🗞The Sunday YEET: A Winter Wedge, A Mini Meme Pop, and Whales to Watch

Stonks go up again.

🎉Last Sunday’s YEET went two for two on the Flow Section weekly picks—NVDA and RKLB—each turning into multi-bagger opportunities. Congrats to those who played!

🕵The SPY Section

The Winter Wedge: big picture—we’re going up until something in this structure breaks:

To break this down:

After the reclaim we had enough juice to also break a long-established downtrend within The Winter Wedge.

2. The top slope would be the overall ES target, but pullbacks within the WW would hit major levels, and potentially the bottom slope and/or a retest of the downtrend breakout

In other words, the vibe is to buy calls with time when it comes to SPY—when we get dips, play them within the ES levels here.

😉The Sparknotes Version: SPY Daily Channel with Gap levels included

Editorial: GME is showing signs of a move—just not THE move

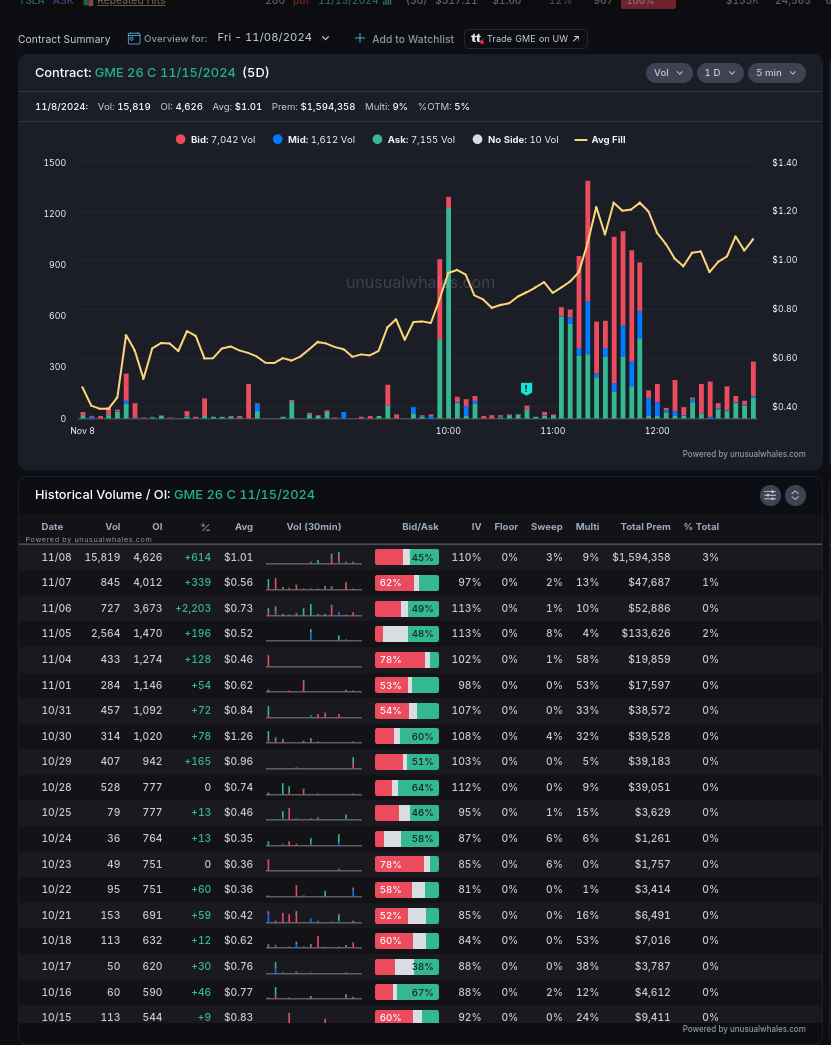

On Friday the 11/15 27c contract caught my eye for the over one million in premium it had leading into the initial pop:

