🗞The Sunday YEET: SPY Clones 3 Identical SPX/SPY 500% Trades, Remedial SPY Read, and Peer Pressured into BTC Chart

Trade Reviews, SPY Analysis, Flow

🚀Note to Plus—this is the week to drill it and seal a new day: I’m a realistic assessor of where we are ,and I use our insane Q1 performance metrics as the standard—as of Friday I’d say I’m 80% of that trader, and I think this week we close the gap.

We are in the perfect position to return to our standard of excellence.

SPY: With two 500%+ trades and some 100%+ at targets sprinkled in, the hard stuff is becoming routine again, and losses are mostly related to correctable greed/target rust. The wrinkle is more so winning better than not losing.

Flow: we are finding a LOT of news. We can’t always say what they’ll do about it, but right now we are at an insane flow find: catalyst ratio. Highest I’ve ever had since doing flow.

I’ll bring my A game this week so Dan can once again be buying wine to celebrate on Fridays. See ya out there, when SPY chops to hell and this is anticlimactic.

🗞The Free Section: A Tale of 3 Identical SPY Trades

✅500% Trade 1 How To:

Basic mechanics here, but one key thing:

🧑🍳SPY GAPS CREATED OVERNIGHT ARE A PRECIOUS GIFT!

There’s automatically a play on the table that, if triggered, is an automatic multi-bagger because of the distance needed to cover the Gap. I’d say roughly 50% of the time they close it the same session, and 70% of the time by the following close.

This is as basic as our play style gets:

SPY survived weekly support

It has a bullish close above the Gap level afterwards

the next hour retests the Gap candle

🧠But what is the Secret Sauce that made this an SPX call-out rather than SPY (calling SPX second half of the day takes a lot of confidence, Theta is a killer)

🧑🍳 The SPX Recipe:

A clear flag on the intraday time-frames

The flag has validated a support or resistance level on the hourly

And the third, and most important part:

🎯A Resolution Target—Usually a Gap or a Monthly—that is a far enough away that its same-day closure will result in a quick acceleration in candles, and thereby contract premium.

✅Loss-into-a-Win: Complete Whiff Analysis During the Sessions Leads to 160% Realization right after (more if WeBull let it be SPX!)

Wednesday I mess up early for an understandable price action nerd reason initially that you probably don’t care about. Then I made it worse by doing what I’ve always done on bearish directional whiffs—I bet on a bounce at support that don’t come.

But after I stop crying, I gather myself ,and look what’s right there—

SAME SPX SETUP AS THE DAY BEFORE, JUST FLIPPED: Bear flag off the Gap level with the monthly as resolution, with two hours to go. I was extremely upset WeBull wouldn’t let me buy SPX that late, so we had to settle for a 160% at target. SPX wouldve been a 5-7 bagger. Again.

THEN AGAIN FRIDAY, MY GOD!

They left a Gap open to the downside like 6 points away from the opening action.

YEET Plus at first was going for a test of the blue gaps, but once it flagged in there it became clear the downside gap was on the table. Even if conservative with the first target it was a 150%+ play—for those who went gap target, a 5 bagger.

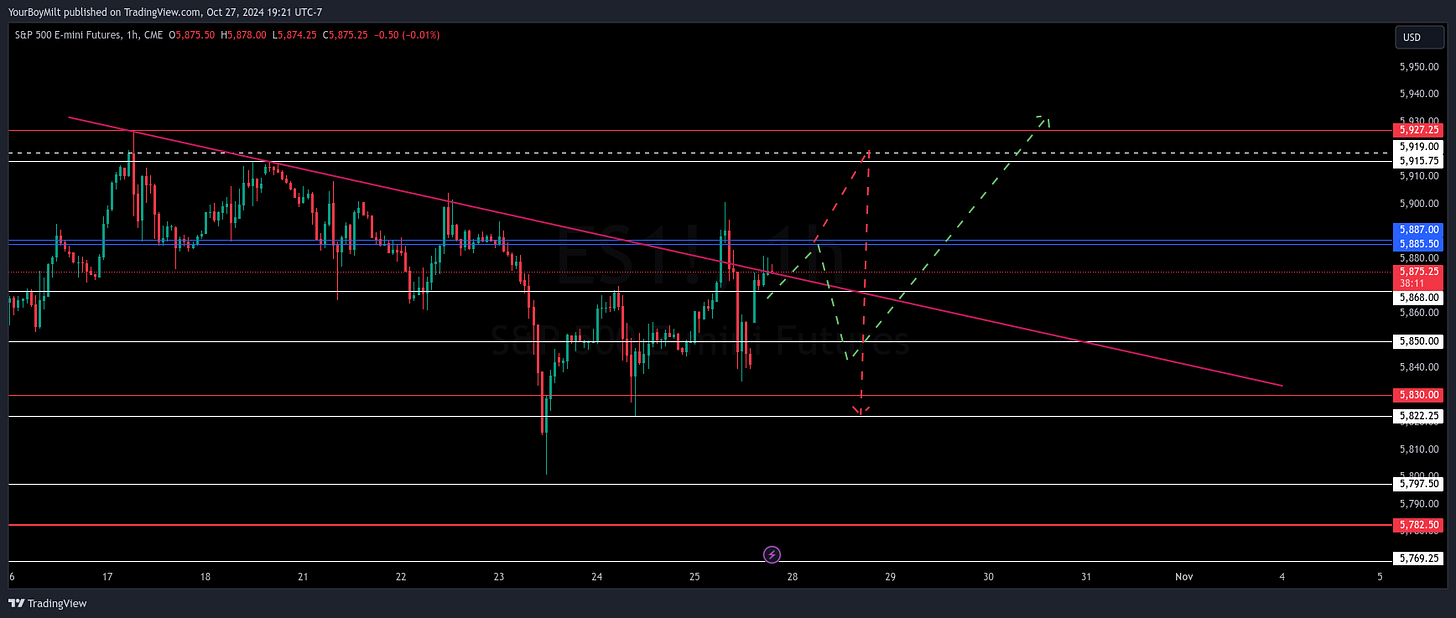

🕵SPY Tomorrow: Incredibly short because the read is incredibly simple

The SPY Read is really easy because of this Gap they created and all the backtesting we’ve done. We will either:

a) Run up to the blue Gap levels, reverse to close, then bounce

b) Run up to the weekly-monthly area, which would be a more damning reversal and likely send us to the monthly just below the gap

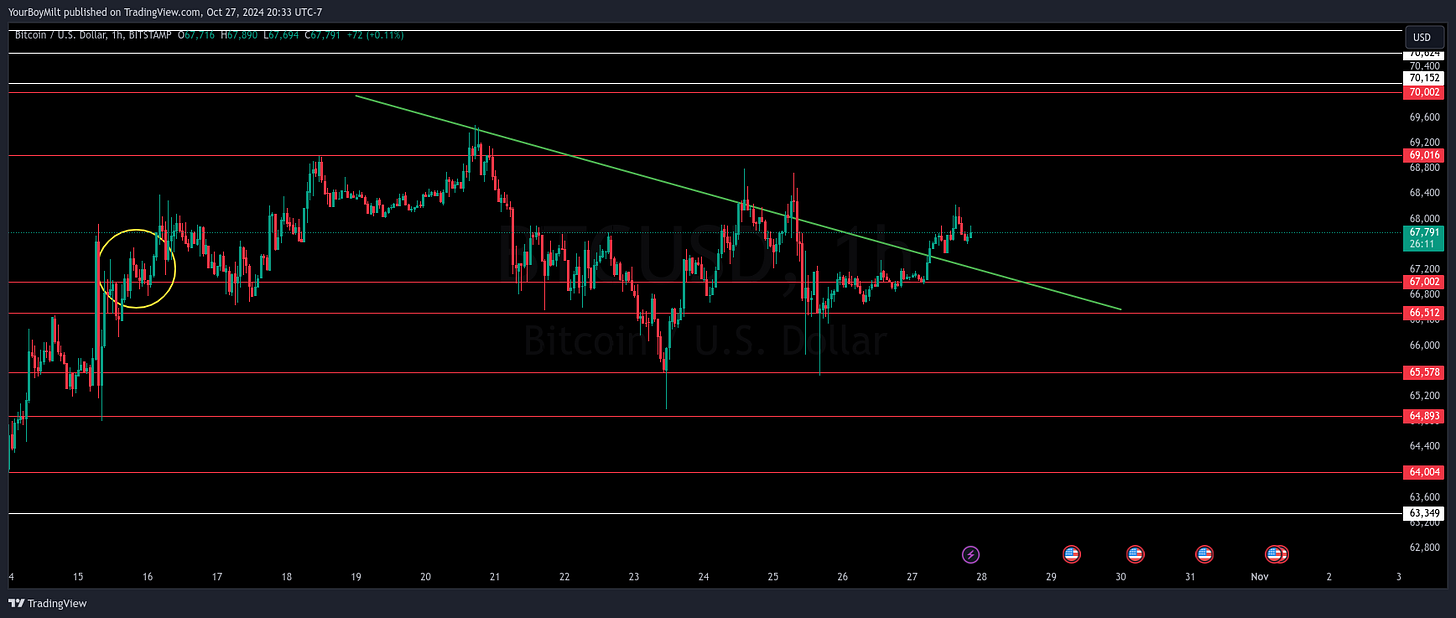

🪙BONUS: BTCUSD

I popped open the bitcoin chart for funsies and it looks like it’s going to rip

-Monthlies held with wicks repeatedly

-Uptrend

-Downtrend outbreak

-Plenty of room to the next monthly

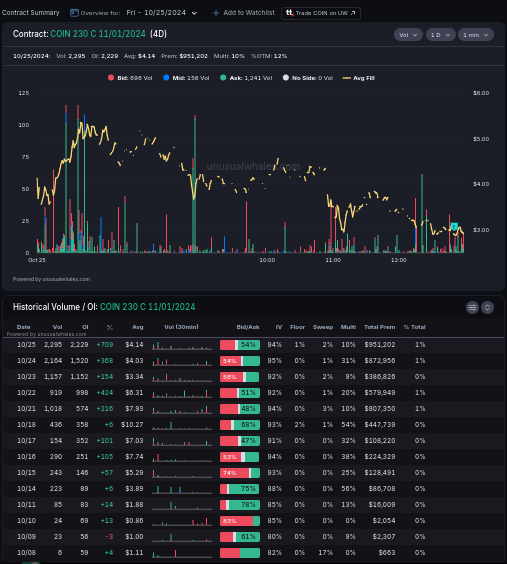

🐳YEET Sympathy Whale Find: COIN 230c 11/1 (we like the 215c if you’re spicy enough to go for a weekly, but 11/8 is the move for security)

This backtest was a perfect place to buy—if we get another retest of 203.23 and it passes we enter there. If it falls through entry is 196/01 with adjust strikes