🗞The Monday Sunday-ish MACRO YEET: TSLA and CVNA! SIGNATURE Trade!

A jam packed start to your week get up and read it son!

💡Editor’s Note: You’re in for a treat, cuz we got a MACRO YEET. Don stopped by for the intro this week and as a reminder—we take no payments for their participation, we just respect our friends’ work.

The lineup is: Macro Intro from Don, then Milt with some SPY, some flow, and a signature trade. Happy Hunting.

Good Sunday evening YEET Readers and Community, (Monday Morning—my bad. —Milt)

Hopefully some of you remember myself or the MacroEdge name from the last several years when I collaborated with Milt! It’s been exciting to watch the YEET thrive and Milt gave me an early platform to share many of my writings on the state of the economy, employment, and of course… (oil), which I write less frequently on today than I would like to. We’re cooking up some exciting things for 2025 and will include much more for you all in the YEET on the macro data & market outlook side of things, including RE data, employment data, valuation modeling, & much more, which I think you all will love. You all can catch some of our incredible data here over 2025, or through MacroEdge Ozone, which I’ve linked below - excited to see you all around in 2025 and engaging with both Milt & myself on X.

Busy week ahead for most of us as we get readjusted back to the normal market schedule. It’s a bit of an odd week this week for markets since the NYSE will be closed on Thursday, January 9th, for a Presidential Remembrance Day, honoring the late Jimmy Carter. There is quite a bit of data coming out this week, with the most important data coming on Friday with the December Employment Report. December’s Employment Report will set the tone for 2025 and we’ll have much more in our Monthly MacroEdge Labor Market Report next week on the overall state of labor, but we’ll have more below, and on Wednesday and Friday following the employment report. See you all there.

Busy Data Week

Monday: S&P Global Services PMI - December

Tuesday: ISM Services - December, JOLTs Job Openings - November

Wednesday: ADP Employment - December, Crude Inventories, FOMC Minutes - December

Thursday: Holiday

Friday: December Employment Report, UMich Prelim - January

Optimism Remains the Name of the Game

Optimism remains the name of the game going into the 2025 year, and there’s really no other way of cutting it. While we have valuations at absolute extremes, and risks are abundant. Until any risk (which I still believe to be employment) rears its head, where operating in these miniature ‘macro cycles’ leading to small corrections in the market with sharp bounces in every instance over 2024. This may change into this year as we’re coming off the back of 2 outlier years in terms of total returns, but it’s important to remain open to the possibility of a 99 style year which would take everyone by surprise, as would a 2000 year, in which we’d see semiconductor names begin to rollover, along with technology more broadly. Speculation remains rampant in cryptocurrency & other gambling areas of the risk asset markets, although this doesn’t mean that risk has left the room.

If we see employment issues expand in the first quarter - expect to see some flight to safety action.

Housing & Manufacturing Key Areas for Employment this Year

The two real critical areas for cyclical employment this year are manufacturing employment and housing employment. Housing employment has not rolled over, while manufacturing employment has softened. Given how critical construction employment is on the overall employment picture - there are my ‘two to watch’ for 2025.

