⚡️The YEET — August 27, 2025

Let's get to it.

📝1 for 1 in the room and 7 of the last 8 Trade Review: Homemade-bounce-gap-test-slingshot

We waited for a support bounce off the of the homemade yellow level that gave the most space to rip above (yellow level support). We knew when it had support there and broke through the downtrend they’d go after one of two levels:

644.4 because they’ve been using it as a key support and resistance for the past, like, 6 sessions

Go ahead and fill the gap

🔑 Levels Key

🔴 Red = Monthly Levels

⚪ White = Weekly Levels

🟡 Yellow = Homemade Levels

🔵 Blue = Gaps

📊 SPY Levels (as of close 645.71)

Above Current Price:

🔴 646.50 ⚪ 646.20 🟡 645.72 🟡 645.71 🟡 645.54 🟡 645.49 🟡 645.24 🟡 645.22 🟡 644.40 🟡 644.25 🟡 643.92

Below Current Price:

⚪ 642.85 🟡 642.18 ⚪ 642.00 🟡 641.47 🔵 640.20 🟡 639.87 🔵 639.29 🔵 638.56

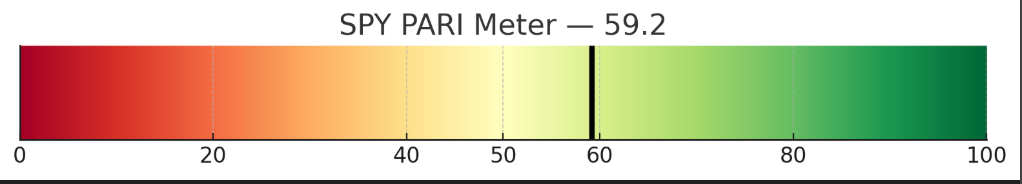

🧠 What’s PARI Saying?

(PARI = Price Action Risk Indicator, our gauge of how healthy SPY’s trend really is.)

Today’s reading: 59.6

Slope (5-day trend): −2.2 (pointing slightly down)

Think of PARI like a car speedometer:

🚦 0–40 = Bearish zone (selling pressure)

🚦 40–60 = Neutral zone (chop, range, indecision)

🚦 60–100 = Bullish zone (buyers in control)

Right now we’re just under 60 → barely in bullish territory, but the slope is negative → the “engine” is revving down.

📊 Chart Views

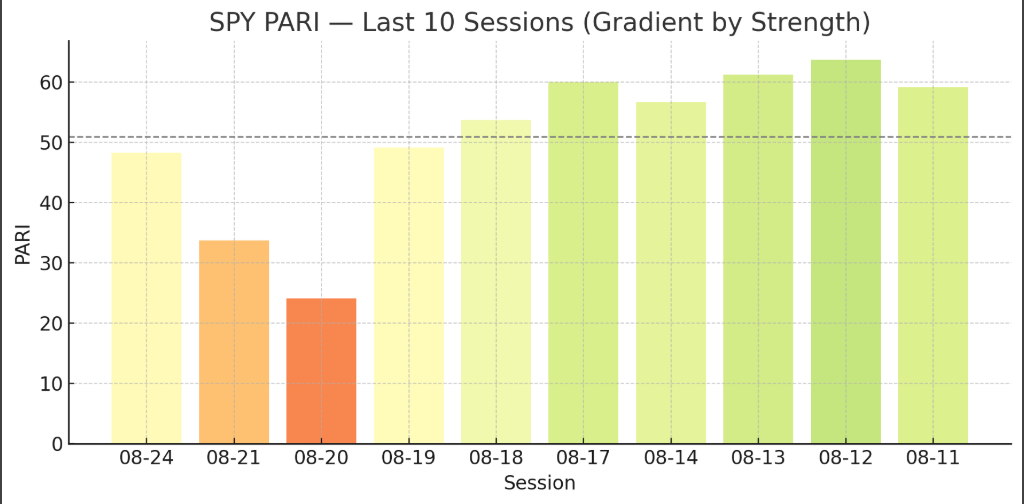

🔟 Last 10 Sessions

Bars show the last 10 PARI prints. Average is ~62. We’re sliding lower from recent highs, which often means momentum is tiring.

