✅The Unusual Whales Strategy Used for 240% SQ, 200% RDDT, and 80% PLTR (puts!) today

Plus callouts are still rocking and all is well in the land of YEET

NOTE: I wanted to include two videos in this post—but because I’m on that Chromebook still I have limitations in file transfer. I linked one from twitter.

The PLTR puts from today were the YOLO of the Day in last night’s YEET Plus flow Section.

🗒What can we learn from another great day?

You may have noticed by now we like to keep things simple—no extra fancy strategies or unintelligible investigating tactics. Our primary Whale Hunting strategy is this:

Determine whether or not activity is a hedge or an actionable follow by developing multiple points of confluence on a given ticker

That’s it. That’s why this strategy works for us…

💡The Two Week Expiry Strangle

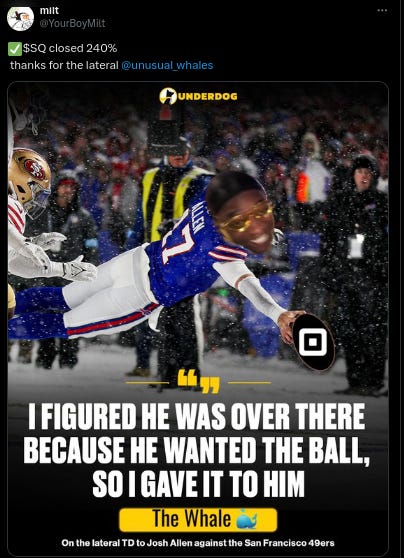

https://x.com/YourBoyMilt/status/1864412925877997643

(video link)

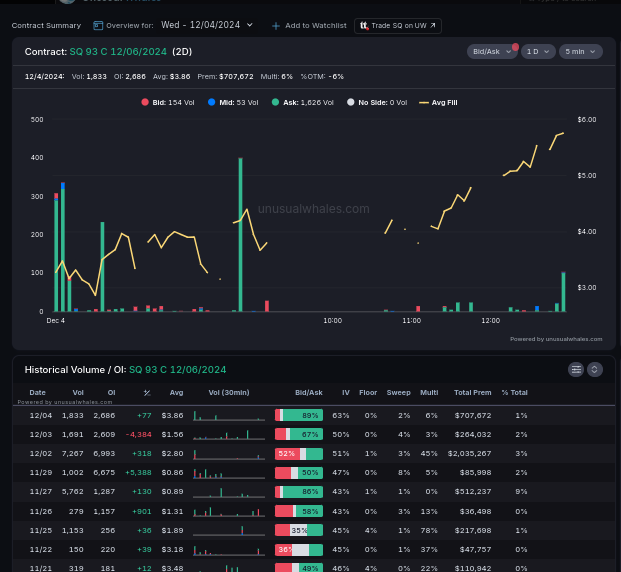

Using SQ as an example here, what you want to find is…

1. A ticker with an outside the money contract within two weeks of expiration. This can also be within a month, FYI—two weeks to a month.

On 11/27 there was an alert for SQ 93c expiring 12/6—more than 5% otm, two weeks to expiration

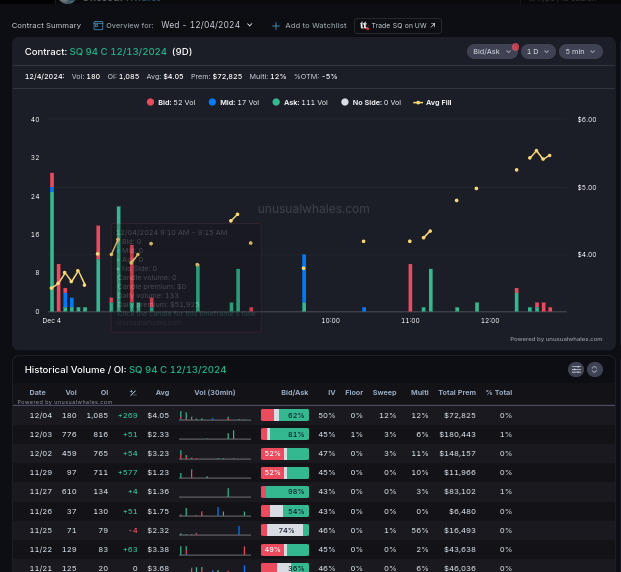

2. An additional OTM alert that also expires within two-week-to-a-month time frame

SQ had an additional alert on 11/27 for the 94c expiring 12/13

The Result?

*pro tip: to play it safe a good strategy is to buy the CLOSER strike of the contracts with the FURTHER expiry

Need a little help finding the contracts?

Annual YEET Subscribers get access to the links for all our filters, plus our tool Cerebro which searches our primary filters for you in the blink of an eye—within seconds you’ll know if a ticker you’re interested in has a Two Week Expiry Strangle.

Want to see which ones we found today…?