🌕THE M A R G I N: A $150 Account Training Exercise, bonus Video Explainer for ✅ 400%, ✅ 450%, ✅ 400%, and ✅ 170% flow trades this week

We will be blessed beyond measure if this makes it to EOD Monday.

🚨Why are we doing this seemingly absurd $150 challenge, The Margin?

Because $150 isn’t that absurd to a lot of people, and the holidays are coming up, I love when I see people say like “that play got me an extra movie ticket” and stuff like that. Most of us options gang are just tossing a few bucks leftover from a check into the well. Hopefully this helps ya toss a bit better

It’s TRAINING: I really don’t care if I flame out day one it’s not that kinda thing—I specifically want to work on my entries and targets and start to define my SPY/Flow balance concretely. This forces us to plan and think in a way that will be beneficial in nuanced ways as we continue.

I just thought the Martian was a funny meme and said eh, fuck it.

⚠️BIGLY CHANGES: DISCORD

We’re going to be in the Discord a lot more because like four different platforms for information and communication is insane for myself and everybody else.

The Free Discord will remain unchanged including trade alerts etc, except for the addition of Circus Maximus

YEET Plus subscribers will have an add on room where they can talk about the plays from plus

Anyone in the Discord—Free, the Plus lounge, whatever it is—needs to be following Nate because in addition to being tied for best flow trader I know (snor and stoner) he’s going to be stepping up as a Community Manager for this thing.

Let's break down what we can afford; basically we have two flavors of Better-Be-Right...SPY 0DTE and weekly contracts.

And not the safe ones, my friend.

💀Goal 1: Double Contract Purchasing Power / Margin for Error

We need to get to enough capital so that we have some breathing room--plays have to develop, and you can't enter perfectly every time. So, we need $250-$300 to be able to pow wow again on next steps— $300 takes us from 1 and a half plays that are somewhat forced risk into a 2-3 play comfort zone

Strategy: We need a mid day SPY trade that can get us 50-70% and (ideally) an EOD index trade with potential. If it's not there we're looking at a flow swing. So let’s have a gander…

🐻SPY Analysis: It is looking f*cked

SPY is bearish. Not because I'm a new bear from Friday--but for the reason I said this would happen Wednesday--we're rounding off as trends are breaking.

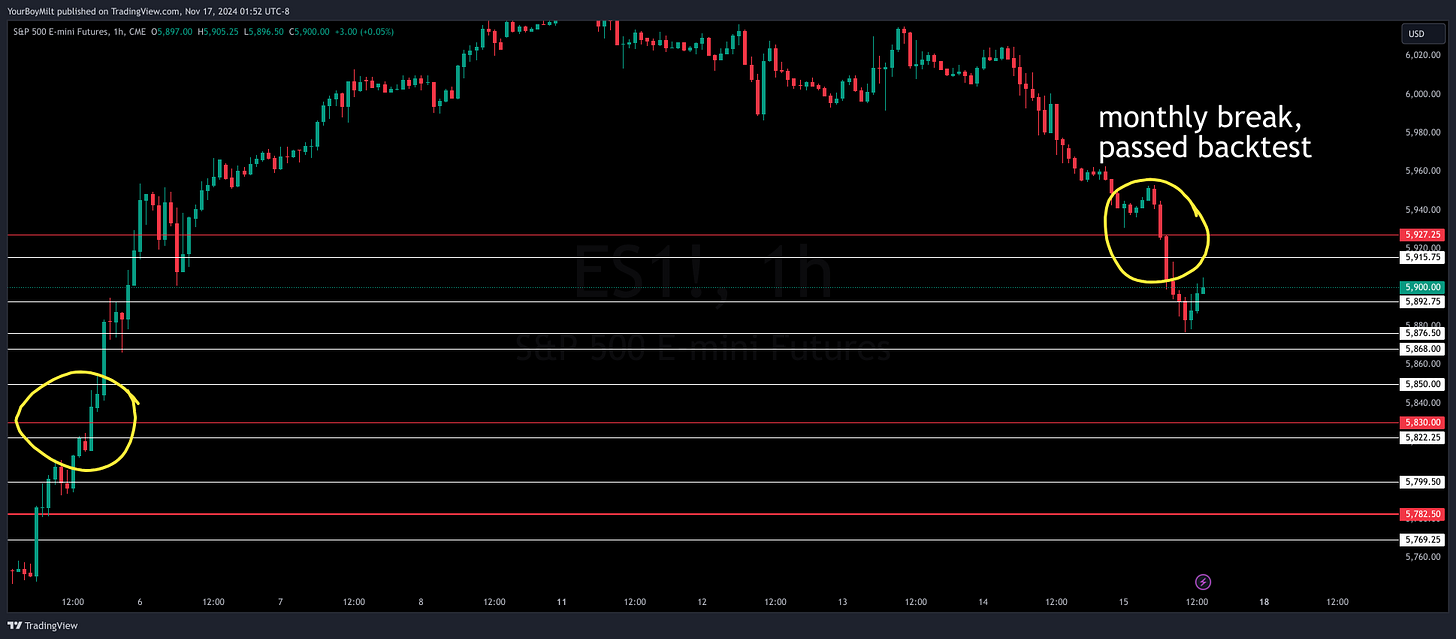

ES: The Imperial Bear Destroyer? Vanquished.

ES Monthly level? Broken, and with a proper backtest on the way down that means technically our next stop is 5830.

“So what’s the problem, guy? If it is bearish buy puts, no?” Well, SPY illustrates the problem given our net worth of $150…

Notice the yellow box of bunched up blue levels—those are all former Gap levels, which tend to move us around like a pinball. So, anything in that range is potential chop, reversals, and other things that a man of my current means simply can’t entertain.

So buckle up boys and girls, what I’m saying is we have no choice but to time a counter trend pop perfectly or catch the bottom of this move. Or we lose it all—no sweat….

👍Plan 1: The Pop

If we get a pop above the 586.2 monthly it’s likely they want to close that lil Gap to the upside—whether it’s a false breakout or not doesn’t matter to us (it will be), we just want to catch the free points off a clean retest.

✌️Plan 2: Channel/Monthly Support Catch

Areas of intersection of structure and levels are gold—if 575 gives us a support hold that’s the shot to shoot

🌊Free Game: The Flow D.E.N.N.I.S. System

The basic methodology behind our most recent picks including:

✅ GME 170%

✅ UPST 400%

✅ SNOW 400%

✅ RIVN 400% (whoops)

🐋The Flow Section: Whales to Watch

Being that I have less than an X-Box 360 to my name, it’s imperative that flow have the following criteria:

Low IV: Can’t just be bleeding chips for the fun of it

Some Degree of Index Independence: We need plays that can take a little heat if the market is going the opposite direction. Materials and commodities are great for this

Cheap: Again, $150—American.