The Sunday(ish/Monday) YEET: Fallout Boy circa 2009

Really roundabout way of saying pop are to be sold as we are going down

Editor’s Note:

-There are going to be a couple of awkward transitions visually on paragraphs likely, and no emojis etc to break things up. And the zoom on flow images will be a little close. Because there are no emojis and there is no zoom in the mother f%#%^^%$ Digital Ocean Debian Linux Virtual Environment. Things go back to normal tonight/tomorrow. Thank you for your patience.

Sugar, we’re going down, down….

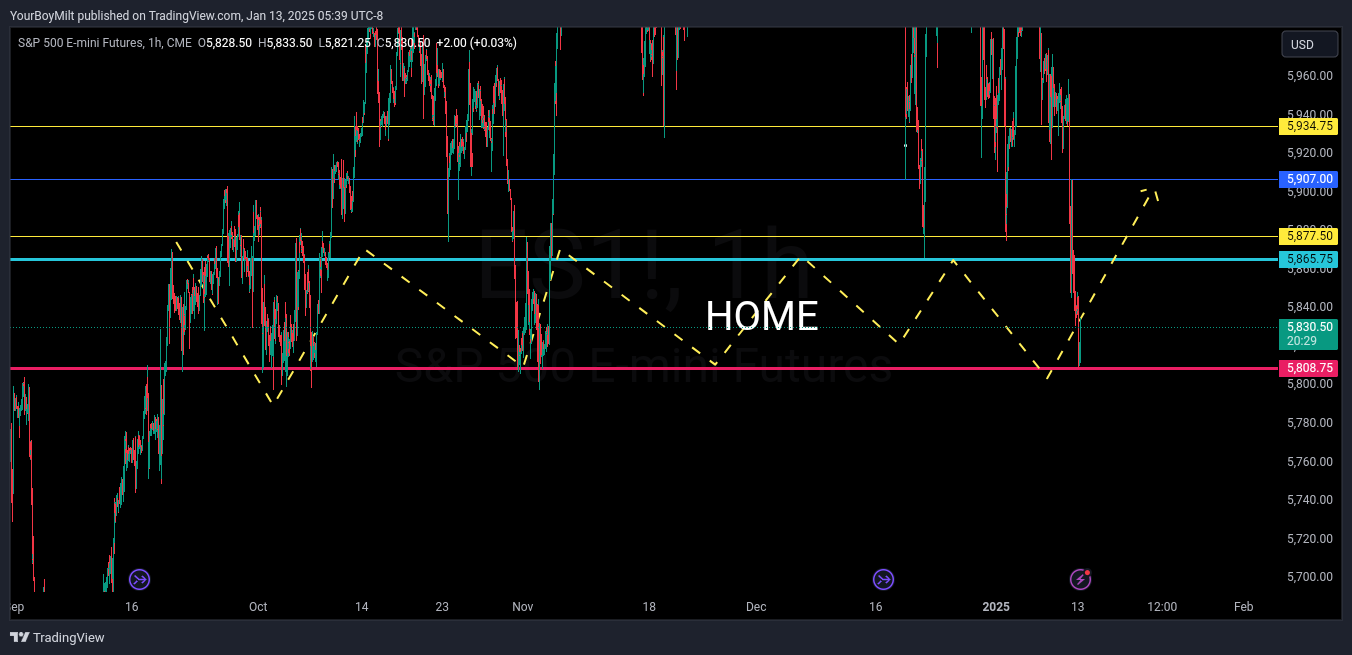

Our Chop Remedy SPY analysis went undefeated on the week, successfully calling the downward move and hitting the target on Friday. Now that we’ve passed that level to the downside, the paradigm has shifted.