📉 Slope (Speed of Change)

The 5-day slope is negative. Translation: PARI is cooling, not heating. Think of it like your car slowing down even though your foot is still on the gas.

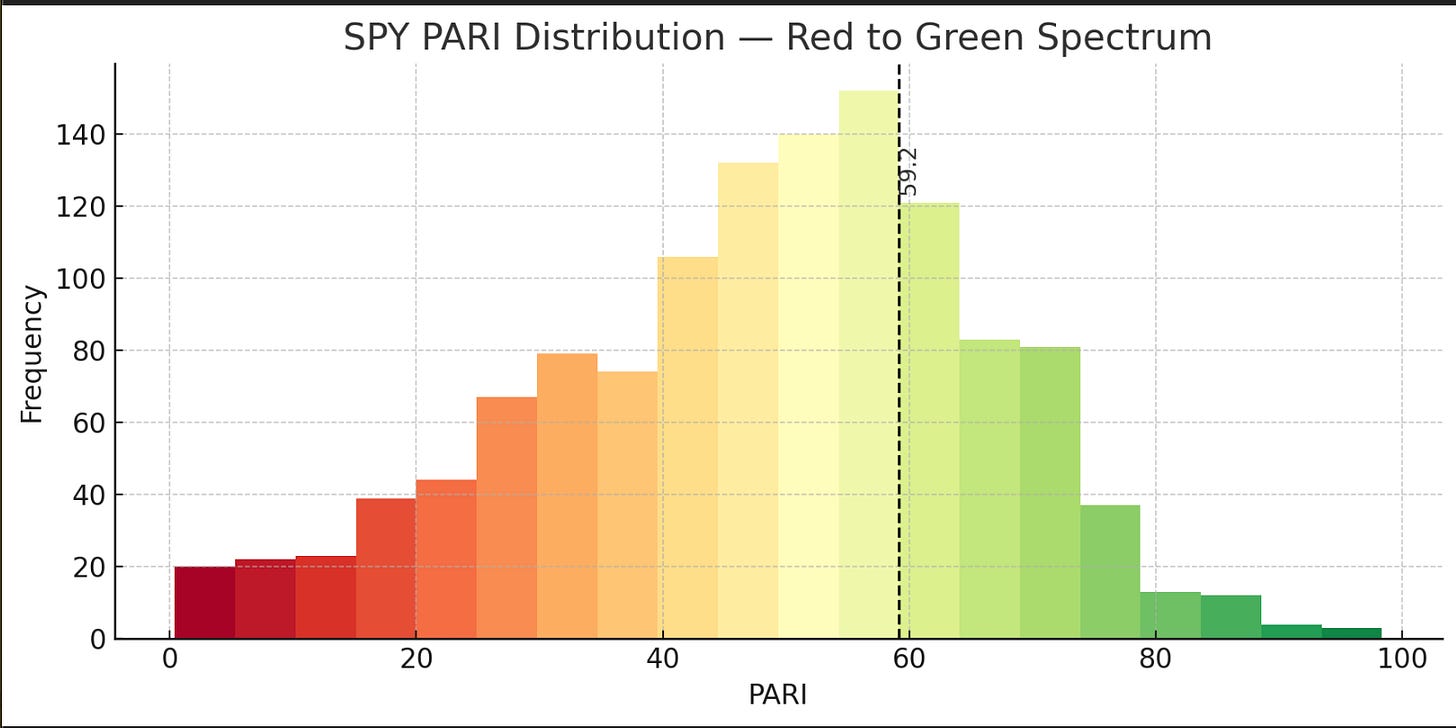

📊 Distribution (History)

Looking at the whole history, most rallies don’t stall until PARI gets into the 70s–80s. Sitting at 59.6 is not powerful enough yet.

🔮 Plain-English Read

👉 This does not look like a clean buy.

We’re sitting just shy of bullish, but losing steam.

Buyers have the ball, but they’re walking it up the court instead of fast-breaking.

Unless PARI flips back above 62 and climbing, this smells more like a range/chop with fading upside.

YEET Call:

Sell-lean / Hold bias here.

Not a time to chase. If you’re long, trim risk into strength. If flat, wait for PARI to either recharge (→ real buy) or crack lower (→ short setup).