+0.71%avg, ✅ win rate 54%

Same PARI zone + PARI rising last 3d:

+1d:

+0.15%avg, ✅ win rate 57%+5d:

+0.47%avg, ✅ win rate 63%+10d:

+0.15%avg, ✅ win rate 63%

📌 YEET Takeaways

Today: PARI in meh-now, better-later mode.

Near-term (+1d): mild upside bias, no raging signal.

Swing (+5d): this is the sweet spot → history says +0.4–0.6% drift with solid win rates, esp. if we hold highs & PARI keeps curling.

Risk flips: 🚨 A jump in realized vol OR fresh momentum break down sends PARI into the 30s → defensive posture.