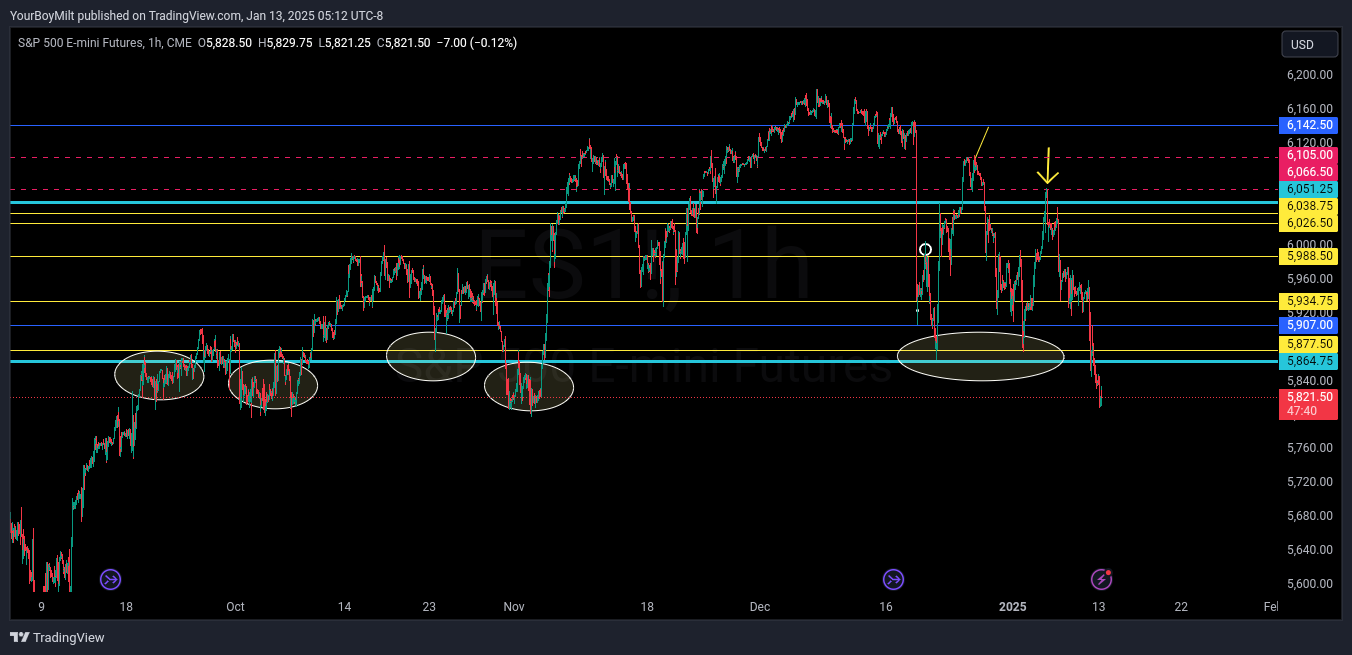

These bright blue borders on the top and bottom—creatively labeled BORDERS-represent our (now previously designed range).

Now that we’ve broken beneath the range, that’s our signal that we’ve likely entered a downward overall trajectory, with bullish price action representing pops rather than reversals.

With that in mind let’s zoom out, and see if we can get other conviction for this for this statement other than a Price Action Hypothesis we tested and proved, like, 5 days ago. (which was validated).