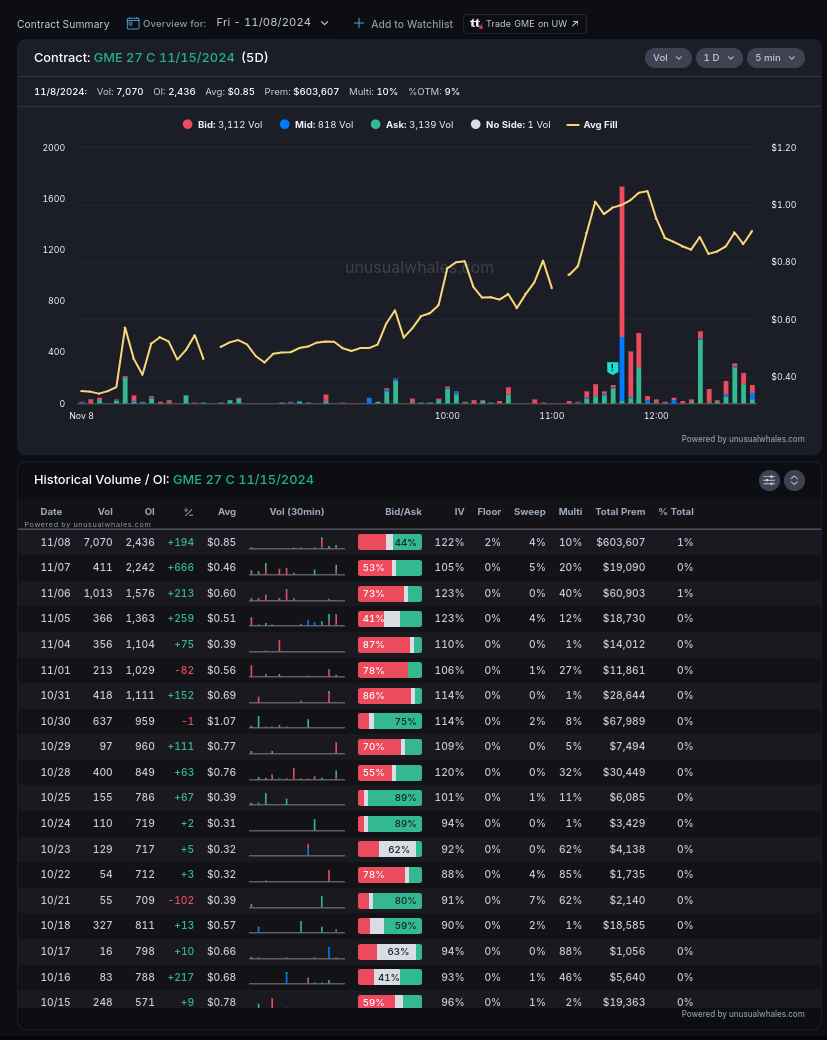

A quick search into EOD showed this activity over multiple strikes including the 27c 11/15:

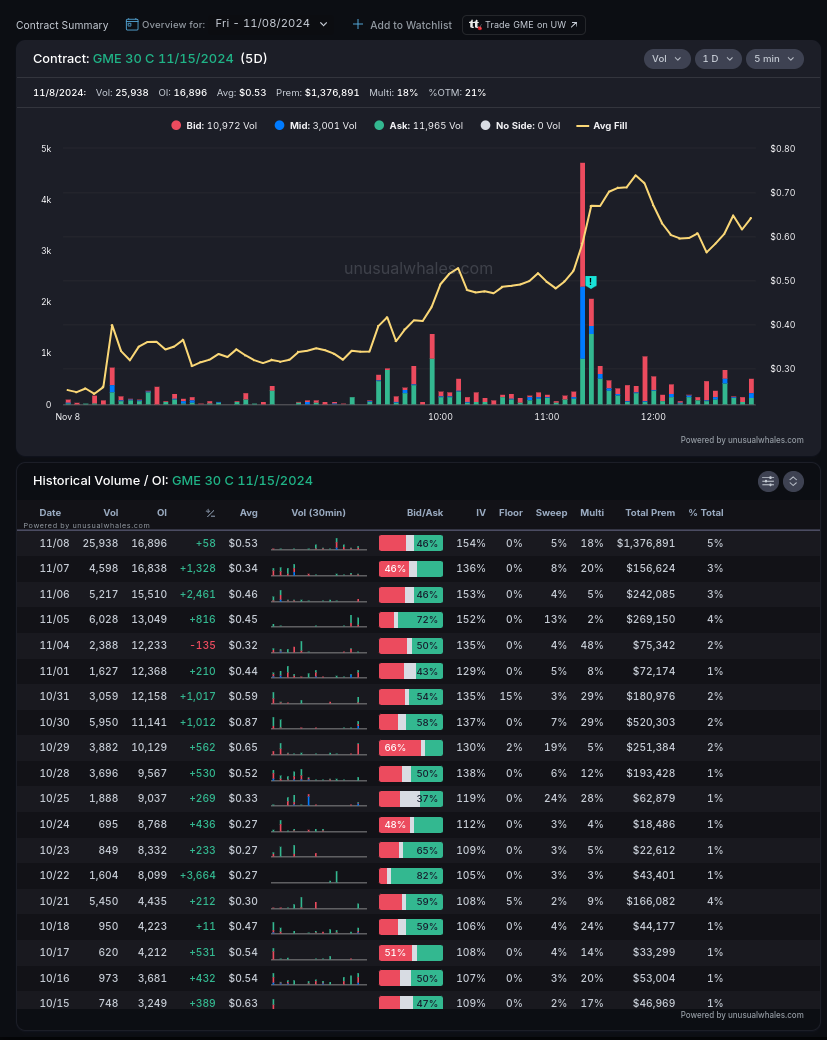

The 11/15 30c:

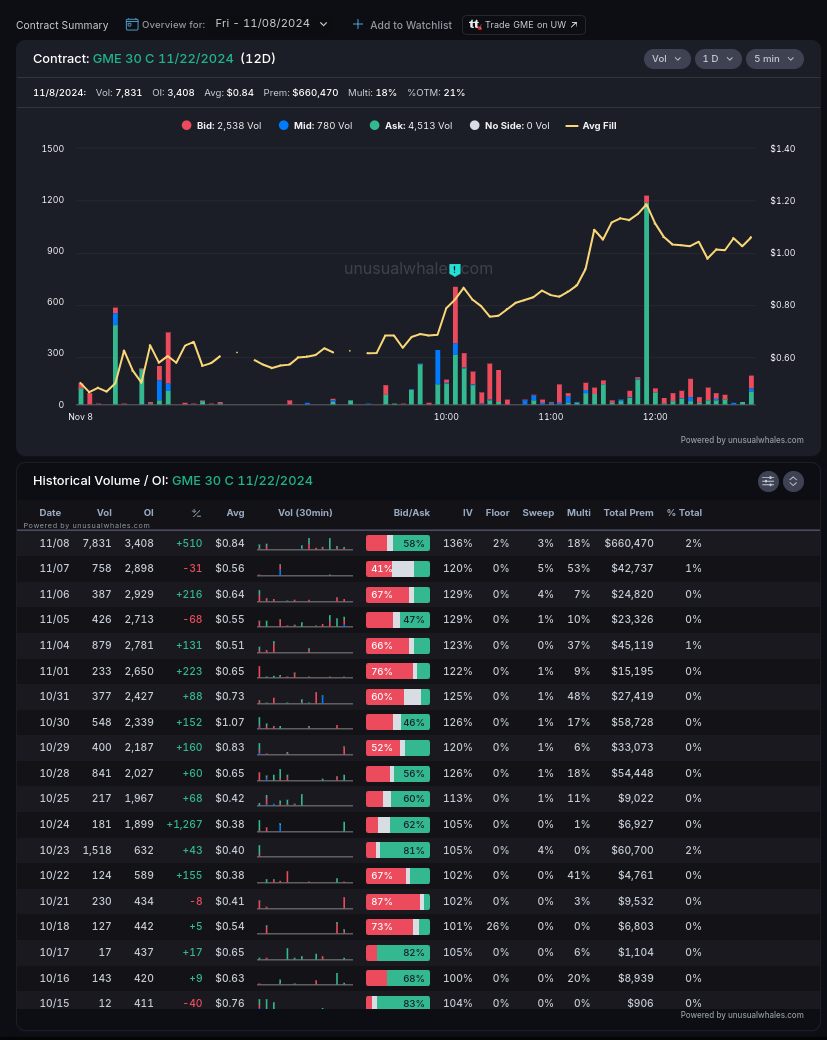

And the 11/22 30c:

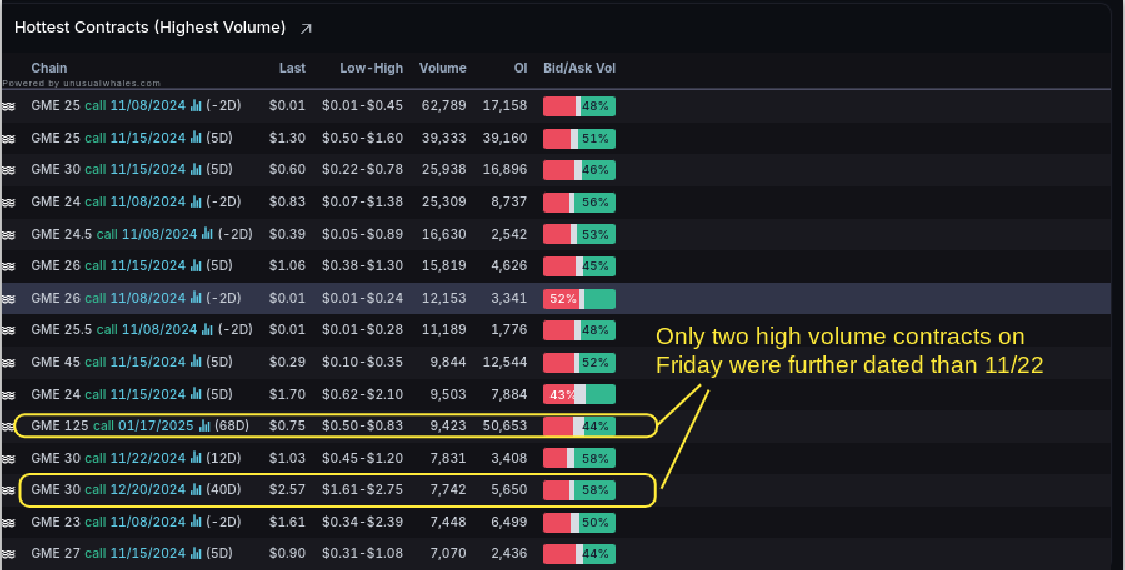

Although it’s a given that GME is ready to rock—the flow says this is not THE big one (You know, “GME to 1,000”—so on, so forth), but is more likely a run of the mill Price Action pop/minor squeeze. Why’s that?

A look at the activity on OTM strikes when GME ramped this Friday shows that most of the whale money was concentrated to the near term—almost all the high volume was on 11/15, with only a few 11/22’s.

In previous GME sagas—the ones with DFV live streams and the whole circus—we saw whales placing money on further dated contracts as IV ramped over days, and sometimes weeks.

Now, that’s not to say that can’t happen if we have a mini launch next week—I’m just saying it isn’t the type of flow that screams “long-term cataclysmic shift in the the global markets”, but moreso “this thing can pop”.

📈The Chart

After being in monthly level Hell of 23-25, we finally got a reclaim of the key level that can launch us above this quicksand. Once we break the final monthly just above 25—and hold it—we have large gaps in resistance that would move us along quickly