🚨The Whale Action Risk Indicator (WARI) is ALIVE

Our greatest creation, maybe. Maybe not. Maybe read more to find out.

🧠 Introducing WARI — The Whale Alert Risk Indicator

Traders love to say “the whales know.”

But what if we could quantify how sure they sound when they say it?

That’s the idea behind WARI — Whale Alert Risk Indicator.

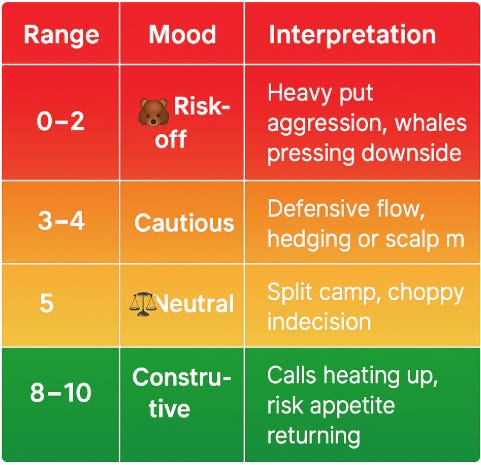

It’s not just another sentiment gauge. It’s a live pulse of how hard, how soon, and how confident big money is betting — all boiled down into one number from 0 → 10.

Think of it as a mood ring for the whales.

⚙️ What Goes Into WARI (without the secret sauce)

WARI looks at four key forces under the hood:

⏰ Urgency (DTE)

How quickly do the whales want it?

A contract expiring tomorrow screams louder than one expiring in three months.

Shorter DTE = higher urgency = stronger conviction that “this move’s coming fast.”🎯 Aggressiveness (Refined OTM)

How far from the current price are they swinging?

A call that’s just 1% out-the-money is serious.

A call that’s 10% away is a dream.

The closer they’re aiming to the current price, the higher the “we mean business” score.💰 Conviction (Size × Vol/OI)

Not all flow is equal.

A 10-lot lotto ≠ a whale dropping $250k on a single strike.

WARI weights orders by both how big they are and how much follow-through there is compared to existing open interest.

Big + fresh = conviction.⚖️ Directional Weight (Calls vs. Puts)

Finally, we measure who’s dominating.

Are whales loading calls or puts after adjusting for all those other factors?

That mix determines where the final WARI score lands on the 0–10 scale.