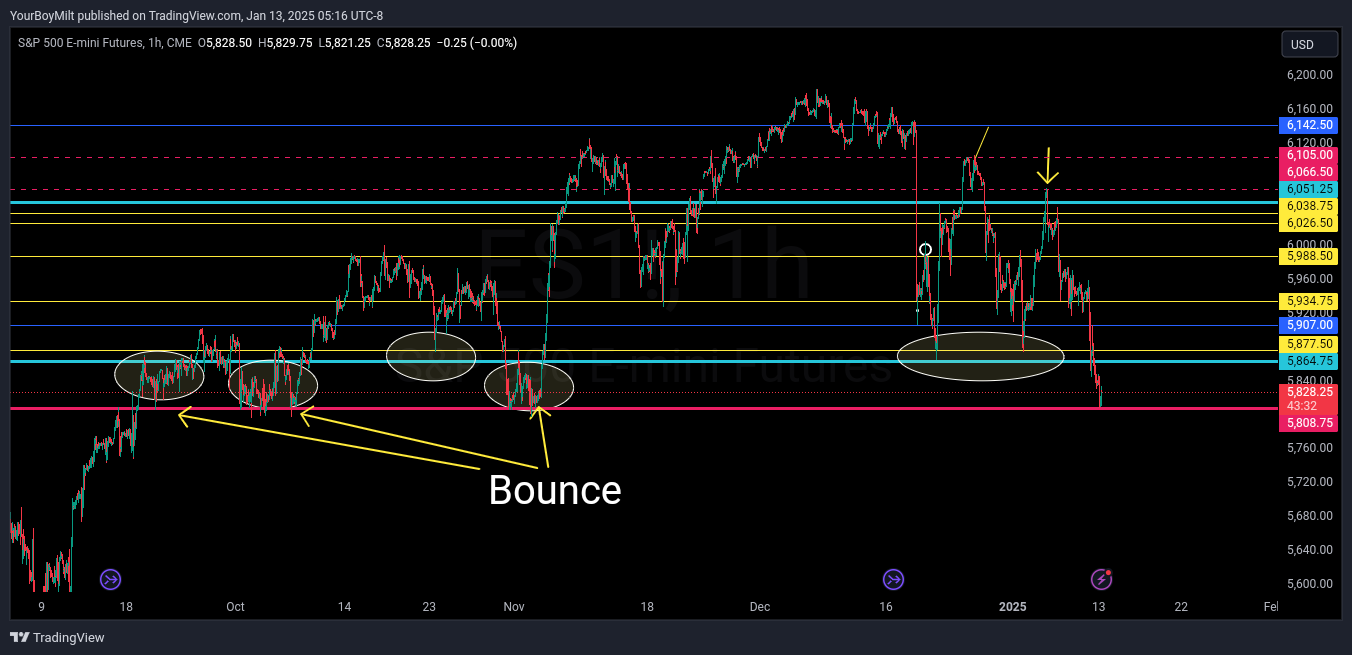

You’ll notice all the white elippses represent points where the price action met significant reversals at our lower blue border, cementing the level as important. What' you’ll also notice is that they give us a level of bounce at the bottom of most of them, as well.

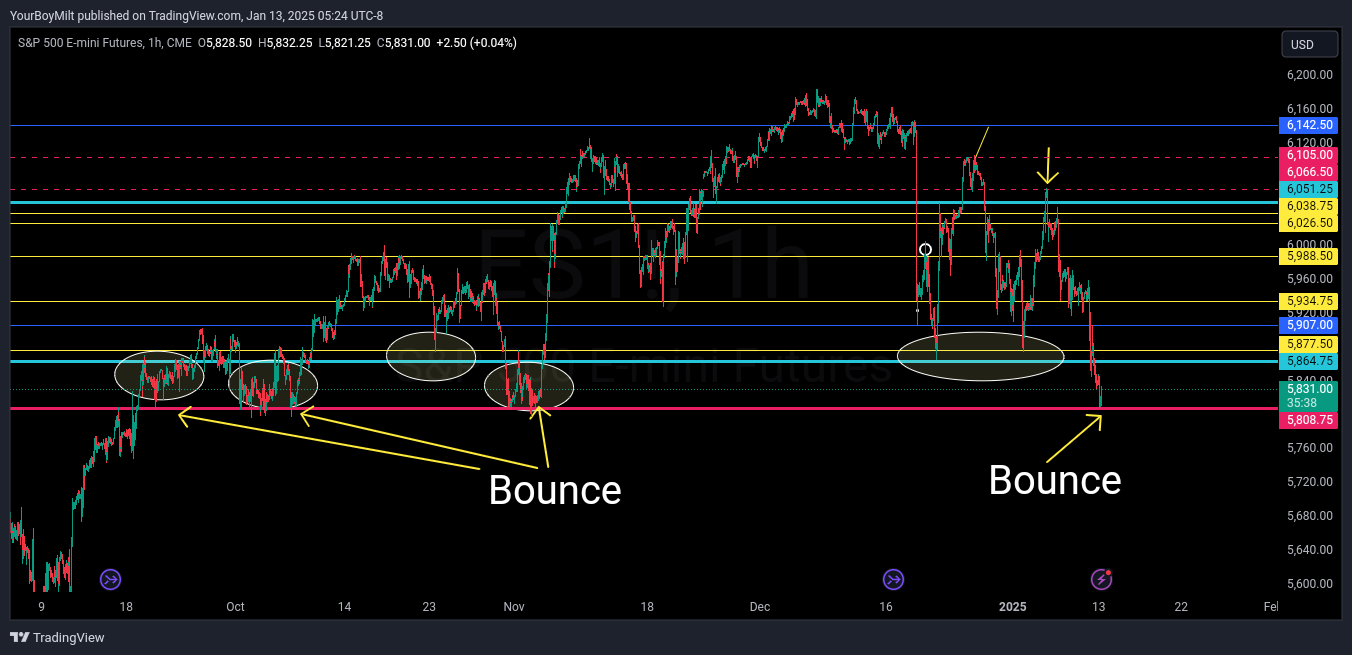

Including the bounce we just saw right now in the pre=market.