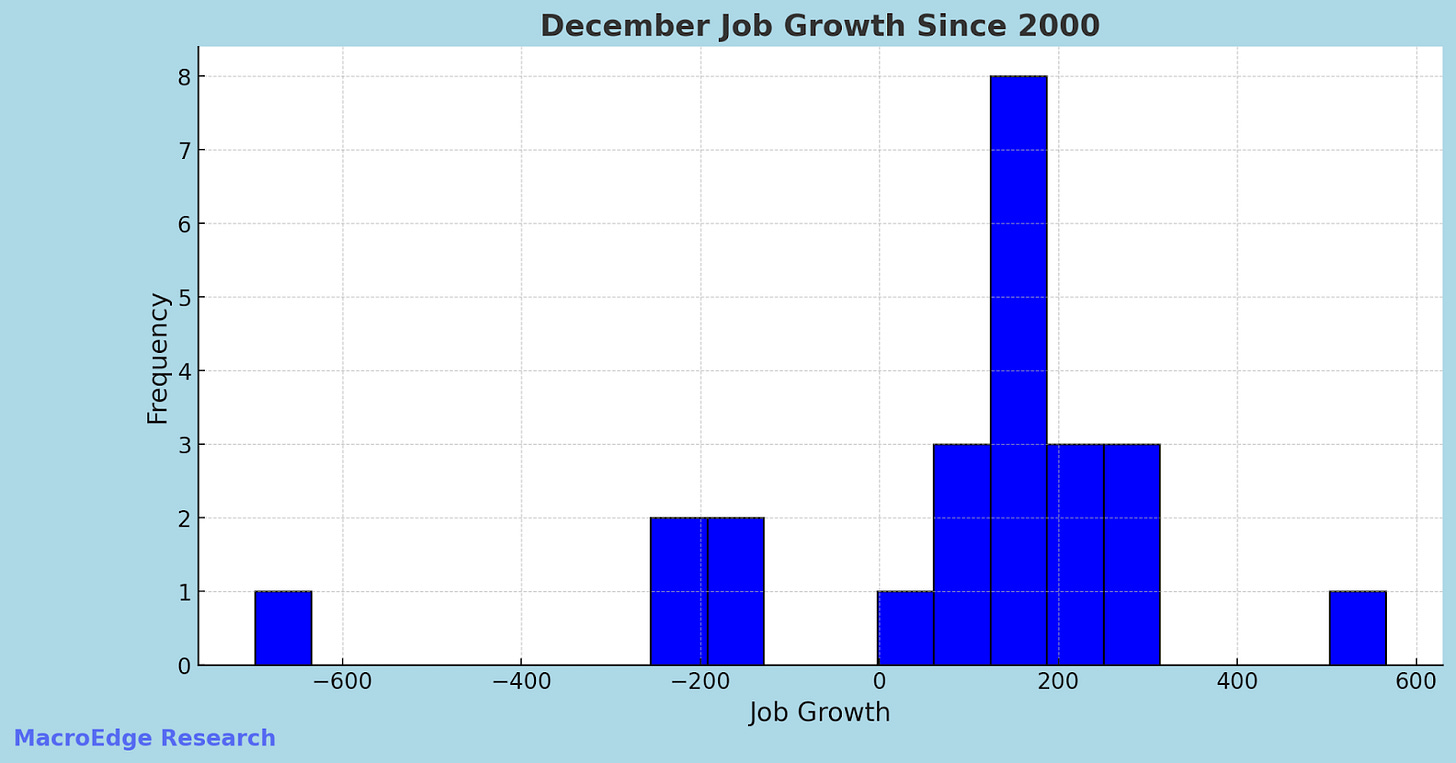

Peek at December Employment Data

Overall, the December labor data is likely to show continued softening on the aggregate, although I remain open to the fact that some firms may have ramped up hiring on the back of a Trump election victory.

Employment growth below 100,000 SA would be quite concerning, while 150,000 would be in-line with a typical December, and over 175,000 will likely send yields higher and lower future rate cut action odds from the FOMC this year.

Employment Report This Week

Given the ‘no rebound’ signal from the near-live employment data in December - I am not expecting much out of the December employment report. With the 10Y back up and the employment market remaining in the year’s long holding pattern, we’re looking for signs of a break to either the upside or downside for confirmation in 2025 of where the trend will be. With historical trends and markers, such as maximum employment being achieved, signaling this year - the risk to the downside remains as the hiring rate remains suppressed and has fallen sharply since the Fed began hiking back in 2022.

November’s figures are likely to be revised softer, and I am forecasting a slight increase in the U3 rate for the headline December print if payrolls come in less than 150,000.

If growth comes in below 150,000 - we’re likely to see further tick up in the U3 headline unemployment rate. For risk assets, however, that hasn’t meant much yet (as mass migration has continued to drive further consumption even with the unemployment rate increasing for the last 2 years).

January Rate Cut?