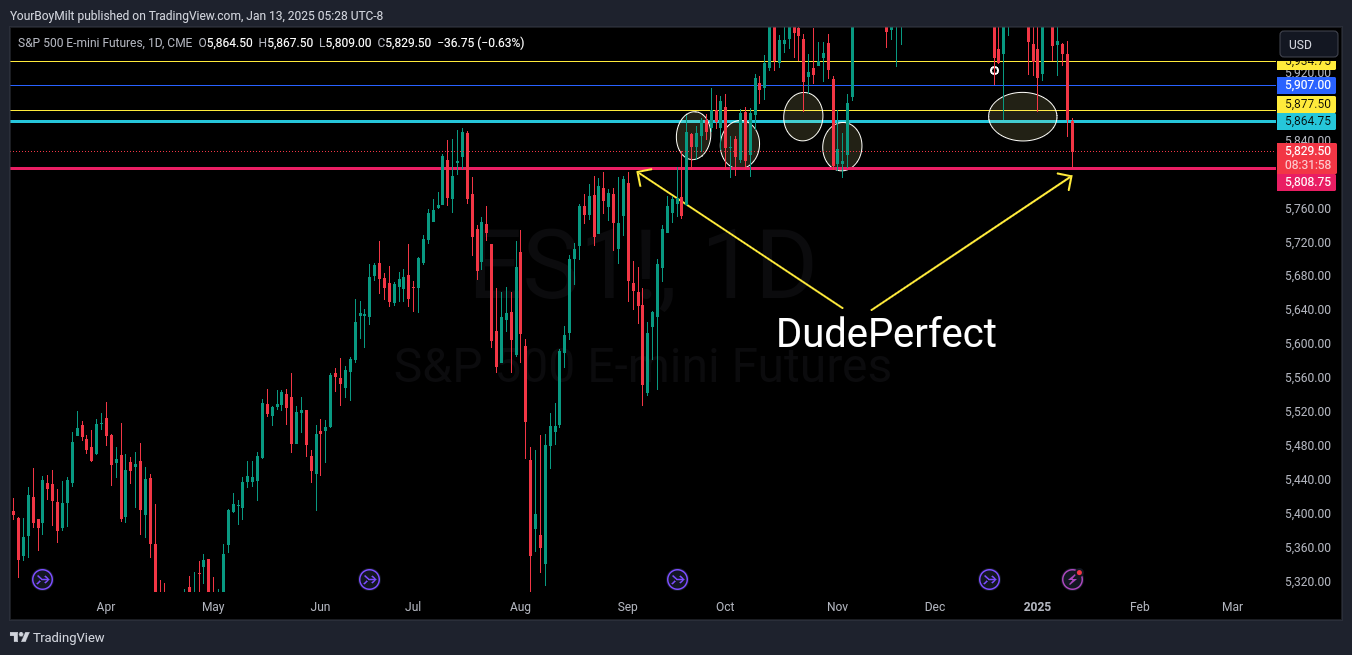

If you’re like me and you think Price Action is pretty cool, you can see how precise it is over time on the daily. Our exact bounce point over night is the top to the cent of what what was a previous bull flag body on the daily:

The Forecast: following our Perfect Price Action Points expect chop until we break beneath (or above) this current boundary corridor:

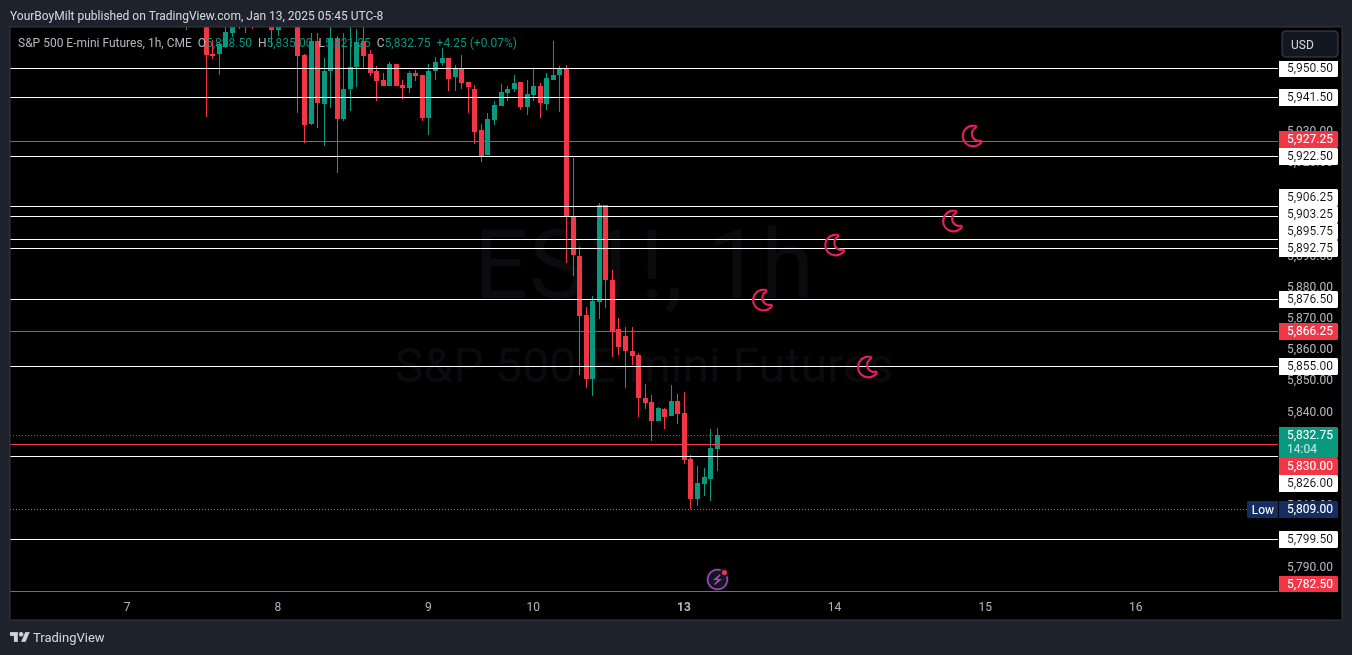

So where do these pops go to if theyu’re not reclaims, as mentioned earlier? That;s where our unbacktested levels come in:

The little moons are all unbacktested levels on the weekly and monthly following the drop. If we close above the 5830 monthly level,that's where we’re going—and each one of those we close above signifies heading to the next one up.

But don’t get too attached—they are almost certainly marks off the checklist just before becoming wicks on the way down.

Milt Says: expect chop this week even if its a bit wide. 0DTE’s can play on the way up since it’s goal-oriented Price Action, but on the way down slow and steady wins the race. We’ll be looking at 1 and 2 DTE’s when we reach that second set of weeklies.

Champagne in my Campaign: A Couple of Picks from YEET Family Members The Champagne Room

Our flow-following and chart loving friends in the Champagne Room Discord had some solid bangers recently, so I thought I’d let ‘em stop by and give you a couple picks.

There was a cool picture of a SeaKing multi-bagger here that won’t load so here is text confirming that this was, indeed, going to be a four bagger from NVAX and that they do that. Click me to go to their Discord.

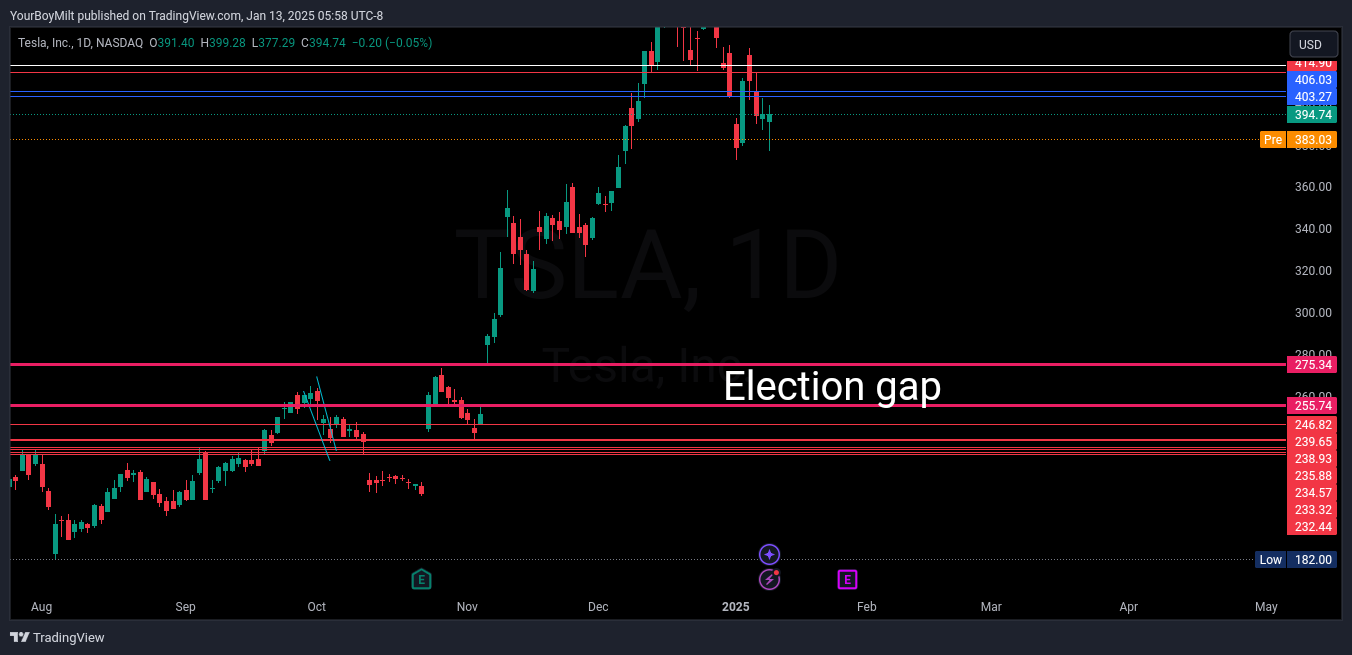

Buddy Bear: TSLA 425c 1/31 once the Election Gap is filled to 255.74

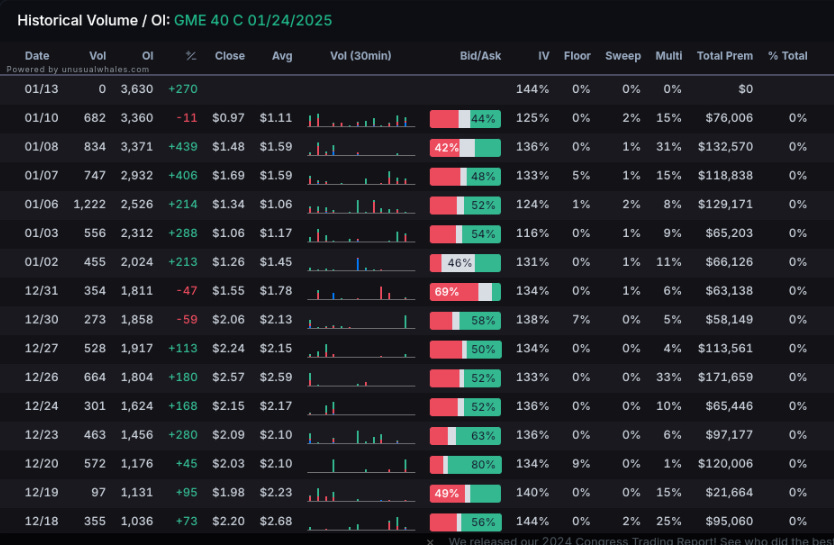

While we wait 75 G.D. years for Buddy Bear’s play to trigger SEAKING OPTIONS will be exciting the people with a GME 40c 1/24 Pick

YEET Plus: Port 1 Profit Take, New Allocation, and Signature Trade

PS BONUS: NFLX 900c coming in….ninth inning save?