Don’t count it out just yet - if the employment report comes in soft enough. In order for a January FOMC cut - you’d need to see a 4.4% or greater headline print on the U3 unemployment rate, with less than 150,000 jobs created. Given the current threshold of 250,000 job creations needed per month to prevent a rise in the overall unemployment rate, it’s possible to see December unemployment tick up slightly to 4.3%, or to 4.4% if job growth slowed further, especially on a y/y basis. The 10Y above 4.6% is signalling the likely slowdown in the pace of cuts this year, although we’ll see where things stand after the December unrevised data release.

Final Thoughts

Get your jackets out for a very cold & busy rest of the week! We’re starting 2025 on a very optimistic note, even given the challenges experienced towards the end of the year. We’ve got many new and exciting things in the works for MacroEdge x YEET this year, and can’t wait to share it all with you in the coming months & years. This year will be big for RESights, our Macro Team, Vision Team, and much more, and we’re excited so many of you are along for the journey with us.

Have a fantastic start to your 2025 and let’s keep rocking.

Don

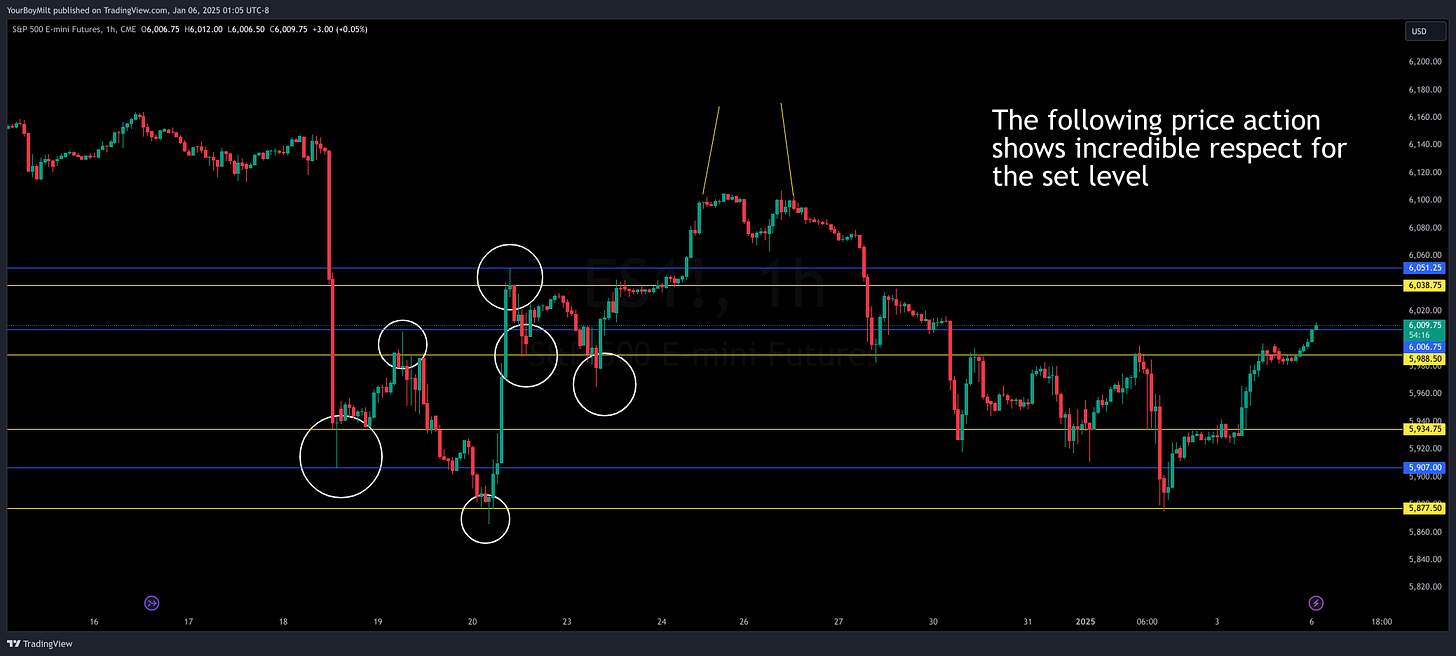

🤓Mystery SPY-ence Theatre 6,000 the Sequel: Revenge of the Reclaim

We were right with our directional calls this week for the most part—but those targets were tricky. If you recall, our idea was that SPY was going to hit 6,000 on the ramp up.

Well damn…we just hit it as I’m typing this, and it brings up a great point. As I go Milt Hawk Pro Trader I’m trying to learn lessons and impart them at the same time, and last week was a great lesson in the reclaim. Although we knew where SPY was headed..we didn’t know when. The market did a really good job of reminding us it can spaz out.:

So how do you know when you’re supposed to wait for a reclaim vs when you’re going to chop—after all, when you’re in it you don’t know that you are. Check this out:

On the hourly, note if you have multiple wicking points over a course of days preceding where you are. The wicks are very important—you want them alone, and mucho pointy.

And you’re cresting above or bobbing below it (essentially you’re in a breakout or a breakdown) take heed…

You’re almost certain to head back into the zone of the “pointy wicks”, and your confirmation of that if when you pass the barrier of the previous high or low point.

Once that happens—and this is the key—your new boundaries (targets and entries) can be solely defined by those wicks), and each one has to get tested before a breakout

.So judging by this method our current breakout for SPY is approaching at…6058

One thing I’ll be curious to see as I tease out this method for identifying and playing chop—this “pointy wick” down at 5865 was left unchecked. My gut tells me at 6058-ish they slam us down to test it and complete the pattern, but my gut be lying. We shall see.

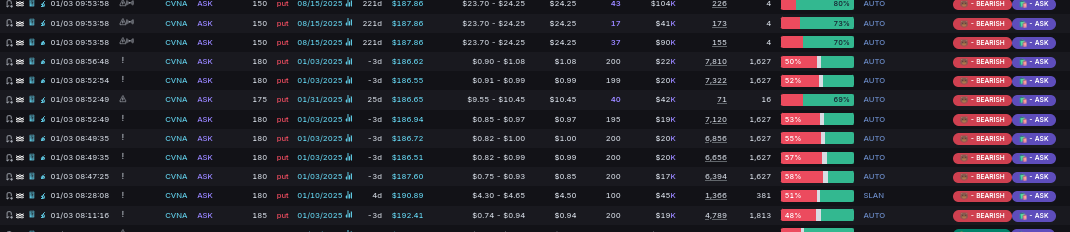

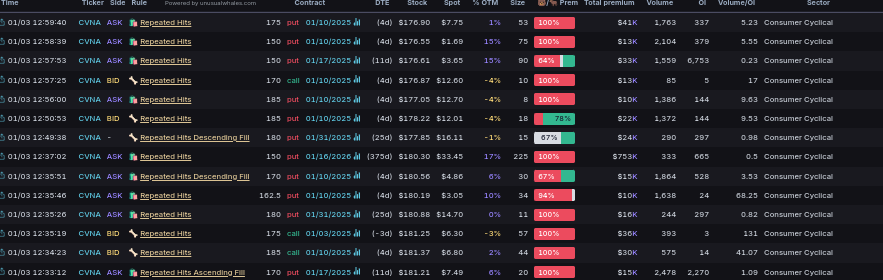

🐳Crashing Out and Cashing Out: A Tale of Two Auto Flows

I’ve been waiting for this moment for months…finally, CVNA is going to sink like a rock. Structurally it was obvious they were climbing too high too fast, but even as they flattened out the flow just wouldn’t agree.

Finally on Thursday and Friday whales stepped up and started placing their bear bets on the biggest little car company on the interwebs—the 175p and even 150p expirys within the next month got slammed to the high heavens.

Not only did the Intraday Sniper get tagged repeatedly on Friday:

But the Becky Alerts Ultra Filter has been juicing puts for days:

Contrast this with Elon’s TSLA, which is still showing no signs of slowing down in the post-election afterglow:

Simply. Ridiculous.

If those premiums are a bit rich for your blood, check out this video where I explain how we played them Intraday on Friday for 160%. You can play em cheap if you wait for your moment to pounce and don’t miss on the shot.

https://x.com/yourboymilt/status/1876081531565019183?s=46

🐳 YEET Plus 🌟 Signature Trade

Signature trades are reserved for flow that we feel has a certain..however you spell that French word jen-ay-say-QUAH! Currently an 80%+ rate of going 100% or more.